Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov. 20, 2025

By Wendy Wen and Kristin Larson, PhD

California continues to dominate the US' solar output that accounted for 22.1% of national solar generation in 2024. While every US state is projected to see solar growth through 2035, California's build-out remains among the most aggressive. According to the S&P Global Market Indicative Forecast for the September quarter of 2025, about 219.8 GW of renewables are expected to be built in California by 2035 — roughly 75.5% solar — ensuring its continued leadership in clean energy, despite tightening margins.

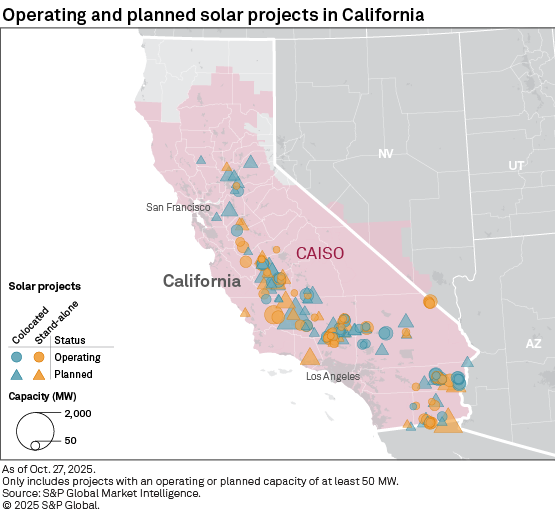

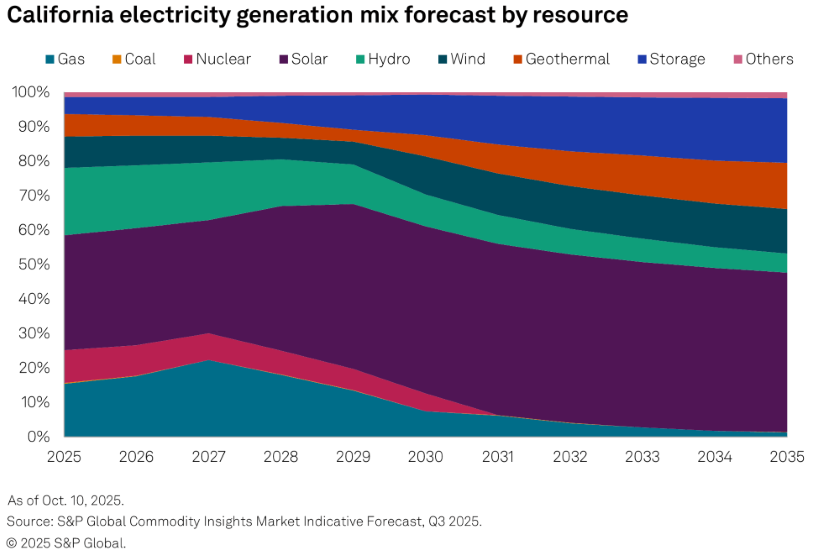

California is now second to Texas in installed solar, with 23.8 GW operating as of October 2025 and an additional 20.6 GW of grid-scale projects in the pipeline — capacity that would nearly double the current fleet. The state remains a central driver of photovoltaic development as it transitions toward 100% carbon-free generation. Statewide clean energy targets require utilities to source 60% renewable energy by 2030 and achieve 100% carbon-free electricity by 2045. Meeting these targets implies substantial new build: the Market Indicative Forecast projects 165.8 GW of solar in California by 2035, lifting solar's share of statewide generation to 60.7% in 2035 from 22.6% in 2024.

Solar's daytime-only, weather-dependent profile limits its contribution to evening net-peak demand, and that contribution declines rapidly at higher penetration. In California ISO, the effective load-carrying capability (ELCC) of solar is forecast to fall to 4.2% in 2035 from 38.4% in 2026, implying that even with 165.8 GW of solar capacity, peak contribution will only be 7.0 GW by 2035. Developers and grid operators are responding to this anticipated change — stand-alone solar has become less common in interconnection queues. According to the Lawrence Berkeley National Laboratory (LBNL), about 320.6 GW of solar entered CAISO's queue through 2024; among roughly 90.9 GW still-active, stand-alone projects represent only about 7.5%, with the remainder paired with storage.

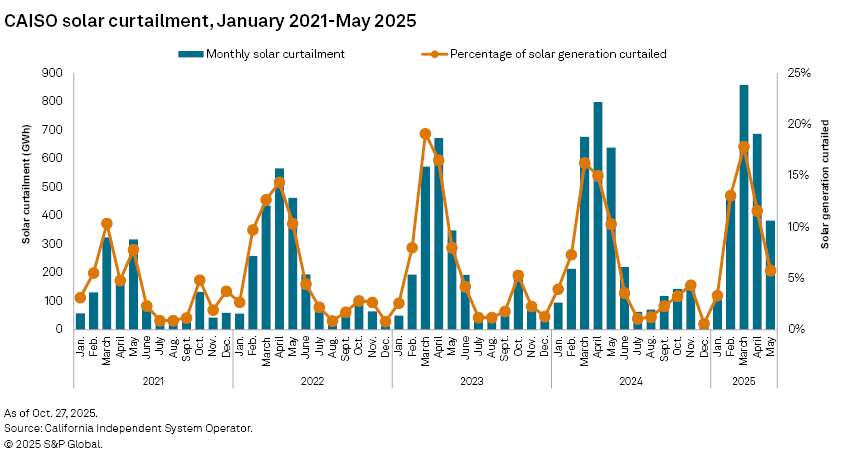

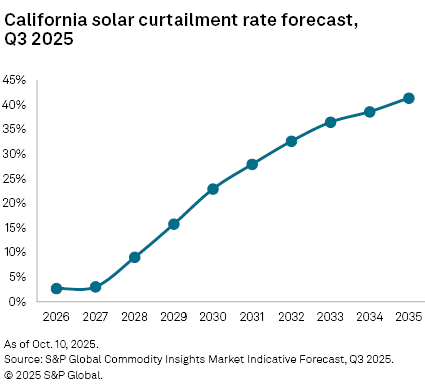

As midday production increasingly exceeds the grid's ability to absorb it ahead of evening peaks, curtailment has become a defining feature of California's solar market and a key driver for solar-plus-storage strategies. In 2024, CAISO curtailed 3.2 million MWh of solar, up 27.2% year over year and more than double of 2021, comprising 93% of systemwide curtailment. Early 2025 data show elevated curtailment, reaching 2.5 million MWh by the end of May, with 17.8% of solar output curtailed in March and 13.1% in February. The Market Indicative Forecast projects California solar curtailment at 48.4 million MWh (23.0%) in 2030, rising to 180.4 million MWh (41.4%) by 2035, with individual project curtailments potentially ranging from 30% to as high as 80%.

With solar saturation and curtailment rising, paired storage has become essential to optimizing curtailed volumes. California was an early adopter of solar-plus-storage, with roughly 76% of its hybrids entering service since 2021. The state currently operates 8.8 GW of hybrid solar, accounting for 25.9% of the national total and representing 37.0% of the state's installed solar capacity. This is paired with at least 4.1 GW of colocated battery capacity. Additionally, there is another 10.8 GW of hybrid solar in development, which constitutes over 52.1% of the entire solar pipeline in California, according to the S&P Capital IQ Pro database.

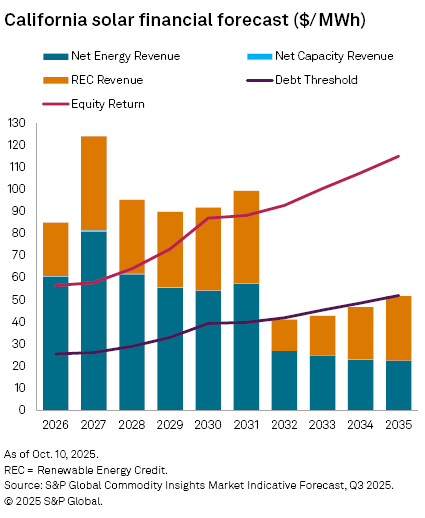

Despite mounting curtailment and declining capacity value, near-term solar economics in California remain favorable. Average energy revenue for solar — stand-alone and colocated — is forecast to decline to $22.6/MWh by 2035 from $60.5/MWh in 2026, driven by capture price erosion during midday oversupply and rising curtailment. At the same time, renewable energy credit (REC) revenue are projected to decline as REC prices ease, once Renewable Portfolio Standard (RPS) targets are effectively met; REC revenues then gradually rebound later in the outlook, as curtailment grows and captured energy revenues compress. As solar's ELCC approaches zero due to high penetration, capacity revenue contributions become negligible. Even so, combined energy and REC revenues are projected to exceed equity return requirements through 2031 and remain sufficient for most projects to meet the estimated debt threshold through the next decade. This financial outlook helps to partly explain the growing relative value of solar-plus-storage, where storage can provide complementary revenues from greater exposure to on-peak prices and from greater eligibility for capacity revenues.

California will remain a top solar market, with economics shifting toward solar-plus-storage as saturation, curtailment and lower capacity value set in. Even with margin compression, its market size and decarbonization goals keep it central to the US energy transition.

Steve Piper contributed to this article.

For wholesale prices and supply and demand projections, see the S&P Global Market Indicative Power Forecast.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.