Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 23, 2025

By Jason Lehmann, Heike Doerr, and Dan Lowrey

US investor-owned energy and water utilities will commit significant capital over the next several years to new infrastructure investments aimed at reliability and resiliency upgrades, new gas, nuclear, renewable and other generation to meet demand growth. Investments will also target the integration of advanced technologies, such as advanced metering, cybersecurity protocols, electric vehicles and battery storage.

This significant capital outlay is anticipated to drive elevated rate case activity and augment profit growth within the energy and water utility sector for the foreseeable future.

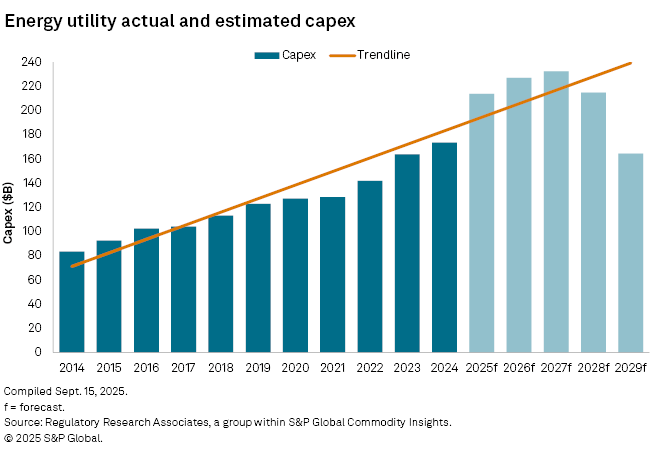

➤ Projected 2025 capital expenditure for 47 investor-owned energy utilities has increased to $214.70 billion, from the $212 billion identified in RRA's Spring 2025 outlook, as the companies refine their capital allocation strategies in response to regulatory requirements, energy demand shifts and other factors.

➤ The updated forecast represents a 24% increase from the $173 billion spent in 2024, a 31% increase compared with the nearly $164 billion spent in 2023 and a nearly 50% hike compared to the $146 billion invested in 2022.

➤ Aggregate energy utility investments are projected to reach $227.80 billion in 2026, $233.30 billion in 2027 and $214.84 billion in 2028.

➤ Within the smaller investor-owned water utility sector, total capex is projected to grow approximately 15% in 2025 to $6.2 billion, from $5.4 billion in 2024. This continues the trend of double-digit growth rates, with 11% posted in 2023 and 13% in 2022.

➤ The aggregate energy capex forecast for 2029 stands at $164.4 billion, up from the Spring outlook's $153 billion. This level is likely to rise significantly over time as utility companies solidify their future project plans throughout the remainder of 2025 and in the years ahead.

Energy utilities are ramping up infrastructure investments in 2025, 2026 and 2027

Several factors are anticipated to drive an increase in utility capex over the coming years. The pressing need to replace aging infrastructure is already catalyzing considerable investment. State-level renewable portfolio standards have necessitated substantial expansions in low-carbon energy generation capabilities.

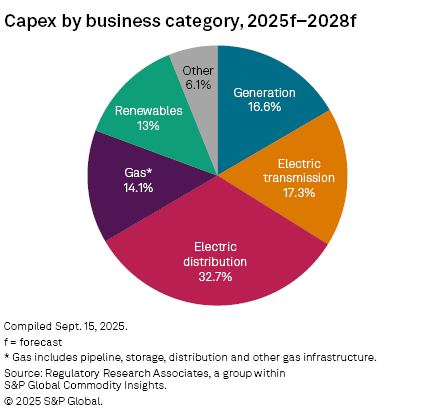

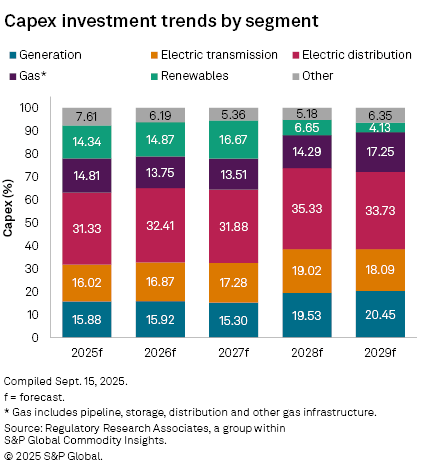

Infrastructure investment strategies for US electric utilities are centered on generation modernization, expansion and diversification; transmission expansion to support new generation and customer growth; distribution investments to improve safety and reliability; and construction of additional facilities and equipment to support new technologies like battery energy storage and advanced metering systems.

Forecast capex for the RRA Financial Focus electric utility group is expected to grow nearly 12% annually from $80.81 billion in 2025 to $99.39 billion in 2027.

For gas utilities, many capex programs are focused on gas distribution and transmission pipeline replacement and system modernization, to improve safety and reliability, as well as investments to expand gas utility systems to accommodate customer growth. Forecast capex for the nine-company Financial Focus gas group is anticipated at $8.68 billion in 2025, $9.02 billion in 2026 and $8.74 billion in 2027.

To meet new customer growth and comply with environmental and water quality regulations, water utility capex programs typically include infrastructure renewal programs to replace mains, services, meters, hydrants and valves, and larger capital projects like water and wastewater treatment and delivery facilities. Capex for the small Financial Focus water group is expected to grow marginally from $6.25 billion in 2025 to $6.34 billion in 2027.

Expansion of traditional, renewable generation resources

Planned fossil and nuclear generation capex for the RRA electric and multi-utility groups is forecast at $87.57 billion between 2025 and 2027, an approximately 12% increase since RRA's Spring 2025 forecast. Renewable energy investment is also anticipated to continue on a growth trajectory in subsequent years; the forecast for 2025–2027 renewable energy generation capex grew slightly to $85.472 billion as of Sept. 15, versus $84.13 billion in March, for the utilities that provide a segmented breakdown of their capex. The aggregate renewables investment in each of these years is likely to be considerably higher, as some utilities only offered a consolidated view of their planned energy investments.

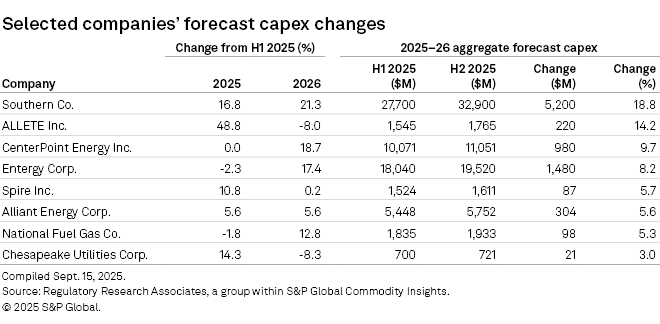

The increase in traditional generation capex is primarily attributable to Southern Co., which increased its five-year base capital plan in July to $76 billion from $63 billion; the company's 2025 and 2026 capex forecasts have increased about 17% and 21%, respectively, since RRA's Spring update. On July 15, the Georgia Public Service Commission approved a stipulated agreement between Georgia Power and the PSC public interest advocacy staff regarding the company's 2025 integrated resource plan. The approval authorizes plant life extensions at multiple steam units and allows for the installation of environmental controls and upgraded capacity across a variety of the company's existing nuclear and natural gas facilities. It also includes the modernization of hydro facilities to increase output and extend life.

Additionally, the company's competitive power business, Southern Power Co., is repowering three existing wind facilities, which are projected to be in service by the first half of 2027. These projects represent approximately $800 million of the increased forecast investment.

Southern Co. stated there is the potential for approximately $5 billion of additional upside related to the pending generation procurement certifications in Georgia and potential FERC-regulated gas pipeline expansions at Southern Company Gas. Georgia Power has filed a request to certify approximately 10 GW of new generation, which includes 7 GW of Georgia Power-owned resources. These requests will be reviewed by the Georgia PSC, with a final determination by the commission expected later this year. If the entire 10 GW of new generation were approved, it would account for an additional $4 billion of new state-regulated generation capital through 2029.

Entergy Corp.'s 2025–2027 planned renewables capex is forecast at $4 billion, up 39% from $2.885 billion in March. Traditional generation capex during this time frame is forecast at $11.87 billion, up 16% from $10.26 billion as of March. The company continues to see strong overall retail electric sales growth, particularly within the industrial sector as large customers bring online new manufacturing, chemical and fuels processing facilities.

Entergy's overall capital plan includes a significant expansion of gas generation, including assets to meet data center demand in Louisiana, and demand growth in Texas and Mississippi. In Arkansas, new legislation intended to encourage investment in electric power infrastructure and generation in the state may portend additional investment to meet data center demand. The company is also undertaking and assessing nuclear power uprates, and it is considering a potential new unit at its 1,399.5-MW Grand Gulf facility in Mississippi.

On the renewables side, while the pace of wind and solar additions has slowed somewhat, several factors are expected to drive ongoing development in electric utility renewable energy, including declining technology costs, state policies and renewable portfolio standards and consumer and corporate demand. According to S&P Global Market Intelligence data, US wind developers added 437 MW of new capacity in the second quarter of 2025, a 994-MW drop from the same quarter a year prior, as clean energy buyers shifted toward larger volumes of solar and battery storage. About 21.5 GW of capacity is under construction at onshore and offshore sites, including over 15 GW planned for completion in 2025 and 2026. US solar developers completed 4.9 GW in the second quarter, down 24.8% from the first quarter and 37.2% lower year over year. Looking ahead, developers plan to add approximately 52 GW of utility-scale solar in 2025, and through 2030, developers plan to energize over 260 GW of additional capacity.

The House Reconciliation Bill (H.R. 1), enacted July 4, 2025, introduced pivotal changes to clean energy tax credits, significantly impacting the financial landscape for renewable energy projects in the US. This legislation, also known as the One Big Beautiful Bill Act, modifies the eligibility criteria for Production Tax Credits and Investment Tax Credits, fundamentally altering investment dynamics in the renewables sector. It requires renewable projects to commence construction by July 4, 2026, or be operational by the end of 2027, to qualify for tax credits, with extended timelines for other technologies, including battery storage and nuclear power. These changes are set to reshape the financial viability and expansion strategies for solar and wind energy projects. For additional detail, see the S&P Global Market Intelligence Special Report, Renewable investments face financial crunch with loss of tax credits.

Natural gas integral to energy transition

Natural gas capex will continue to be driven by the need to replace aging gas distribution infrastructure over the long term, in line with state and federal safety mandates. Despite challenges in various regions, natural gas is expected to remain a vital energy source for the foreseeable future, particularly to bridge capacity gaps created by rising data center demand that cannot presently be entirely met by renewables due to intermittency and insufficient availability of energy storage.

Furthermore, midstream pipelines and downstream distribution networks are poised to play a pivotal role in efforts by many midstream and utility companies to extend the lifespan of their infrastructure through LNG exports and through domestic transportation of renewable natural gas and hydrogen blends.

For additional insight into infrastructure investments over the next several years within the US utility industry, refer to the capex databook as of Sept. 15, 2025, also available via the Research Library. The data incorporates intelligence distilled from the aggregation of multiple individual company forecasts.

Download the capex databook.

To access the most recent previous capex analysis, refer to Energy utility capex predicted to top $1 trillion from 2025 through 2029.

Note: This report is designed to identify capital expenditure trends in the US utility sector, drawing data from a range of sources, including corporate investor presentations, annual reports and other sources. While S&P Global Market Intelligence strives to ensure the accuracy of the included underlying data, the sources vary in terms of depth, quality and timeliness. Actual company-specific capital expenditure information should be acquired from filings with the US Securities and Exchange Commission.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a complete, searchable listing of RRA's in-depth research and analysis, visit the S&P Capital IQ Pro Energy Research Library.

Data visualization by Zain Ullah.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

Content Type

Theme

Products & Offerings

Segment

Language