Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 01, 2025

The House Reconciliation Bill 1 (H.R. 1), also known as the One Big Beautiful Bill Act, was signed into law on July 4, 2025, and marks a major turning point in US energy policy. By revising the Production Tax Credit (PTC) and Investment Tax Credit (ITC) established under the Inflation Reduction Act of 2022, H.R. 1 introduces stricter eligibility requirements: renewable projects must begin construction by July 4, 2026, to qualify for safe-harbor provisions, or they must be operational by the end of 2027 to qualify for the tax credits. The bill also eliminates tax credits for US energy projects that rely too heavily on foreign entities of concern as defined under the terms of the H.R. 1. These changes are expected to accelerate near-term solar development ahead of tax credit expirations while reshaping fossil fuel generation dynamics. This article examines H.R. 1's implications for fossil resources — capacity, generation, financial performance and emissions — drawing on a new Commodity Insights analysis that compares with the baseline second-quarter 2025 Market Indicative Power Forecast.

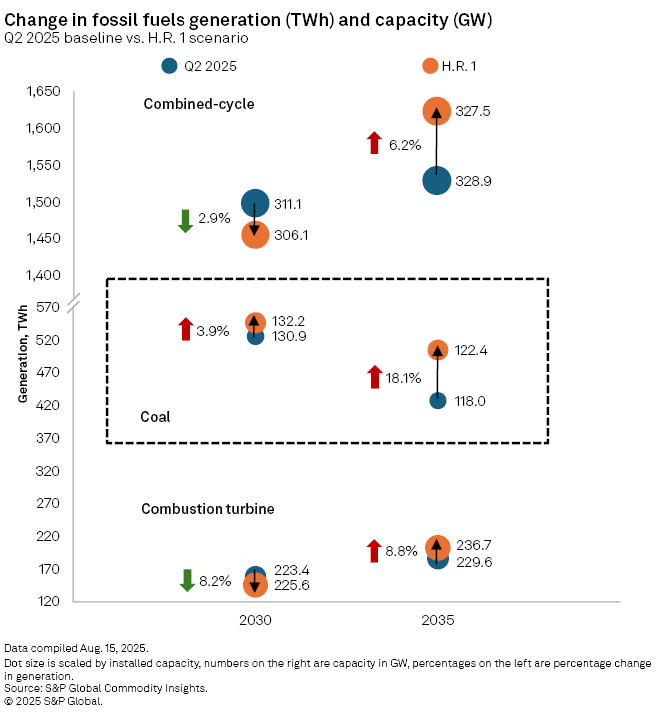

H.R. 1 produces notable shifts in fossil generation. Combined-cycle (CC) gas capacity is forecast to remain steady relative to baseline, slipping from 311.1 GW to 306.1 GW by 2030, while generation falls by 42.7 TWh (2.9%) as renewables expand. By 2035, CC output rebounds to 1,623.1 TWh, 6.2% above the baseline forecast, reflecting its role in balancing the grid as renewable growth slows. Gas combustion turbine peaking plants play a smaller but important role. Though capacity rises by 2.1 GW in 2030, generation falls 8.2% below baseline, highlighting the critical need for peaking capacity to supplement additional solar, but only for short periods. By 2035, capacity has grown by 7.2 GW, and generation follows, climbing to 202.7 TWh, 8.8% above baseline.

Additionally, we forecast that coal benefits most from higher utilization under H.R. 1 despite no new capacity. Capacity remains at 132.2 GW in 2030, but generation rises to 546.5 TWh, 3.9% above baseline, lifting nationwide generation share to 10.2%. By 2035, two-thirds of forecast coal retirements are reversed, keeping capacity at 122.4 GW, producing 505.1 TWh in generation, nearly 77.5 TWh (18.1%) above baseline.

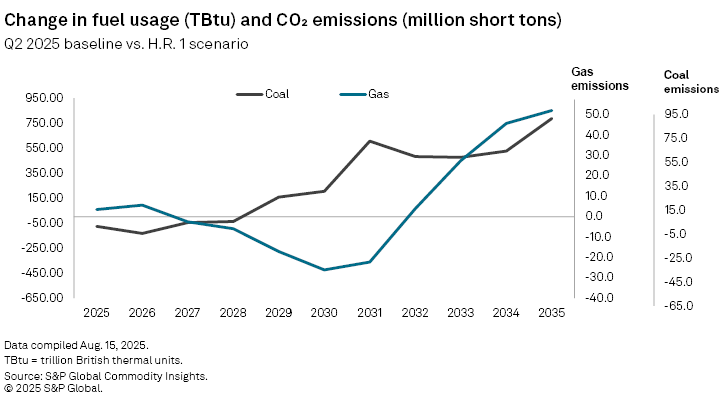

H.R. 1 slows the renewable transition by increasing fossil fuel usage. Gas consumption remains subdued through 2030 as renewables accelerate development, then rises sharply, adding 866 trillion Btu by 2035 and 51 million short tons of CO2 emissions above baseline. Coal shows a modest near-term relative decline as renewables grow, but its usage climbs as renewable expansion slows, adding 786 trillion Btu and 81 million short tons of CO2 emissions above baseline. Together, these shifts increase fossil reliance and move the US further from a net-zero electricity trajectory.

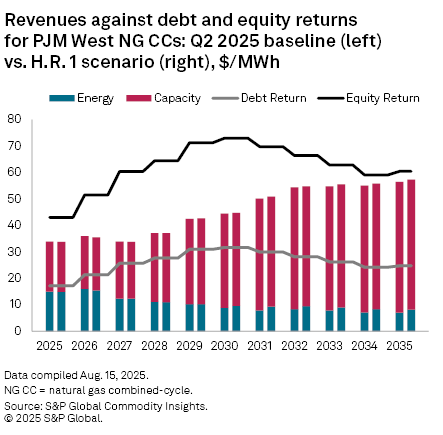

While weaker renewable returns could spur more gas investment, high construction costs remain a barrier. CC plants benefit from efficiency and rising energy prices but are sensitive to carbon pricing. PJM West, closer to the Marcellus gas source and outside Regional Greenhouse Gas Initiative (RGGI) regulations, shows positive spark spreads and strong capacity revenues under both scenarios, with slightly higher returns under H.R. 1. Still, S&P Global Commodity Insights estimates that target equity thresholds are not met until after 2035. By contrast, PJM East faces higher gas costs and RGGI carbon emissions prices, producing negative spark spreads.

H.R. 1 reshapes the US power mix through 2035 by slowing renewable expansion and increasing reliance on gas and coal. Both baseload and peaking gas plants play a greater role in balancing the system, while high construction costs limit new builds and elevate the importance of existing units. Coal retirements are reduced, and fossil fuel consumption rises, adding to carbon emissions. These dynamics strengthen near-term reliability but extend dependence on fossil resources, making the path to a net-zero electricity system more challenging.

Data visualization by Zain Ullah.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

Content Type

Theme

Products & Offerings

Segment

Language