Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 16, 2025

By Katherine Matthews, Marc Rayos, William Mason, and Ying Li

Anglo American PLC and Teck Resources Ltd. announced a proposed merger of equals on Sept. 9, combining the two entities into the Anglo Teck Group. The all-share merger would create a top-tier copper producer valued at over $53 billion, competing alongside the likes of Freeport-McMoRan Inc. and Southern Copper Corp. Should the regulatory bodies in various jurisdictions approve, the new company will be headquartered in Vancouver, Canada, and listed primarily on the London Stock Exchange, Toronto Stock Exchange, Johannesburg Securities Exchange and New York Stock Exchange.

Note that for the remainder of the article, any mention of the combined Anglo-Teck company will be referred to as "MergeCo" to avoid any potential confusion.

– The Anglo American-Teck Resources merger would create a $53 billion diversified miner, positioning itself as a top-tier global producer with 70% of earnings coming from copper.

– Strategic asset synergies, including at the Collahuasi and Quebrada Blanca mines, could help address water scarcity and infrastructure challenges through innovative solutions.

– Beyond copper, MergeCo will maintain significant exposure to zinc through the Red Dog mine and Trail Operations, alongside other commodities including high-quality iron ore and manganese.

– Complex regulatory reviews, particularly in Canada, may extend the merger timeline and potentially invite alternative bidding scenarios.

Overview

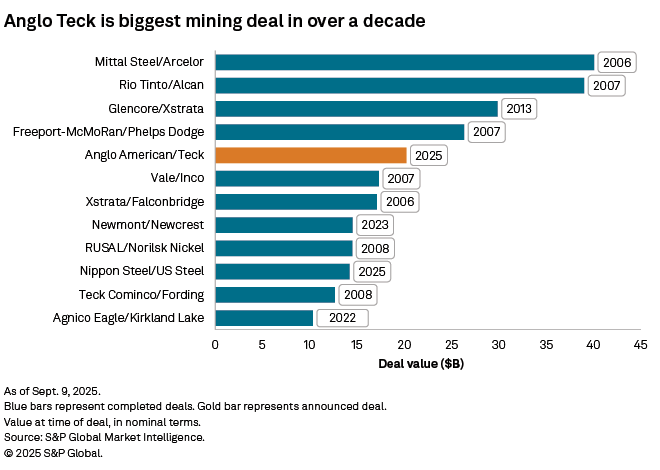

The megadeal would represent the biggest transaction in over a decade in nominal deal value, should it reach completion, at over $20.22 billion at announcement. The merger will be executed through a plan of arrangement, whereby Anglo will issue 1.3301 ordinary shares in exchange for the Teck A common and Teck B subordinate voting shares. In addition, Anglo will pay its shareholders a special dividend of $4.5 billion, equating to approximately $4.19 per ordinary share. The deal is expected to close in 12-18 months and will result in Anglo and Teck shareholders owning 62.4% and 37.6% of MergeCo, respectively.

The proposed merger is 2025's biggest metals-focused deal, far ahead of the Nippon Steel Corp. acquisition of U.S. Steel Corp., which closed in June for $14.2 billion, and the largest in 12 years since the 2013 $29.9 billion Xstrata Ltd. takeover by Glencore PLC.

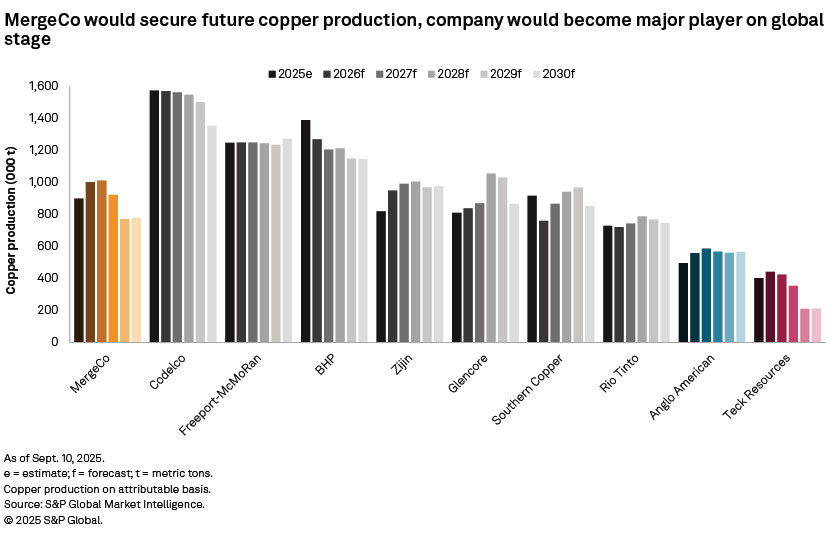

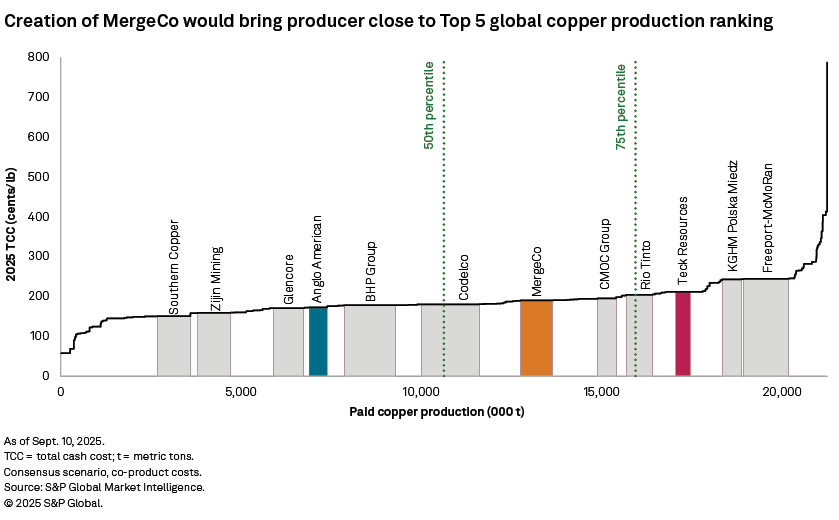

The deal's significance cannot be overstated in the current environment. Teck shares Anglo's focus on copper as a critical metal for future growth, and the global copper landscape has fundamentally shifted due to constrained upstream mined supply and a rapid expansion in downstream smelter capacity, notably in China. The concentrate market deficit is forecast to become more pronounced in the future. Smelter margins are squeezed due to suppressed treatment charges, and the supply pipeline alongside these projected market imbalances creates an imperative for major miners to secure long-term, low-cost copper production. This environment has led companies to adopt risk-averse strategies centered on acquiring existing operations, as opposed to exploring and developing new mines. Protracted permitting and development timeframes, high capital costs, jurisdictional misalignment and geopolitical instabilities all feed into an unappetizing risk profile for exploration. With Anglo and Teck combining their copper output, MergeCo would be competitive against other majors, including Zijin Mining Group Co. Ltd. and Glencore.

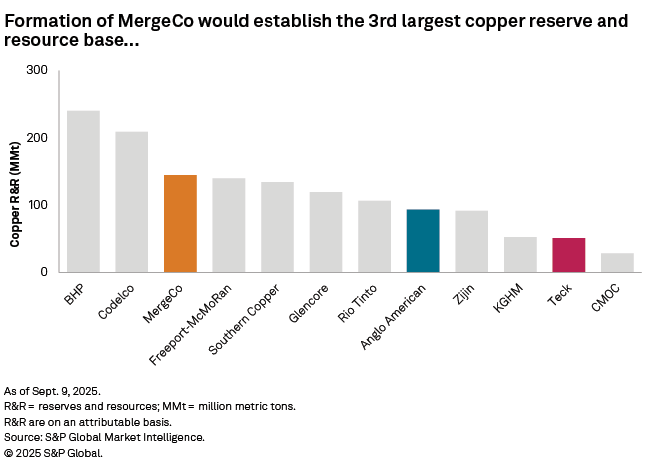

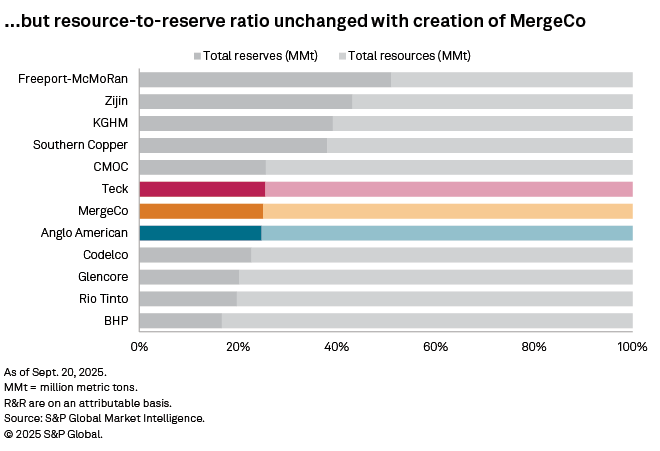

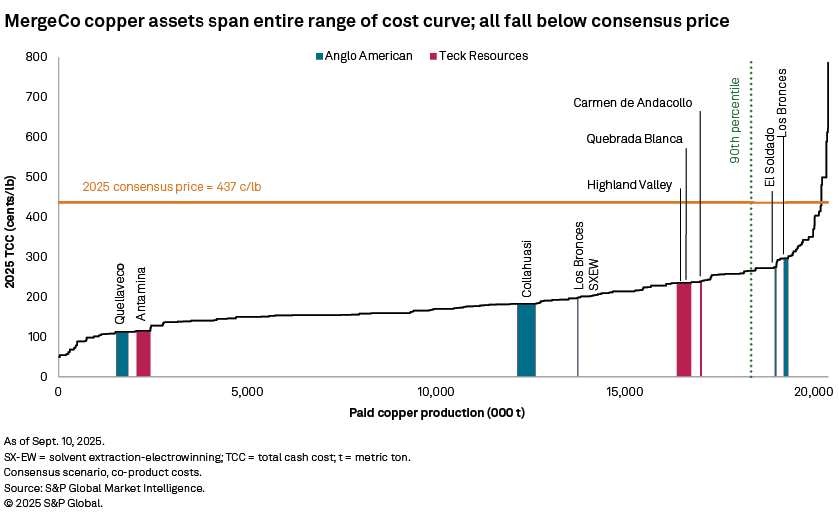

Anglo has operations in multiple commodity markets, including a strong presence in the copper sector. The merger offers significant operational synergies at two adjacent copper mines in Chile, Collahuasi and Quebrada Blanca (QB). In 2024, Teck's QB mine produced 207,800 metric tons of copper, and Collahuasi is one of the largest mines globally in terms of production volume. Combining output from the two properties has the potential to yield an additional 175,000 metric tons of copper per year through merging preexisting facilities and building new cooperative infrastructure. For example, the merger announcement outlined plans describing a new 15-km conveyor system that would link the two operations, allowing high-grade material from Collahuasi to be processed at the QB mill. MergeCo would possess the third-largest copper reserves and resources in the world, behind only BHP Group Ltd. and Codelco. The combined entity will have access to approximately 36.4 million metric tons of copper in reserves as of Sept. 10, placing it sixth in global rankings.

In the lead-up to the MergeCo announcement, both mining operations were facing significant operational and financial challenges that threatened the assets' individual viability. Collahuasi has been grappling with critical water scarcity issues that severely impacted its output during the first half of 2025, resulting in reduced net profits. Additionally, the mine has been experiencing declining head grades, which further exacerbated production costs and hampered margins. QB was dealing with substantial financial pressures stemming from its Phase 2 (QB2) expansion project. It faced significant cost overruns, amounting to over $4 billion, and persistent ramp-up delays that hindered its ability to achieve projected production targets. Infrastructure bottlenecks, tailings management problems and geotechnical issues in-pit further complicated the operational landscape.

Asset Analysis – Teck

Aside from copper, zinc is Teck's flagship commodity and remains a high-margin business unit where it operates as a global leader. The business is built on two key assets: the massive Red Dog open-pit mine in Alaska and the Trail Operations smelting and refining complex in British Columbia, which provides favorable cost advantages due to its integrated nature. Although zinc prices are not as volatile as they are for copper, the low-cost nature of the Red Dog operation enables it to remain profitable in almost any price cycle, providing Teck with a reliable and consistent source of cash flow. Teck also has the benefit of coproduct zinc from its 22.5% interest in the Antamina polymetallic operation in Peru, along with copper, molybdenum, lead and silver.

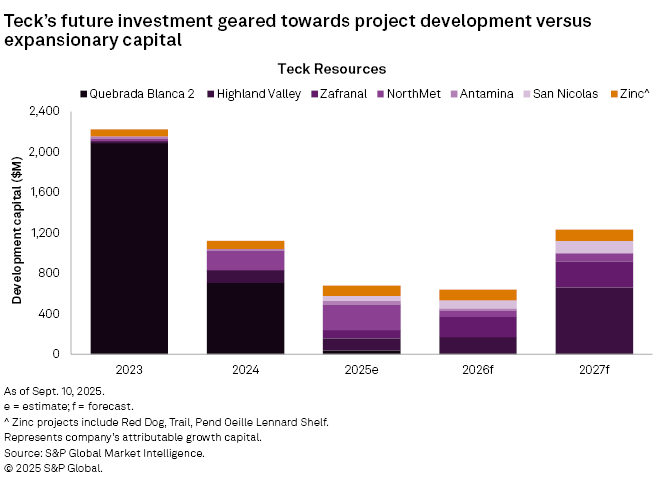

The company's near-term growth plans include the Highland Valley Copper Mine Life Extension Project in British Columbia, which will extend the life of Canada's largest copper mine through 2046. Over the life of the mine, it is expected to produce 132,000 metric tons of copper per year. The project's updated capital estimate is between $2.1-$2.4 billion, forecast to be spent over a 2025–2028 development time frame.

The San Nicolas copper-zinc project in Mexico, in partnership with Agnico Eagle Mines Ltd., is undergoing a feasibility study and is targeting production in 2028. Initial capital costs are estimated to range between $300 million and $500 million net to Teck. The project has a forecast production rate for the first five years of 63,000 metric tons copper and 147,000 metric tons zinc per year. Likewise, the Zafranal project in Peru is a potential future source of significant copper production, supported by economic byproduct gold grades in the concentrate. Production is forecast to commence in 2029, with an estimated output of approximately 150,000 metric tons copper concentrate per year over the first five years. The estimated attributable initial capital costs sit at approximately $1.5 billion-$1.8 billion. While not as advanced or large as the QB operation, it is a valuable and low-risk option for medium-term growth. Its development timeline places it behind other projects in Teck's capital allocation priorities, however.

The remaining growth projects also include two undeveloped copper projects in British Columbia: the Galore Creek copper-gold-silver project, jointly owned with Newmont Corp.; and Schaft Creek, a large copper-gold-molybdenum-silver porphyry deposit. However, due to their weighty capital costs estimated at over $3.5 billion, the two projects are held in developer portfolios as "optionality" assets, and this price tag cannot be justified by current project economics alone. Galore Creek is more advanced and strategically positioned, yet both projects remain monumental undertakings that will require a perfect alignment of high metal prices, technical innovation and capital availability to ever be developed into production centers.

Asset Analysis – Anglo

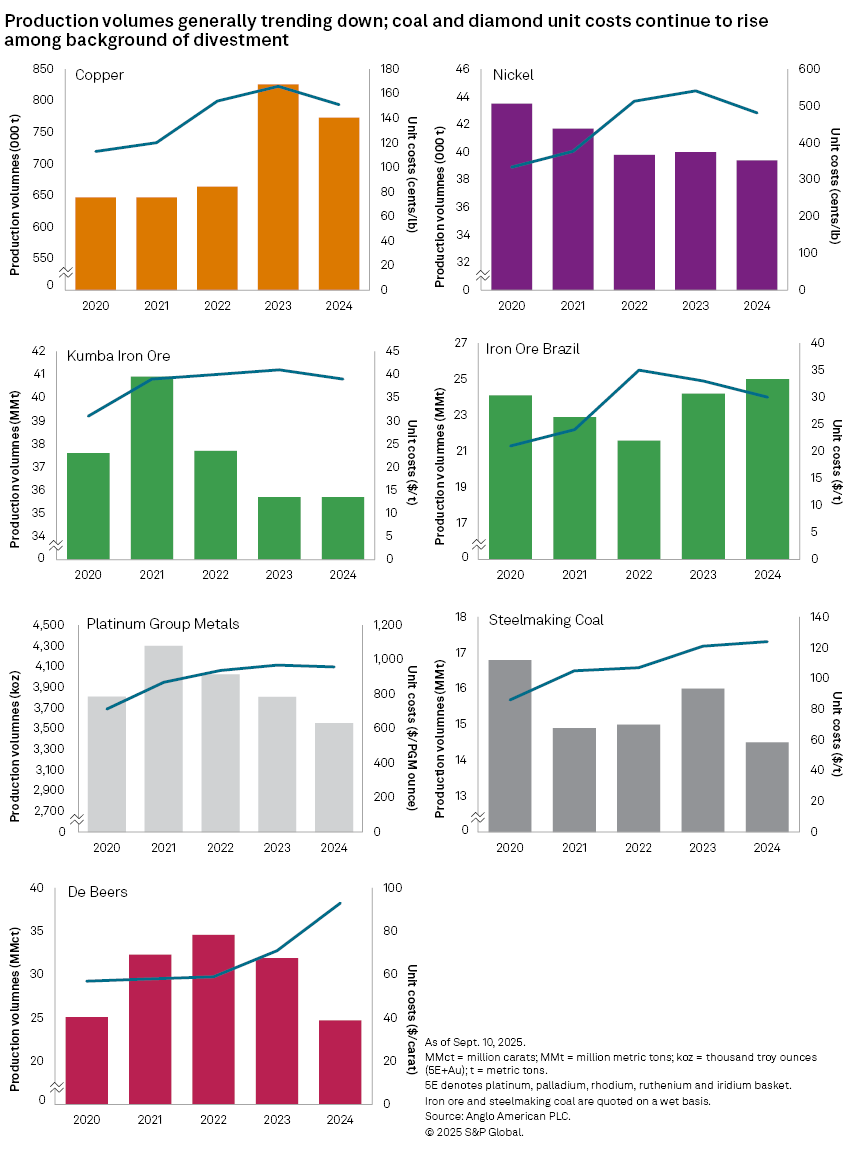

Production volumes across most of Anglo's commodity sectors, apart from iron ore, trended downward in 2024. With the backdrop of slated divestments to simplify its portfolio, the company recently announced over 200 job cuts at its metallurgical coal sites in Queensland, Australia. Other operators have also announced cuts or are even shuttering sites due to a strained local market, with high royalty rates and low commodity prices a factor. Anglo's nickel and PGM business units have also faced uncertainty in recent years. For now, the company's commodity focuses are copper in South America, premium iron ore products from Kumba Iron Ore Ltd. and Minas Rio in Brazil, manganese in Australia, and a commitment to developing its Woodsmith polyhalite project in the UK. The company recently completed the divestment of its platinum arm, Valterra Platinum Ltd. (formerly Anglo American Platinum Ltd.). The demerger was enacted on May 31, 2025, with Anglo agreeing in May 2024 to sell its 51% stake for $4.9 billion; the sale of its remaining interest of 19.9% was announced in September 2025 for $2.5 billion.

In August 2024, Anglo's transaction with Peabody Energy Corp. for its Australian steelmaking coal operations was terminated on the suggestion that the gas event at its Moranbah North complex constituted a "material adverse change." The company is now working toward a safe restart of the operation, commencing the arbitration process seeking recompense and an alternative sales process for value.

Triggered by the changing landscape in the global nickel market, Anglo announced a planned sale of its assets in Brazil to MMG Ltd. for $500 million. This would signal MMG's first foray into operational nickel holdings. However, the deal has garnered criticism from the American Iron & Steel Institute, with Brazil's Administrative Council for Economic Defense launching an investigation into the proposed transaction.

The De Beers SA subsidiary is still up for sale; diamond margins in 2024 were squeezed and continue to be pressured into 2025, according to company reports. Sustained low market demand and disruptor technologies in the form of lab-grown diamonds have resulted in a significant consumer-side structural shift. With a "dual track" approach now underway, Anglo is keen to offload this business unit, despite moves from Botswana's government to gain full control of the subsidiary for the country's economic sovereignty.

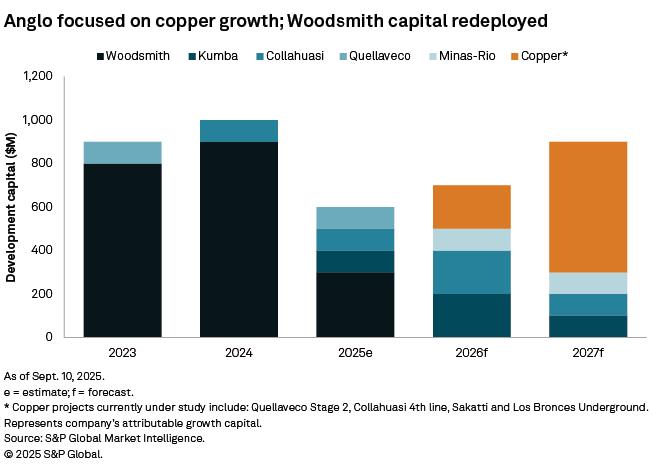

Anglo has planned for its growth capital to be directed predominantly toward major copper expansions — such as at Quellaveco in Peru and Los Bronces in Chile — as well as its Sakatti greenfield project in Finland. Sakatti is a polymetallic deposit and has recently been identified by the European Commission as a strategic project under the EU Critical Raw Materials Act. Elsewhere, the Kumba Iron Ore division is slated to receive growth capital to execute its Ultra High Dense-Media-Separation program, specifically at Sishen, South Africa. It will enable a reduction of run-of-mine cutoff grade to 40% from 48% while increasing the volume of its premium-grade product. The project is due to come online in 2028 and is forecast to require around $1 billion in total, with around $400 million remaining to be spent.

Despite recording a $1.6 billion impairment in 2024, the company has already invested significant capital into its UK-based Woodsmith polyhalite crop nutrients project. The company has dramatically cut the projected spend on the deposit, which is not expected to exceed $300 million in 2025; $184 million was spent during the first half compared to $500 million over the same period in 2024. No capital is forecast to be spent on the project in 2026. Should the Anglo American board receive approval, the capacity is planned to reach approximately 13 MMt/y of polyhalite product, with a ramp-up in activities planned from 2027 onward.

Exploration overview

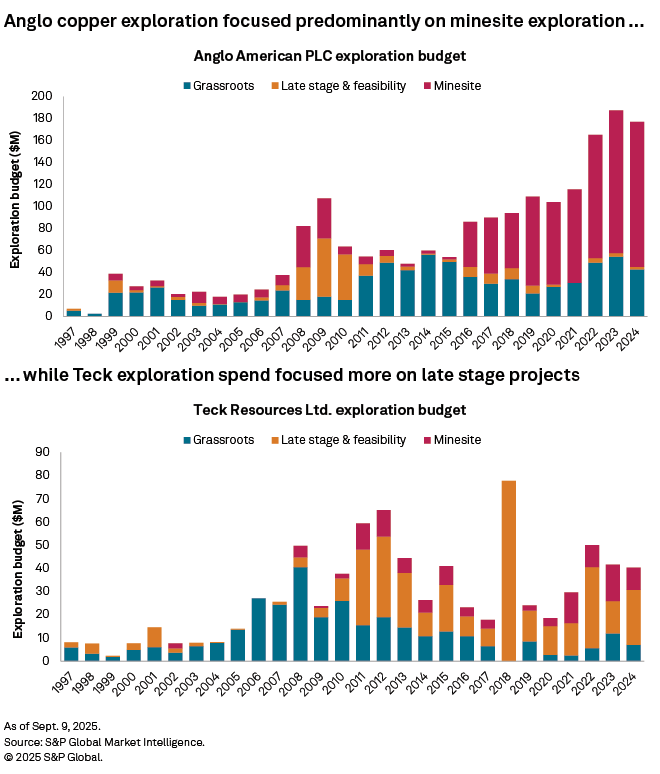

In addition to the operational synergies Anglo American is seeking with the merger, co-venturing with Teck Resources will present an opportunity to access several early-stage copper projects slated for development. The two company's have different exploration capital allocation focuses. Over the past few years, Anglo focused primarily on minesite exploration, accounting for over 74%, or $132 million, of its total budget in 2024. Conversely, Teck's investment strategy dedicated to grassroots exploration in 2006–10 has shifted toward late- and feasibility-stage exploration in recent years. In 2008, 81% of the company's budget was allocated to grassroots exploration, predominantly centered in South America. However, it swung to late-stage exploration in 2024, taking $23.7 million (59%) of the total budget. Teck's investment in exploration in Canada has also surged since 2021, totaling $20.7 million in 2024. The last period in which Teck directed significant exploration capital to Canada was 2011–15, peaking at US$24.3 million in 2012.

Interlopers incoming?

While the merger in its current form boasts operational and cost synergies, the deal stipulates a transfer of Teck's executive jurisdiction to Vancouver post-merger, along with evidently supporting continued investments in Teck's existing operations and the broader Canadian mining sector. This comes following 2024 revisions to the Investment Canada Act designed to insulate the country against abrupt changes in trade policies. In assessing foreign investments, regulators will now consider additional factors that may stifle Canadian businesses and impact supply chains. The review is expected to last at least 12-18 months, and a transaction value of this size will be the first to be scrutinized if it is of net benefit in exceptional situations. As such, this is seen as one of the bigger hurdles for the deal. The lengthy review period also leaves room for other bidders to counteroffer. Given the stricter regulations surrounding Teck and the need to win over holders of their Class A shares, Anglo's larger, lower-cost copper portfolio may be more desirable. Bids from other companies will likely make the timeline for finalizing the Anglo-Teck merger longer than anticipated.

Glencore made an unsolicited bid for Teck in 2023; however, due to various concerns raised by the company's board of directors and shareholders, the company rejected the initial approach and a subsequent revised bid. Teck then split its metallurgical coal business as Elk Valley Resources Ltd., with Glencore ultimately acquiring this unit. It is anticipated that many of the concerns that Teck had against Glencore's 2023 approach still exist, and it will reject any new offer.

However, an approach by Glencore to Anglo may be met with a better reaction. Both companies are listed on the LSE and, of course, the steelmaking coal assets in Queensland will appeal. Glencore has 44% equity ownership in the Collahuasi open pit in Chile, and a theoretical merger of Glencore and Anglo features a more attractive consolidated copper cash cost versus MergeCo, with a production profile rivaling Codelco and BHP. But Glencore may have limited financing options after acquiring Elk Valley Resources. Aside from its increased debt load, Glencore will also have to contend with shareholder sentiment on the sustainability front with its expanded steelmaking coal segment.

BHP also made an unsolicited bid in April 2024, this one directed toward Anglo. BHP attempted two further up-bids, both of which were roundly rejected by Anglo, resulting in BHP eventually withdrawing its offer. While the deal value was significant, the opportunistic nature of the approach and requirements stipulated by BHP soured discussions. The deal structure was particularly complex, requiring the divestment of its iron ore and platinum businesses in South Africa, and it exposed Anglo to notable risk with the deal execution and immediate liabilities, as well as the future pipeline. A rival bidder did not enter the scene, and subsequently, Anglo broke up much of its business into its simplified portfolio plan, committing to its belief that a stand-alone strategy would be more beneficial to the company and its shareholders than BHP's proposal. At this stage, BHP is not expected to make a rival bid for Teck. Even though there would be greater exposure to copper assets, the anticipated cost of a competing bid will be weighty. BHP's focus is on maximizing its current assets, including significant investment in its Escondida operation and developments in new technologies such as Full SaL, which has been tested both at Escondida and at its Spence production center. BHP also holds equity in several projects in the region, including a 50% stake in the Filo del Sol deposit near the Argentina-Chile border, alongside Lundin Mining Corp.

Interested parties will need more than buying power to take hold of either Anglo or Teck. The deal is structured in a mutually beneficial way for both companies, and a prospective bidder would also need to have significant sway with the governments in Canada and South Africa. Current legislation in Canada would potentially require significant upheaval and relocation of an interloper's C-suite, while Anglo is so entrenched in South Africa that any untying of that structure would be lengthy, disruptive and high-risk. South Africa's government is a significant shareholder in Anglo via its state-owned Public Investment Corporation Ltd., and so it can easily interrupt any conversations that would not be in the country's best interests.

With the goal of enhancing copper portfolios amid rising demand driven by the green energy transition, former failed bids by BHP and Glencore indicate that a nuanced and personal approach serving shareholders and national interests must be considered for a deal of this magnitude to come into fruition. The deal timing is significant, given several factors are at play, including a significant dearth in concentrate supply becoming apparent from 2030 and global copper discoveries decreasing in recent times. The development of greenfield and brownfield assets will help MergeCo address these concerns and likely create further growth opportunities; however, preexisting complications at individual operations may hamper timelines and cause expenditure forecasts to be exceeded, disrupting the course outlined for this synergy.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.