Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 18 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

A Soft Landing Is Still a Landing

Economists have not achieved a consensus on the direction of the US economy. While all concede that the much-predicted recession has yet to come, some believe that it has merely been delayed until the fourth quarter or early 2024. Others insist that the threat of recession has passed and we are currently enjoying the elusive “soft landing” from rising interest rates, which occurs when economic growth slows but there is no recession. In this case, a soft landing would be signaled by inflation returning to its 2% target without negative economic growth or a significant jump in unemployment numbers. The challenge for economists is that the difference between a soft landing and a recession is primarily one of degree. In both cases, we would expect to see cooling economic growth, increased bankruptcies and defaults, and slowing wage growth. Because recessions develop over six months or more, the same data can be interpreted as evidence of an impending recession and a soft landing.

Some market observers believe that a recession is still on its way. Peter Brennan, senior reporter at S&P Global Market Intelligence, said that interest rates, which have risen to 5% from near zero in March 2022, have yet to fully impact businesses and consumers. The US economy grew at 2.1% in the second quarter, and unemployment is still unusually low at 3.8%. But Brennan quoted a variety of economists who suggested that credit downgrades of regional lenders, slowing growth in real disposable personal income and drying liquidity for households indicate cracks in the US economy.

Still, the US economy continues to show surprising resilience. S&P Global Market Intelligence economists believe that the US economy is capable of sustainable growth of 1.75% to 2%, meaning that 2% growth would not indicate the economy was overheated and that an inflation rate of 2% could be maintained. Despite the interest rate hikes, the US economy continues to grow above its sustainable rate. The labor market remains exceptionally tight, with only 6.36 million unemployed people chasing 8.83 million job openings. The Federal Reserve has indicated that further interest rate hikes at its September meeting are unlikely due to signs of moderating inflation, although further raises in the future are possible. US equity investors are also showing signs of fading risk aversion, indicating that fears of an immediate recession have passed.

In the case of either a soft landing or a recession, we would expect higher interest rates to impact corporate borrowers first. Corporate bankruptcies filed year to date have exceeded annual totals for both 2021 and 2022. In the three most-populous US states — California, Texas and New York — corporate bankruptcies are approaching 2010 levels. According to S&P Global Ratings, there have been 69 US corporate defaults in the year to Aug. 31, far eclipsing the 25 corporate defaults in the same period of 2022.

The state of affairs today is not much different than it was in June, when S&P Global Ratings Chief Economist Paul Gruenwald said that inflation was too high and unemployment was too low from a price stability perspective. “This combination is the result of an economy that is running too hot or, to put it more precisely, an economy that is running above potential with a positive output gap,” Gruenwald said. “In order to close the gap, growth needs to spend some time below its potential rate of around 2.0%. This can be achieved with a short, sharp decline (a recession) or a longer period of below potential (a longer landing). But land we must.”

Today is Monday, September 18, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week Of September 18, 2023

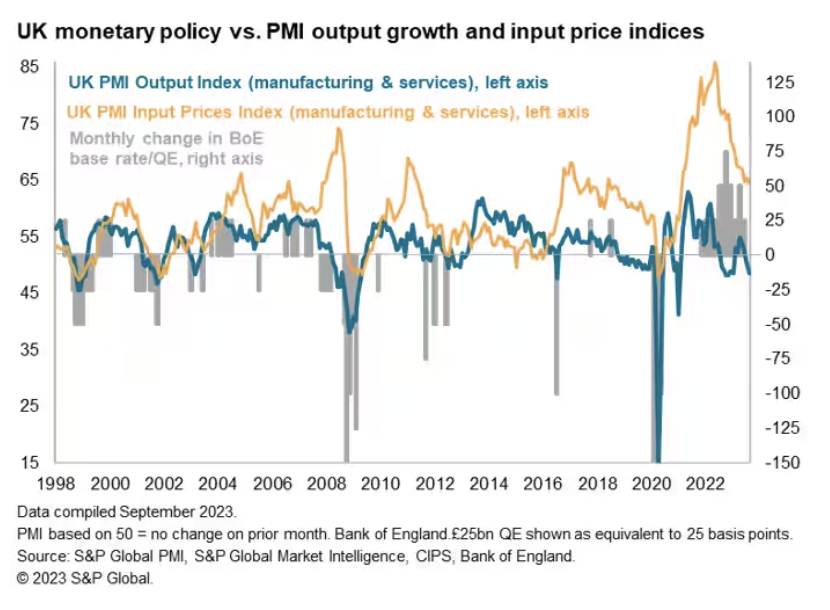

A series of central bank meetings unfold in the coming week, notably including in the US, UK and Japan, while flash PMI data bookend of the week for early insights into September economic conditions across the major developed economies. Other key economic releases include inflation data from the eurozone, UK and Japan alongside US housing market data.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Innovating For Insurance: Charting A "Smarter" Path To The S&P 500

How can an index adjust to prevailing market conditions by design? Meet the S&P 500 IQ Index, a dynamic risk control index that uses intraday technology to rapidly respond to changing markets, increasing S&P 500 exposure when markets are stable and leaning into cash during times of volatility.

—Watch the video from S&P Dow Jones Indices

Access more insights on capital markets >

G20 Summit In India

India, the current president of the Group of 20 (G20), hosted the G20 Leaders' Summit in New Delhi from Sept. 9 to Sept. 10. The summit began with a unanimous Leaders' Declaration, where participants affirmed the G20 as the "premier global forum for international economic cooperation." Russian President Vladimir Putin and Chinese President Xi Jinping did not attend the summit; both sent representatives instead.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

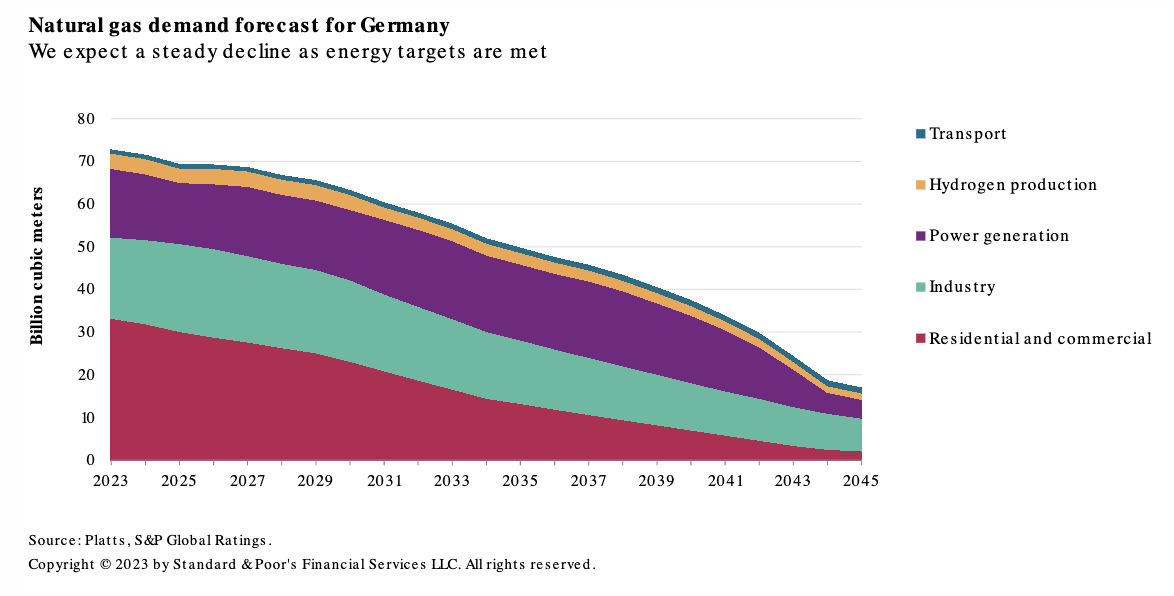

Germany's Green Energy Ambitions Spark A Transformative Decade For Utilities

Germany's accelerated greening of its power mix to 80% by 2030 has profound implications for power utilities as it requires massive investments into new generation capacity and grid strengthening over the next decade. Favorable prices and lower supply risks should give generators the financial headroom to accelerate investments in the energy transition. For power grid operators, an increased state presence should help bridge the vast funding gap to achieve the energy transition.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Listen: At Asia’s APPEC, Energy Transition And Russia Steal The Limelight

The 39th annual Asia Pacific Petroleum Conference in Singapore captured the tone of Eastern oil markets in early September, catapulting the energy transition back into focus after the distraction of recent world events. Richard Swann, Dave Ernsberger and Joel Hanley share their views on what was a lively week, packed with information on oil, carbon, shipping, biofuels and more. They also reveal the conference’s oil price prediction for the end of the year.

—Listen and subscribe to Platts Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

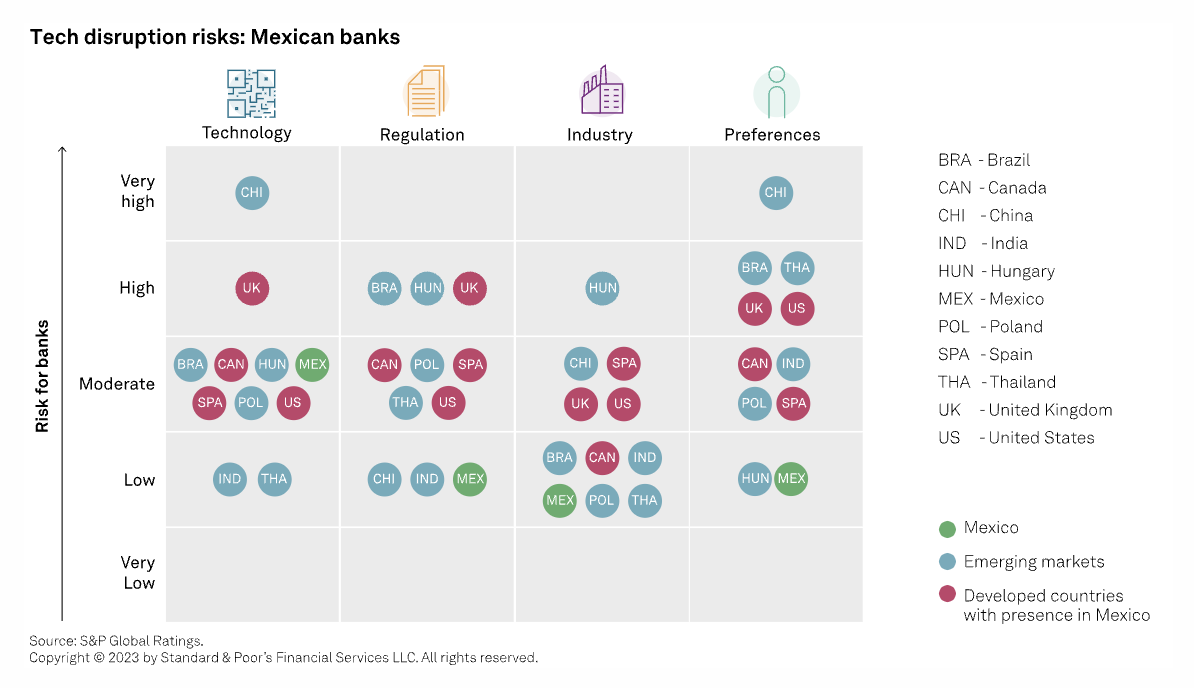

Tech Disruption In Retail Banking: Financial Inclusion In Mexico Will Remain Low Despite Digitalization

Mexican banks, in general, have kept their risk appetites in check when it comes to retail banking: Their focus has been on middle- and high-income customers, as well as large corporations and small and midsize enterprises with better credit quality. This conservative approach is a response to obstacles such as Mexico's large informal sector, which strongly prefers cash transactions; a high level of income inequality; and the country's inefficient rule of law. All of this means that access to banking services in Mexico is low relative to the access that exists in peer countries throughout Latin America and the emerging markets.

—Read the report from S&P Global Ratings

Content Type

Location

Language