Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Sep 11, 2023

By Ben Herzon and Lawrence Nelson

The US economy is growing significantly above its sustainable trend of roughly 1¾% to 2%, showing striking resilience in the growth of spending amid financial conditions that have tightened measurably over the past year or so.

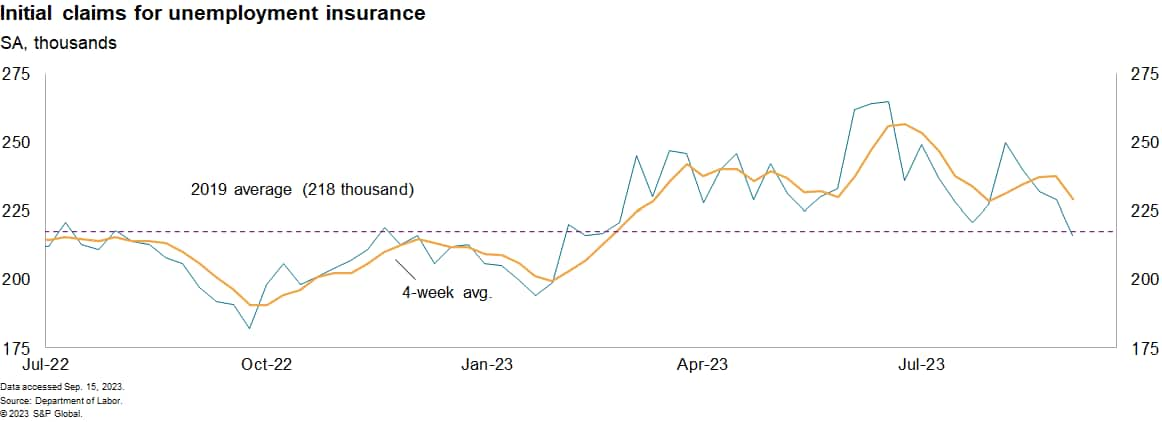

Exceptionally tight conditions in the labor market largely remain. In the latest week, initial claims for unemployment insurance declined for the fourth consecutive week and continuing claims edged lower as well; both now sit below their 2019 average. Last week's report that the unemployment rate rose in August was not a sign of labor market cooling, although there are hints of cooling: Previously reported data show material declines in job vacancies, indicating labor demand may be softening without it necessarily being reflected in job losses. Still, wage gains exceed a rate consistent with 2% inflation, so some degree of increased labor-market slack is likely needed to slow wage gains.

The Federal Reserve is not itching to tighten policy at its upcoming September meeting. A couple of recent favorable inflation readings — core PCE inflation has slowed somewhat faster than anticipated — has even the hawkish members willing to wait for more data.

Some observers have marveled at the "immaculate disinflation" that has occurred while the unemployment rate remains near historic lows. To be sure, inflation has come down a bit quicker than expected, but given the unique causes of the surge in inflation, including significant overshooting in the level of many commodities and goods prices, a rapid disinflation was always possible as many post-pandemic imbalances were unwound. Given the strength in growth, labor-market tightness, and stubborn wage inflation, we believe further progress on inflation will come more slowly, and we continue to expect another 25-basis point rate hike by the Fed in November.

The economy does face some potential challenges in the near term. Failure of demand to cool and inflation to continue its recent decline could lead to more rate hikes that would increase the risks of a subsequent and more pronounced slowing in demand and a recession — a mini boom/bust scenario. A possible budget stalemate could result in a federal government shutdown, which would imply a modest adverse shock to fourth quarter GDP growth depending upon its duration. A potential strike by the UAW against major automakers could also impact growth. Getting both a government shutdown and a prolonged auto strike could change the outlook materially.

For now, tail winds are keeping the economy moving ahead rapidly, but storm clouds on the horizon suggest that could change in the not-too-distant future.

This week's economic releases:

Learn more about our economic data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.