Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 13 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Signs of Soft Landing Emerge for Australia's Economy

Like other developed economies in the West, Australia has been plagued by high levels of inflation over the past year. This prompted the country’s central bank to tighten its monetary policy by aggressively increasing interest rates. After a series of interest rate hikes, inflation has begun to cool, and the Australian economy appears to be headed for a soft landing — a slowdown in economic growth that approaches, but avoids, a recession.

As the odds of a soft landing have improved in the US, analysts forecast the same Down Under. "It is, in principle, possible for the [Australian] economy to see a soft landing, with excess demand reduced not via a recession but through a period with actual growth lagging potential growth," according to Louis Kuijs, chief economist of Asia-Pacific at S&P Global Ratings. S&P Global Ratings forecast weak economic growth for Australia at 1.4% for 2023 and at 1.2% for 2024, along with a modest rise in unemployment. If the unemployment rate rises by about 1 percentage point, the Australian economy should be able to pull off a soft landing, Kuijs said.

The rapid rise of global inflation was caused by supply chain constraints and other knock-on effects of the COVID-19 pandemic and Russia’s invasion of Ukraine. The core inflation rate — underlying price increases excluding those of the volatile energy and food sectors — surged as businesses passed on higher operational and labor costs to consumers. COVID-19 stimulus funds also boosted consumer spending, resulting in more expensive goods and services. As two of the world’s major commodity producers went to war, production and trade were disrupted, causing global energy and food prices to soar.

Australia recorded a 7.8% inflation rate in the fourth quarter of 2022, its highest in more than 30 years. To tame inflation, the economy needs to cool to establish a better balance between supply and demand, Kuijs said. To achieve this, the Reserve Bank of Australia has raised interest rates several times since May 2022, pausing in July 2023 to keep interest rates at 4.1% for three consecutive months, saying inflation had crossed its peak. Still, the central bank warned that inflation remains too high, signaling that further rate hikes are possible before the end of this year.

Higher interest rates in Australia are having the intended effect of an economic growth slowdown and are cooling inflation. Many Australians are facing financial pressure, with household budgets getting squeezed, savings buffers becoming exhausted and the cost of doing business becoming more expensive.

"The combination of higher inflation and higher interest repayments has meant that real household disposable incomes have fallen around 5% year on year. … The rising cost of living is impacting all of our customers," said Matt Comyn, CEO of Commonwealth Bank of Australia, which is the country’s biggest lender by assets.

Australia’s banking system should be able to pull through the financial stresses brought about by rising rates, according to S&P Global Ratings. Analysts estimate that Australian banks’ debt market activity will pick up, their mortgage books will remain robust and their nonperforming loans will stay below trend. Mortgage arrears, or missed mortgage payments, remain low, although they are likely to tick up in the second half as borrowers begin to feel the full effect of the rate increases. Some customers will find it difficult to service their mortgages, but they are a small cohort, and most borrowers should be able to absorb the higher costs, the analysts said.

While the most likely scenario for Australia is a soft landing, a sharper economic downturn may still arise if inflation becomes stickier than expected and leads to more aggressive rate hikes, or if declining consumer confidence and other factors further drag growth, according to S&P Global Ratings.

Today is Wednesday, September 13, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

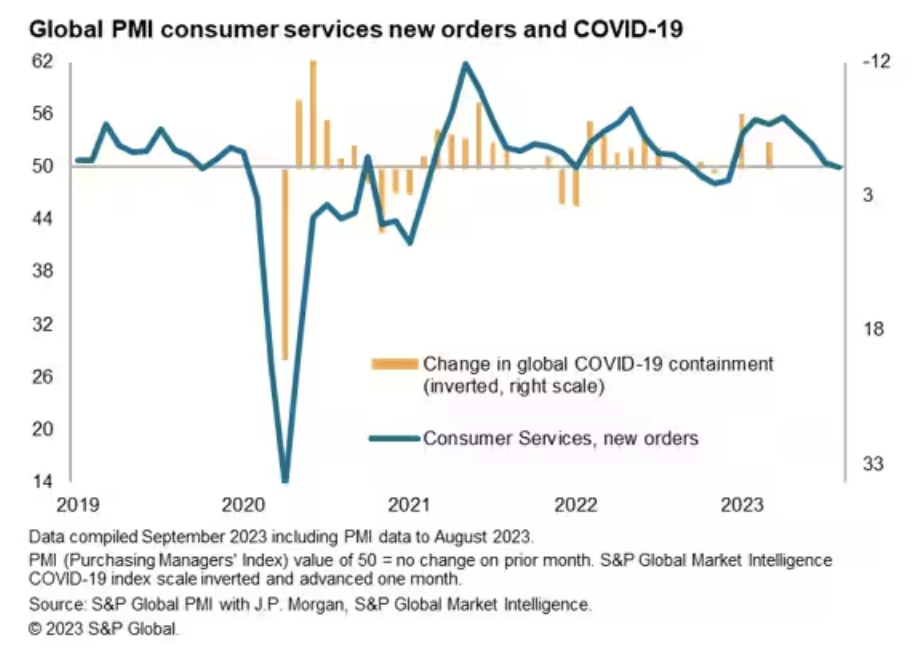

Renewed Fall In Demand For Consumer Services Bodes Ill For Growth But Will Pull Inflation Lower

Global PMI survey data, based on data from S&P Global's 40 national business surveys, showed the overall rate of output growth fading for a third month running in August, dropping to its lowest since the current upturn began in February. However, another way of gauging the health of the global economy is by looking at sectoral performance. The advantage of the worldwide PMI data is that the survey results can be analyzed at both the country level and a detailed sector level.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

S&P US Indices H1 2023: Analyzing Relative Returns To Russell

After a challenging year in 2022, the US equity market saw a strong turnaround in the first half of 2023, with the S&P 500® up 17% since year-end 2022. Exhibit 1 shows that the rebound was also observed across the cap spectrum. Returns in the second quarter outperformed the first quarter after the market shook off regional bank concerns earlier this year.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

Fractal Shipping Pauses Russian Crude Trade As Fleet May Be Expanded

Fractal Shipping, which has carried 88 million barrels of crude and oil products since December 2022 — half of it of Russian origin — is considering expanding its fleet of 28 ships to include ships that are less than 10 years old, while seeking more traditional business in India, Turkey and the Persian Gulf now that the window on Russia crude has closed, CEO Mathieu Philippe said in an interview in Dubai with S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Unpacking Big Oil’s Risky Bet On German Offshore Wind

The hefty premiums paid by BP and TotalEnergies in Germany’s latest offshore wind auction reflect the value these companies place on diversification — but do the economics stack up? Competition for offshore concessions has been fierce, but the sector is also under extreme cost pressure from stressed supply chains and rising inflation. S&P Global Commodity Insights’ news editors Henry Edwardes-Evans, Andreas Franke and Alex Blackburne discuss these issues with S&P Global analyst director colleague Coralie Laurencin.

—Listen and subscribe to Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

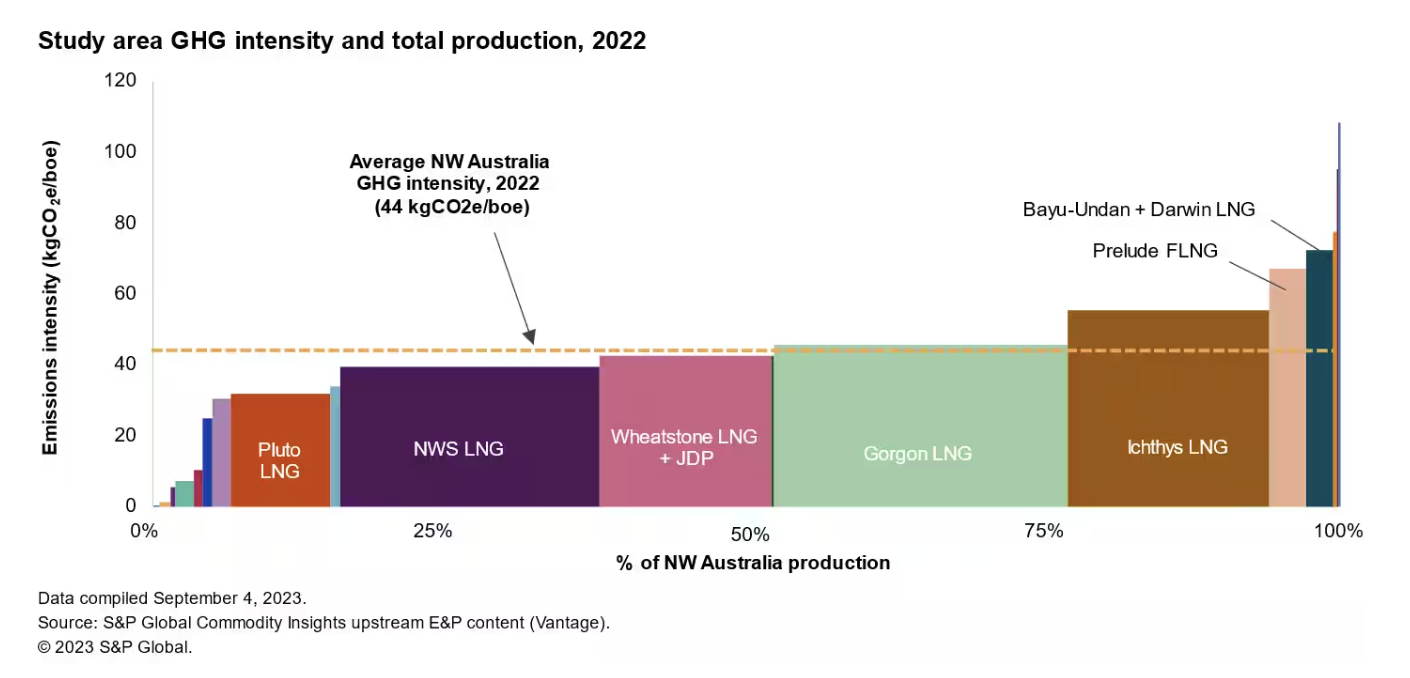

Contrasting Upstream Emissions In Northwest Australia Offshore

The area offshore northwest of Australia, spanning from the North Carnarvon Basin to the Bonaparte Basin, is the country's most significant petroleum producing area. The commercialization of gas in the region, through the development of liquefied natural gas (LNG) projects, has played a significant role in establishing Australia as a prominent global producer of LNG. This achievement started with the Northwest Shelf LNG asset, and has been realized over four decades, during which time the LNG facilities, and other oil and gas field developments, have been sanctioned.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

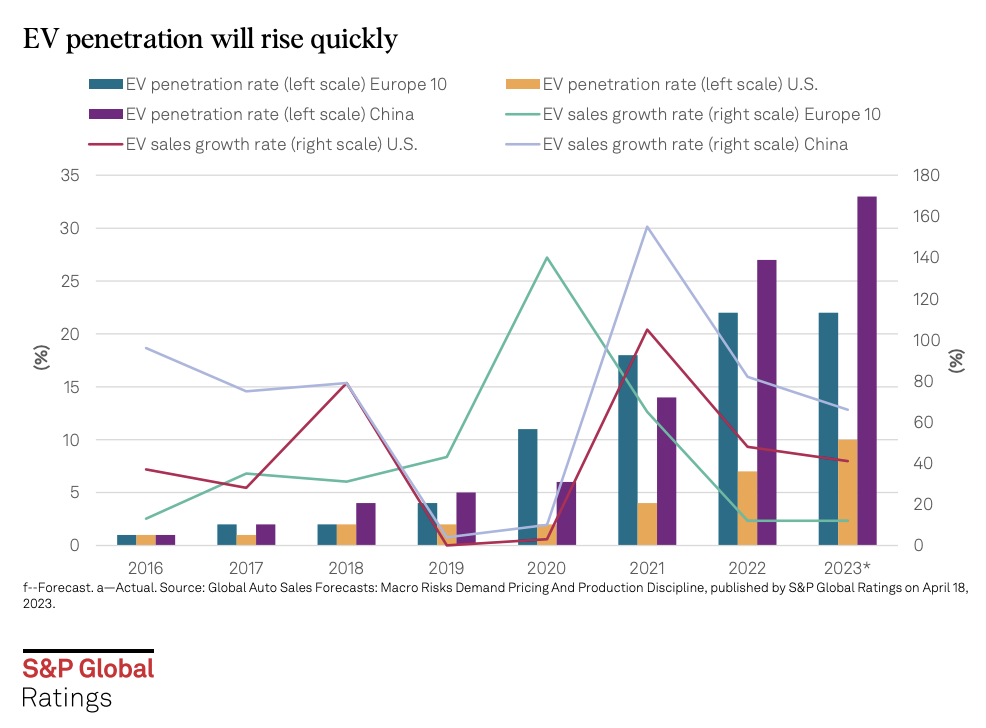

Sector Review: Taiwan Top 50 Corporates: Rising Sustainability Awareness Opens Opportunities In The Electric Vehicle Supply Chain

Investments by the top 50 corporates in electric vehicle (EV), renewable energy and sustainable products are generally positive to their business position and underpin potential growth prospects and improving business diversity. Intense competition for some products could increase business risk and offset the benefit of business diversity and growth potential. The benefit to business position alone is less likely to materially strengthen credit profiles over the next one to three years, given the limited EBITDA contribution from these products before at least 2025.

—Read the report from S&P Global Ratings

Content Type

Location

Language