Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Reinsurance Reevaluates in the Face of Growing Catastrophe Risk

After floods hit Florida, Georgia and South Carolina this week, causing property damage, Hurricane Idalia has moved into the Atlantic. This storm and the tragic wildfire in Maui are expected to lead to billions of dollars in property and casualty insurance claims. Ultimately, these claims will hit the books of global reinsurers, which are paid to assume some of the financial risk for claims against insurance companies. As large storms and natural disasters grow more frequent because of climate change, the cost of assuming catastrophic risk has increased for large reinsurance companies. The investment portfolios of these companies are also being impacted by persistent inflation and higher interest rates. The reinsurance team at S&P Global Ratings examined these overlapping burdens and concluded that the industry in aggregate is well situated to manage potential unrealized losses from interest rate changes and claims related to catastrophe risk.

Reinsurers collect premiums from insurance companies and invest those premiums in a variety of assets. Like banks, reinsurance companies tend to hold a sizable percentage of their portfolios in fixed-income securities, many of which have decreased in value due to interest rate increases. Analysts at S&P Global Ratings do not believe that the current unrealized losses on fixed-income securities for the top 20 global reinsurers represent a material risk. Because of reinsurers’ need to pay out claims on short notice, they take a proactive approach to cash flow management and maintain robust liquidity. Many of the top 20 reinsurers maintain S&P Global Ratings-calculated liquidity ratios of over 200%, placing them in a position to absorb unrealized losses from corporate and government bonds. Reinsurers are expected to remain focused on underwriting discipline, rather than generating better investment income, since unexpected liabilities represent a more significant risk.

Total claims related to the wildfire that recently destroyed Lahaina on the Hawaiian island of Maui are expected to be about $3.2 billion, although analysts at S&P Global Ratings believe that figure could increase due to the challenges of reconstruction so far from the mainland US. To put that number in some perspective, total claims related to the 2018 Camp fire in California were estimated to be about $10 billion. Analysts at S&P Global Ratings believe that the Maui claims will have a limited impact on credit ratings for insurance and reinsurance companies.

While the reinsurance industry may not see a big impact from the Maui fires, the appetite for catastrophe risk is variable among major global reinsurers. Following six years of elevated losses due to catastrophes, the cost of reinsurance for property has increased. Half of the top 20 global reinsurers have chosen either to reduce their natural catastrophe exposures or maintain them at current levels, despite high demand and rising premiums. According to analysts at S&P Global Ratings, this indicates that the pricing correction for property catastrophe risk is continuing and that coverage prices for insurers will rise further. Given the continued, strong demand for catastrophe risk coverage, S&P Global Ratings anticipates that global reinsurers will deploy more capital to this area. The return on equity for the property catastrophe business should continue to improve if losses remain within budget. This year, insured losses are tracking above the historical average due to a broad range of natural disasters.

“We think that many reinsurers, in addition to allowing for exposure growth and inflation, are continuing to factor a greater climate variability into their forecasts this year,” according to S&P Global Ratings’ analysis. “At the same time, elevated losses from midsize perils (such as floods, convective storms and wildfires) are contributing to the long-term trend of rising insured losses from natural perils.”

Today is Friday, September 1, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

The next edition of the Daily Update will be published Tuesday, September 5.

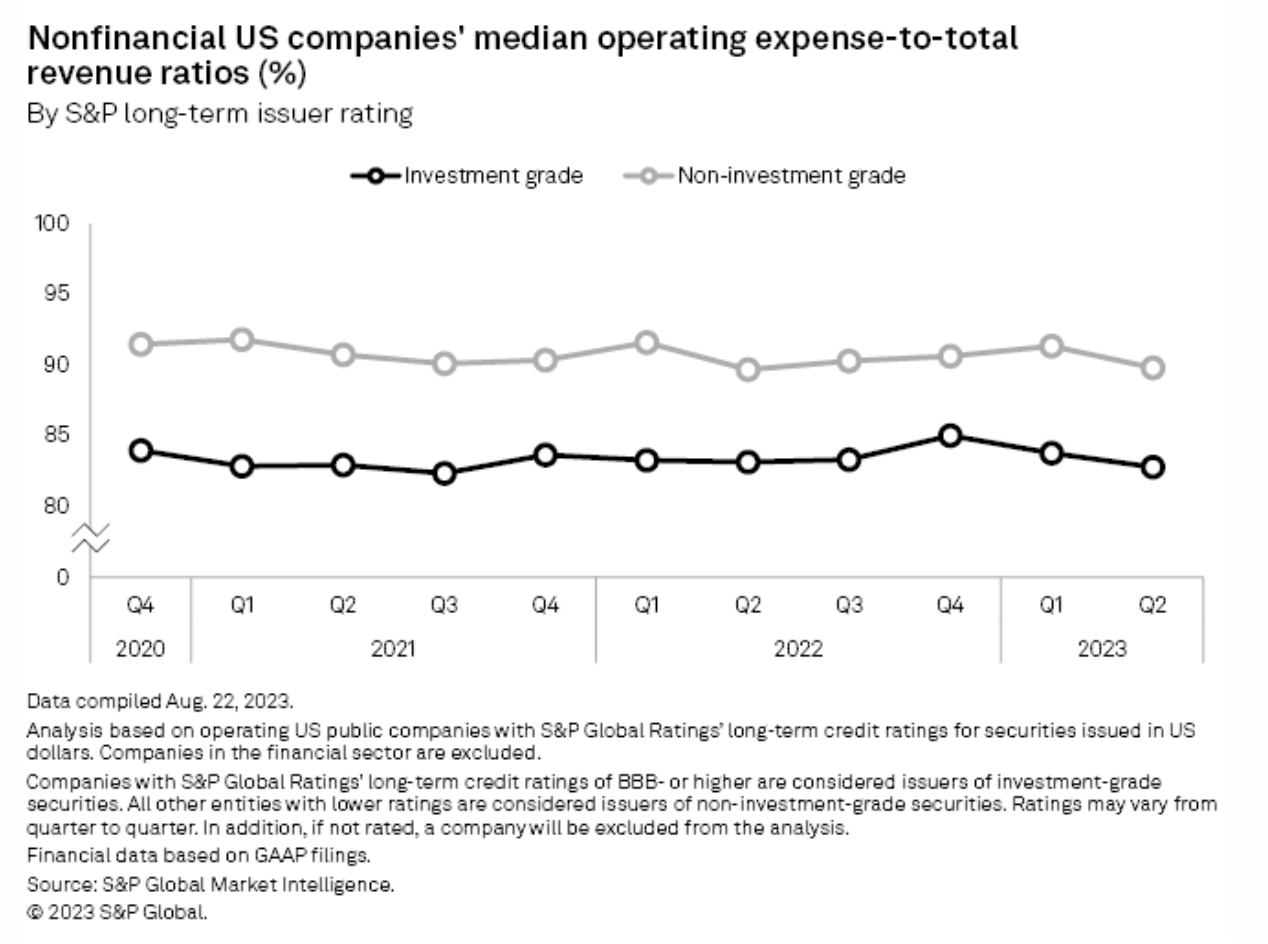

US Companies Becoming More Efficient By Cutting Expenses

US companies are reducing their operating expenses as a proportion of revenues to boost efficiency. The median ratio of operating expenses compared to total revenues for companies rated investment grade by S&P Global Ratings declined to 82.8% in the second quarter, down from 83.8% in the first quarter, according to the latest data from S&P Global Market Intelligence. A lower ratio is typically more desirable as it indicates a company can generate revenue at lower costs.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

How The Property Downturn Is Hitting Asia-Pacific Banks

Fully three-quarters of attendees at a recent S&P Global Ratings webinar examining the effects of a property downturn on Asia-Pacific banks said China was the most severely affected. While property sectors are weak in several key economies, notably China's, most Asia-Pacific banks have sufficiently diverse lending and adequate capitalization to absorb the strains. While S&P Global Ratings sees several property markets are under pressure, no banking system yet in Asia-Pacific is in significant difficulty.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

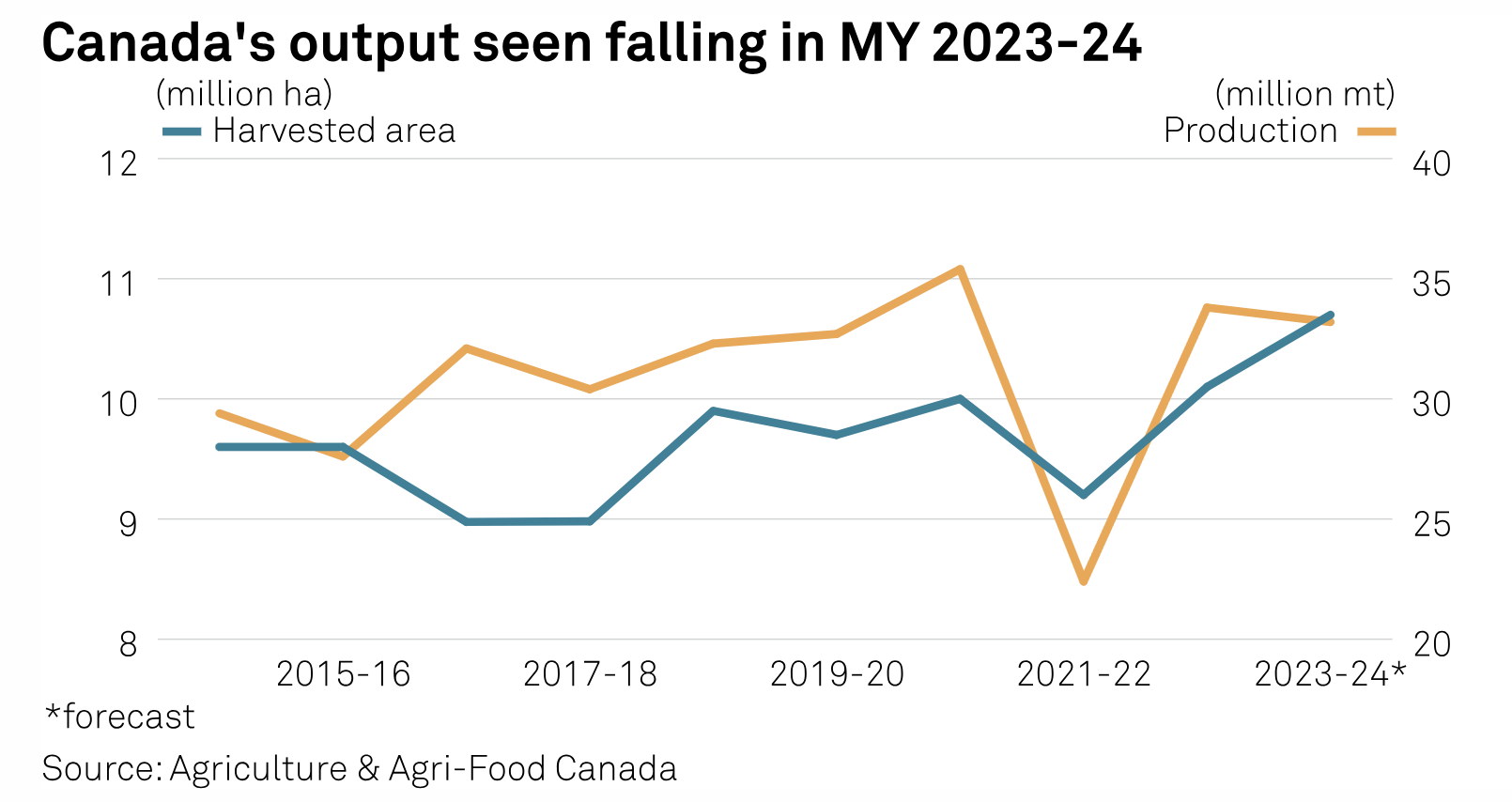

Drought Dries Up Canada's Prospects For Wheat Exports

When global wheat supplies started tightening due to the Russia-Ukraine war and El Nino drying out Australian crop, Canada was expected to be the bright spot in the market. In its August principal field crop update, Statistics Canada reported that farmers planted the country's widest wheat area since 1997, at 10.7 million hectares for marketing year 2023-24. Spring wheat led the expansion, with area planted rising 8% on the year to 8.3 million hectares.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

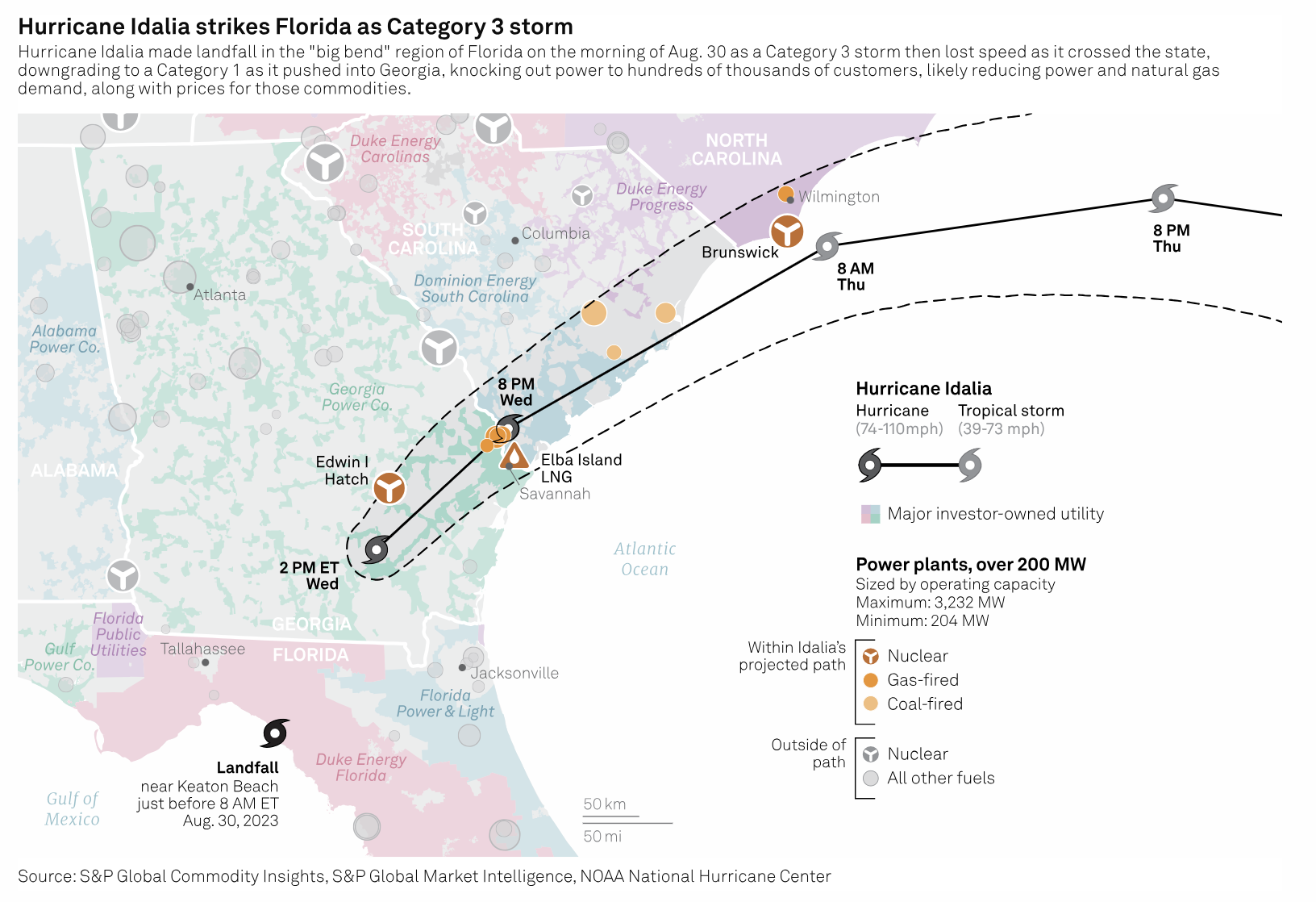

Idalia Hits Florida As A Category 3 Storm, Knocking Out Power To Hundreds Of Thousands

Hurricane Idalia made landfall in the "big bend" region of Florida on the morning of Aug. 30 as a Category 3 storm, then lost speed as it crossed the state, downgrading to a Category 1 as it pushed into Georgia, knocking out power to hundreds of thousands of customers and reducing power and natural gas demand along with power prices. Significant impacts from storm surge will continue along the Gulf Coast of Florida into the evening, the National Hurricane Center said.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Summer Slump: Global Recycled Polymer Markets Wait For Western Markets To Find Solid Footing

A sluggish start to the peak summer demand season has disrupted the global recycled PET markets, with subpar demand from beverage bottling in North America, squeezed margins, stiff competition from virgin resin and pessimism running rampant. S&P Global Commodity Insights' Heng Hui, global market lead for sustainable chemicals, Lee Joon lei, associate editor for petrochemicals, Charlie Wright, associate editor, and Antoinette Smith, senior editor for Americas chemicals, discuss the current RPET conditions and provide a look ahead at the rest of the year and early 2024.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

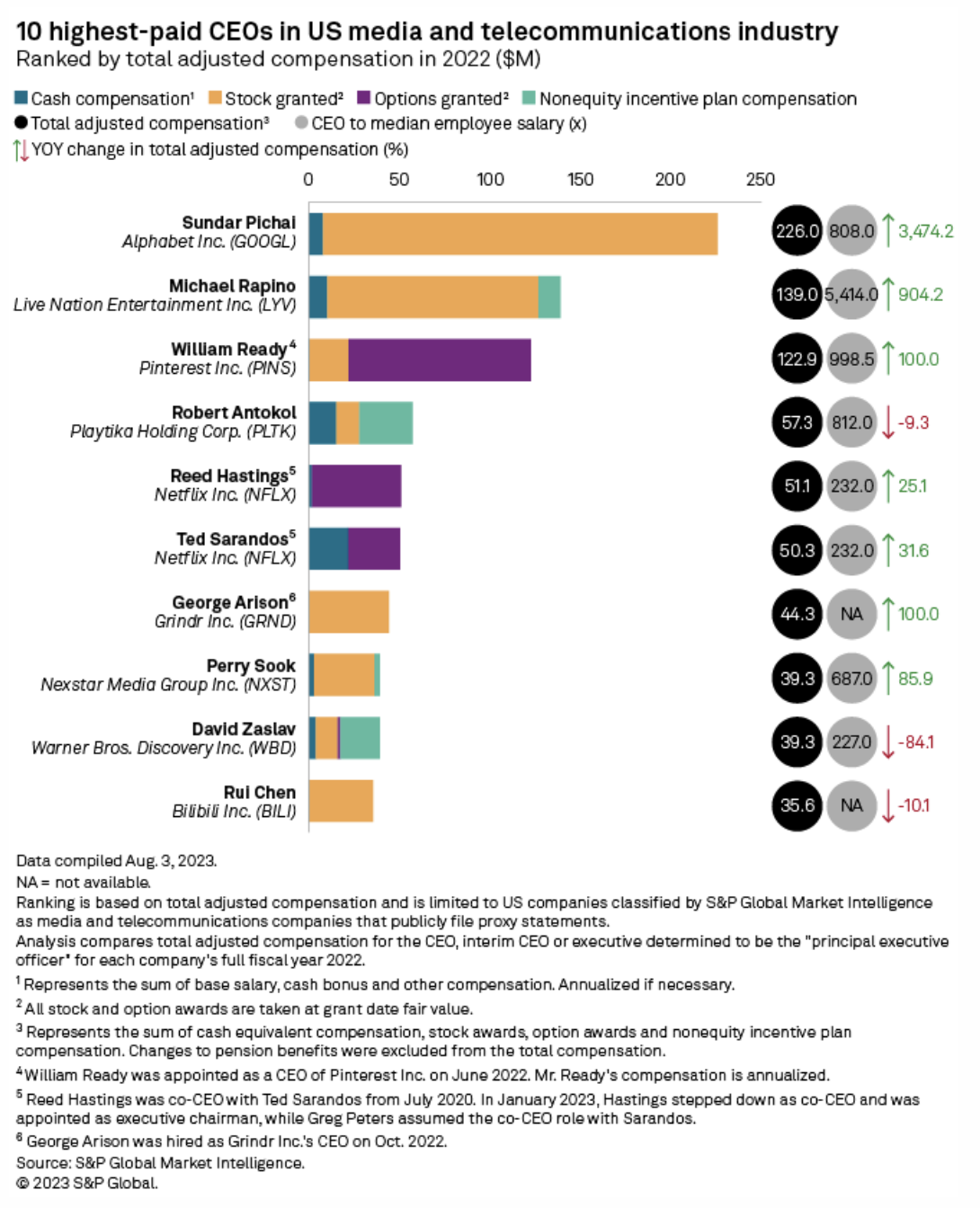

Alphabet's Sundar Pichai Tops 2022 Media, Telecom CEO Pay Rankings

Alphabet Inc. CEO Sundar Pichai outearned his peers in the US media and telecom industries in 2022 after receiving sizable stock awards, according to S&P Global Market Intelligence data. Pichai received almost $226.0 million in total adjusted compensation in 2022, up from roughly $6.3 million in 2021. Pichai's 2022 compensation comprised $7.9 million in cash pay, including a salary of $2.0 million, and $218.0 million in stock awards.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Language