Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 1 May, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Streaming Evolves in a Changing Media Landscape

The media landscape isn’t fragmenting — it has already fragmented. Cord cutting continues to eat away at linear television. Most consumers are subscribing to several streaming services. And live sports, long seen as the last line of defense for linear TV, are moving increasingly to streaming models.

Results from S&P Global Market Intelligence Kagan's fall US survey of 2,500 respondents showed increasing commitment to multiple streamers. Of the total respondents, 83% use at least one subscription video-on-demand (SVOD) service, and 84% use at least one free video-on-demand service. Globally, Netflix led the way with average viewing hours, followed by Amazon Prime Video and Disney+. India was an outlier since Disney+ Hotstar usage was on par with Netflix. The top three streamers — Netflix, Amazon Prime Video, and Disney+ — are leading in all global markets surveyed, except South Korea.

The plurality of total daily video hours is still going to linear TV at 38%. However, SVOD viewing hours represent 21% of total TV/video hours in the UK, 18% in the US, and 13% in France and South Korea.

The most popular content for SVOD subscribers is original TV programs, such as "Stranger Things" or "Game of Thrones."

“Originals are definitely climbing,” S&P Global Market Intelligence Kagan analyst Brian Bacon said on a recent "MediaTalk" podcast episode. “But we do have to keep in mind that theaters are back open now. So, the share of respondents that are selecting recent movies as the content they most enjoy has gone down. As one thing gains, something else needs to be dropping down.”

The inclusion of sports on streaming services has become a big money business. According to S&P Global Market Intelligence Kagan, US TV and streaming sports media rights payments are expected to grow to nearly $35 billion by 2027 as new deals are forged. Comcast, Disney, Paramount and Warner Bros. Discovery are all shifting more live sports programming to their streaming platforms. In future Kagan media consumer surveys, “live sports” will be added as a choice for content preference due to continued interest and engagement.

Today is Wednesday, May 1, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

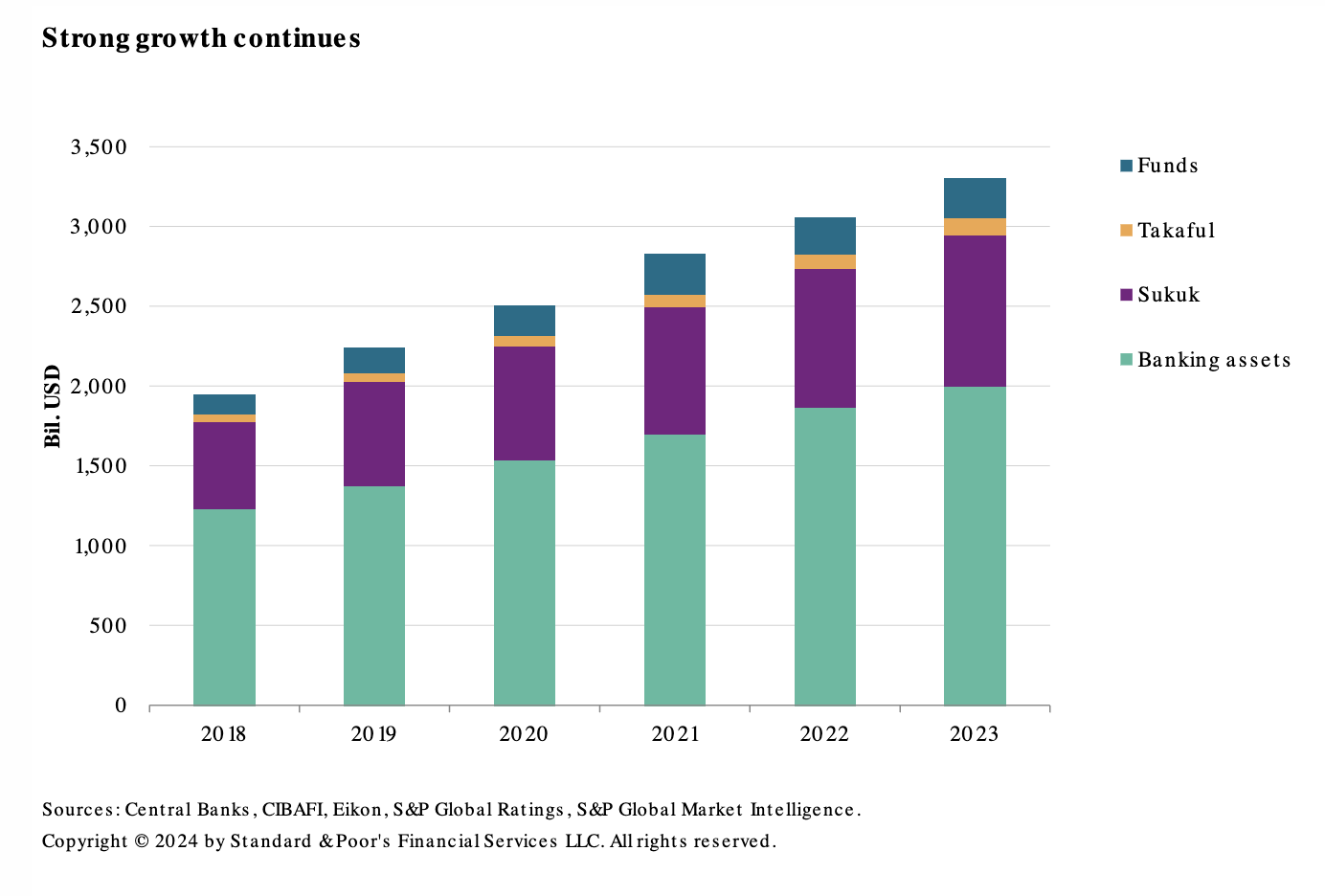

Islamic Finance 2024-2025: Resilient Growth Anticipated Despite Missed Opportunities

Total assets of the global Islamic finance industry continues on its growth path. S&P Global Ratings expects high-single-digit growth in 2024-2025 after a growth of 8% in 2023 (excluding Iran). Although Islamic banks in Saudi Arabia grew at a slightly lower pace than peers in other countries, there was a significant drop in Kuwait as 2022 numbers were inflated by a large acquisition. In the United Arab Emirates (UAE), Islamic finance growth quickened in 2023 thanks to the robust performance of the non-oil economy. Other Islamic finance countries contributed only 15% of the industry's incremental growth in 2023.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

This Week In Credit: A Jump In Speculative-Grade Upgrades

The number of positive rating actions or outlook revisions outnumbered negative ones again last week. Nine out of 10 upgrades were on speculative-grade issuers. However, S&P Global Ratings added a new fallen angel, bringing this year’s count to seven. There were three defaults last week, two of these were US companies that completed distressed exchanges in which lenders will receive less than originally promised. Homebuilders and real estate replaced chemicals, packaging and environmental services as the sector with the highest negative bias. Credit risk pricing improved as bond and CDS spreads tightened. Benchmark yields rose at the longer end while short-term rates remained broadly stable.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

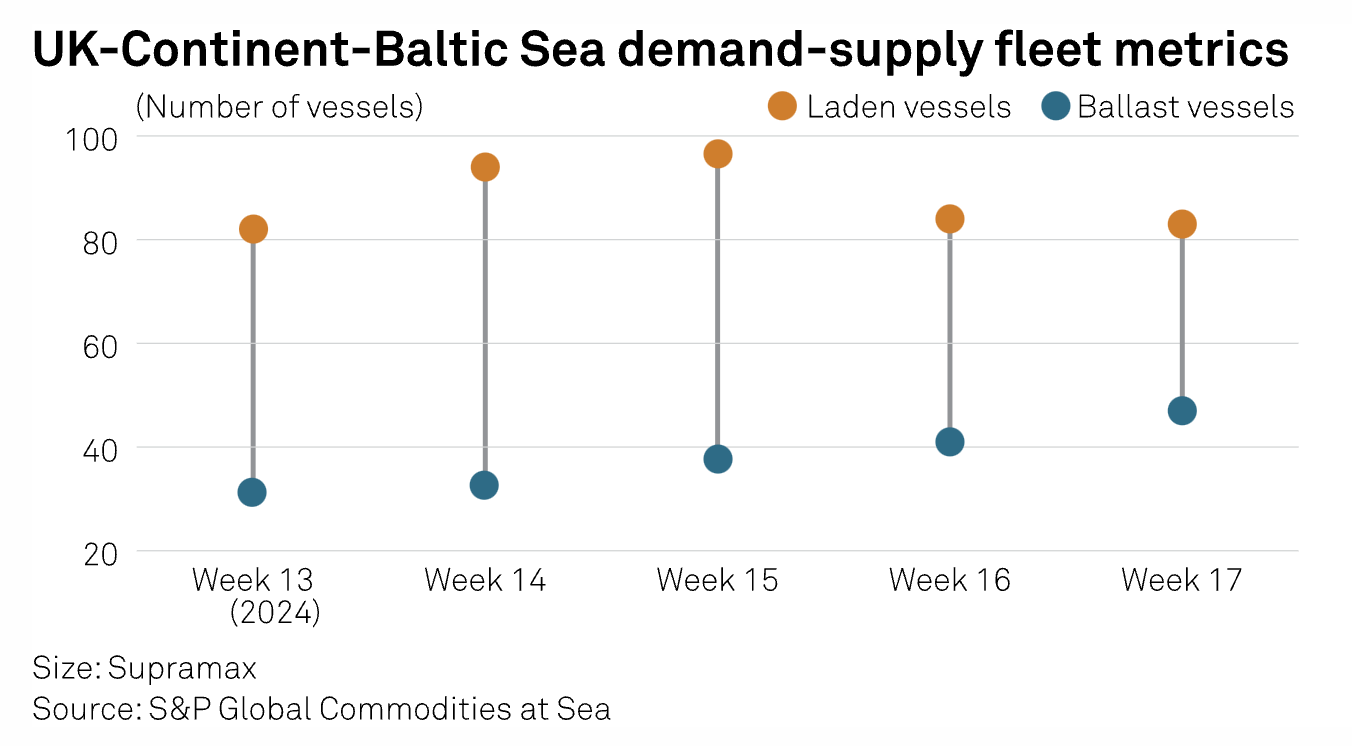

Atlantic Supramax Scrap Market Comes Under Pressure In Week 17

The Supramax segment in the Continent and Baltic Sea regions has been marked by negative sentiment as pressure due to pressure from a bearish scrap spot market and softer freight rates amid imbalances between cargoes in the market and spot tonnage supply in the week of April 22-26. "There is a lot of tonnage built in the region and there are no scrap cargoes," a charterer said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

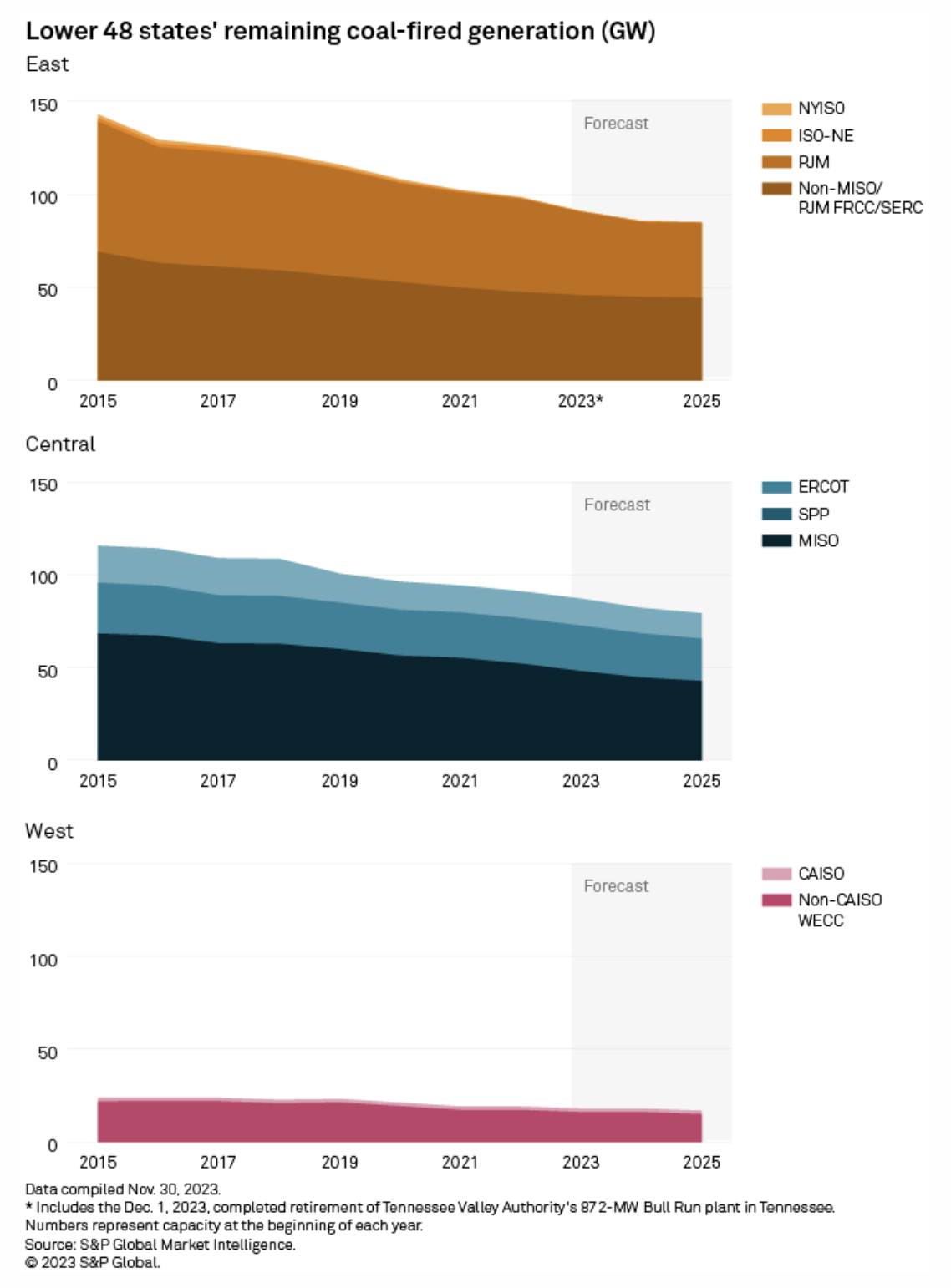

US EPA Finalizes CO2 Limits For Power Plants, Updates Mercury Standards

The US Environmental Protection Agency on April 24 finalized two rules aimed at tackling air emissions in the power sector, requiring certain fossil-fired generators to cut their carbon emissions by 90% and strengthening regulations on their mercury and air toxic emissions. The first rule requires all existing coal-fired power plants planning to operate beyond 2039 to capture 90% of their CO2 emissions. New natural gas-fired combined-cycle generators — those set to come online 60 days after the rule's publication — will be subject to the same limit, effectively mandating the installation of carbon capture technology.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

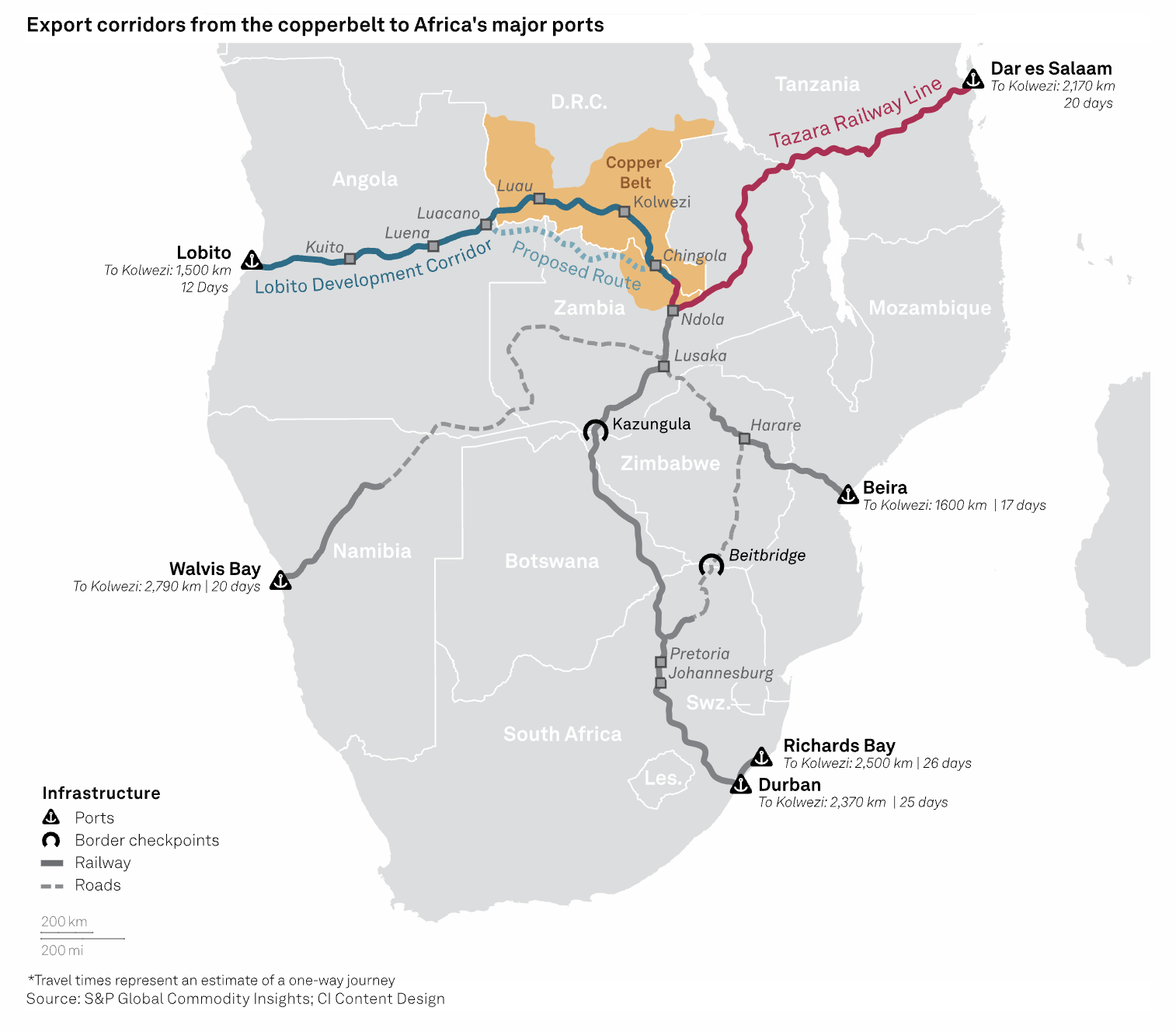

Duelling Rail Projects Hint At Intensifying Contest For Africa's Critical Minerals

The network of ageing railway infrastructure connecting the mineral-rich areas of the Copperbelt straddling Zambia and the Democratic Republic of Congo to Africa's major ports has emerged as an area of intense competition among global powers amid surging demand for critical minerals. Motivated by a desire to break China's grip on African mineral supply and bypass the logistical bottlenecks in South Africa that have constrained copper and cobalt exports in recent years, a US- and European Union-backed partnership is investing heavily in upgrading and extending the existing rail corridor linking northern Zambia and the southern DRC to the Port of Lobito in Angola.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

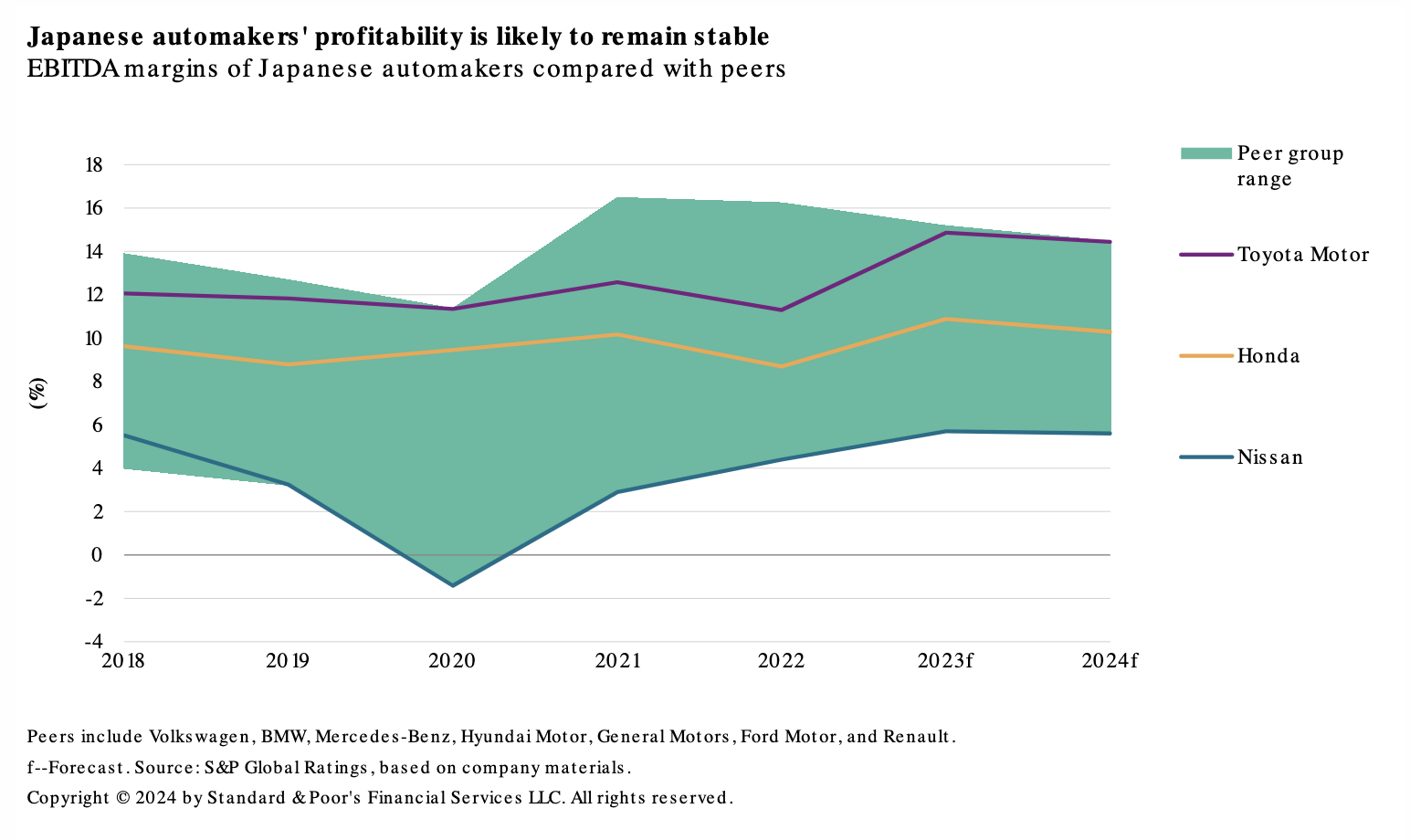

Hybrids Prop Up Japanese Automakers

For now Japanese automakers' trailblazing of technology in hybrid vehicles continues to mitigate a slow shift to electric vehicle production and sales. Hybrid electric vehicles (HEVs) comprise 10%-30% of their total unit sales. Given the transition to electric mobility is the primary trend in vehicles this decade and the varying pace of electrification in different markets, it is crucial that Japanese carmakers solve for how to flexibly meet demand for HEVs, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) in separate markets, in S&P Global Ratings’ view.

—Read the article from S&P Global Ratings