Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Silvergate to SVB – The Dangers of Concentration

Rising interest rates are hard on banks. Investments that looked good when interest rates hovered around zero can go underwater when rates tick upward. This isn’t really a problem if depositors aren’t all asking for their money at the same time. Banks can take their time unwinding unprofitable positions and repositioning their balance sheets. However, if a bank is highly concentrated in a single industry or sector, and that industry or sector is experiencing headwinds, you have all the ingredients necessary for a bank run. This creates pressure on the entire U.S. banking system.

The story here begins with Silvergate Bank. According to S&P Global Market Intelligence, Silvergate is a cryptocurrency-centric bank that got caught out in the “crypto winter.” After FTX Trading collapsed in 2022, many of the cryptocurrency exchange’s counterparties found themselves in sudden need of liquidity. Silvergate shared many customers with FTX, and those customers started to withdraw their deposits from the bank. This created the conditions for a bank run since the withdrawals led to concerns about the bank’s stability, which led to further withdrawals.

Todd Baker, a senior fellow at the Richman Center for Business, Law and Public Policy at Columbia Business School and Columbia Law School, and a guest on S&P Global Market Intelligence Director of Financial Institutions Research Nathan Stovall’s “Street Talk” podcast, analyzed the situation: “What happened here — crypto volatility in the business is the cause — but it’s really no different from a situation you might have had in the 1980s or 90s with an oil-patch lender that was overconcentrated in oil and gas exploration. It’s just a bad idea for a bank to be completely concentrated in one industry.”

As of last week, according to S&P Global Market Intelligence, Silvergate Capital remained the most-shorted U.S. stock. Investors anticipated that the company wouldn’t be able to survive the combination of devaluing assets and deposit outflows. Shortly after, the bank decided to pursue voluntary liquidation.

The collapse of Silicon Valley Bank, or SVB, follows a similar narrative. SVB represents the second-largest bank failure in U.S. history. Two days before regulators closed the bank on March 10, SVB looked relatively healthy, with a market capitalization of $15.86 billion and shares trading at 1.3x book value. While SVB did not have much cryptocurrency on its balance sheets, some of its investments were underwater due to rising interest rates. The bank announced that it would need to sell some of its investments at a loss. When SVB followed up this news with an announcement that it was seeking $2.25 billion in capital through an offering, depositors got jittery.

According to S&P Global Market Intelligence, the tech-focused bank was suffering deposit outflows in line with a general downturn in the technology industry. Once word got out from venture capital funds to their portfolio companies to withdraw deposits from SVB, the ingredients for a classic bank run were in place.

Now, many technology companies are struggling with payroll and other aspects of business operations with their money suddenly inaccessible. However, Monday’s announcement that the government would compensate depositors for losses seems to have calmed the markets. Still, other regional banks such as First Republic Bank, Western Alliance Bancorp and PacWest Bancorp have seen their stock prices take a hit.

Unfortunately for SVB, had depositors not panicked, the bank would likely have survived this rate cycle as they have survived others in the past. The bank maintains a healthy, although illiquid balance sheet. HSBC announced that it would acquire SVB's London-headquartered unit for a nominal sum of £1. JPMorgan Chase, PNC Financial Services Group, Apollo Global Management and Morgan Stanley have all expressed interest in acquiring the bank's holding company, SVB Financial Group.

Today is Tuesday, March 14, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

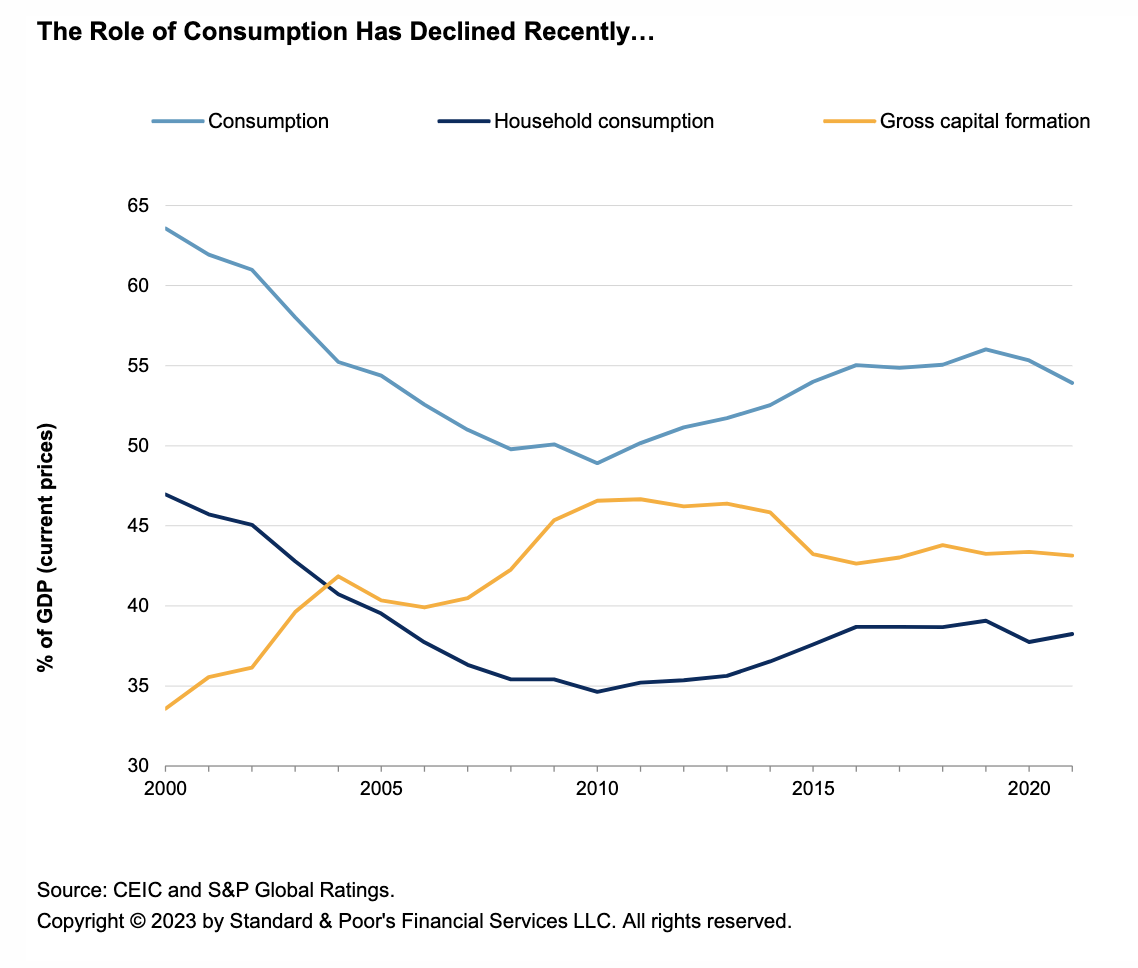

Economic Research: The Case For Cautious Optimism On China's Rebalancing And Openness

Beyond the immediate economic boost from China's reopening, lies the potential for larger shifts. The next few years should reveal whether setbacks in China's economic rebalancing and openness are temporary or intractable. S&P Global Ratings is cautiously optimistic but sees risks, especially regarding rebalancing. The rebalancing process toward a larger role for consumption and services stalled in the mid-2010s and even reversed in recent years. And, after having grown in line with the economy for decades, imports started to lag in the mid-2010s. In both areas, developments were particularly unfavorable in 2022.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: Street Talk | Episode 107: Lessons Learned From A Modern Day Bank Run

Higher rates have put deposits under pressure across the banking industry, but liquidity strains have been far more pronounced at a few banks, resulting in severe hits to their stock prices. Crypto-focused bank Silvergate announced plans to voluntarily wind down its operations after facing a liquidity crunch, but others like SVB Financial raised capital and purged its bond portfolio after seeing a higher cash burn among its clients. In the episode, Todd Baker, a senior fellow at the Richman Center for Business, Law and Public Policy at Columbia Business School and Colombia Law School, discussed the recent liquidity crunch at Silvergate, the asset/liability management lessons observers can learn from the turmoil and the risk that banks face when focusing on a given industry. Baker, who previously served as the chief corporate strategy and development officer at three large banks, also provided insight into the unfolding situation at SVB Financial.

—Listen and subscribe to Street Talk, a podcast from S&P Global Market Intelligence

Access more insights on capital markets >

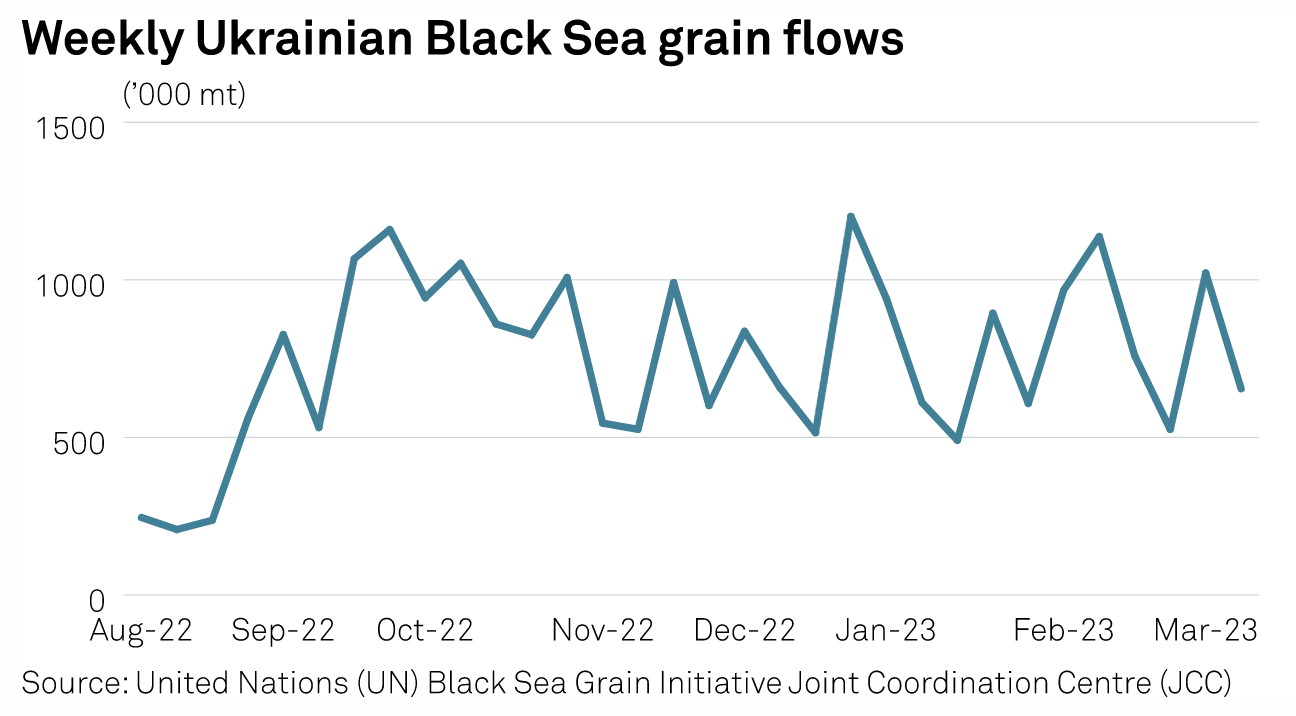

Black Sea Watch: Potential Extension Of Safe Passage Deal Supports Ukraine Grain Flows

Upbeat sentiment regarding the potential extension of the UN-brokered safe passage agreement on March 18 has provided some support to falling weekly Ukrainian Black Sea grain flows, with data from the Joint Coordination Centre pointing to above-average grain shipment sizes so far in March. With market participants slightly more optimistic than during the previous extension deadline in November, average daily Ukrainian seaborne grain flows via the Black Sea are trending close to 125,733 mt/d so far in March, some 4% higher than February's daily average, according to JCC data.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Women In Leadership: How Amalgamated Bank CEO Navigated A Career Spanning Crises And Continents

In the latest episode of S&P Global Sustainable1’s special Women in Leadership series of the ESG Insider podcast, hosts Lindsey Hall and Esther Whieldon are speaking with Priscilla Sims Brown, CEO of New York-based Amalgamated Bank — a company she describes as “a little bit unusual” in the financial services world in that it is a socially responsible bank focused on ESG and sustainability.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

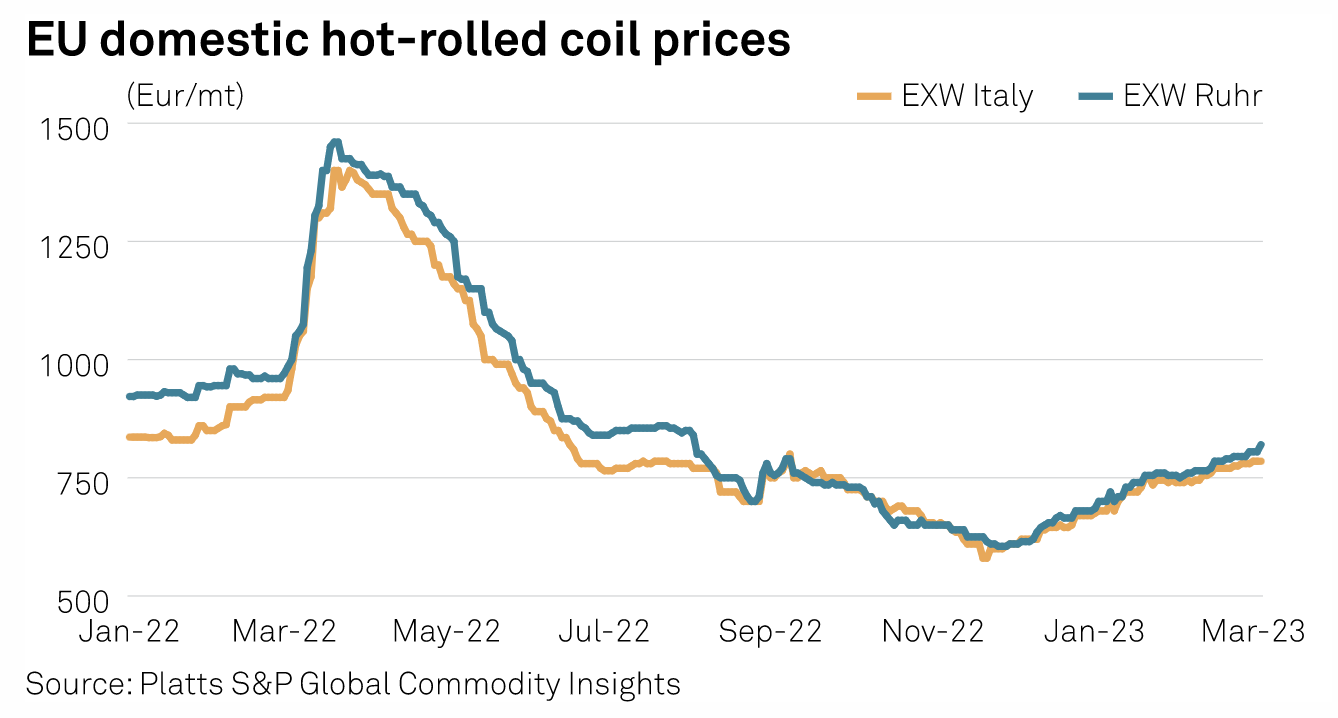

Back In Action: European Mills Restart Idled Blast Furnaces On Higher Flat Steel Prices

Domestic coil prices rapidly rose in March 2022 due to panic buying triggered by Russia's attack on Ukraine on Feb. 24. The market originally anticipated that the geopolitical tension would cut availability of steel and might result in shortage. Against this expectation, steel demand suffered while supply remained on normal levels, despite a disruption of Black Sea supply and effects from sanctions. As a result, domestic coil prices in Europe had started to decline, with the negative trend lingering until December.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

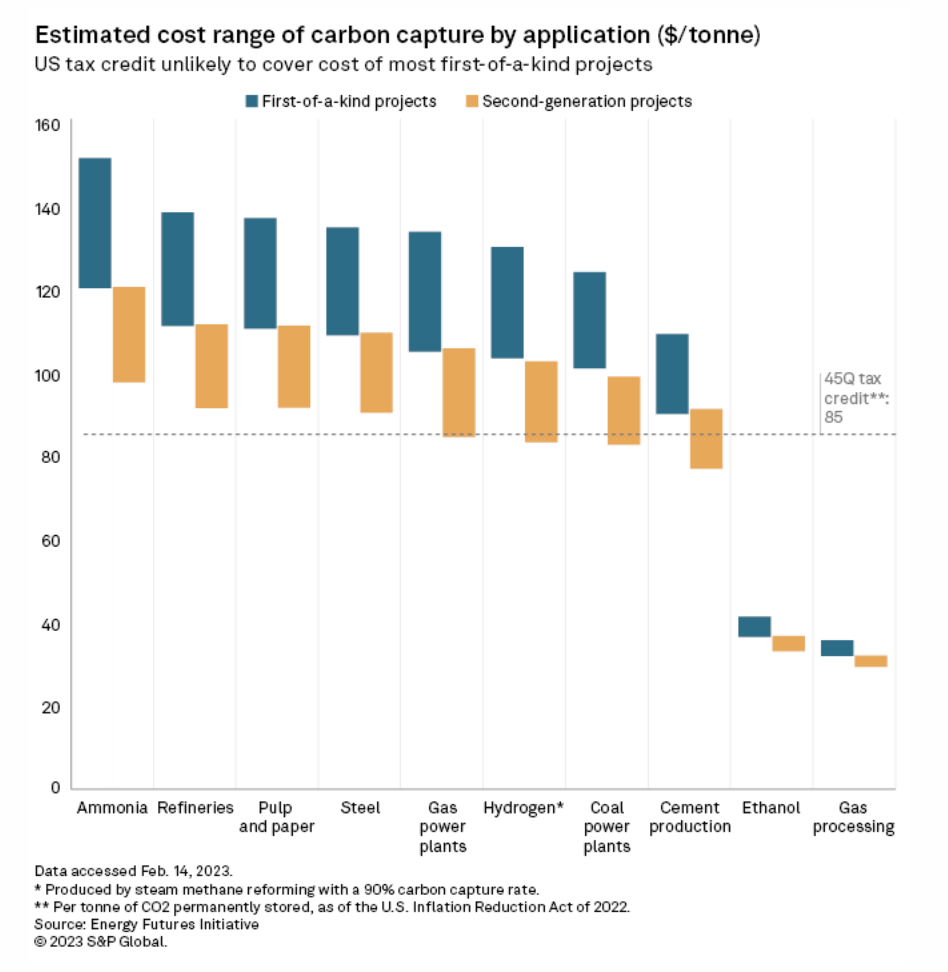

Technology Not To Blame For Carbon Capture's Failure To Launch, Advocates Say

When the U.S. Congress increased the federal bounty for carbon dioxide captured from smokestacks, The New York Times published a guest essay: "Every Dollar Spent on This Climate Technology is a Waste." The opinion, written in August 2022, refers to carbon capture and storage, or CCS, the catch-all phrase for technologies that scrub CO2 from emissions streams and sequester it more than a mile underground. According to the authors, two former developers of the technology, CCS is a "hopelessly uncompetitive" greenwashing campaign of the fossil fuel industry.

—Read the article from S&P Global Market Intelligence