Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Metals and the Invasion

The metals industry has shown some resilience in the wake of Russia's invasion of Ukraine, but producers in these two countries continue to face dire threats as the fighting drags on.

The conflict, now in its second year, has directly affected Ukrainian metals and mining companies, while sanctions, both mandated and self-imposed, have taken their toll on Russian output. Secondary effects of the invasion, such as energy shortages, continue to roil markets around the world. While the industry has somewhat adjusted to the situation, a recent escalation in attacks on Ukrainian infrastructure and the increasing isolation of the Russian economy paint a bleak picture for metal producers.

The invasion has already had a devastating effect on Ukraine's metals industry. One of the country's biggest metal producers, ArcelorMittal Kryvyi Rih, saw its steel output drop to about 20% of capacity in 2022, due in part to multiple blackouts and material shortages caused by Russia's blockade of Black Sea ports. To continue operating, the company had to "reinvent ... logistics routes from scratch," according to CEO Mauro Longobardo, who envisions the plant's output returning to 50% of capacity in 2023. Notably, the company has remained committed to its environmental, social and governance efforts during the war, with multiple environmental-related investments planned for 2023, Longobardo told S&P Global Commodity Insights.

The challenges faced by ArcelorMittal are not unique in the war-torn country. In 2022, estimated iron ore production in Ukraine fell 58% year over year, and steel output dropped 68.5%, according to S&P Global Market Intelligence data. Relief for the country's battered metals industry does not appear to be coming soon, either. Recent targeting of Ukrainian power infrastructure by Russian forces is incapacitating foundries, which depend on a consistent energy supply. New threats to port cities are similarly hampering the country's metal production capacity.

Like their Ukrainian counterparts, Russian metal producers have recalibrated to this post-invasion reality. Cut off from alumina imports from Ukraine and Australia, Russian aluminum producer United Co. Rusal turned to China for its raw materials needs. The company saw its production costs increase 33.2% year over year in the first half of 2022 but also managed to grow revenues by 31% in the same period, according to S&P Global Market Intelligence estimates. The company is now reportedly planning to construct an alumina refinery to ease its dependence on China.

Traders, meanwhile, are making record profits as the commodities sector reconfigures its supply chains in light of sanctions and self-imposed restrictions on Russian metal products. Driven partially by elevated commodity prices, profits at Trafigura Group more than doubled to $7.0 billion in 2022 from $3.1 billion in 2021, and Glencore's profits increased 3.5 times to $17.32 billion, according to company reports. Key mining products are still finding their way to buyers despite the disarray in commodity markets.

Potash illustrates well this malleability in the supply chain. Russian exports of the mineral have remained at near pre-invasion levels despite self-sanctioning by European and U.S. buyers, who turned to Canada to make up the difference. Russia has also had some success finding willing buyers among other top potash consumers, such as Brazil.

The Russian potash industry may yet suffer the consequences of the invasion. Sanctions on the Russian finance and banking industries are expected to delay planned mining expansions in Russia and Belarus, making it difficult for producers in both countries to grow their operations, despite abundant reserves of the crucial fertilizer component. Perhaps more significantly, customers turning to Canada for potash may be hesitant to reestablish a trade partnership with Russia, even after the war in Ukraine ends.

This isolation puts Russian metal producers in a precarious position. Continued success for companies like Rusal now hinges on Chinese demand for Russian metal, which is expected to decline in 2023. With the conflict showing no signs of abating in the near term, the metals industries of Russia and Ukraine will need to continue adapting to survive.

Today is Friday, March 10, 2023, and here is today’s essential intelligence.

Written by Adam Rihner.

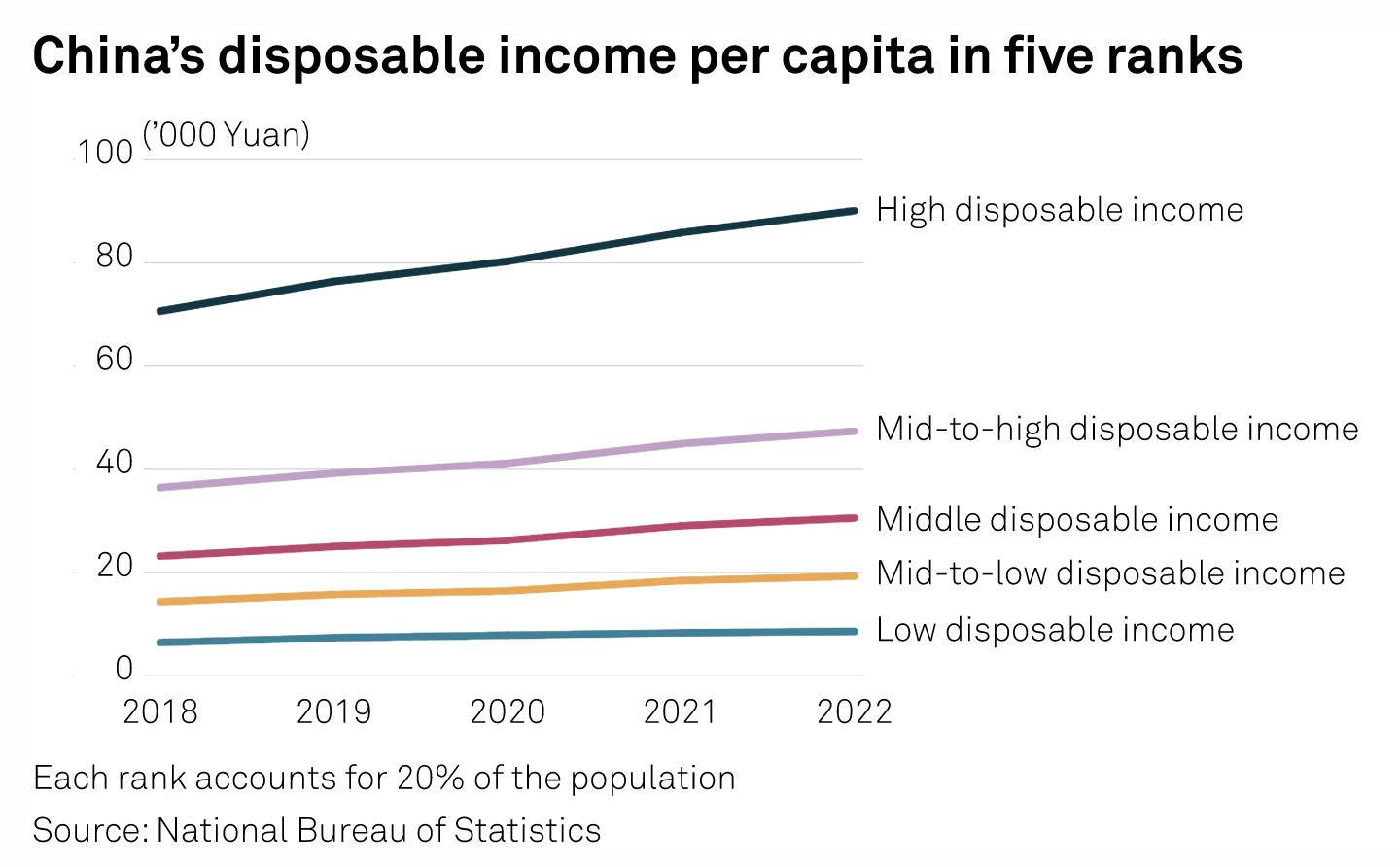

China's Economy Is On A Patchy Way To Recovery

China has witnessed a rapid revival of consumer spending in service sectors since the Lunar New Year holidays started Jan. 21, bouncing back from a distressing period during an unprecedented pandemic wave in December and January. There has been a remarkable growth seen in spending, indicated by a flush seen in sectors such as dining, moviegoing, accommodation and tourism. Enthusiastic tourists have flocked popular cities since late-January, booking up hotels and even pushing up local coffee prices.

—Read the article from S&P Global Commodity Insights

Access more insights on the global economy >

Sovereign Wealth Fund-Backed Private Equity Deals Plummet In 2022

The value of global private equity deals with sovereign wealth fund investment fell by nearly half in 2022. Transactions with sovereign wealth fund investment totaled $39.03 billion across 11 deals in 2022, compared to $74.36 billion across 10 deals a year earlier, according to S&P Global Market Intelligence data. The size of these deals also decreased year over year. In 2021, the three largest transactions were valued at $32 billion, $20.01 billion and $17 billion, while 2022's top deal was below $12 billion.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

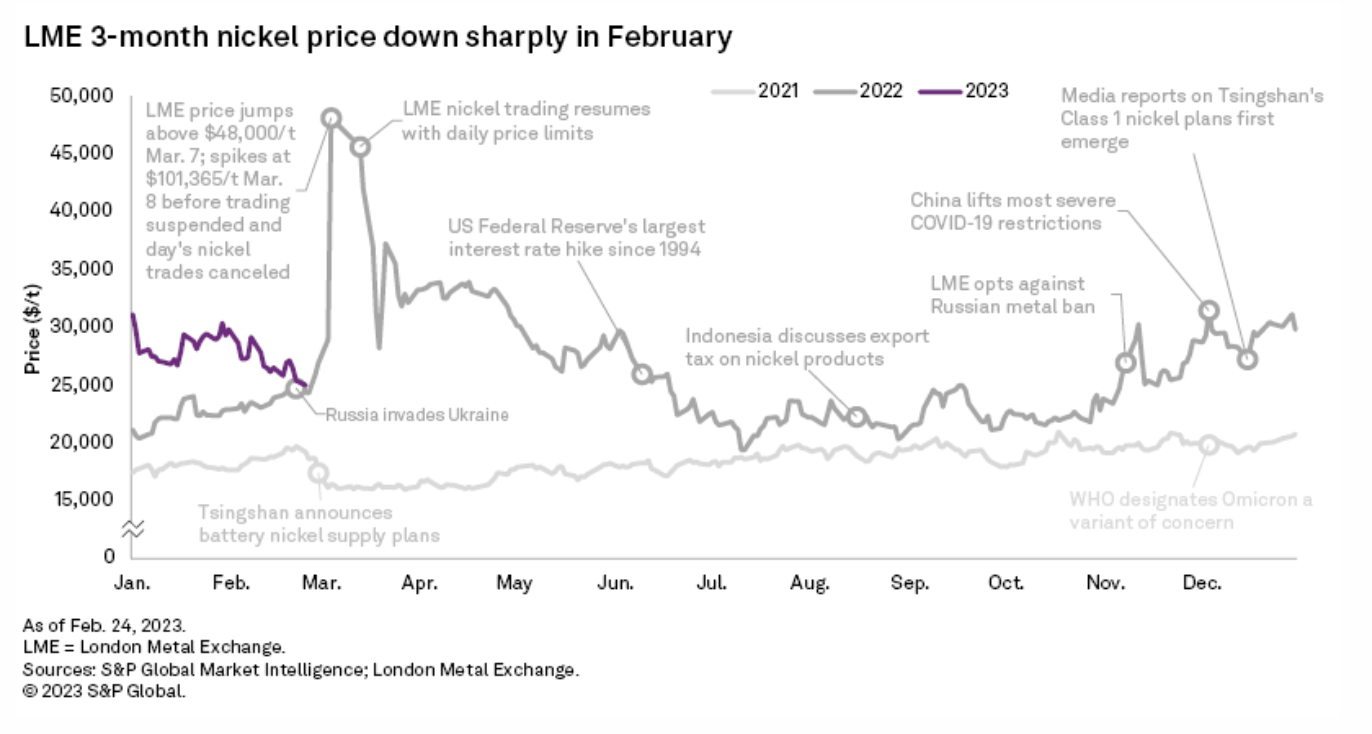

Nickel CBS February 2023 — LME To Restart Asian Trading Hours; Prices Drop

In its monthly Nickel Commodity Briefing Service report, S&P Global Commodity Insights discusses the nickel market within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts. The London Metal Exchange, or LME, announced that it will restart its Asian nickel trading hours from March 20, a year after the exchange was forced to close the session following the historic nickel short squeeze in March 2022.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: Women In Leadership: No, Horace Mann CEO Is Not Working The Coat Check

March is National Women’s Month, and to mark the occasion S&P Global Sustainable1 is bringing you the latest in its special series of the ESG Insider podcast focused on women in leadership. This episode features Marita Zuraitis, CEO of Horace Mann, a financial services and insurance company that serves U.S. public educators. Marita talks about how she handles the unconscious bias she has encountered on her path to the C-suite.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Renewable Energy Corporate Leaderboard, 2018-2027

The top 10 U.S. corporations by contracted renewable energy have accumulated a green energy portfolio of more than 52 GW, or about two-thirds of the total tracked by S&P Global Commodity Insights for U.S. corporate off-takers, up about six percentage points from year-ago levels. The corporate renewables leaderboard reflects the scale and business model of the top players across the U.S. technology and telecommunications sectors — global in nature and relying heavily on energy-hungry datacenters. That said, the ranking may also denote first-mover advantage; if so, prolonged momentum is likely to occur as laggards raise their game to bring their renewable portfolios up to speed

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

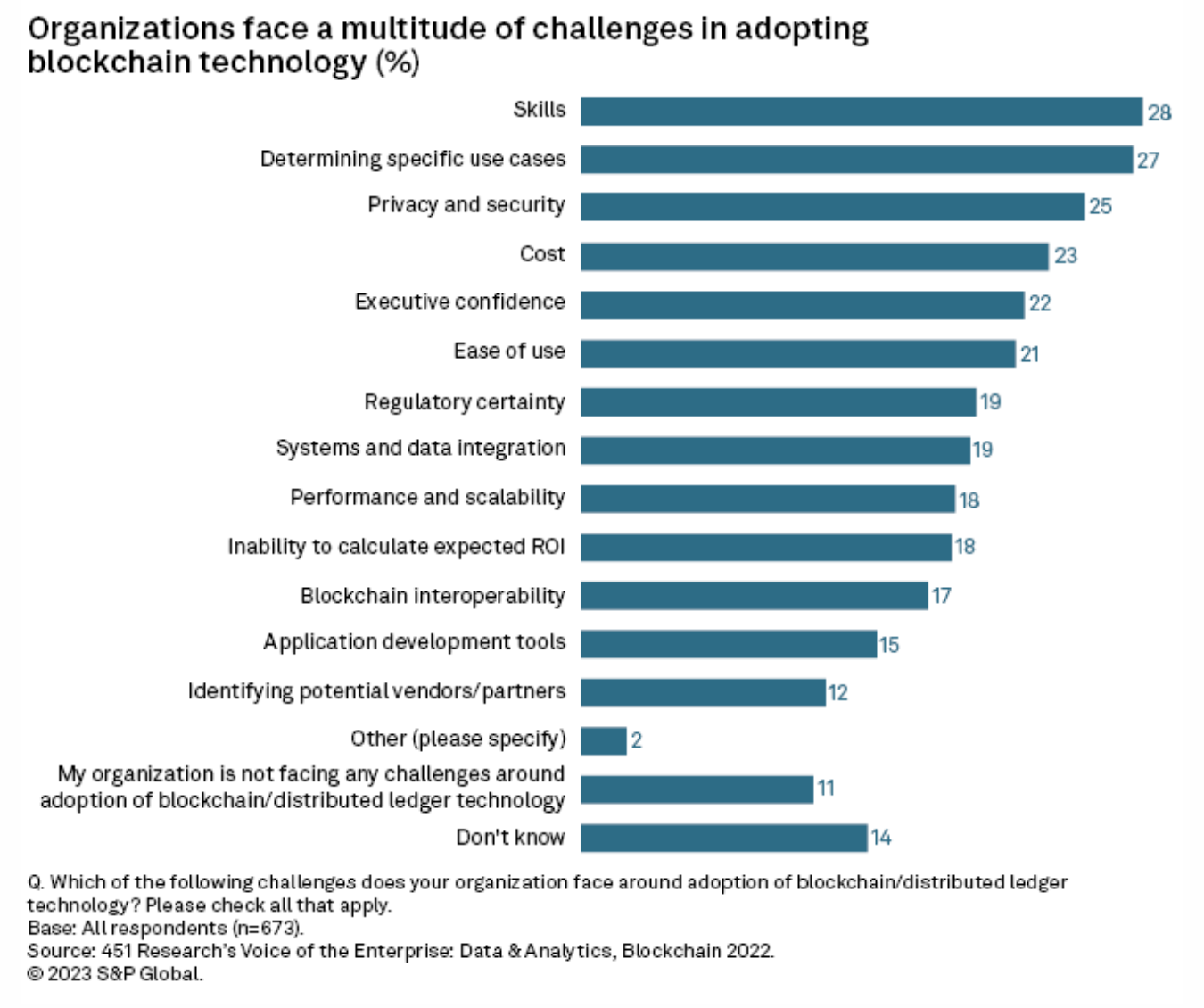

Blockchain And The Metaverse, Part 2: Challenges

In this two-part series, 451 Research looks at the link between blockchain and the emerging metaverse wave of innovation. Part 1 considered the opportunities for distributed ledger technology and looked at definitions, drivers for convergence, and blockchain use cases in the metaverse. Part 2 considers the challenges of both potential convergence and codependence. S&P Global's extended metaverse coverage is described in the metaverse primer.

—Read the article from S&P Global Market Intelligence