Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Jul, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Battery Metals in Short Supply in Race To Decarbonize

The US is already lagging Europe and China in the adoption of electric vehicles, but the administration of President Joe Biden has set ambitious goals to close the gap. Leveraging incentives contained in the Inflation Reduction Act of 2022, the US announced a goal of having 50% of all new vehicle sales be electric by the end of this decade. One challenge in achieving this goal is the availability of the required battery metals to power all those vehicles. The “Platts Future Energy” podcast from S&P Global Commodity Insights tackled the topic of battery metals in a two-part series titled “Battery metals wanted: The US' race to decarbonize.”

“We are in the middle of a once-in-a-century disruption and this is now happening in every corner of the auto industry,” said Jay Hwang, senior technical research analyst at S&P Global Mobility.

EV batteries make up about 40% of the total cost of the vehicle, according to Hwang, so the cost and availability of battery metals are crucial to maintaining affordability. The biggest question facing the industry is how the battery metal supply chain can expand to cover the increasing demands for EVs. The most concerning issues faced by the battery metal supply chain are geopolitical risks related to these strategic metals and emerging market risks. The lack of financial investment in the upstream sources, or mining and processing, of battery metals is an ongoing challenge. Given that a 10-year timeline is not unusual for bringing new mines online, we could be confronting greater shortages as EVs gain greater adoption.

Stronger demand from manufacturers and slow upstream development have driven battery metals prices, especially lithium prices, to record highs. While prices have retreated somewhat from 2022 levels, many market observers anticipate further price rises, absent new battery technologies. Manufacturers have attempted to control for unpredictable battery metals prices by entering long-term contracts with suppliers.

A potential source of battery metals that could alleviate these upstream shortages is “black mass.” Despite the ominous name, black mass is just an industry term for crushed and shredded waste batteries. Battery metals such as lithium, manganese, cobalt and nickel can be extracted from black mass. While the hope is that battery metals will eventually become a closed loop, in which old EV batteries provide most of the materials for new EV batteries, the lack of standardization in battery technology at this point renders the value of black mass limited.

While the Inflation Reduction Act was designed to stimulate green industries and energy in the US, countries that have free trade agreements with the US are also beneficiaries under the act. This includes Canada and many Latin American countries that have half of global lithium reserves. The decision by Chile to nationalize lithium reserves seems to reflect that raw materials related to the energy transition are going to be treated a lot like oil and natural gas were during the hydrocarbon era.

“With countries increasingly seeking to secure their supply of critical elements, I think this will likely result in economic clash between the supplying and demanding nations,” said Adriana Carvalho, managing editor for Latin America metals at S&P Global Commodity Insights.

Today is Friday, July 28, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Fed's Rate Hike In July Set To Be Last For 2023; Full Impact Yet To Be Felt

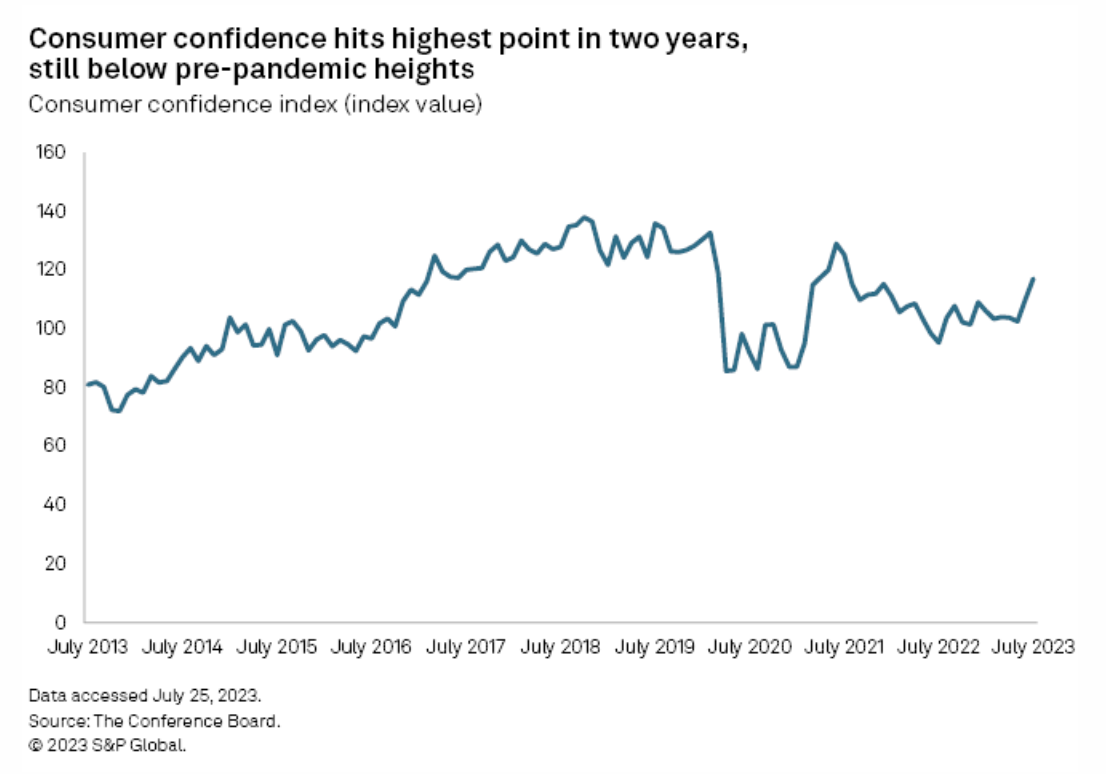

The Federal Reserve has increased interest rates for what may be the last time in 2023. After not hiking in June, Fed officials unanimously agreed July 26 to approve another hike of 25 basis points, raising the benchmark federal funds rate target range to between 5.25% and 5.5%. The upper bound of the rate has not been as high as 5.5% since 2001. Many expect this will be the last interest rate increase in the current hiking cycle. Shortly after the Fed announced a 25-basis-point hike, more than 80% of traders were betting that the Fed would not hike at their September meeting, according to the CME FedWatch Tool, which measures investor sentiment in the fed funds futures market.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Mean Reversion

Over more than 20 years of live history, the S&P 500 Equal Weight Index has outperformed the S&P 500 by a substantial margin. Between Dec. 31, 1990, and June 30, 2023, Equal Weight’s compound annual growth rate was 11.82%, well ahead of the cap-weighted S&P 500 at 10.55%. This performance edge is a product of robust underlying characteristics, most importantly a tilt toward smaller-capitalization stocks. Equal Weight’s historical returns have outpaced those of virtually every active large-cap U.S. equity portfolio in our SPIVA database.

—Read the article from S&P Dow Jones Indices

Access more insights on capital markets >

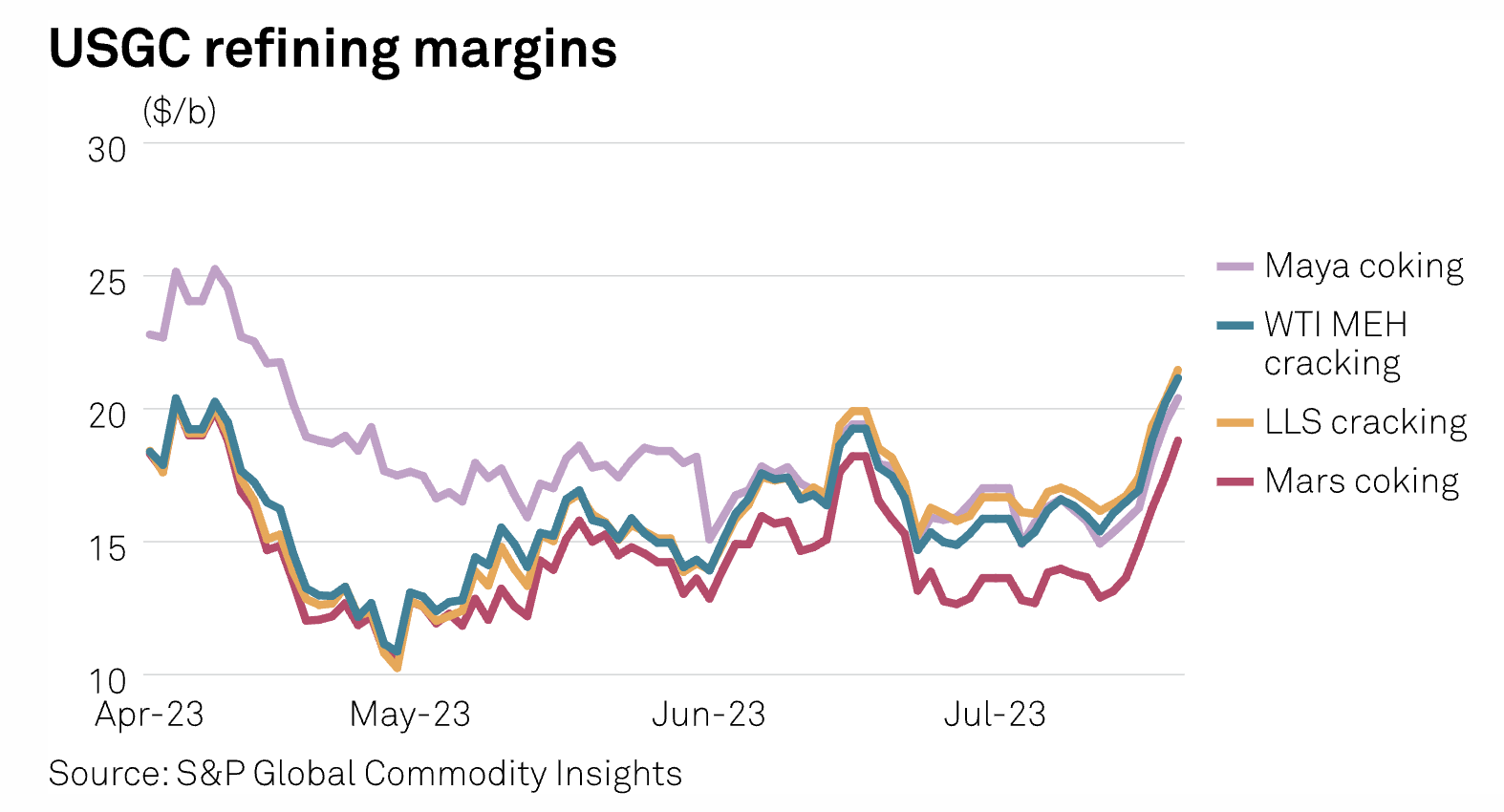

Soaring US Refined Product Exports Support Stronger Margins

Most US refining margins moved higher for the week ended July 21 as global demand for US gasoline and diesel remains strong, an analysis from S&P Global Commodity Insights showed July 24. US refineries are finishing their ramp-up to full rates following a heavier-than-normal maintenance season, eclipsing restarts from around the globe. With ongoing refinery downtime in other regions like Latin America and Asia expected to continue through August, export demand for US refined products is expected to stay robust.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

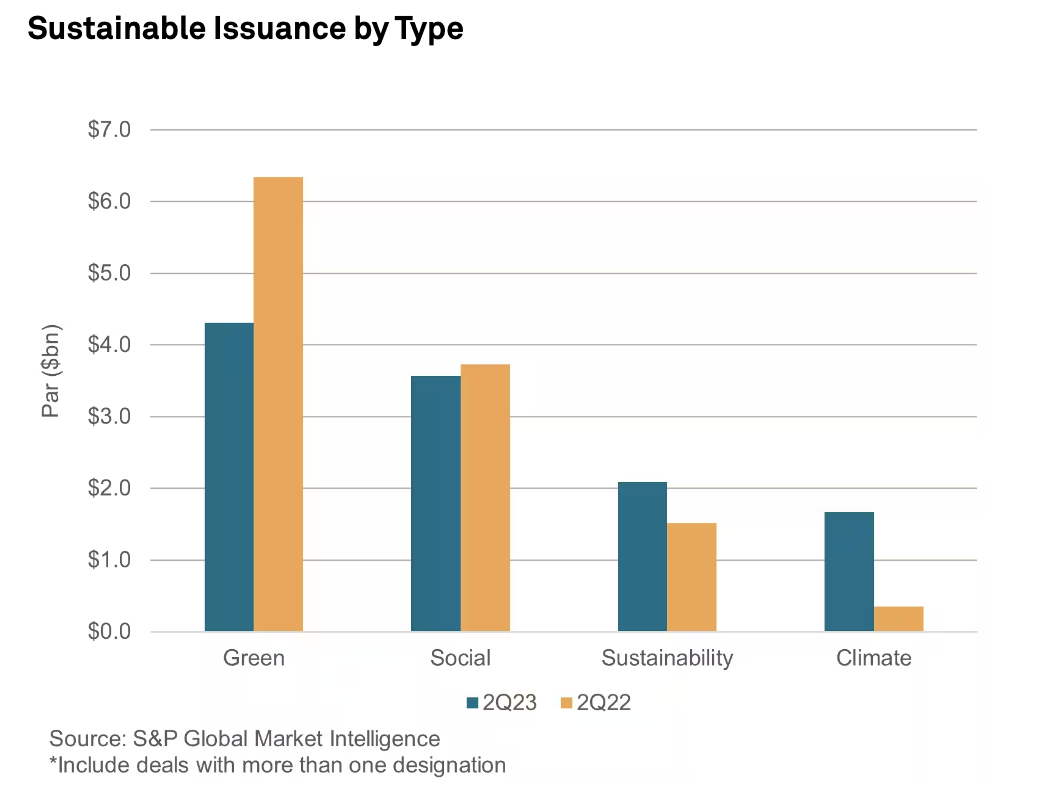

Q2 2023 Sustainability Muni Recap

S&P Global Market Intelligence Global Markets Group's municipal bond analysts have reviewed Q2 2023 municipal bond new issue data and analytics to identify the quarter's sustainable issuance trends. S&P Global Market Intelligence data indicates that sustainable municipal bonds issuance (including corporate issues) declined 14% from $11.6B in Q2 2022 to $10.0B in Q2 2023 while the overall muni issuance only declined by 8% Y/Y, from $116.0B in Q2 2022 to $107.0B in Q2 2023, marking a surprising deceleration of sustainable municipal issuance.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

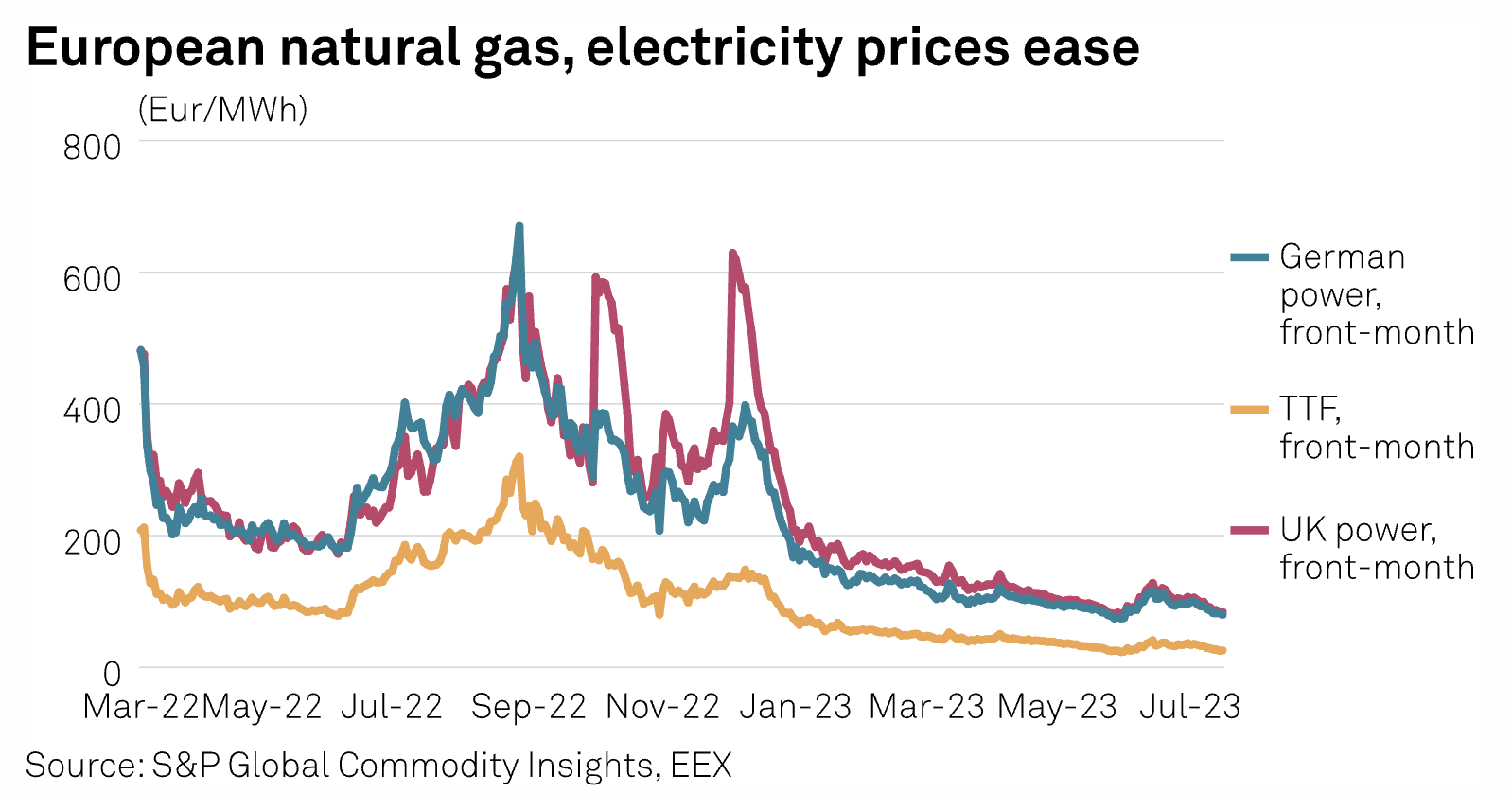

The Energy Crisis: A Change In The Zeitgeist

Europe will hit a new milestone in late 2024 once it survives its first winter without Russian natural gas pipeline supply, yet in this "new normal" prices will be persistently volatile and prone to sharp spikes, as the market is left at the mercy of LNG supply, unlikely ever to regain pre-crisis stability. Natural gas, power and LNG prices in Europe, the US and Asia have stepped way down from pre-Ukraine war levels in recent months, indicating that the crisis that started in late 2021 may be retreating.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

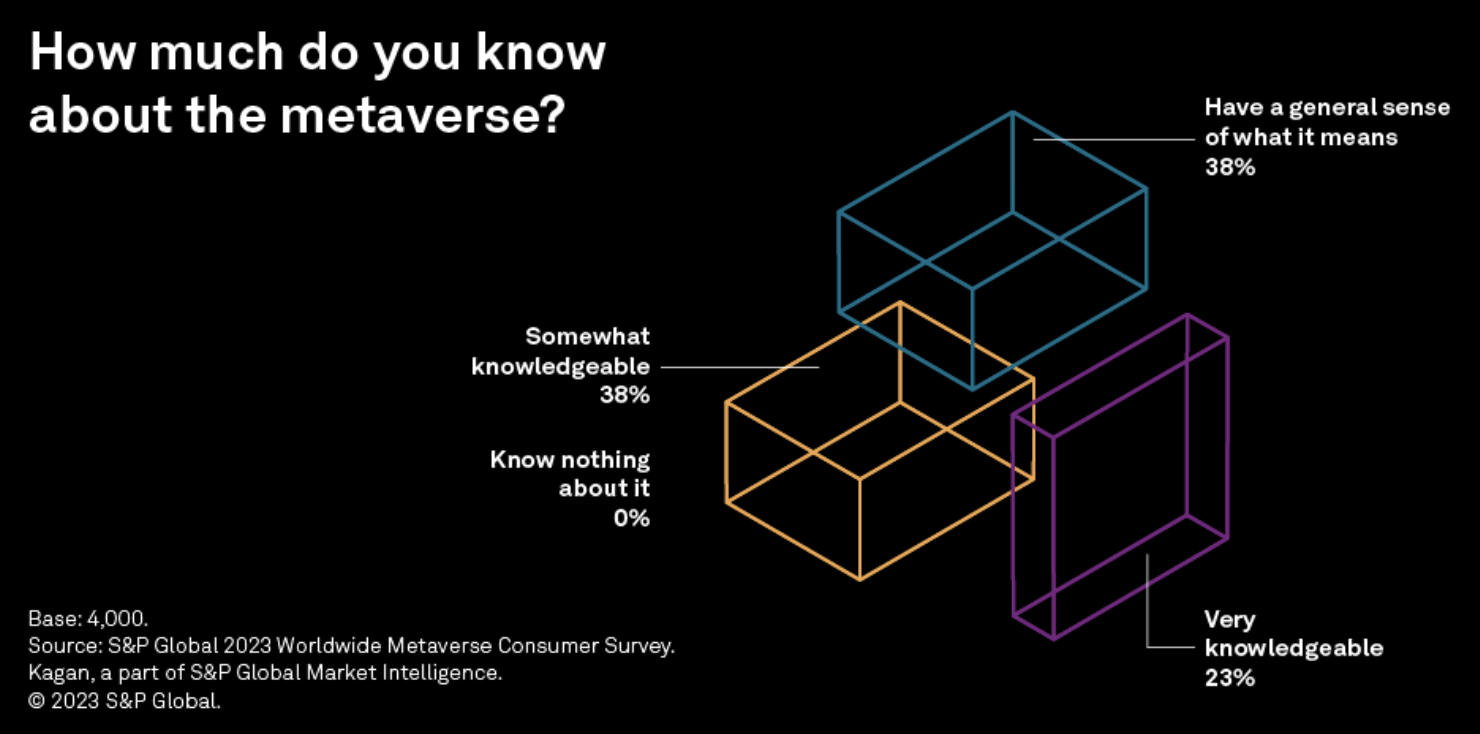

Consumer Survey: Many Are Aware Of And Ready To Enter The Metaverse

More than half of global respondents to a recent S&P Global consumer survey consider themselves somewhat or very knowledgeable of the metaverse and a strong majority have an interest in experiencing it. These results suggest that metaverse stakeholders have already established a potential audience to tap into and that the opportunity to capitalize on the market does exist.

—Read the article from S&P Global Market Intelligence

Content Type

Location

Segment

Language