Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Jan, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Issuance and Defaults Climb for Corporate Bonds

The year 2023 confounded expectations. With interest rates climbing globally, expectations for a hard landing into a recession mounted. But that recession was deferred indefinitely. For corporate credit markets, this created contrasting trends. On the one hand, higher interest rates precipitated higher defaults as borrowers struggled to pay for the higher cost of capital. On the other hand, a healthy and growing economic picture encouraged further issuance. Credit market optimists and pessimists both suffered reversals. Currently, 2024 looks set for more of the same for corporate credit markets — more issuance and more defaults.

Corporate defaults were up 80% in 2023, rising to 153 defaults from 85 defaults in 2022. The US accounted for 63% of those defaults, which is unsurprising given the comparative size of the US in corporate credit markets. S&P Global Ratings attributed the number of US defaults to the number of issuers having been rated CCC+ or below, with many issuers dealing with negative cash flows, elevated leverage, high interest expenses and weak liquidity.

US defaults were up 185% in 2023 compared with the previous year. European defaults were up a comparatively modest 91%. Persistent core inflation, a drawn-out period of high rates, and slower growth hammered lower-rated issuers. The sectors most exposed to consumer spending, such as media, consumer products and retail, accounted for 42% of defaults in 2023, and weakness in those sectors looks to continue in 2024. Europe and North America also led in downgrades of corporate bond issuances.

Elevated defaults and downgrades are expected to continue in 2024. These rating actions are anticipated to be concentrated at the lower end of the rating scale — B- or below — where close to 40% of issuers are at risk of downgrades. S&P Global Ratings forecasts that financing costs will remain high even though rate cuts are expected.

Despite the sharp increase in defaults and downgrades, global bond issuances last year totaled $7.7 trillion, up 4.8% from $7.2 trillion in 2022. S&P Global Ratings projected that the growth in issuances will continue this year, rising 4.3% to roughly $8 trillion. Issuances from nonfinancial corporates are estimated to increase 5.5% in 2024, while financial services issuances are estimated to grow about 6%, with upside potential.

Part of the reason that issuances continue to grow despite higher rates is the sizable upcoming maturity wall, particularly for rated maturities over the next three years. A total $5.8 trillion of global issuances are projected to come due by 2026, with some of that issuance being rolled over into new debt. This may mean that elevated defaults and issuance could become a trend in corporate bond markets.

Today is Wednesday, January 31, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

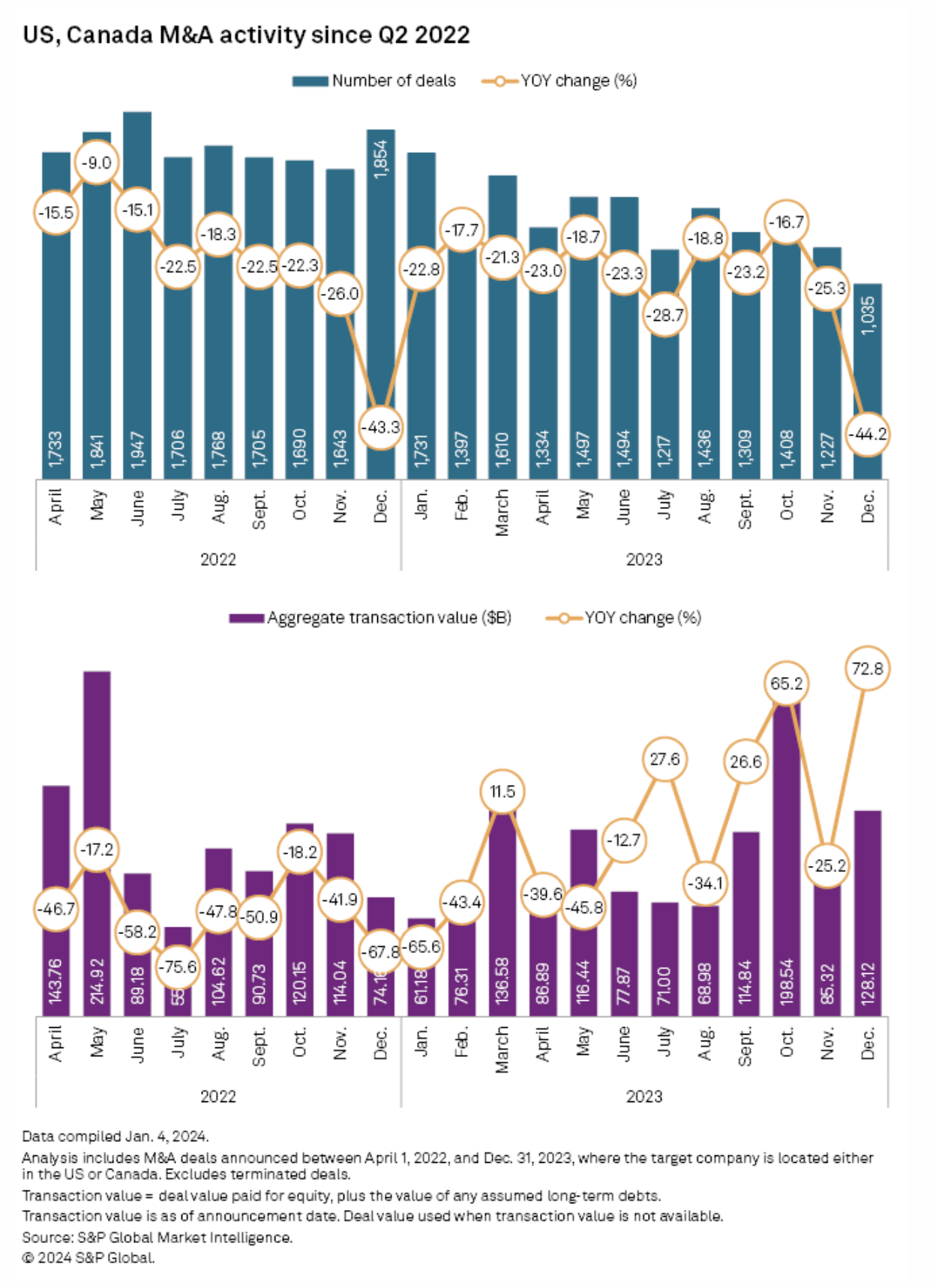

North American M&A Activity Slump Extends Through 2023

North American M&A activity remained dismal in 2023 as high interest rates bore down on companies' M&A appetite for a second consecutive year. The total value of mergers and acquisitions in the US and Canada fell to $1.222 trillion in 2023, a 15.3% drop from a revised $1.442 trillion in 2022. The number of transactions in 2023 also dropped 23.7% to 16,695 from a revised 21,871 in 2022, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Retail Loans Surge In India As Central Bank Seeks To Stem Possible Risks

Indian commercial banks' retail lending has risen faster than loans to large businesses since the COVID-19 pandemic, S&P Global Market Intelligence data showed, underscoring the central bank's concerns about unsecured loans. Retail loans was the fastest-growing segment among the three biggest private sector lenders, and among their state-owned peers, since at least the fiscal year ended March 2021, Market Intelligence data showed.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

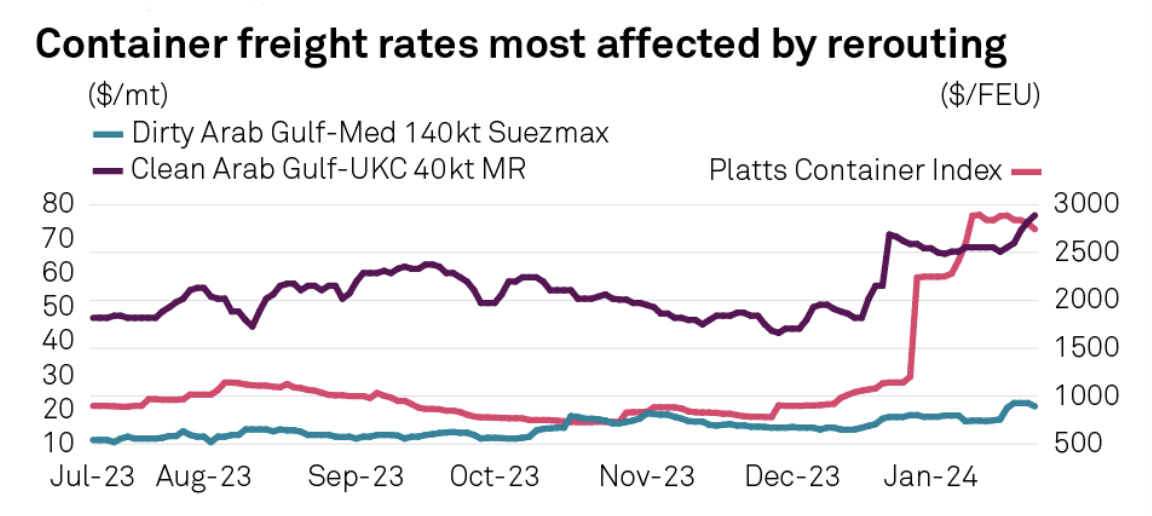

Trafigura Tanker Fire Extinguished After Latest Houthi Missile Attack

Trafigura said Jan. 27 that a fire onboard a petroleum products tanker it operates has been extinguished, after the vessel was struck overnight by a missile attack by Houthi militia in the Gulf of Aden. "The vessel is now sailing towards a safe harbour," Trafigura said in a statement. "The crew continues to monitor the vessel and cargo closely." Trafigura identified the petroleum products tanker as the Marlin Luanda. The tanker was carrying a naphtha cargo bound for Singapore, according to market sources and data provided by S&P Global Commodities at Sea.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

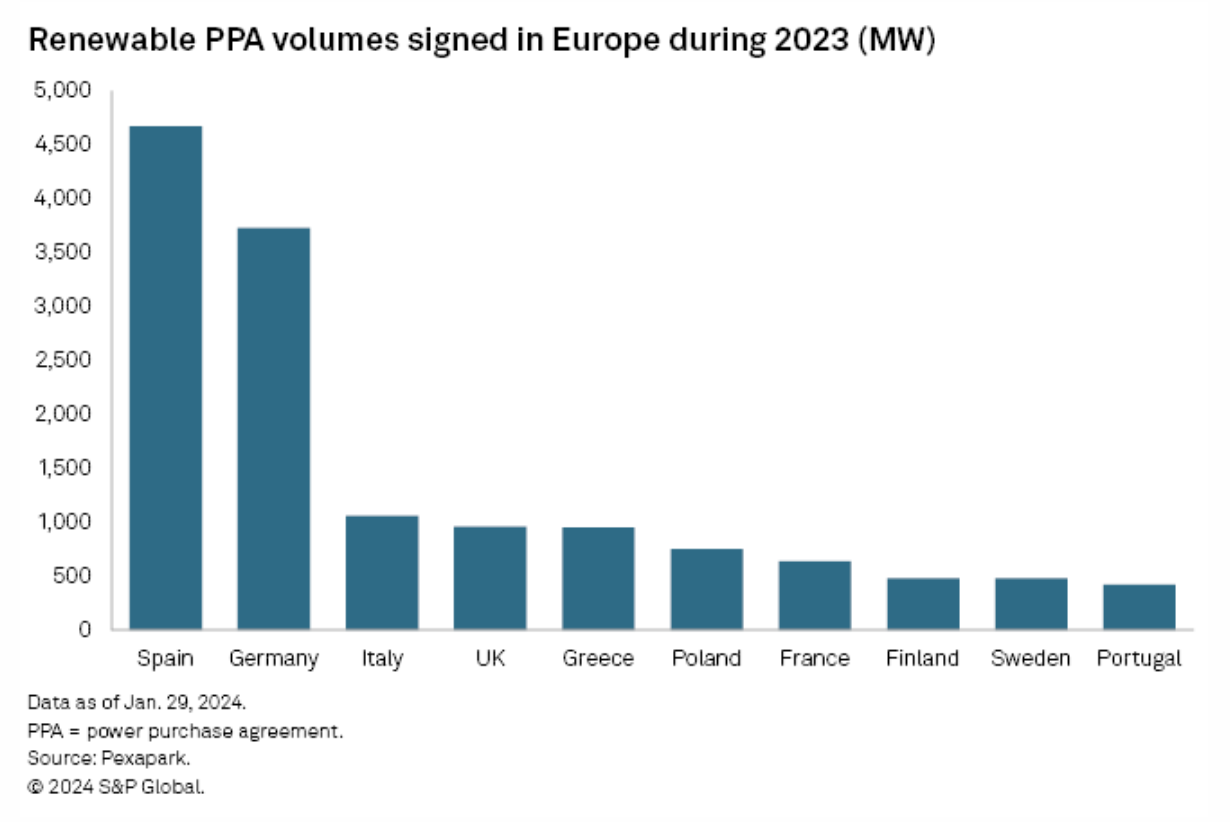

'Permanent Shift': European Renewables PPA Dealmaking Surged In 2023 — Pexapark

Activity surged in Europe's renewables power purchase agreement market in 2023 with 272 long-term deals signed by corporate and utility offtakers, a 65% increase compared to the prior year, analytics firm Pexapark said in its annual report Jan. 29. Volatility in commodity markets eased in 2023, giving more counterparties the confidence to sign power purchase agreements (PPAs), Pexapark said. Regulatory uncertainty, for instance in the form of windfall taxes, also abated. Yet, higher financing costs tested some transactions, Pexapark noted. 2023 was the first full year since tracking of deals began where financing challenged the PPA market, the firm added.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

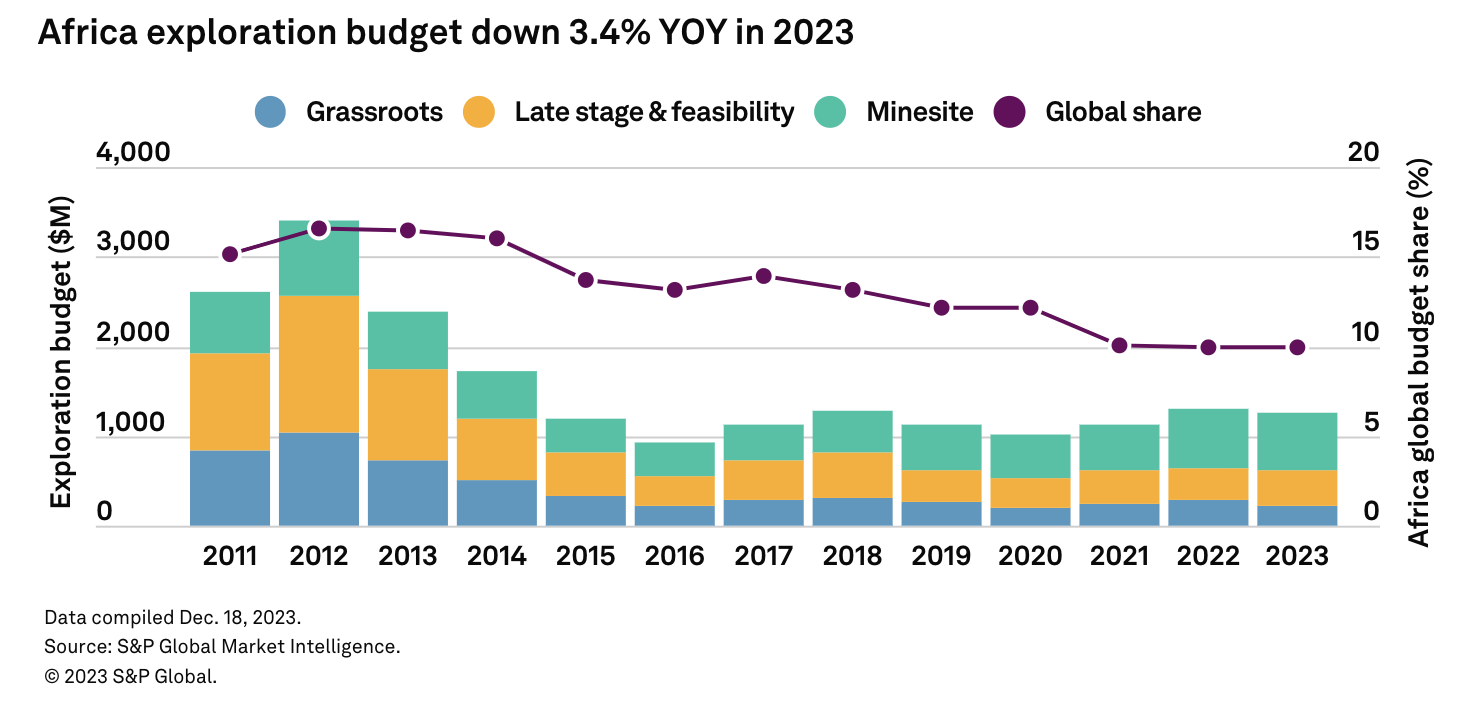

Africa Mining By The Numbers 2024

With an abundance of resources critical to the global energy transition effort, Africa continued to garner attention from the mining sector in 2023, despite a weakening global economic outlook. Indeed, the continent is quickly emerging as one of the prime targets for the development of new mines to meet the demand for commodities such as copper, lithium and others.

—Read the article from S&P Global Market Intelligence

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 150: Technology In Media Production

Technology’s impacts are felt in many areas, including podcasts. We pull back the curtain a little, with producers Darren Rose and Kyle Cangialosi in addition to host Eric Hanselman, to look at the transformations that are driving media production. Concerns about deep fakes are all the rage, but the realities of the technical capabilities are still progressing in their ability to deliver professional quality media. This podcast is benefiting from AI-powered studio tools, too.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence