Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Feb, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Tough Times for Banking

The banking sector is cyclical in nature and sensitive to the ebb and flow of the broader economy. In a cyclical market, it is typical for bad times to follow good, and vice versa. Coming off a stellar 2021 that saw the industry bounce back from the fallout of the COVID-19 pandemic, 2022 was a historically dismal year for banks given economic, geopolitical and regulatory uncertainties.

Investment bankers working on M&A and capital offerings had it rough in 2022 as prevailing macroeconomic headwinds dragged dealmaking. In a reversal of expectations, global M&A and equity offering activity slumped in 2022 after reaching historic heights in 2021. Globally, the aggregate value of M&A deals across all sectors declined 35.8% on an annual basis to $2.983 trillion, and the total value of equity issuance plunged 66.6% to $351.76 billion. In 2022, leveraged buyouts were at their lowest point since the coronavirus outbreak in 2020.

Bank M&A in particular slowed to a crawl. Global bank deal volume in 2022 fell 19.6% year over year to 505 transactions, the lowest number in the past five years, according to S&P Global Market Intelligence. The value of U.S. bank deals in 2022 dropped to its lowest annual level since 2014 after soaring to a 15-year high in 2021. The number of bank transactions in Europe hit a five-year low.

"In 2022, lower equity prices and greater volatility gave issuers little incentive to sell shares at reduced valuations, nor did they motivate potential sellers to pursue M&A transactions, and they gave buyers less wherewithal to make acquisitions," according to S&P Global Market Intelligence’s “Global Q4 2022 M&A and Equity Offerings” report.

The slowdown in transaction activity was underpinned by the rapidly rising interest rate environment, which distorted deal math and made M&A less appealing. Increased geopolitical concerns, reduced valuations and decreased executive confidence in the economic outlook also contributed to the deal doldrums. For dealmaking to turn around, greater market stability through relaxed monetary policies and lower rates is needed. “A better-performing market can lead to a more conducive dealmaking environment,” S&P Global Market Intelligence’s report said.

Similarly, funding pressures drove down deposits and net interest margins for some of the largest banks in the U.S., and bank stocks deteriorated at the end of 2022. As the Federal Reserve raised the benchmark interest rate by 50 basis points last December, major U.S. exchange-traded banks posted a negative 4.8% median return during the month, according to an S&P Global Market Intelligence analysis.

Banks sought to strengthen reserves in 2022 as they braced for a possible slowdown in 2023. Most large U.S. banks expanded their credit loss provisions during the fourth quarter of 2022. The uptick in provisions reflects “our more conservative view on credit given the increasing economic uncertainty, loan growth and changes in specific reserves," Stellar Bancorp CFO Paul Egge said on an earnings call.

The “crypto winter,” which pertains to a period of poor performance in the cryptocurrency market, also dealt a blow to some banks tied to the sector. Cryptocurrency prices and volumes took a big fall in 2022, while FTX Trading and other digital asset exchanges filed for bankruptcy. This resulted in heavy losses related to digital asset deposits and greater regulatory scrutiny, causing some banks to reduce costs and withdraw from the cryptocurrency space.

"[Cryptocurrency] really is in a nuclear winter, but in reality, it's back just to where it was pre-COVID," FinPro President Don Musso said in an interview. Silvergate Capital CEO Alan Lane, meanwhile, said the cryptocurrency market was experiencing a "crisis of confidence."

After a year blighted by inflationary and liquidity pressures, interest rate hikes, rising recession fears and regulatory challenges, it remains to be seen whether the downbeat trends that defined the banking sector in 2022 represent a temporary blip or are a sign of tough times ahead.

Today is Wednesday, February 15, 2023, and here is today’s essential intelligence.

Written by Pam Rosacia.

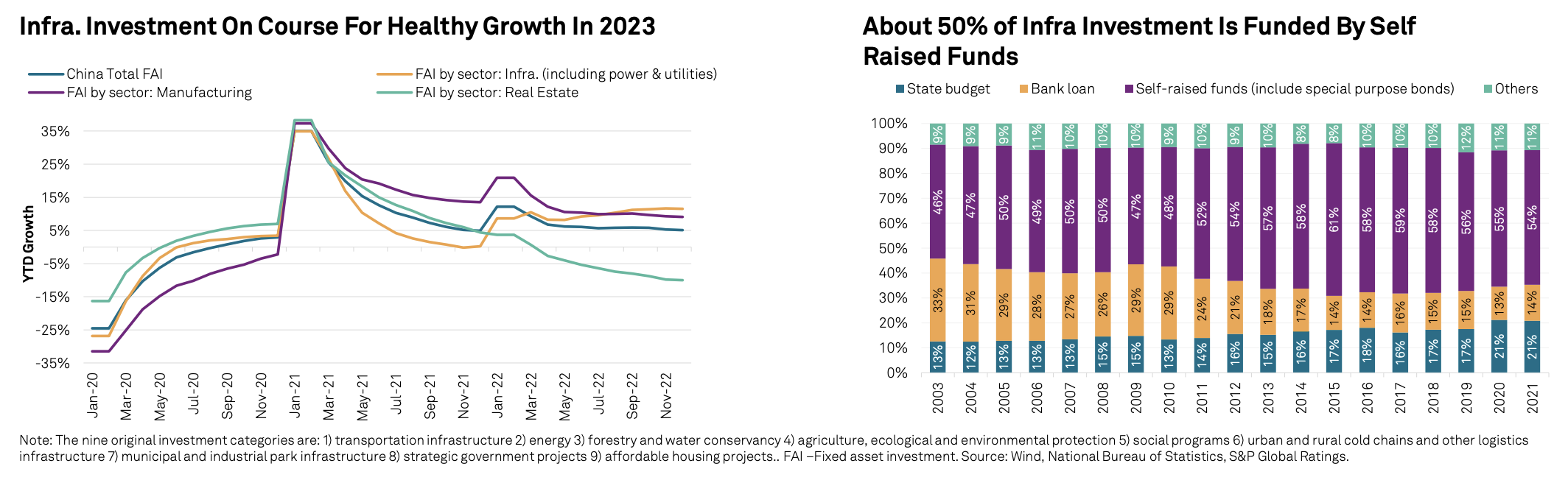

China Engineering & Construction 2023 Industry Outlook: Rated Companies To Expand With Slimmed Rating Buffers

The credit profiles of most rated E&C companies will be stable in 2023. Earnings growth will tend to keep interest coverage ratios (our usual rating trigger) steady. S&P Global Ratings expects the revenue of most rated E&C companies to grow by 8%-11% in 2023, supported by solid order backlogs and continuous expansion of infrastructure investment. Moderating raw material costs, and a potentially lower receivables-to-revenue impairment ratio, could gradually help the profitability of its rated companies to recover in 2023.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Banks Pump The Brakes On Cryptocurrency As Regulators Signal Growing Concern

Banking regulators' recent speeches, guidance and policy statements have made their stance on cryptocurrency clear: digital assets are a threat to the safety and soundness of the banking industry, and banks should proceed with caution. Though the agencies have yet to issue formal, proposed rules regarding banks' involvement in crypto activities, industry experts told S&P Global Market Intelligence that regulators have made their opinions clear.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Pakistan Mulls Buying Cheap Russian Crude, Oil Products Amid Hurdles

Pakistan is keen to purchase cheap crude and discounted oil products from Russia as it grapples with high external debt and weak local currency, but hurdles such as high logistics costs and product specification mismatch stand in the way, industry and government sources said. As Pakistan continues to suffer from severe shortage of foreign exchange reserves, any short- or long-term deals with Russia to take crude and oil products at low prices would help reduce the nation's financial burden, government officials, refinery executives and Karachi-based analysts told S&P Global Commodity Insights.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability Insights: Asia-Pacific Sustainable Bond Issuance To Increase In 2023

In 2023, Asia-Pacific looks likely to post 20% growth in GSSSB issuance, outpacing other regional markets and reaching a total value of about $240 billion. The steep rise in percentage terms is mainly due to a lower existing base of issuance. However, growing awareness of sustainability imperatives across the region, especially decarbonization, also contributes to market momentum.

—Read the report from S&P Global Ratings

Access more insights on sustainability >

Power Demand Recovery Slows Down Owing To Gloomy Global Demand

S&P Global published the Southeast Asia power and renewable market briefing for the fourth quarter of 2022. The report discussed the power demand, supply, pricing and major market events in the quarter, as well as the latest proposed or enacted policies and regulations. The data from the power market indicates a fluctuation in the year-over-year (y/y) power demand growth in the fourth quarter of 2022 in Southeast Asian countries, including Vietnam, Thailand, Malaysia and Singapore, with a range of -3 y/y% to 7 y/y% compared to the previous year, reflecting a slowdown in the recovery of power demand.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

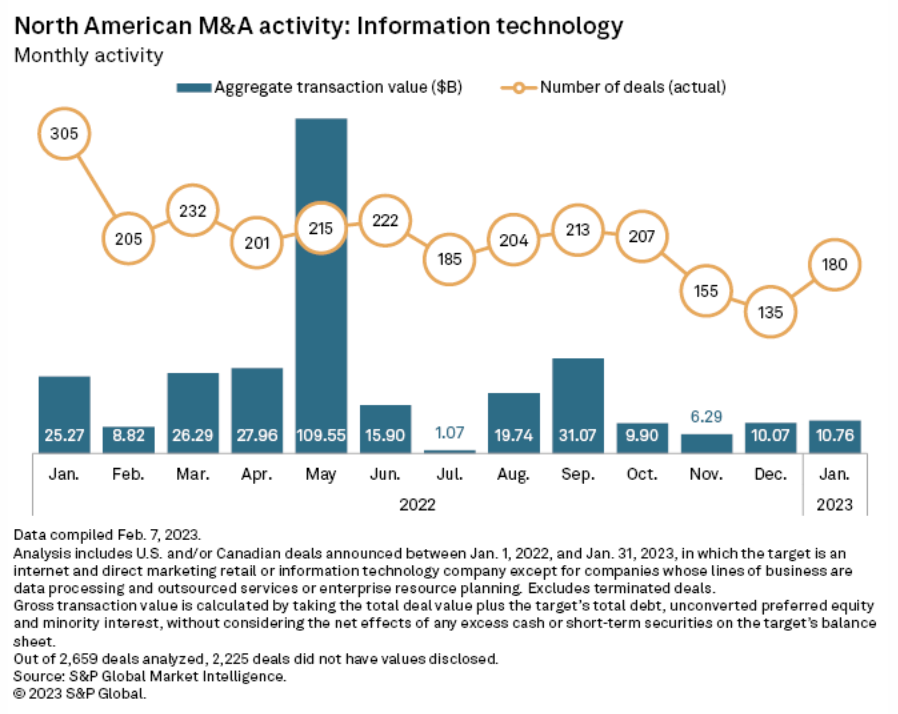

Deal Tracker: Infotech M&A Activity, Values Plunge YOY In January

Information technology M&A activity in North America had a lukewarm start to 2023, with total deal values plunging by more than half year over year in January. There were 180 transactions announced in the sector with an aggregate value of $10.76 billion, down 57.42% from $25.27 billion a year ago, according to S&P Global Market Intelligence data. The total number of deals represents a 40.98% decrease from the 305 transactions announced in January 2022. The latest figures, however, were a slight improvement from December 2022, when the sector recorded 135 deals with $10.07 billion in aggregate value.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek