Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 03, 2020

Weekly Pricing Pulse: Mainland China and vaccine optimism supports risk-on trading

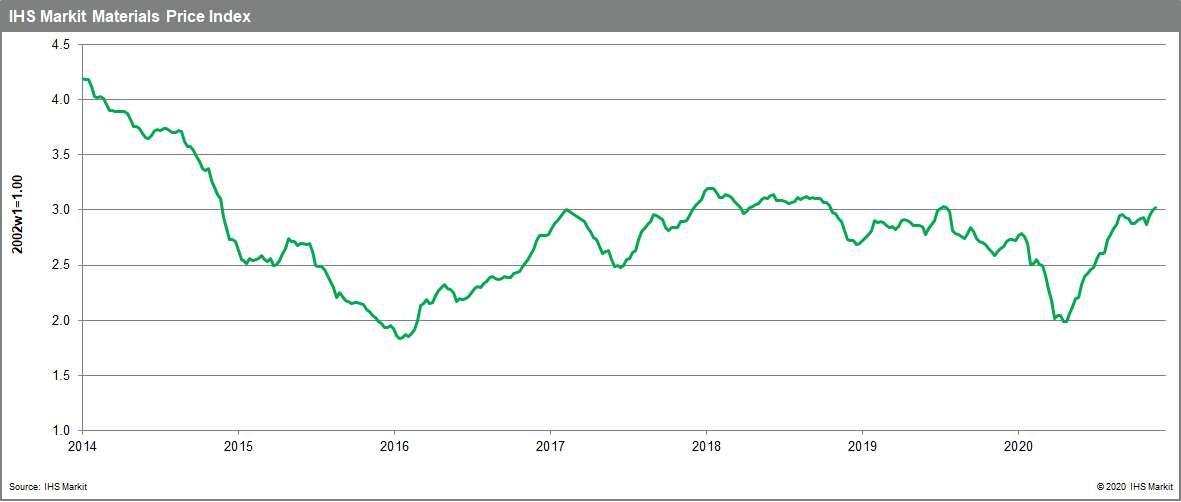

Our Materials Price Index (MPI) rose 1.6% last week, its third consecutive increase. Commodity prices remained relatively flat between September and early November as the third quarter rally faded on rising COVID-19 case counts in both North America and Europe. Sentiment has become decidedly bullish in the past few weeks, however, with markets locked on to each fresh data release from mainland China and the positive news on vaccine trial results. Markets also seem to be taking heart from the US election, which has produced a definitive result on the Presidency, removing one uncertainty for the near future.

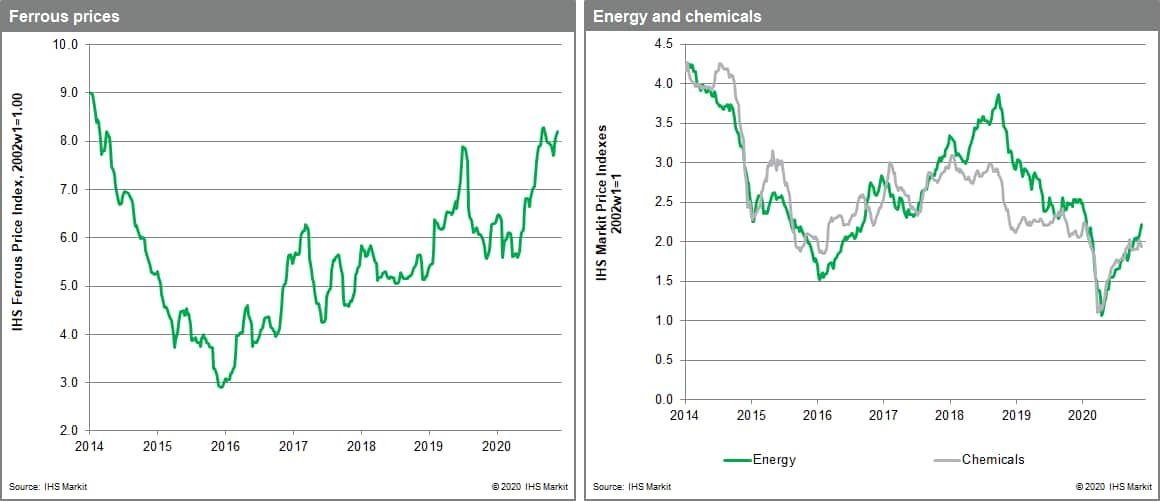

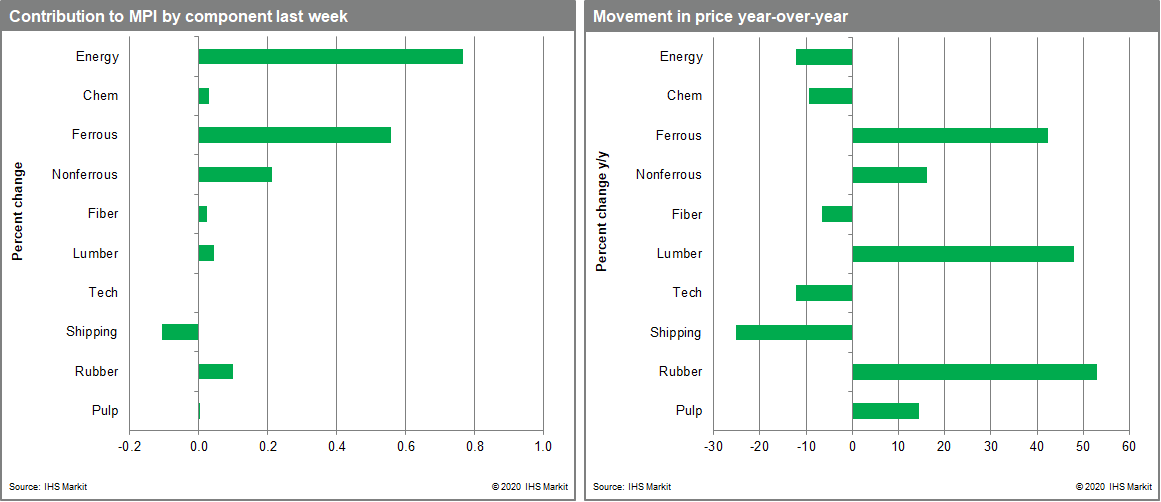

Energy prices collectively surged 6.8% on strong moves in coal (7.6%), oil (7.1%) and gas (3.9%). Vaccine optimism drove crude oil prices on hopes that demand could begin to return to normal sooner rather than later in 2021. Indications that oil producers will not be lifting production as planned at the start of next year also helped lift prices. LNG prices were driven higher by news of South Korea's decision to suspend production at 16 coal-fired power plants to curb pollution, which will see gas demand increase in north Asia. On the supply side, the market is digesting the impact of an outage at Qatar gas. Thermal coal prices rose last week as Chinese buying remained firm in early winter restocking activity, despite threats by Chinese authorities to limit purchases from Australia. Non-ferrous metals rose 2.2% as the complex found support from firm demand in China and stronger risk-on sentiment outside of China. Copper rose 3.2% to hit a seven-year high on a 20% decline in visible global inventories in the last month. Steel raw materials moved 1.3% higher with iron ore spot prices pushing back up to recent seven-year highs by rising steel prices in China. Turkish scrap prices also hit a two and a half year high and look set to continue rising. Rubber rose 2.3% rising further after the technical sell-off two weeks ago. Disruptions in rubber production and supply chains remain present and demand has also firmed on vaccine news.

Commodity prices have resumed their third-quarter rally, kickstarted by the combined effect of positive vaccine news, the conclusion of the US election (with the promise of some sort of second stimulus package) and continuing good news from mainland China's manufacturing sector. Fundamentally, Chinese demand is the sole support for global markets - outside of China consumption for most of the commodities tracked by the MPI is expected to contract this year. Markets, however, being forward looking, are pricing in hope for an early end to the pandemic and more normal consumer spending earlier rather than later in 2021.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mainland-china-vaccine-risk-trade.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mainland-china-vaccine-risk-trade.html&text=Weekly+Pricing+Pulse%3a+Mainland+China+and+vaccine+optimism+supports+risk-on+trading+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mainland-china-vaccine-risk-trade.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Mainland China and vaccine optimism supports risk-on trading | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mainland-china-vaccine-risk-trade.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Mainland+China+and+vaccine+optimism+supports+risk-on+trading+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-mainland-china-vaccine-risk-trade.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}