Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 19, 2018

Banks and property developers boost Singapore dividends

- Our average forecast yield for the index is 3.8%, the highest among other key benchmark indices in the region.

- Dividends from the index are anchored by the banking, real estate and telecommunication sectors

- Increase in dividends is mostly attributed to higher payouts projected for banks and property developers.

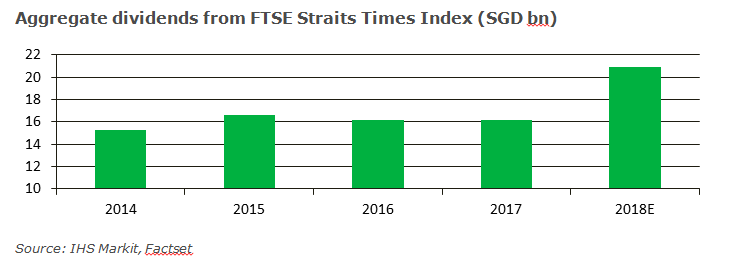

Aggregate dividends in Singapore are set to hit multi-year high in 2018. We are forecasting companies in the FTSE Straits Times Index (STI) to return SGD 20.9bn in dividends to shareholders this year, up 29% from SGD 16.2bn in 2017. Dividend growth had been lackluster in recent years due to the collapse in oil prices, as oil and gas companies reduce payouts and banks become conservative with dividends, as a result of the decrease in their bottom line figures.

However, dividends announced since the beginning of this year, suggests a turnaround in payouts from the benchmark index. The index now boasts an average forward dividend yield of 3.8% based on our forecasts, the highest compared with other benchmark indices in the region.

Dividends from STI are anchored by the banking, telecommunication and real estate sectors. On aggregate, dividends from these sectors are estimated to grow by 30% year-on-year to SGD 13.5bn, which represents nearly two-thirds of the projected aggregate dividends in 2018. This report provides an in-depth look at these key sectors to explain our predicted dividend trajectory of the index.

Banks – strong fundamentals to underpin dividend growth

The banking sector comprises of DBS Group Holdings (DBS), United Overseas Bank (UOB) and Oversea-Chinese Banking Corporation (OCBC), and we are forecasting these three banks to announce SGD 7.7bn in dividends in 2018, translating to an uplift of around 80% from the amount registered a year ago.

Real Estate – Contrasting dividend outlook for developers and REITs

We are expecting dividends from the real estate companies to come in at SGD 2.6bn, which represents an uplift of around 7.1% from the dividends declared in 2017. Property developers account for around 55% of aggregate dividends from the sector, and Real Estate Investment Trusts (REITs) account for the remaining 45%.

Telecommunications – Intense competition to drag sector dividends

Aggregate dividends from the telecommunication sector are expected to fall in 2018 due to the absence of the one-off special dividend from Singapore Telecommunications Limited (Singtel) in 2017. Payouts are projected to be relatively flat in short term, weighed on by intense intra-industry competition.

To access the report, please contact dividendsupport@markit.com

Chong Jun Wong, Senior Research Analyst at IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-and-property-developers-boost-singapore-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-and-property-developers-boost-singapore-dividends.html&text=Banks+and+property+developers+boost+Singapore+dividends+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-and-property-developers-boost-singapore-dividends.html","enabled":true},{"name":"email","url":"?subject=Banks and property developers boost Singapore dividends | S&P Global&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-and-property-developers-boost-singapore-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banks+and+property+developers+boost+Singapore+dividends+%7c+S%26P+Global http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanks-and-property-developers-boost-singapore-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}