Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 23, 2016

Resilient August Eurozone PMI points to 0.3% GDP rise in third quarter

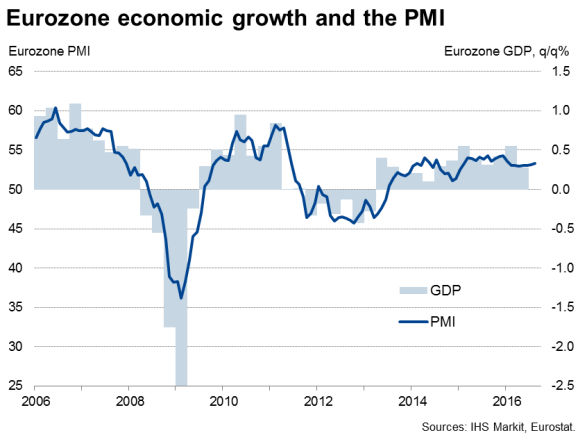

The August flash PMI indicates that the eurozone remains on a steady growth path in the third quarter, with no signs of the recovery being derailed by 'Brexit' uncertainty.

At 53.3, up from 53.2 in July, the flash estimate of the Markit Eurozone PMI" inched up to a seven-month high. With the index only slightly above the average seen throughout the year to date, growth in the third quarter is likely to be similar to that seen in the first half of the year.

However, a slowing in manufacturing order book growth and a dip in services optimism led to a weakened rate of hiring and suggested that growth could fade in coming months. Inflationary pressures meanwhile remained muted.

More steady growth

The PMI survey data are consistent with the region's GDP growing at a quarterly rate of 0.3% in the third quarter, or 1.2% annualised, which is similar to that seen on average over the first half of the year.

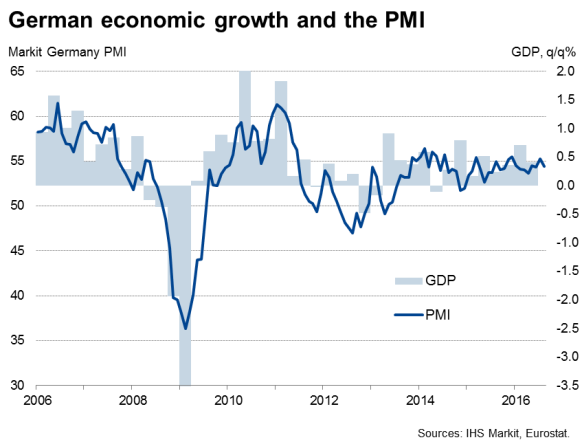

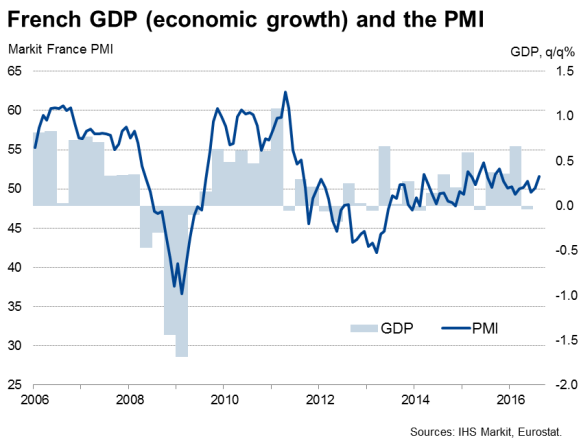

Looking at the national data, the PMIs suggest that a solid 0.5% pace of expansion in Germany is being accompanied by a return to modest growth in France in the third quarter, while the rest of the region is also seeing growth pick up after slowing in the second quarter.

With the ECB waiting to gauge any detrimental impact of the UK's referendum to leave the EU, the solid PMI readings point to little material 'Brexit' impact on the Eurozone economy, and therefore take the pressure off the central bank to introduce more stimulus at its September meeting. The region still looks to be on course for at least a 1.5% economic expansion in 2016.

Warning lights

However, the August surveys also flashed some warning lights which suggest that policymakers will keep the door open for more stimulus later in the year.

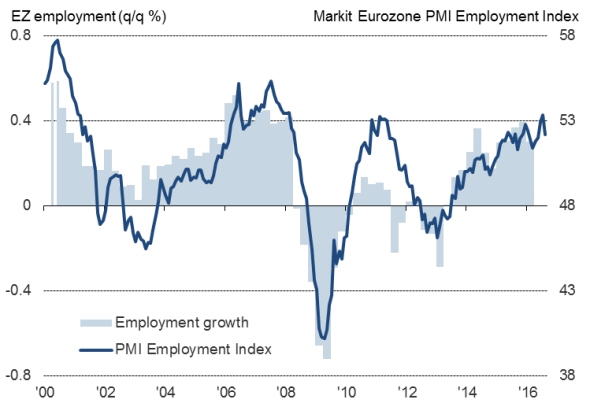

In particular, there were signs that the strongest spell of job creation seen in the region over the past five years may be cooling. Although employment rose again in August, the rate of increase slowed to a three-month low, hit by weaker hiring trends in both manufacturing and services.

Employment

Sources: IHS Markit, Eurostat.

Hiring appears to have been affected by worries about demand.

Whereas inflows of new business in the service sector rose at the fastest rate for four months, new orders received by factories grew at the slowest rate for one-and-a-half years.

The future strength of demand in the service sector was meanwhile called into question as business expectations about the year ahead among service providers fell to its lowest since December 2014.

Lack of inflation

An additional factor suggesting that more stimulus may be required at some point is an ongoing lack of inflationary pressures. Although input costs rose for the fifth month in a row, the rise was the smallest since April. Average selling prices meanwhile fell again, dropping at a slightly greater rate than July, continuing the trend of falling prices seen over much of the past five years.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-Resilient-August-Eurozone-PMI-points-to-0-3-GDP-rise-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-Resilient-August-Eurozone-PMI-points-to-0-3-GDP-rise-in-third-quarter.html&text=Resilient+August+Eurozone+PMI+points+to+0.3%25+GDP+rise+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-Resilient-August-Eurozone-PMI-points-to-0-3-GDP-rise-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Resilient August Eurozone PMI points to 0.3% GDP rise in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-Resilient-August-Eurozone-PMI-points-to-0-3-GDP-rise-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Resilient+August+Eurozone+PMI+points+to+0.3%25+GDP+rise+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23082016-Economics-Resilient-August-Eurozone-PMI-points-to-0-3-GDP-rise-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}