Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 22, 2016

Pokemon No

Pokemon Go has proved a surprise smash hit for Nintendo, but the surge seen in Nintendo shares has attracted plenty of scepticism, with short sellers piling in.

- Nintendo short interest has nearly tripled to a new yearly high since shares surged last week

- Gamestop has seen short interest sink to a two and a half year low as stock bounces back

- Bearish sentiment in Nintendo shares isolated as gaming sector has seen covering ytd

Augmented reality has long been mooted as a future growth driver for the video games industry, but a breakthrough hit demonstrating the technology's commercial potential proved fleeting prior to last week's launch of the Pokemon Go. The viral hit, which is on track overtake Twitter in terms of daily users, has propelled Nintendo shares to over twice their pre-launch levels as investors piled in to get a piece of the action. The unexpected success, and its impact on Nintendo shares, has left plenty of doubters however as short interest in Nintendo shares has more than tripled in the last ten days.

Current demand to borrow Nintendo's domestically listed shares now stands at 2.5% of shares outstanding, which matches the recent 12 month highs seen in the tail end of last year. Nintendo's ADR line of shares has also seen an even bigger jump in shorting activity with demand to borrow now three and a half times the levels seen a week ago. While both listings have proved popular with short sellers, the majority of short positions by value are found in the Japanese listing which sees $840m of loans out to short sellers against $42m in the ADR listing.

Gamestop sees covering

Another stock impacted by the recent volatility has been GameStop which has seen been one of the first companies to capitalise on the game's ability to corral users looking to visit its augmented reality "stops". GameStop's CEO was quick to tout the impact of the increased footfall on its sales which sent its shares up sharply on Monday. The latest surge added to a recent bounce in GameStop shares which are now up by 22% in the last month. Unlike Nintendo, GameStop's recent surge has not seen any material increase in its already high short interest given the demand to borrow GME shares is down by 20% in the last month to 18% of shares outstanding.

GameStop's current short interest is in fact the lowest in two and a half years and now stands less than a third of the levels seen at the start of the year when a massive 50% of GameStop shares were out on loan.

Nintendo short interest isolated

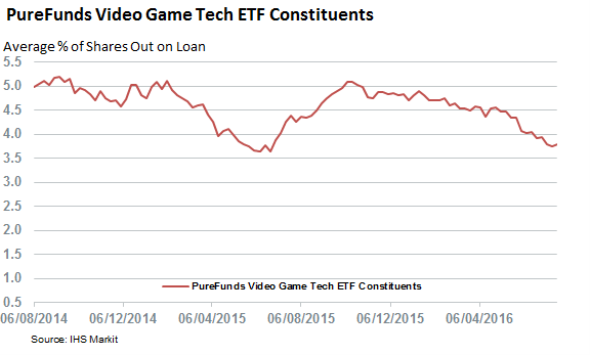

The covering seen in GameStop shares is echoed by the rest of the video games sector as the shorting activity among the constituents of the recently launched PureFunds Video Game Tech ETF, which invests in Nintendo and GameStop, now lies at a new a yearly low.

The current average demand to borrow shares of the ETF's constituents is 2.8% of shares outstanding, a fifth less than at the start of the year. The covering has been pretty universal as three quarters of the constituents that seen any significant shorting activity have seen demand to borrow fall in recent weeks.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-equities-pokemon-no.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-equities-pokemon-no.html&text=Pokemon+No","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-equities-pokemon-no.html","enabled":true},{"name":"email","url":"?subject=Pokemon No&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-equities-pokemon-no.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pokemon+No http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22072016-equities-pokemon-no.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}