Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 22, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Shorts hold onto Outerwall and Lumber Liquidators, despite prices moving against them

- Logitech sees record short interest ahead of earnings post acquisition of Jaybird

- Dividend expected to be slashed in half at Japanese shipper K-line, most shorted in Apac

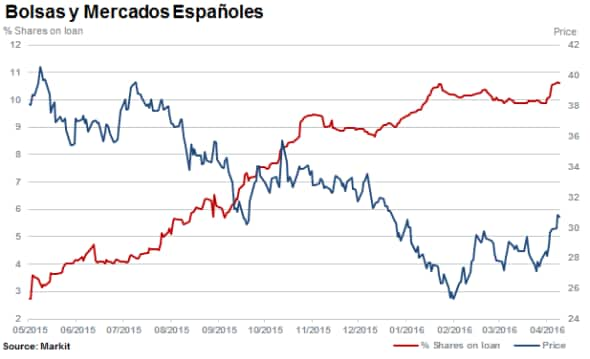

North America

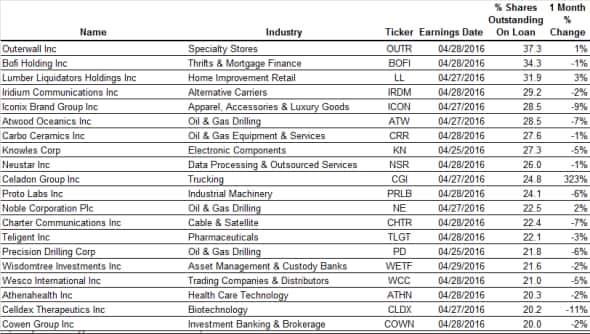

For a consecutive quarter the most shorted ahead of earnings this week in North America, is Outerwall with 37.3% of its shares currently out on loan. Short sellers have however, lost substantial ground, holding on to costly positions as shares have surged 58% since late February. The stock has been spurred on by the company announcing a doubling of its dividend and exploring "strategic and financial alternatives to maximise shareholder value".

Despite the move eroding short sellers' profits, only 15% of short positions have been trimmed with short sellers still prepared to pay above 15% to borrow, indicating high conviction levels remain.

Attracting high levels of short interest for a consecutive quarter is Bofi Holdings with a third of its shares which remain outstanding on loan despite the stock rising by some 7.8%.

Lumber Liquidators first appeared on short sellers' radars in 2015, with shares falling over 70%. Appearing once again among the most shorted stocks ahead of earnings this week, with 31.9% of shares outstanding on loan. Shares have rallied by a third since February 26th 2015.

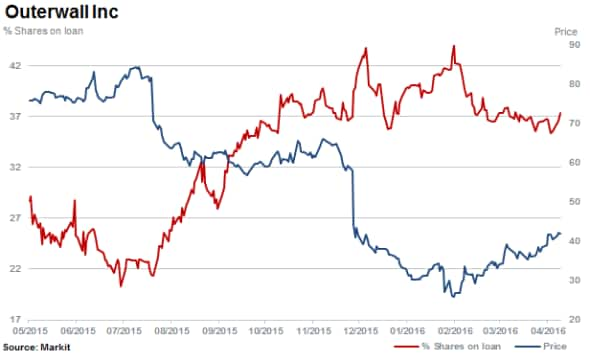

Synthetic proppants supplier (small sand-like particles) Carbo Ceramics continues to be heavily shorted with 28.4% of shares currently outstanding on loan. Since short interest levels broke through 20% in 2014, shares in the company have plummeted over 80%.

A recent 53% rally in Carbo Ceramic shares actually saw short sellers add to positions with the stock subsequently erasing gains and falling back to trading near a three year low.

Europe

With a fifth of its shares currently sold short, Aixtron leads stocks ahead of earnings in Europe this week.

The German based equipment manufacturer of semiconductor equipment has seen shares surge 39% since February 12th 2016. Resilient short sellers have however, held onto positions and additionally they have also been prepared to pay a high cost to borrow stock.

Short interest in Swiss listed Logitech International has doubled in the last 12 months with 14.6% of the company's shares currently outstanding on loan. The firm just announced the $50m acquisition of Jaybird, growing the companies audio and music portfolio.

Short sellers have targeted Logitech's lacklustre sales growth in recent years. However, Logitech shares have moved 9% higher in the last 12 months.

Outotec, a Finnish based provider of minerals and metals based processing technology is third most shorted ahead of earnings in Europe. 11.3% of shares are currently outstanding on loan and the company's stock has slid 38% in the past 12 months.

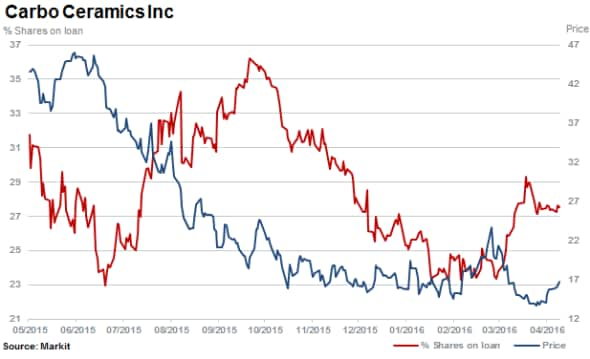

Bolsas y Mercados Espa"oles (BME) -the Spanish stock market operator has 10% of its shares sold short and sees significant demand to borrow in Europe ahead of earnings. The cost to borrow stock has surged since the start of the year (approaching 10%) and short sellers have held tight as the stock participated in the February rally, rising some 20%.

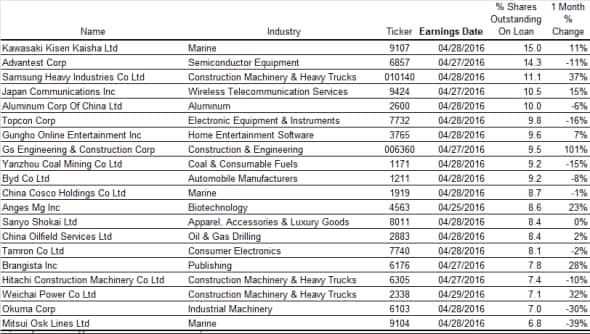

Apac

Markit's Dividend Forecasting is expecting a 58.3% dividend cut at Kawasaki Kisen Kaisha (K-Line which leads the most shorted companies ahead of earnings in Apac this week.

Currently with 14.9% of shares outstanding on loan, the company recently cut forecasts for operating income and earnings per share, swinging violently from "5.3 to "-53.3 and guiding for a "50bn loss for the year.

K-Line cited a slowdown in the Chinese economy and emerging markets as declining demand remained sluggish. Additionally the firm expects further costs arising from implementation of structural reform in its dry bulk business.

A surge in short interest has been seen in recent weeks at Samsung heavy Industries. Currently the third most shorted stock in Apac with 11% of shares sold short. Similarly to K-line, Samsung's shipbuilding is struggling with weak demand and a glut in supply - the stock is down 38% in the past 12 months.

Second most shorted in Apac is Advantest with 13.5% of shares are outstanding on loan. The firm manufactures semiconductor and component test equipment and has seen shares fall by 20% in the past year.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f22042016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}