Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 17, 2016

Bank of England holds rates. Will the next move be a cut?

No surprise as the Bank of England's Monetary Policy Committee left interest rates unchanged at its latest gathering. All nine committee members voted to keep policy on hold.

The Bank highlighted how uncertainty regarding the June vote on the UK's membership of the EU is exacerbating wider concerns about the domestic and global economic outlook.

Policymakers noted how spending by businesses and overall demand in the economy could weaken as a result of the intensifying Brexit fears, which would worsen an already shaky start to the year.

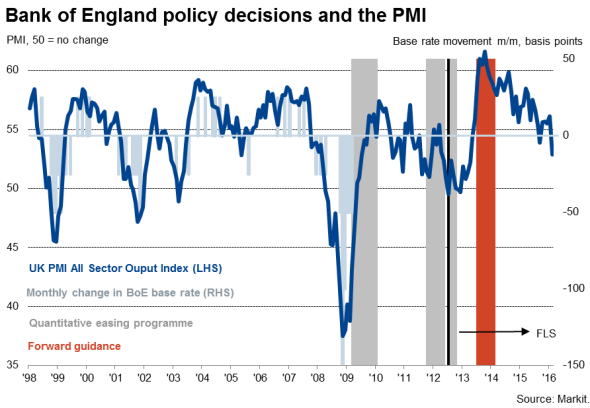

Global economic growth slowed to near-stagnation in February, according to PMI data, with weaker rates of expansion seen in the US, eurozone, Japan and China as well as the UK. The UK PMIs showed the largest slowdown for 4" years, dropping to a level consistent with a mere 0.2% quarterly GDP growth rate.

While the Bank stressed that rates are more likely to rise than fall over the next two years, the nagging fear amongst policymakers is that there's little scope to use conventional rate cuts if the economy enters a new recession, and doubts hang over the effectiveness of further quantitative easing. It's a major concern that the PMI has already been pushed into territory which has in the past seen the Bank of England inject more stimulus into the economy.

The chances of the Bank having to resort to further new non-standard measures to boost the economy have therefore increased considerably in recent weeks, as rising uncertainty regarding 'Brexit' has compounded wider concerns about the outlook for domestic and overseas demand.

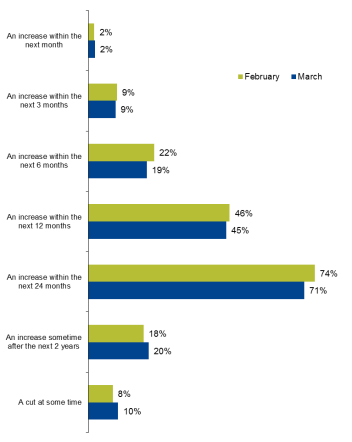

A recent survey of UK households found that the proportion expecting the next move by the Bank of England has risen to one-in-ten in March.

Households' views on next move in Bank of England base rate*

* "The interest rate set by the Bank of England is currently 0.5%. Please let us know when and how you think the Bank will next change interest rates by choosing one of the options below: Please choose one answer." Historical data available upon request.

Source: Markit HFI.

Hopes are pinned on the recent weakening of sterling acting as a stimulus by providing a boost to exports and overseas demand reviving as a result of looser global financial conditions. The latter is linked to lower market interest rates expectations as other central banks, notably the ECB and US Federal Reserve, have also become more concerned about the outlook.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Bank-of-England-holds-rates-Will-the-next-move-be-a-cut.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Bank-of-England-holds-rates-Will-the-next-move-be-a-cut.html&text=Bank+of+England+holds+rates.+Will+the+next+move+be+a+cut%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Bank-of-England-holds-rates-Will-the-next-move-be-a-cut.html","enabled":true},{"name":"email","url":"?subject=Bank of England holds rates. Will the next move be a cut?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Bank-of-England-holds-rates-Will-the-next-move-be-a-cut.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+England+holds+rates.+Will+the+next+move+be+a+cut%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17032016-Economics-Bank-of-England-holds-rates-Will-the-next-move-be-a-cut.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}