Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 16, 2015

Global business optimism hits post-crisis low amid US/eurozone divergence

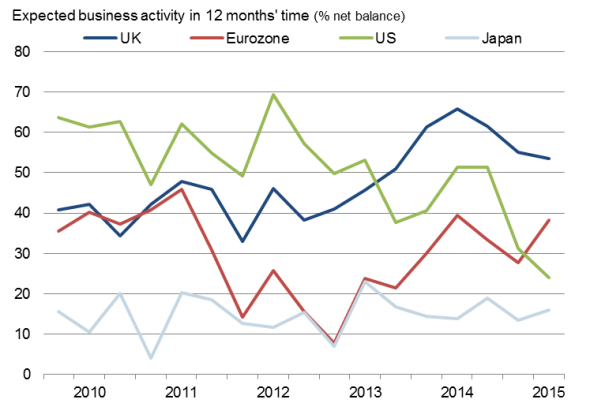

US and eurozone economic fortunes continue to diverge, with companies in the euro area more optimistic that their counterparts in the US for the first time since 2009. Optimism fell in the US but improved in the eurozone, pointing to growing economic differences that are likely to drive further bond and equity market divergences.

Global business optimism has waned to a post-crisis low, according to Markit's Business Outlook Survey. The survey is conducted three times a year and the results reflect expectations for the coming year at some 6,100 companies worldwide.

The deterioration in the global outlook was largely driven by optimism among US firms falling to the lowest seen since the survey started in 2009. Hiring intentions also hit a post-crisis low in the US, pointing to weaker employment growth in coming months.

Business optimism about the year ahead

Developed world

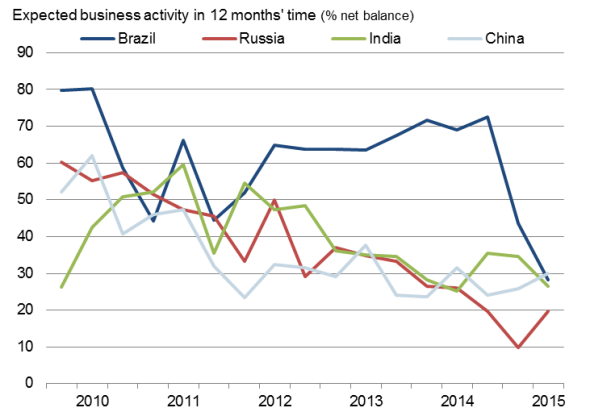

Emerging markets

Eurozone optimism higher than US for first time since 2009

Recent US economic indicators have been mixed: retail sales, industrial production and factory orders data have pointed to a marked slowing of the economy so far this year, corroborating weak PMI survey data, but non-farm payroll data have continued to show impressive gains. The outlook survey results therefore suggest that the economy has moved down a gear, and that hiring will eventually moderate to match the weaker pace of expansion.

Just as the US is showing signs of slowing, brighter signs of life are appearing in the eurozone. For the first time since the survey began in 2009, eurozone companies are now more positive about the year ahead than their US counterparts.

Across the single currency area as a whole, business optimism has risen to a level just shy of last year's post-crisis high. Employment intentions have meanwhile hit a post-crisis high in the euro area, contrasting with the new low seen in the US.

The survey therefore adds to growing expectations that the eurozone economy is set for stronger growth in 2015, with a nascent upturn (as signalled by the PMI hitting a seven-month high in February) buoyed by the ECB's quantitative easing, which commenced in March.

UK outperformance contrasts with further malaise in Japan

The UK economy is meanwhile set to enjoy yet another year of strong growth, with survey respondents more upbeat than their peers in the US, eurozone and Japan.

The survey therefore adds further expectations that the UK economy will see robust growth in 2015 as it benefits from sustained low interest rates and rising consumer spending at home, alongside improving demand in its main export market, the eurozone.

While the struggling eurozone economy looks set to see a revival this year, the survey is signalling no such turnaround for Japan. A slight improvement in optimism failed to prevent Japanese companies seeing the weakest prospects of all countries monitored amid worries about a lack of demand in the domestic market. Last year's sales tax hike clearly caused a set-back to Japans' recovery, and the survey suggests that the authorities need to do more to instil greater confidence among businesses.

Emerging markets drag on global growth

Business expectations across the main emerging markets edged up only slightly from the survey low seen late last year, albeit diverging significantly among the 'BRICs'. Optimism was the strongest in China, where expectations about business activity were the most buoyant for a year. Confidence meanwhile sank to a new survey low in Brazil and a near-record low in India. However, the darkest outlook was seen in Russia, where expectations revived from October's survey low but remained weaker than at any time seen prior to last summer.

The emerging markets consequently look set to continue to act as a drag on global economic growth in 2015. Recessions look inevitable in Russia and Brazil. Even in China, optimism remains historically weak and there is a growing threat of deflation, with companies expecting prices to fall for the first time in the survey's history.

The survey results highlight the need for greater stimulus if China is to meet its growth target of "around 7%" in 2015 and if Brazil and Russia are to avoid deep recessions.

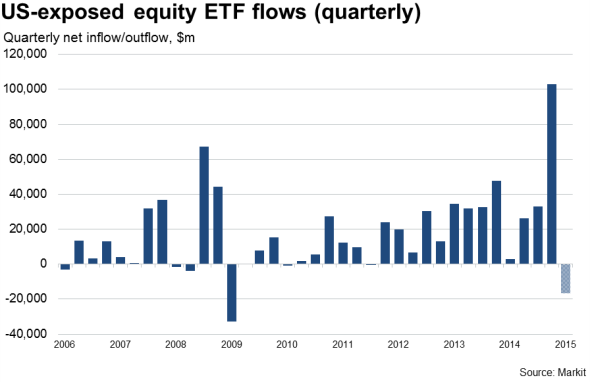

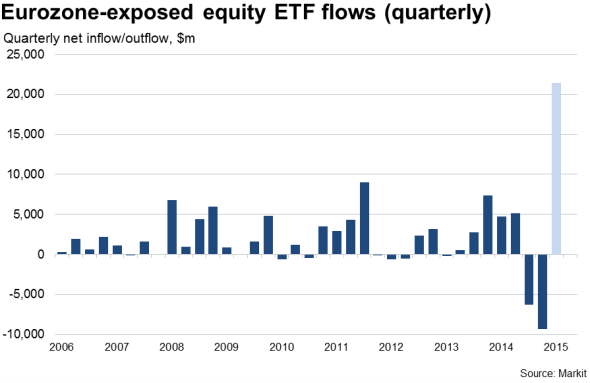

Investment flows

The survey data support the growing view among investors that the euro area presents better opportunities for corporate performance than the US.

From an equity market perspective, ETF data show money flowing out of US equity exposures towards the euro area. US ETFs are suffering their largest quarterly outflows for six years so far this year*, while euro area equivalents are on for their biggest ever quarterly gain. Not only is 2015 likely to see a widening policy divergence, with the US poised to hike interest rates as the euro area embraces QE, stock market valuations in the euro area have generally lagged well behind those of the US. The US S&P 500 is up 204% from its crisis low in 2009, the Eurofirst 80 index of euro area stocks is up a far more modest 112%.

US and eurozone equity ETF flows*

* Shaded bars show Q1 up to and including 15 March.

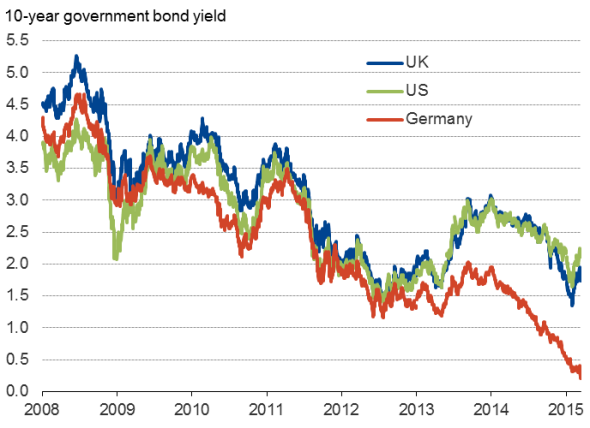

US and eurozone bond markets are diverging with the different economic outlooks, with the UK broadly following the US as investors price in rate hikes by the Fed and Bank of England at the same time as the ECB loosens policy. Market bond pricing data show the spread between 10-year German bonds and equivalent US Treasuries at 2%, the widest seen since 1989.

Ten-year government bond yields

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-Economics-Global-business-optimism-hits-post-crisis-low-amid-US-eurozone-divergence.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-Economics-Global-business-optimism-hits-post-crisis-low-amid-US-eurozone-divergence.html&text=Global+business+optimism+hits+post-crisis+low+amid+US%2feurozone+divergence","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-Economics-Global-business-optimism-hits-post-crisis-low-amid-US-eurozone-divergence.html","enabled":true},{"name":"email","url":"?subject=Global business optimism hits post-crisis low amid US/eurozone divergence&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-Economics-Global-business-optimism-hits-post-crisis-low-amid-US-eurozone-divergence.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+business+optimism+hits+post-crisis+low+amid+US%2feurozone+divergence http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16032015-Economics-Global-business-optimism-hits-post-crisis-low-amid-US-eurozone-divergence.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}