Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 12, 2015

UK construction output revisions point to healthier economy

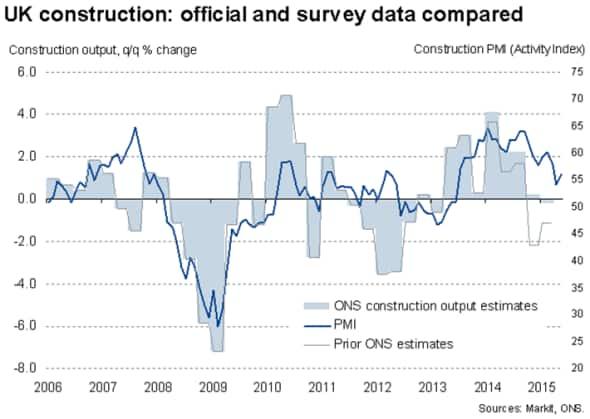

The economic upturn over the past year has been stronger than previously though after substantial data revisions show that the UK construction sector has not acted as such a drag on the economy. The revisions bring the economy's performance more into line with recent survey evidence.

Rather than contracting 1.1% in the first quarter, the sector is now estimated to have more or less stagnated, contracting by just 0.2%. The data mean the economy is likely to have grown 0.4% instead of the 0.3% previously estimated by the ONS. Business survey data had pointed to a stronger start to the year than the official data.

Upward revisions to back data also mean the economy grew 3.1% in 2014, rather than the prior 2.8% estimate. A 2.2% contraction in the fourth quarter of last year has been revised away to show 0.2% growth.

Revisions were due to "the incorporation of late data, new seasonal adjustment parameters and the introduction of an interim solution for deflators".

Although construction output fell 0.8% in April after a 1.4% rise in March, the revisions suggest these latest data points should be treated with a major dose of salt, especially as the business survey data have pointed to stronger growth.

Post-election rebound

After indicating a weak start to the year due to a lull in the commencement of new projects ahead of the general election, PMI data indicate that activity picked up again in May, rebounding from a near two-year low in April. Optimism about the year ahead surged to a nine-year high, suggesting that companies viewed the election result as favourable for their businesses.

Our expectation is therefore that building activity, and growth in the wider economy, will continue to revive in coming months. However, the strong pound and prospect of rising interest rates mean that 2015 economic growth will probably fail to match the impressive 3.1% expansion that the ONS now estimates was seen in 2014.

The buoyant mood among firms in the building sector is reflected in an upbeat outlook for corporate earnings among sector analysts. Markit's dividend forecasting team is consequently expecting the construction and materials sector to post an 8% increase in the dividends for this current financial year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-UK-construction-output-revisions-point-to-healthier-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-UK-construction-output-revisions-point-to-healthier-economy.html&text=UK+construction+output+revisions+point+to+healthier+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-UK-construction-output-revisions-point-to-healthier-economy.html","enabled":true},{"name":"email","url":"?subject=UK construction output revisions point to healthier economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-UK-construction-output-revisions-point-to-healthier-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+output+revisions+point+to+healthier+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12062015-Economics-UK-construction-output-revisions-point-to-healthier-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}