Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 11, 2016

Global economy stuck in low gear at start of Q2

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

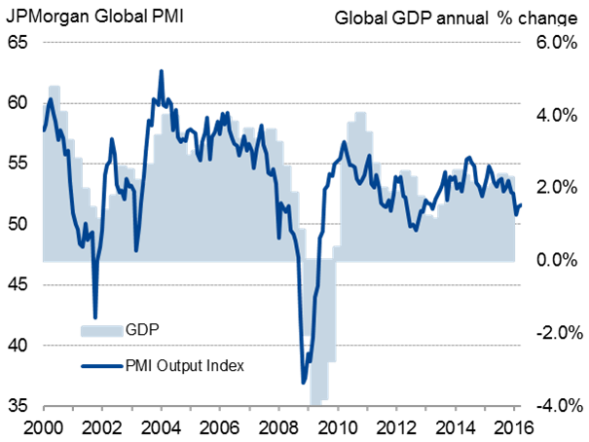

Global economic growth edges higher but still close to three-year low

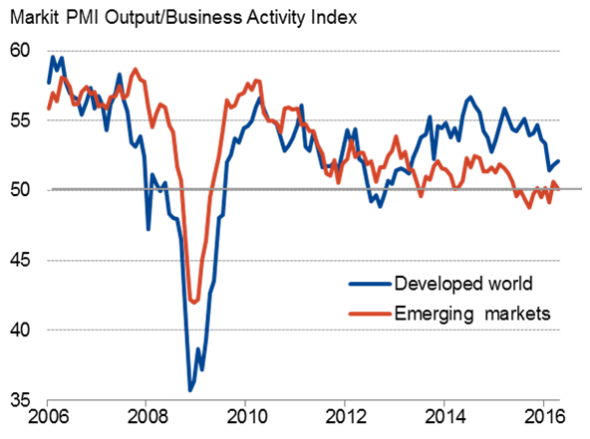

Global economic growth ticked higher for a second successive month in April, according to the JPMorgan Global PMI", compiled by Markit, but was still one of the weakest rates seen for over three years. The PMI is broadly consistent with global GDP growing at an annual rate of just 1.5% (at market prices) compared with a long-run average of 2.3%. Developed world growth continued to edge higher from February's recent low, though remained weaker than at any time seen since early-2013, while emerging markets returned to stagnation.

Global economic growth (GDP v PMI)

Developed v emerging markets

Sources: JPMorgan, Markit, Thomson Reuters Datastream

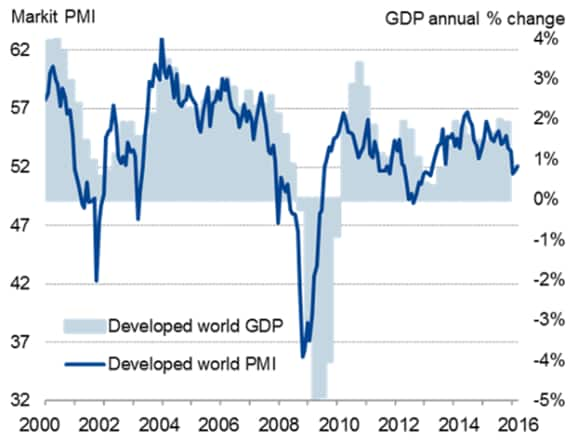

Developed world growth stuck in low gear at start of Q2

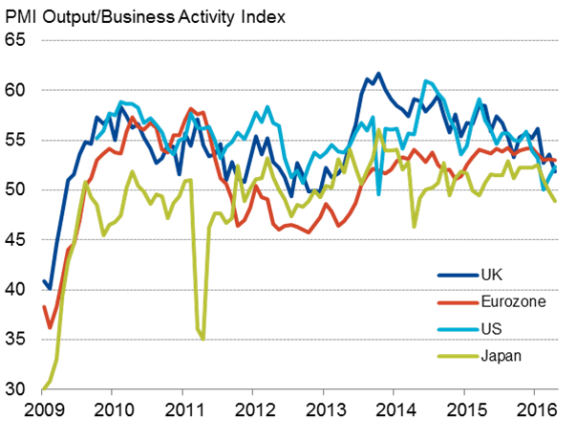

Despite lifting higher in April on the back of a stronger US performance, the PMI surveys are signalling sub-1% annual developed world GDP growth at the start of Q2, remaining little higher than February's near three-year low. Both US and UK growth rates remained considerably weaker than seen throughout last year, hit in part by political worries, and Japan slid deeper into decline. Subdued eurozone growth rounded off the disappointing picture, but again masked winners and losers within the region.

Developed markets growth (GDP v PMI)

Four largest DM economies

Sources: CIPS, Markit, Nikkei, Thomson Reuters Datastream

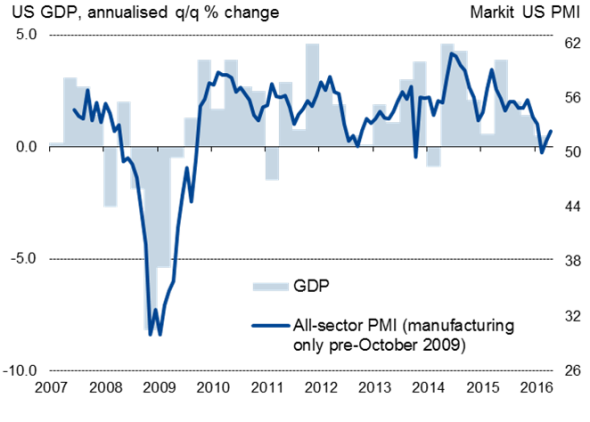

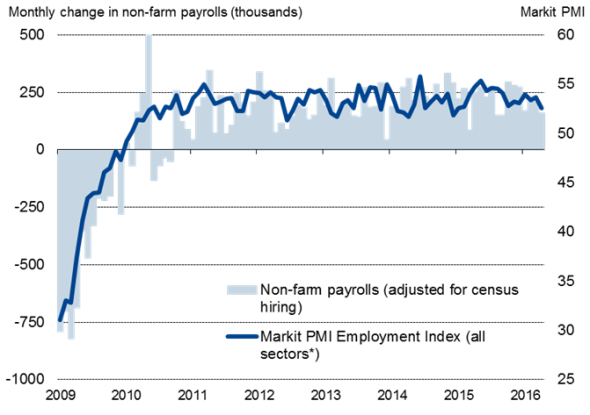

US growth and hiring weaken in line with PMI signals

US economic growth slowed to an annualised rate of just 0.5% in Q1, corroborating Markit PMI surveys which have been signalling a near-stagnation since February. Hiring also slowed, with non-farm payrolls up 160k in April, defying expectations of a continuation of the c.200k gains seen in recent months but exactly in line with the PMI. The PMI series show hiring having waned amid elevated levels of business uncertainty compared to last year, in many cases linked to election worries. However, April PMI data signal a slight upturn in the pace of service sector growth.

US economic growth (GDP v PMI output)

US payrolls v PMI employment

Sources: Markit, U.S. Department of Commerce, U.S. Bureau of Labor Statistics

Use the download link below to access a full overview of the April PMI surveys, including details of all major economies, policy implications and the market impact.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Economics-Global-economy-stuck-in-low-gear-at-start-of-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Economics-Global-economy-stuck-in-low-gear-at-start-of-Q2.html&text=Global+economy+stuck+in+low+gear+at+start+of+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Economics-Global-economy-stuck-in-low-gear-at-start-of-Q2.html","enabled":true},{"name":"email","url":"?subject=Global economy stuck in low gear at start of Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Economics-Global-economy-stuck-in-low-gear-at-start-of-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+stuck+in+low+gear+at+start+of+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052016-Economics-Global-economy-stuck-in-low-gear-at-start-of-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}