Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 03, 2015

Chaebols embrace South Korean dividends

Incentivised by newly introduced taxes, South Korean conglomerates are expected to deliver record breaking levels of dividends across all sectors.

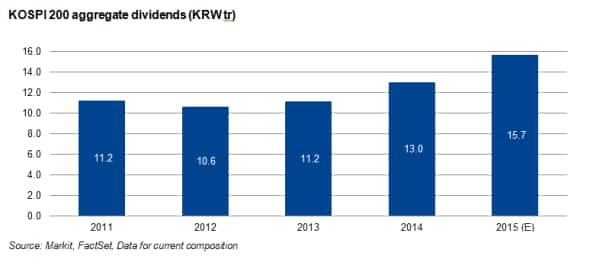

- KOSPI 200 dividends surge 20.8% to a record high KRW 15.7tr

- Chaebols have embraced dividend message with highest ever growth expected in 2015

- Despite record dividends investors pull $1.45bn out of South Korean ETFs year to date

For the full report on South Korean dividends please contact us

A turnaround in corporate governance

Conditional support given to selected chaebols (conglomerates) in South Korea during the 1960s incentivised the aggressive growth of the country's exports and enabled rapid industrialisation.

However this resulted in a large concentration of economic power vesting in founding families controlling vast business empires. Since the Asian crisis in the late 1990s, these firms have been notorious cash hoarders.

The subsequent accumulation of asset wealth in companies by a small number of majority shareholders left very little scope to 'leak' cash to 'outside' minority shareholders. The opaque and limited shareholder discourse was highlighted in 2014 when Hyundai made a significant property purchase without consulting minority shareholders.

Government pressure pays dividends

As minority investors' outrage gained momentum, tightly controlled chaebols were dissuaded from the continued hoarding practices through the introduction of a profits tax. Implemented by the Korean government in 2014, the measure saw headline dividends grow by 16.2% in the same year.

Markit Dividend Forecastingexpects aggregate dividends from KOSPI 200 companies to rise for the third consecutive year, and forecasts 20.8% higher dividends of KRW 15.7tr for FY15, up from KRW 13tr paid for the previous corresponding period.

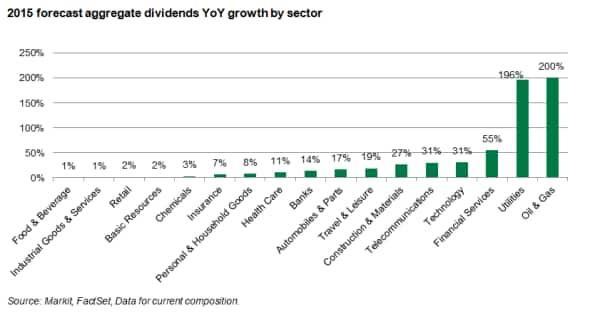

All sectors boosting dividends

Government-linked companies have fuelled tremendous dividend growth in the past few years, however strong sector wide growth has also been seen. Oil & gas and utilities firms are expected to deliver exceptionally strong dividend growth; growing two-fold in 2015. Utilities dividend growth will be largely driven by two government-linked companies; Korea Electric Power Corp and Korea Gas Corp. Total dividends for these companies soared more than fivefold last year and expected to be KRW 1,500 and KRW 270 per share respectively.

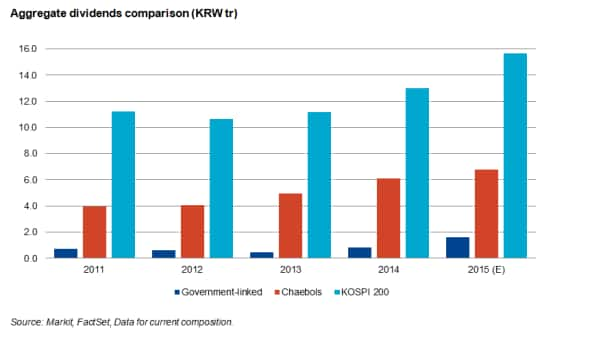

Record dividends from Chaebols

Total dividends from the three largest chaebols, Samsung, Hyundai and LG groups, are likely to grow 11% this year to KRW 6.8tr, representing approximately 43% of the index aggregate amount. Samsung Electronics is forecast to return 30%-50% of annual free cash flow through share buybacks and dividends for the next three years, and expectations are for record high total dividends of KRW 2.8tr, up 8.4%. Hyundai Motor Co and Kia Motors are projected to distribute 31.5% and 8.9% higher aggregate dividends respectively.

Aggregate dividends comparison (KRWtr)

Markit Dividend Forecasting estimates reflect companies' aims to raise their payout ratios to 15% this year and to 20%-30% in the mid- to long-term. This is impressive growth from the previous year's 6% payout ratio.

Dividends not enough to counter selloff

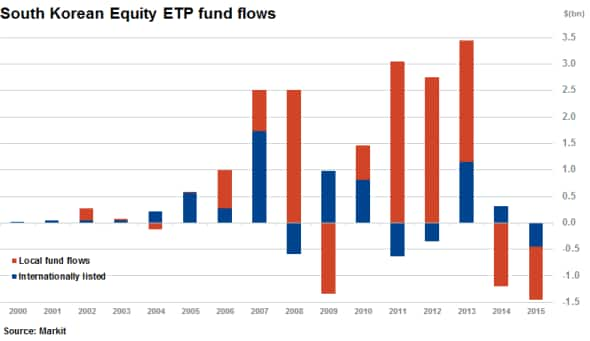

Investors' reactions to the increased dividends have been watered down due to the impact of market events and volatile fund flows during 2015. A continued selloff in emerging markets and price weakness in commodities has hurt large South Korean industries, with the KOSPI 200 looking to end flat for 2015.

Largely due to the selloff in emerging markets, investors have withdrawn $1.5bn from South Korean equity ETFs year to date. While flows have been volatile, year to date outflows in local funds have been twice that of internationally listed funds.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-equities-chaebols-em.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-equities-chaebols-em.html&text=Chaebols+embrace+South+Korean+dividends","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-equities-chaebols-em.html","enabled":true},{"name":"email","url":"?subject=Chaebols embrace South Korean dividends&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-equities-chaebols-em.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chaebols+embrace+South+Korean+dividends http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03122015-equities-chaebols-em.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}