Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 01, 2016

Global PMI signals shift to higher gear at start of third quarter

Growth of worldwide factory activity edged higher for a second successive month in July to reach an eight-month high.

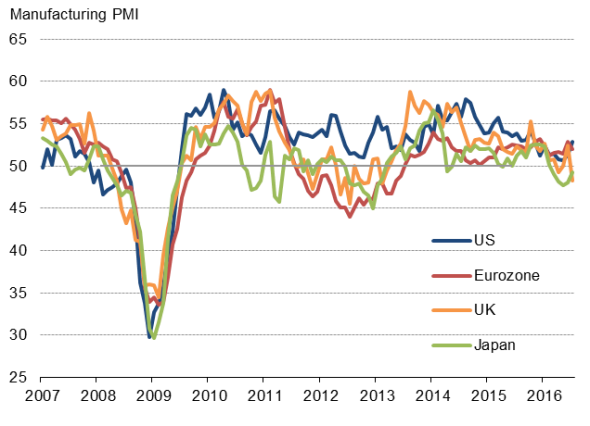

The upturn provides a tentative indication that - despite the UK being hit hard in the immediate aftermath of the Brexit vote - global production may be starting to shift up a gear after an especially weak second quarter. Prior months had seen the weakest period of manufacturing expansion since late-2012, a time when the world was struggling in the face of the escalating eurozone debt crisis.

The upturn in the PMI signals an acceleration in annual global manufacturing output growth to just under 2%, up from stagnation in recent months.

Although the UK PMI suffered its largest fall since 2008 and Japan's exporting producers once again struggled to live with a strong currency, growth slowed only slightly in the Eurozone, the US enjoyed a marked improvement in performance and China's factories showed a tentative return to growth.

Global manufacturing output

PMI at eight-month high

The JPMorgan Global PMI, compiled by Markit from its worldwide business surveys, rose from 50.4 in June to 51.0 in July. While still indicating only a marginal improvement in business conditions, the rise was the best seen since last November.

Exports rose, albeit only marginally, for the first time in six months, helping drive stronger order book growth. With inventories of finished goods falling, the orders: inventory ratio rose to one of the highest seen over the past year-and-a-half, boding well for further production gains in August.

Price and hiring trends improve

There was also brighter news on inflation. Input costs rose for a fourth successive month, with July seeing the largest monthly increase since August 2014 as commodity prices continued to firm.

These higher costs were increasingly passed through to customers, with average factory gate prices also up for a fourth month running, showing the biggest monthly rise for two years.

With demand and production trends strengthening alongside a tentative improvement in pricing power, factories took on extra staff worldwide for the first time in six months, adding further to hopes that the underlying trend in manufacturing is beginning to revive.

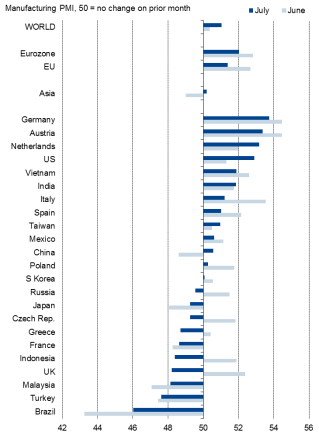

Strong national variations

The improvement was by no means broad-based, however, with marked variations in performance. Of the 23 countries for which latest data were available at the time of the calculation of the global aggregate, PMI numbers fell in 13 countries, with the steepest drop seen in the UK.

In the month following the UK's decision to vote to leave the EU, the PMI suffered its largest points fall since November 2008, dropping to its lowest level since February 2013.

However, only ten countries recorded sub-50 PMI readings signalling a deterioration in manufacturing activity. The steepest downturn was once again seen in Brazil, followed by Turkey. The UK sank to fourth from the foot of the rankings, just ahead of Malaysia, down from seventh place in June.

Worldwide manufacturing PMI rankings

Sources for charts: JPMorgan, Nikkei, Caixin, IHS Markit.

Limited Brexit contagion

There was little indication of Brexit contagion outside of the UK. The eurozone, where any impact is likely to be felt to the greatest extent, saw growth weaken but still enjoyed one of the best performances seen during 2016 so far.

Especially strong growth was generally seen in the northern euro countries. Germany in fact led the global PMI rankings, followed by Austria and then the Netherlands, with companies only reporting modest Brexit impact via heightened political uncertainty and some export losses.

More worrying slowdowns were recorded in Italy and Spain, which were in turn generally linked more to domestic factors and weak global demand than Brexit.

The US goods-producing sector appeared to brush off any headwinds, enjoying the strongest improvement in business conditions for nine months. With Markit's US PMI having signalled the worst performance for over six years during the second quarter, July's improvement suggests growth may be reviving slowly.

UK and Japan drag on DM growth

Asia malaise shows signs of lifting

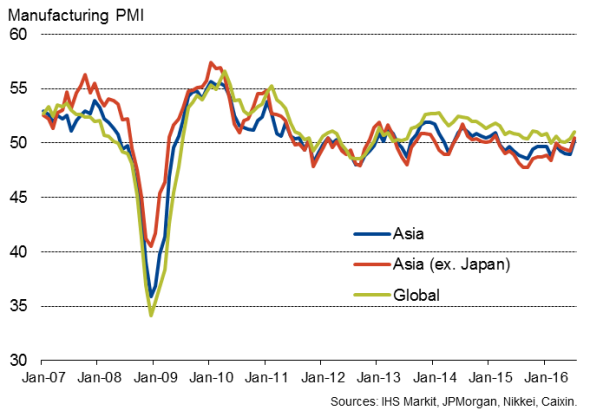

The malaise that has been plaguing Asia's manufacturers showed tentative signs of lifting, though activity rose only marginally. The region's PMI nevertheless signalled the first expansion for almost one-and-a-half years, with a slightly stronger reading if Japan is excluded.

Struggling once again with a strong yen, Japan's manufacturers reported a fifth consecutive month of decline, with exports falling at the sharpest rate for three-and-a-half years.

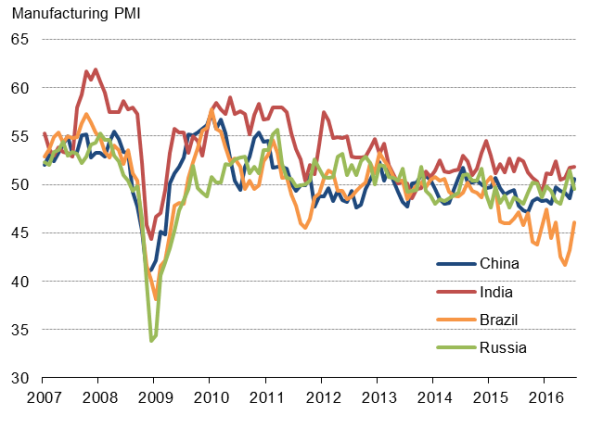

In contrast, the rate of export decline eased in China, helping push the Caixin PMI back into growth territory for the first time in just under one-and-a-half years.

Stronger demand from China helped drive improved manufacturing trends in other Asian countries, notably Taiwan. However, for the fourth successive month, the strongest performance in Asia was again seen in Vietnam, followed closely by India.

Manufacturing in Russia meanwhile relapsed after a brief return to growth in June, and other eastern European countries also suffered. The Czech Republic, which had led the PMI rankings earlier in the year, saw manufacturing business conditions deteriorate for the first time in over three years, and Poland saw growth slow to near stagnation - its worst month since activity began rising almost two years ago.

China upswing helps boost EM manufacturing

Asia drag easing

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082016-Economics-Global-PMI-signals-shift-to-higher-gear-at-start-of-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082016-Economics-Global-PMI-signals-shift-to-higher-gear-at-start-of-third-quarter.html&text=Global+PMI+signals+shift+to+higher+gear+at+start+of+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082016-Economics-Global-PMI-signals-shift-to-higher-gear-at-start-of-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals shift to higher gear at start of third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082016-Economics-Global-PMI-signals-shift-to-higher-gear-at-start-of-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+shift+to+higher+gear+at+start+of+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01082016-Economics-Global-PMI-signals-shift-to-higher-gear-at-start-of-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}