Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

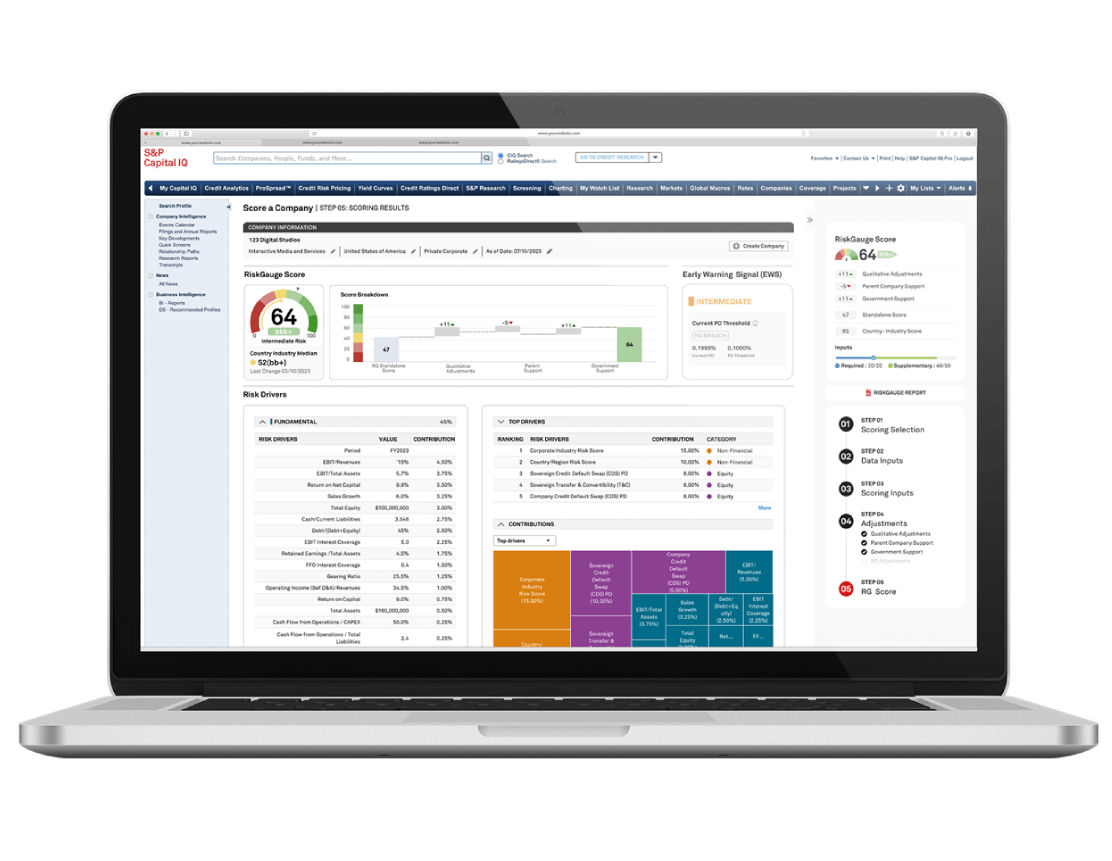

The new RiskGaugeTM Desktop brings our most powerful analytical tools into a streamlined platform that makes it easy to assess, monitor, and manage customer credit risk for over 400 million companies worldwide.

Unpredictable market conditions are putting pressure on many corporations’ customers, especially those that are small- and medium-sized enterprises (SMEs). You need a clear view of your credit risk for all the customers you do business with – domestically and around the world.

View your entire portfolio on a single dashboard that showcases the details that matter most to you.

Stratify your customers by country and industry to assess potential default.

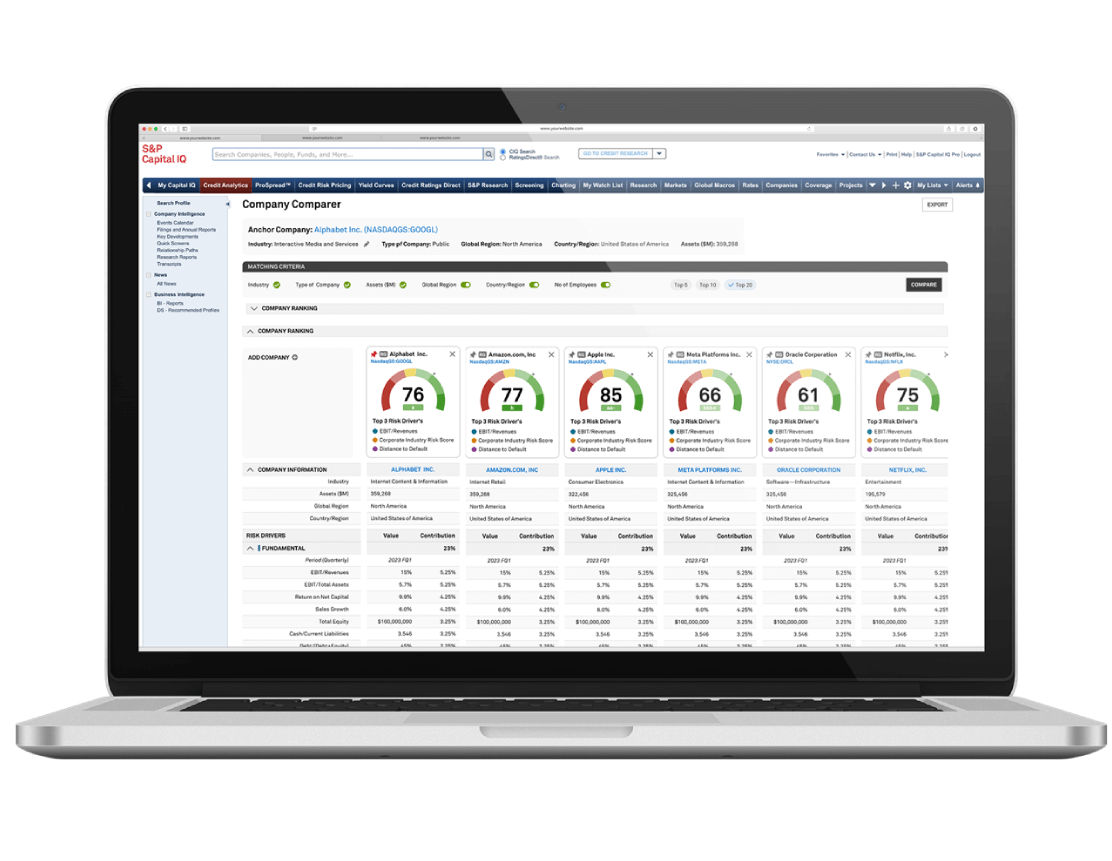

Compare over 400 million companies to their peers with filters to drill into important details.

Leverage our extensive datasets to access what you need to score any customer.

Get a single, comprehensive report that provides the ultimate view of a customer’s credit situation.

RiskGauge Desktop instantly provides a clear view of your customers’ credit risk with dashboards, high-level portfolio surveillance views, comprehensive business credit reports, and more. At the center are RiskGauge Scores ― one score per customer that tells the whole story based on a holistic assessment of their fundamental credit risk and market-based signals. Rankings from 1 to 100 show those with the lowest (100) and highest (1) credit risk.

Accelerate your customer credit workflow with this single platform that delivers pre-calculated risk metrics, scalable analytical tools, and early warning alerts so you can anticipate credit risks and opportunities across all your customers ― all in one place.

Leverage this dedicated, transparent solution to obtain reliable credit and liquidity risk assessments with a single view of customer credit risk across your business. Paired with our proprietary insights and expanded probability of default capabilities, you have the most advanced, comprehensive credit management solution at your fingertips.

Streamlined credit risk solution from analysis through to surveillance.

RiskGauge Score provides holistic entity scoring and transparent risk drivers.

Credit risk dashboard and early warning system for actionable insight.

See how we’re helping corporations create a clear view of credit risk with a fully integrated risk management platform.