Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Asset managers across the public and private markets are obligated to adhere to the compliance policies and procedures outlined in their governing indentures. Navigating within the bounds and limitations of the indenture requires detailed credit risk analysis, trade lifecycle management and compliance test monitoring.

WSO Compliance Insights streamlines the credit risk management process and automates the execution of compliance tests. It ensures you receive accurate reports, based on real-time data, that help you manage your portfolio more effectively and efficiently, while eliminating the amount of time spent performing custom analytics and creating in-house reports.

Private credit and CLO managers benefit from:

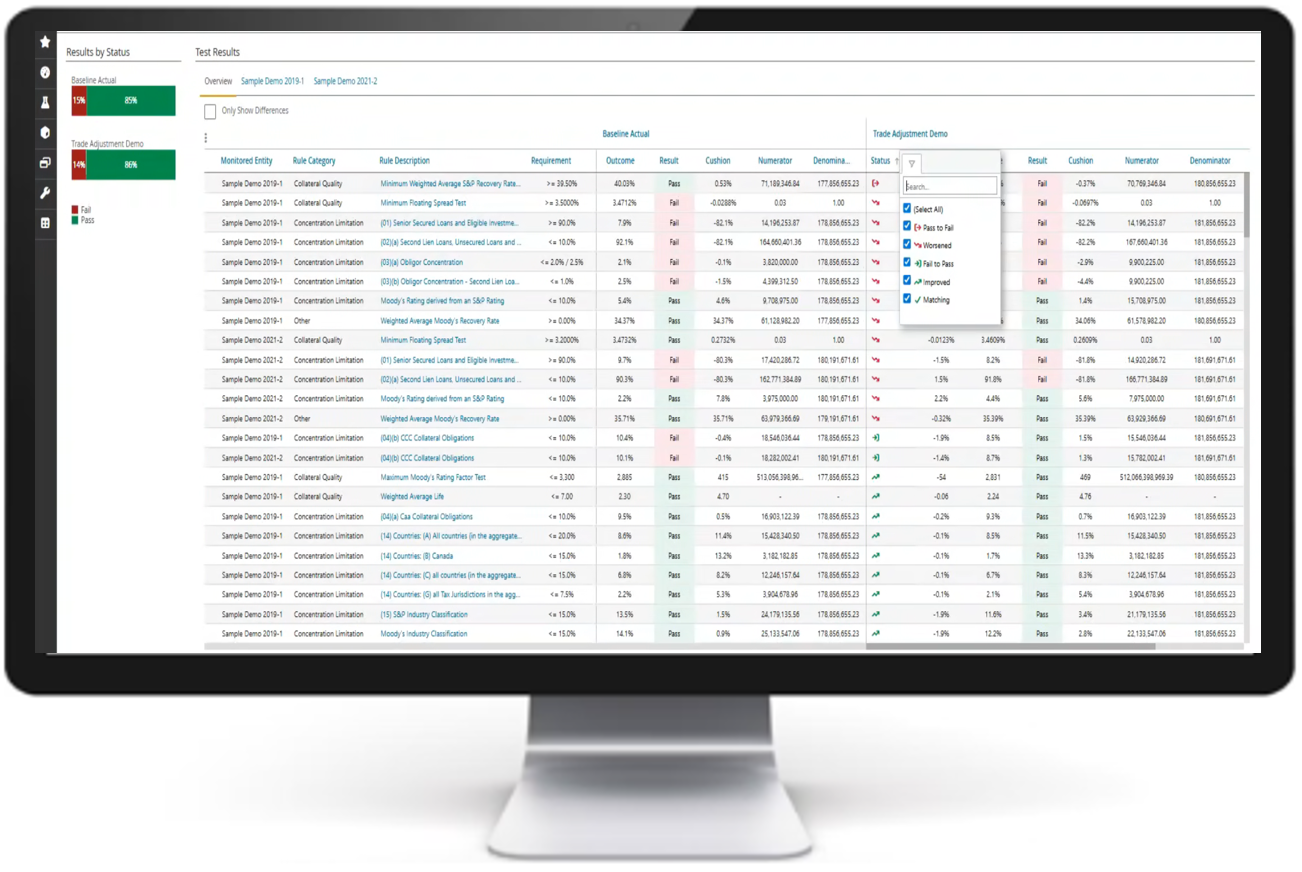

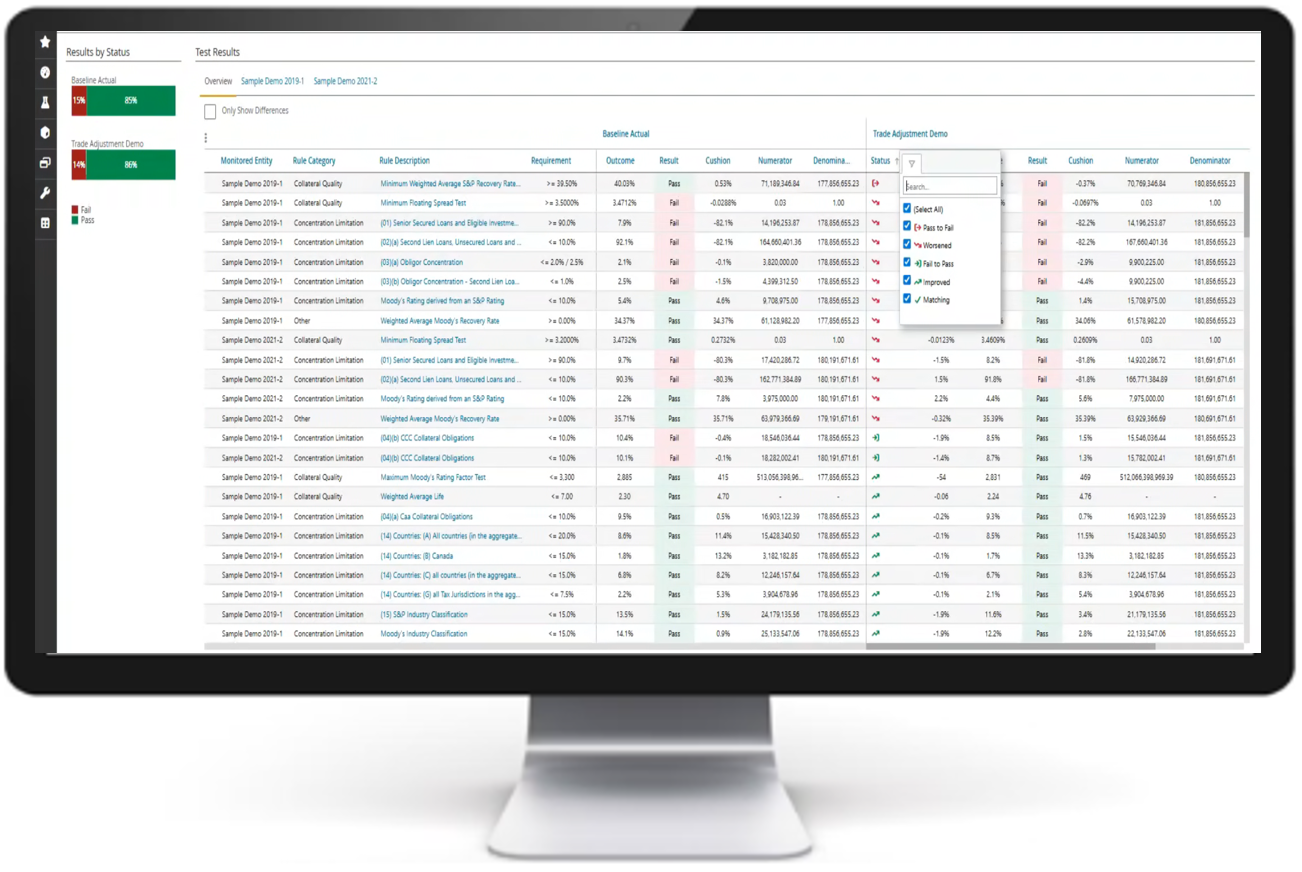

Visualize new test results in real-time within the compliance dashboard, enabling you to analyze impactful changes throughout the day as holdings and securities change within WSO.

Leveraging the real-time integration with WSO, run hypos against actual information as it exists in WSO versus from start of day information. This robust offering supports cross-deal and cross-asset allocation, as well as multi-trade scenarios and shell asset creation.

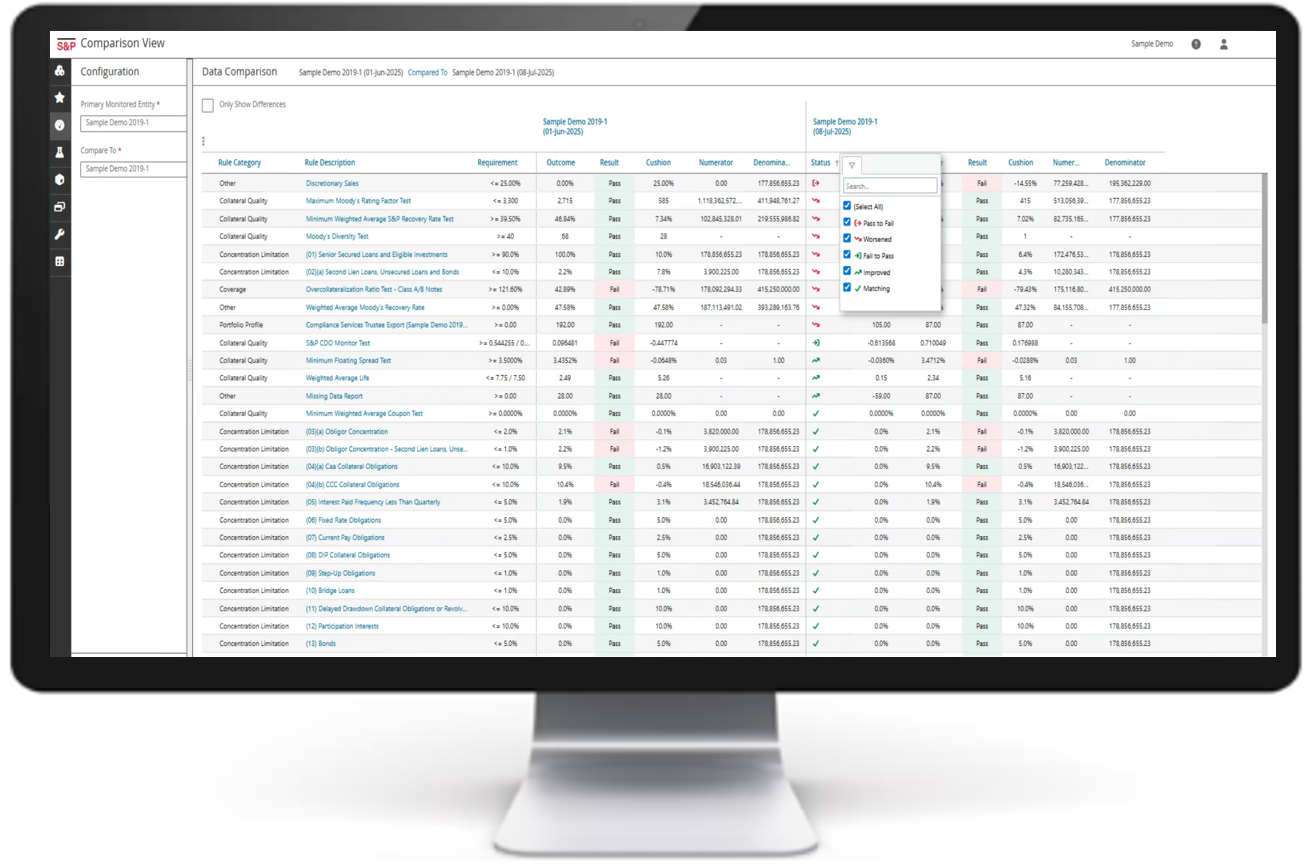

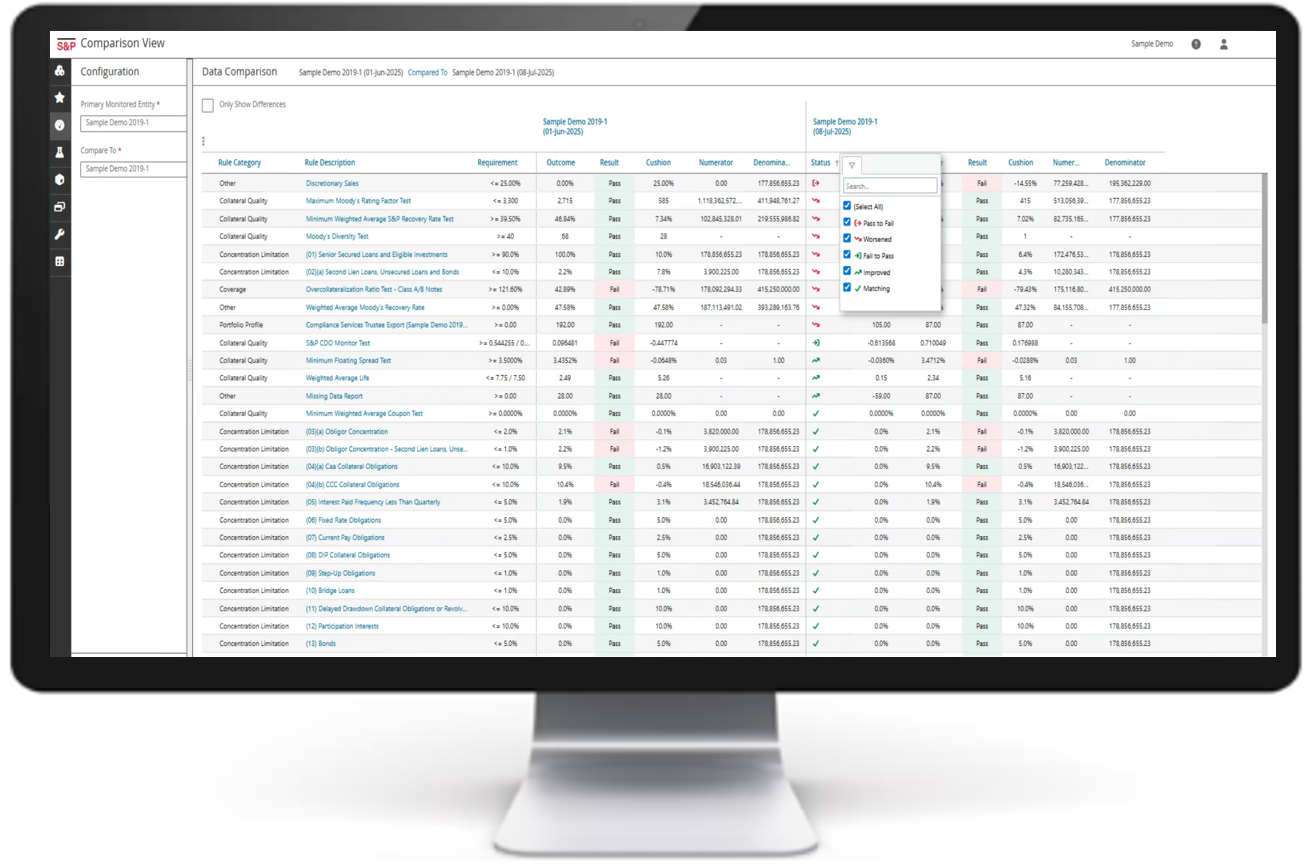

Reconcile test result differences with ease through the Comparison View screen, a powerful tool that performs a ‘side by side’ comparison of test results across multiple data sets, or across multiple points in time for a single data set. Differences are highlighted for easy identification and accompanying drilldowns detail the changed data points.

Visualize new test results in real-time within the compliance dashboard, enabling you to analyze impactful changes throughout the day as holdings and securities change within WSO.

Leveraging the real-time integration with WSO, run hypos against actual information as it exists in WSO versus from start of day information. This robust offering supports cross-deal and cross-asset allocation, as well as multi-trade scenarios and shell asset creation.

Reconcile test result differences with ease through the Comparison View screen, a powerful tool that performs a ‘side by side’ comparison of test results across multiple data sets, or across multiple points in time for a single data set. Differences are highlighted for easy identification and accompanying drilldowns detail the changed data points.

Ensure you have the most timely and accurate data that impacts your compliance tests. Get in touch to find out more or request a demo.