Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the hotel and timeshare industry and where investors should look to find an investment edge.

The hotel industry is a sub-industry of the hospitality industry and is made up of companies focused on providing lodging facilities. These companies include hotels that are either company-owned, company-operated, franchised or licensed.

Hotels are establishments that host guests overnight by providing accommodations, meals and other related services mainly on a short-term basis. A major investment for a hotel business is its property, which includes rooms equipped with basic amenities. In exchange for accommodations and other services, hotels charge room rates that can vary across hotel properties and can also vary based on the services offered. Some hotels may not only levy room charges on their customers but also charge them for access to additional amenities such as restaurants, spas, swimming pools, meeting rooms, game zones, gyms, childcare and housekeeping services. The amount and manner in which these charges are levied on the customers can vary across hotel properties. Hotel room charges depend on several factors such as the hotel location, the surroundings, rating of the hotel, the quality of services offered, hotel room size and so on. Every country has its own set of laws governing the requirements for setting up a hotel. For example, the U.K. has a prerequisite for hotels to have food and beverage outlets, while other countries require hotels to meet a minimum hotel room size.

The timeshare industry, also referred to as the vacation ownership industry, enables consumers to share ownership of the vacation properties. Multiple parties hold exclusive rights to use a property for a specific time period (usually a week). The industry has evolved from a weekly intervals system to a points-based system that provides more flexibility to exchange vacations over several properties at various destinations.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for hotels and timeshares, whether at a company or industry level, here are some of the hotel KPIs to consider:

The hospitality industry operates its hotels and other business segments under one of the following operating models:

Franchised or licensed model: In the franchise model, the hotel group functions as a franchisor, with which different hotel owners sign a franchise agreement. The hotel owners who run the franchisee hotels are thereby licensed to run their hotel using one of the hotel group’s or franchisor’s branding. The franchise agreement allows the franchisee to not only use the franchisor’s brand name but also related commercial services, such as reservation systems and marketing and information technology services. However, the franchisees have to invest their capital into the hotels and are charged a certain percentage of room sales as franchise fees.

The franchisor has a performance obligation to provide the franchisees a license to use the company’s brand names. The franchisor is in turn entitled to initial application fees and ongoing royalty fees. The initial application fees are fixed considerations, payable upon submission of a franchise application. The royalty fees are variable considerations and are based on a percentage of certain hotel revenues, mainly room revenues plus a percentage of food and beverage revenues.

Managed or company-operated model: Company-operated hotels are either owned or managed by the company. In this model, companies have performance obligations to provide hotel management services and an intellectual property license of the hotel system to the managed hotel for using the company’s brand name. As compensation for such services, the company is entitled to receive base management fees, which are a percentage of the hotel revenue, and incentives fees, which are generally based on the hotel’s profitability.

Owned or leased model: In an owned or leased business model, revenue is generated from hotel room sales, food and beverage sales, and other such services. For owned and leased hotels, companies provide accommodations and other ancillary services to hotel guests and are entitled to a nightly hotel room revenue and additional fees for any ancillary goods and services sold. Revenue is recognized when rooms are occupied and services are rendered; however, they are payable by the hotel guests at the time of check-out.

A timeshare is a shared-ownership model in the hotel industry in which multiple parties hold exclusive rights to use the same hotel property for an allotted period of time. Timeshare companies market and sell vacation ownership intervals, manage resorts and/or operate points-based vacation clubs.

There are two major operating segments for revenue generation in the timeshare industry:

In addition, rental, financing and cost reimbursements also contribute to a timeshare company’s revenues.

Vacation ownership allows customers to share ownership and use of fully-furnished vacation homes or resorts. Vacation ownership resorts typically provide multi-room accommodations with in-unit kitchens and laundry facilities. They may also provide resort-like amenities such as swimming pools, gyms and spas, restaurants and bars, sports and recreation facilities, and convenience stores. The purchaser can buy an interest known as a vacation ownership interest (VOI). The interest can be for a “timeshare estate,” which is a real estate ownership, or a “timeshare license,” which is on a contractual right-to-use basis for a specific resort or a group of resort properties.

Developers sell VOIs for a fixed price that is paid fully at closing or is financed by a loan. Many timeshare companies provide customers with financing options or facilitate access to third-party bank financing. Sales of VOIs are either cash sales or developer/seller-financed sales. Generally, companies receive upfront deposits and the remainder of the purchase price at the closing. Until the legal rescission period has expired, customer deposits are recorded as refundable liabilities or advance deposits on the company’s balance sheet. Revenue is recognized when the statutory rescission period has expired, the sales contract is executed, receivables have been deemed collectible, and the remainder, if any, is assured. Companies also record a provision for loan losses to hedge against default risks of estimated vacation ownership contract receivables. This provision is largely based on the company’s static pool analysis, which tracks historical payment default data.

Resorts and club management includes day-to-day management of resorts, clubs or lodging properties, membership programs, vacation exchanges, and certain accounting and administrative functions. Timeshare companies offer vacation exchange services to timeshare owners. A timeshare owner deposits their interval or points from a resort or club into the company’s network to have the option to use another owner’s interval at a different destination. The company assigns a value to the owner’s deposit. This value is based on several factors such as supply and demand for the destination, dates of the interval, size of the property and the amenities available. Companies offer their members the option to exchange their VOI usage rights, facilitate such exchanges, and generate revenues through annual membership fees and commissions. Timeshare companies also offer vacation rental opportunities to members of the network that allow members to rent accommodations.

VOI rental revenue is generated from renting inventory held for sale as interests in vacation ownership programs. Alternatively, rental revenue is also generated from renting inventory that is controlled by the company because its owners have opted for alternative usage options under vacation ownership programs.

Financing services revenue is the interest income on loans that are provided as an option to qualifying purchasers of vacation ownership products. Financing revenue also includes loan servicing and other fees.

Cost reimbursements include direct and indirect costs that are reimbursed to the company under management contracts. Timeshare companies are entitled to reimbursement of costs incurred from providing club and resort property management services for day-to-day operations.

Average daily rate (ADR) measures the average room price and is used to assess the operating performance and pricing levels of hotels. ADR trends provide information related to the pricing environment of a hotel group. ADR is calculated by dividing the property room revenue by the total number of rooms sold.

Occupancy rate refers to the number of rooms occupied in a hotel, compared to the total number of rooms available at a given time. Expressed as a percentage, occupancy rate is used to gauge the demand at a hotel group for a given time period. It measures the capacity utilization of a hotel. Achievable ADR can also be determined based on the occupancy percentage as it indicates an increase or decrease in demand for hotel rooms. Occupancy rate is calculated by dividing the total number of occupied rooms in a hotel by the total number of rooms available in the hotel.

Revenue per available room (RevPAR), a commonly used performance measure in the hotel industry, is the product of ADR and occupancy rate. RevPAR for hotels enables the comparison of room revenues among comparable properties to evaluate a hotel’s performance.

Room nights are calculated by multiplying the number of days available in a given period by the total number of rooms available across all hotels of the hotel group.

Room revenue is calculated by multiplying the total number of room nights by RevPAR. Such room revenues are generated at owned, leased, managed and franchised hotels.

System-wide revenue is the total sales generated at hotels. A major component of system-wide revenue is room revenue. Base management fees and incentive management fees are computed on the basis of system-wide sales for managed hotels. Franchise fees are calculated by multiplying system-wide sales for franchisee hotels by the royalty rate. These fees together constitute managed and franchise revenue.

Other revenue may include global design fees, termination fees, and other property and brand revenues. As a part of the loyalty program, companies enter into agreements with financial institutions to issue co-branded cards and receive certain fees when customers redeem their loyalty points.

Cost reimbursements are applicable under management and franchise agreements. Companies are entitled to reimbursement for certain costs incurred on behalf of the managed, franchised and licensed properties. These costs mainly consist of payroll and related expenses at managed properties and also include certain operational and administrative costs that are predetermined in the contracts.

Total revenue is the sum of owned and leased revenue, managed and franchise revenue, other revenue and cost reimbursements.

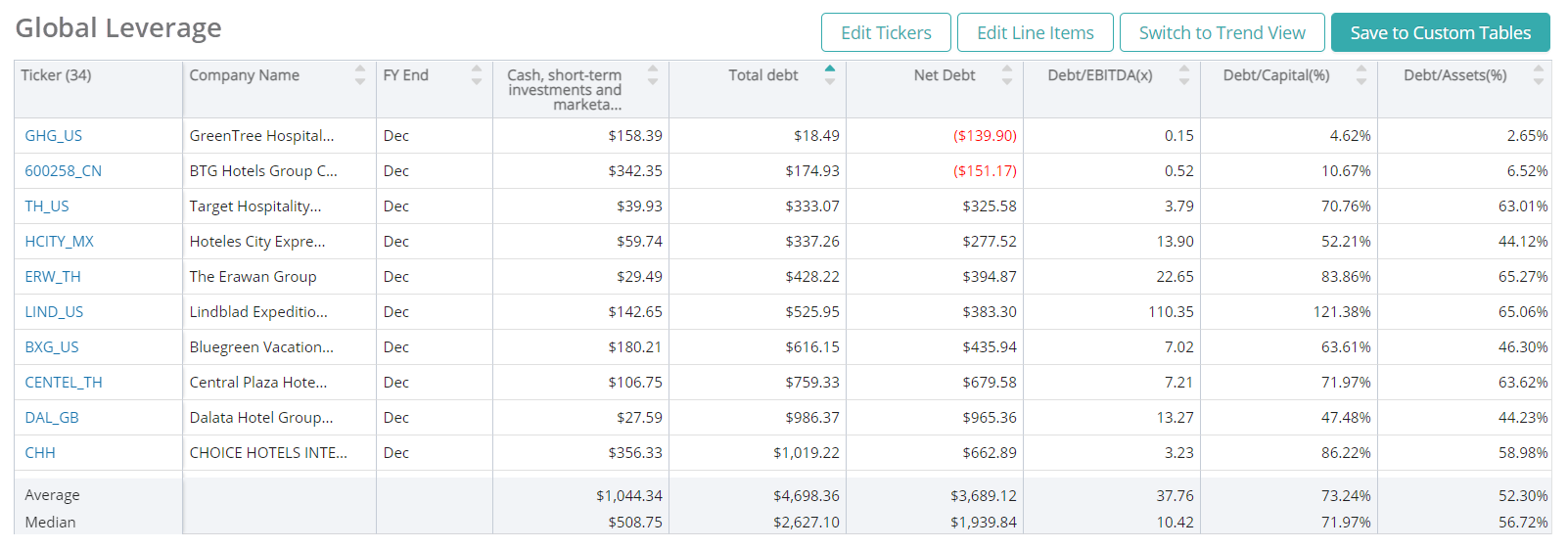

Visible Alpha offers 8 hotels, resorts and cruise lines comp tables, comparing forecasts for key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for Marriott International competitors or RevPAR. Every pre-built, customizable comp tables is based on region, sub-industry or key operating metrics.

This guide highlights the key performance indicators for the heotels industry and where investors should look to find an investment edge, including: