Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the home building industry and where investors should look to find an investment edge.

The home building industry consists of companies that are primarily engaged in the construction of privately owned homes. These companies build new houses designed for home buyers and include attached and detached single-family residential homes, townhomes and condominiums.

In addition to their home building operations – which typically constitutes the vast majority of their total business – they also provide financial services to their customers, including insurance products, title services and mortgage banking services such as loan originations.

While not a significant portion of overall sales, the revenue generated from land sales fluctuates. Some of the factors that feed into their landholding decisions include business strategy; assessments of existing needs; strength and number of developers and other land buyers; available opportunities to sell land at acceptable prices; market conditions where it is more profitable to sell land than construct.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for home building, whether at a company or industry level, here are some of the home building KPIs to consider:

There are two primary types of houses built in the U.K.: Private housing and affordable/social housing.

Private housing refers to home sales to private owners, whether they are owner-occupied or rented privately. In the U.K., this excludes social housing.

Affordable or social housing consists of homes sold to housing associations that help deliver homes to lower-income residents. Housing associations are established to provide affordable houses on a non-profit basis. Eligible households receive affordable housing based on their income and local house prices. Based on the rent charged, these homes can be broadly classified as:

Total overall revenue includes home building revenue and financial services revenue. Home building revenue consists of home revenue and land revenue. The home revenue for a given period is calculated by multiplying the number of homes delivered by the average selling price of those homes.

To evaluate profitability, analysts focus on gross margins, EBIT margins, pre-tax margins and net margins. Gross margins are particularly important due to the industry’s high construction costs. Companies with strong expense management skills have better gross margins.

Developable land for the production of homes is a core resource for the business. Companies invest and purchase land in attractive markets that meet their investment return standards. However, they may also periodically sell land parcels to third parties for commercial or other development. When acquiring new land, companies focus on parcels with lots zoned for residential construction. These parcels are either “finished lots,” which are fully developed to start home construction, or partially finished lots.

Homes delivered to customers represent the total number of deliveries of homes to buyers during a specified period. Homes delivered is derived by multiplying the backlog conversion rate times the beginning backlog.

Backlog consists of homes under a purchase contract but not yet delivered to a homebuyer.

The ending backlog represents the number of homes in the backlog from the previous period, plus the number of net orders (new orders for homes less cancellations) generated during the current period, minus the number of homes delivered during the current period.

The backlog at any given time is affected by cancellations, homes delivered and community counts. The backlog value represents potential future housing revenues from homes in the backlog. Finally, the backlog conversion rate is the number of homes delivered in a given period divided by the respective period’s beginning backlog.

Net new orders (new orders for homes less cancellations) are directly affected by community count, where community is defined as a single land development in which new homes are constructed as part of an integrated plan. Community count is the number of communities that are open for sales of homes.

The community development process mainly consists of the following phases:

The community development process typically takes 6-18 months and depends on various factors like local, state and federal statutes; the process of government approvals and utility service activations; type of offering; the size of the community; financing; availability of construction materials and skilled labor; weather conditions; consumer demand; and economic conditions of the housing industry.

Communities offer various home designs, including single-family detached, condominium-style units, and multiple-story structures or duplexes that vary significantly in size and amenities. Companies typically provide a variety of house floor plans and elevations in each community with interior options and upgrades as well as exterior facades. They also build one to three model homes for each community so that prospective homebuyers can preview the designs and features available.

The absorption rate/contracts per community represent the number of net new home orders divided by the average community for the period. The U.K. market uses different terminology for similar concepts: communities are called sites; net new orders are called private reservations; backlog is referred to as the order book.

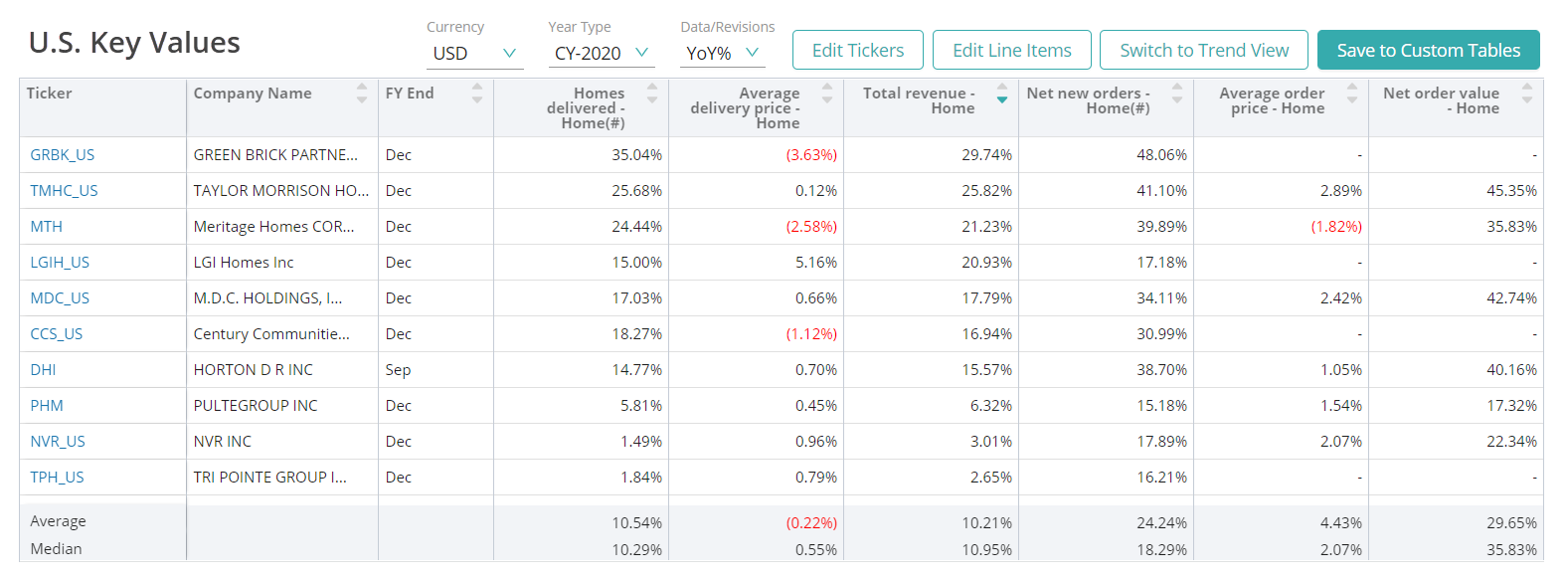

Visible Alpha offers 10 home building comp tables, comparing key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for Meritage Homes Corporation competitors or global average selling price. Every pre-built comp table is based on region or key operating metrics and is fully customizable.

This guide highlights the key performance indicators for the home building industry and where investors should look to find an investment edge, including: