Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the health care facilities industry and where investors should look to find an investment edge.

The health care facilities industry encompasses health care providers that offer an array of services such as acute care, internal medicine, general surgery, diagnostic, ambulatory, nursing and emergency services. Some facilities, such as psychiatric hospitals, also provide a range of mental health services through inpatient, outpatient settings and partial hospitalization.

The major stakeholders in the health care facilities industry are hospitals, physicians, insurance companies, pharmaceutical firms, corporates, patients and the government. Hospitals provide inpatient and outpatient care services. Insurance companies sell policies to individuals, corporates and the government, and settle claims raised by hospitals. The government subsidizes health care for the marginalized, people with disabilities and senior citizens through various federal and state-funded health care programs.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for health care facilities, whether at a company or industry level, here are some of the health care facilities KPIs to consider.

Inpatient care covers any general acute care medical need that requires the patient to be admitted to the hospital for at least 24 hours. This includes:

Outpatient care covers medical treatments or procedures that do not require the patient to be admitted to the hospital for supervised care. This includes:

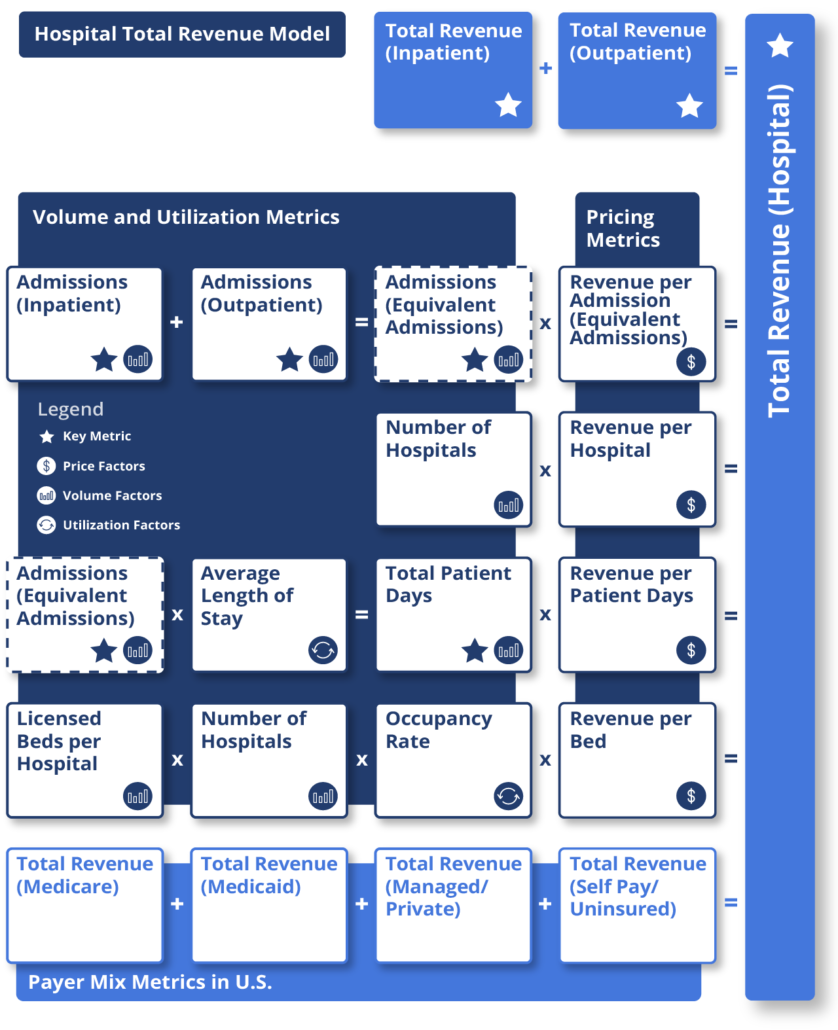

Equivalent admissions represents the combined inpatient and outpatient volume. It is computed by multiplying inpatient admissions with gross patient revenues (inpatient and outpatient revenues) and then dividing that number by inpatient revenues.

Demographics and market share play a crucial role in ensuring the long-term viability of hospitals. Hospitals that are levered to local markets with high population growth and a relatively high market share have a competitive advantage, which can help leverage volume growth across existing cost structures. Inpatient admissions, outpatient admissions, equivalent admissions, number of hospitals, patient days, occupancy rate, average licensed beds and the average length of stay are all important volume metrics in gauging the scalability of the hospital business and are readily provided by companies in the U.S.

The financial performance of a hospital can be evaluated based on a wide range of factors, such as the hospital’s overall debt leverage and liquidity, in conjunction with its operating performance and margin. Pricing metrics such as revenue per inpatient admission, revenue per equivalent admissions, revenue per patient days and revenue per hospital are also analyzed to compare the hospital’s pricing power and performance. Volume metrics, such as inpatient admissions and outpatient admissions, and capacity metrics, such as the number of beds and number of hospitals, are evaluated to understand the scale and reach of the business. In terms of profitability, operating margin and earnings before interest, taxes, depreciation, and amortization (EBITDA) margin are often analyzed, along with cost metrics like operating expense (OPEX) per hospital.

From a liquidity perspective, debt/EBITDA, interest coverage ratio and debt/capitalization are important ratios to determine the ability of a hospital to meet its financial obligations given its high leverage.

Hospitals often have to wait for a substantial amount of time to obtain financial reimbursement from insurance companies or government agencies. As a result, cash management and sufficient cash flow is essential to financial stability. Liquidity metrics like cash flow from operations (CFO), cash flow coverage ratio (CFO/total debt), cash and cash equivalent and capital expenditures (CAPEX) requirements are key metrics for investors analyzing hospitals’ liquidity needs.

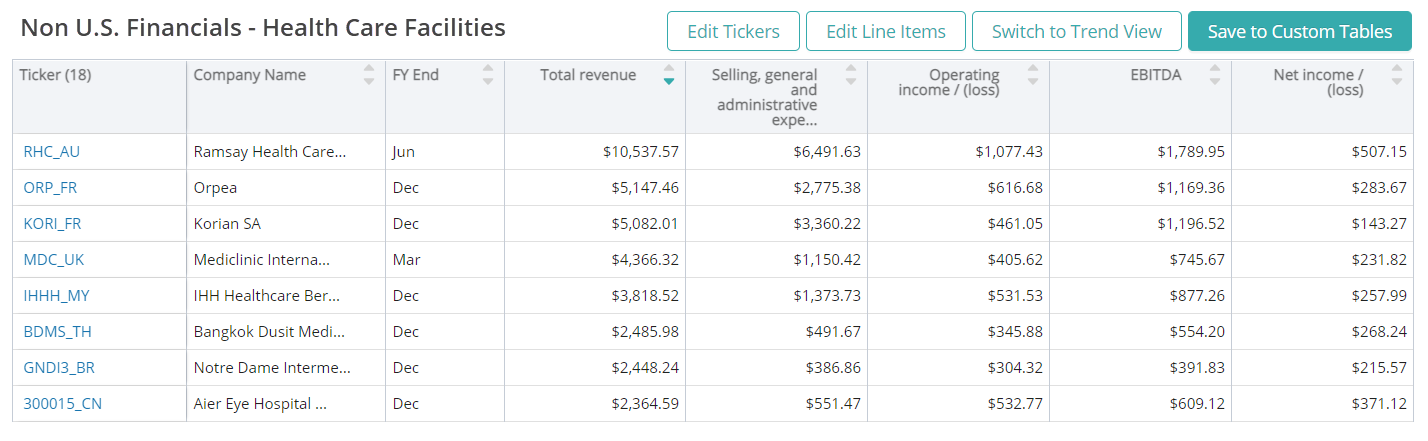

Visible Alpha offers 14 health care facilities comp tables, comparing key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for HCA Healthcare competitors or revenue per admission. Every pre-built comp table is based on region, sub-industry or key operating metrics. All comp tables are fully customizable.

This guide highlights the key performance indicators for the health care facilities industry and where investors should look to find an investment edge, including: