Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the Delivery, Airfreight, and Logistics industry and where investors should look to find an investment edge.

The delivery, airfreight, and logistics industry comprise companies that provide courier, packaging, mail delivery services, air freight transportation, ocean freight transportation, supply chain management, and logistics services. The services offered by companies in this industry include time-definite delivery, small package ground delivery, low-cost or economical delivery, and day-definite delivery for express letters, documents, small packages, and palletized freight. These companies provide domestic, international, commercial, as well as residential freight services via air, ocean, and land.

Trucking and railroads are some of the other prominent industries in the larger transportation and logistics space. You can learn more about the two industries by visiting Visible Alpha’s Guide to Railroads KPIs and Visible Alpha’s Guide to Trucking KPIs.

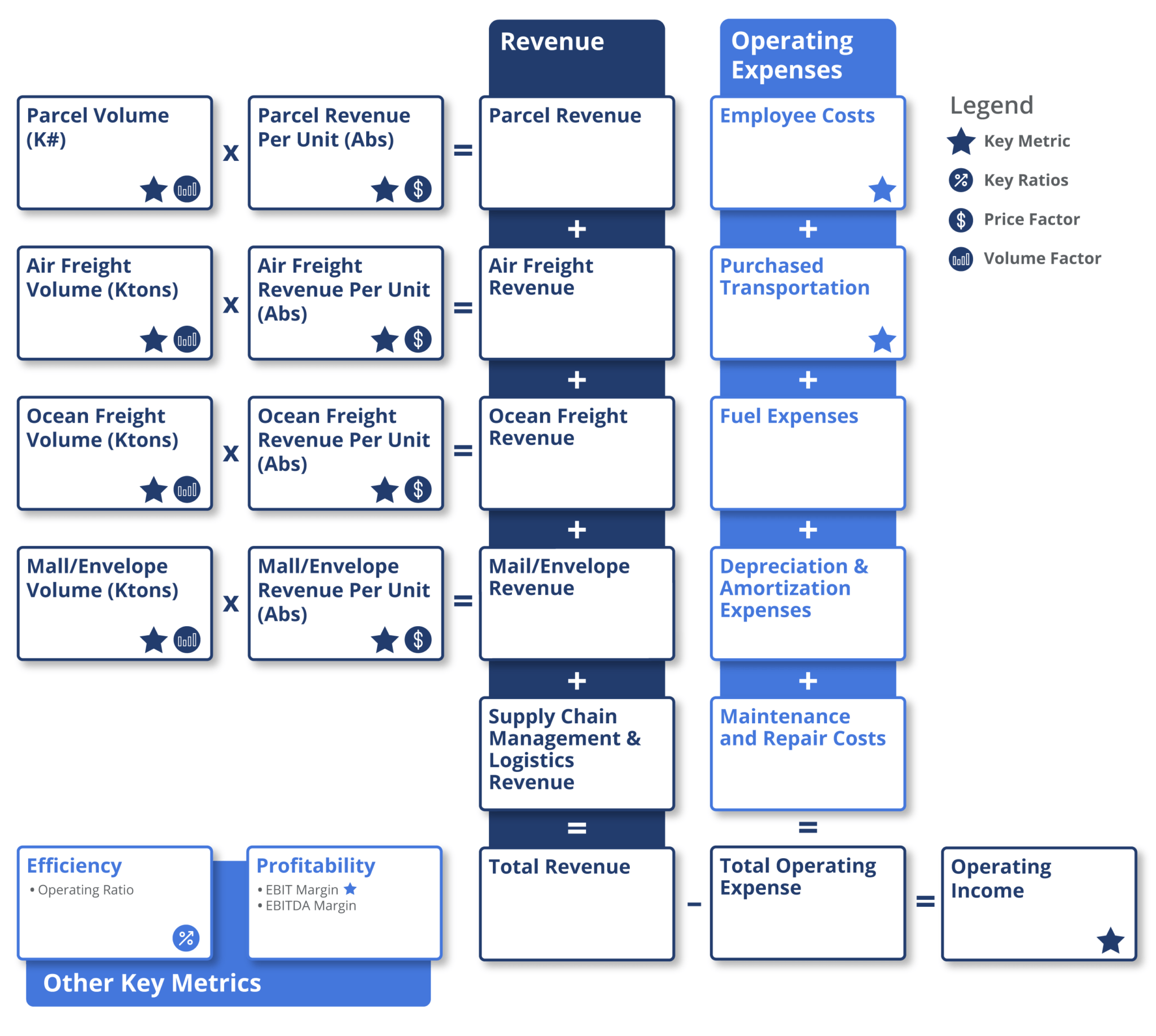

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for the Delivery, Airfreight, and Logistics industry, whether at a company or industry level, some industry KPIs to consider are:

Some major expenses for delivery, airfreight, and logistics companies include:

Together these expenses account for the total operating expenses of companies in the industry. A highly tracked efficiency ratio for expenses in this industry is the operating ratio, and it is calculated by dividing the total operating expense by the total revenue.

Companies in this industry generate revenue from providing packages, mail, and other delivery services. Total revenue is the sum of revenue generated from parcel delivery, mail/envelope delivery, air freight delivery, ocean freight delivery, logistics, and supply chain management services.

Parcel revenue is derived by multiplying volume – which is the number of parcels – with revenue per package delivered. Mail or envelope revenue is derived by multiplying volume – the number of mail/envelope – with revenue per mail delivered. Ocean freight revenue is derived by multiplying the volume delivered via ocean with revenue per parcel. Airfreight revenue is derived by multiplying the volume delivered via air with revenue per parcel.

In addition to traditional delivery services, companies provide logistics services that include transportation, storage/loading and unloading, international logistics, logistics equipment leasing, and packing services to customers. And lastly, supply chain management revenue is generated by providing customized supply chain solutions to customers including warehousing, brokerage services, transportation, and other value-added services.

Key measures of profitability for companies in the industry are EBIT (earnings before interest & taxes) margin and EBITDA (earnings before interest, taxes, depreciation & amortization) margin. EBIT margin, also known as operating margin and is calculated as EBIT divided by total revenue. EBITDA is an important metric for companies in the delivery, airfreight, and logistics industry, given the industry’s high depreciation and amortization costs. EBITDA margin is a measure of a company’s operating profit as a percentage of its total revenue. Investors evaluate profitability by looking at the level and directional change of EBITDA margin.

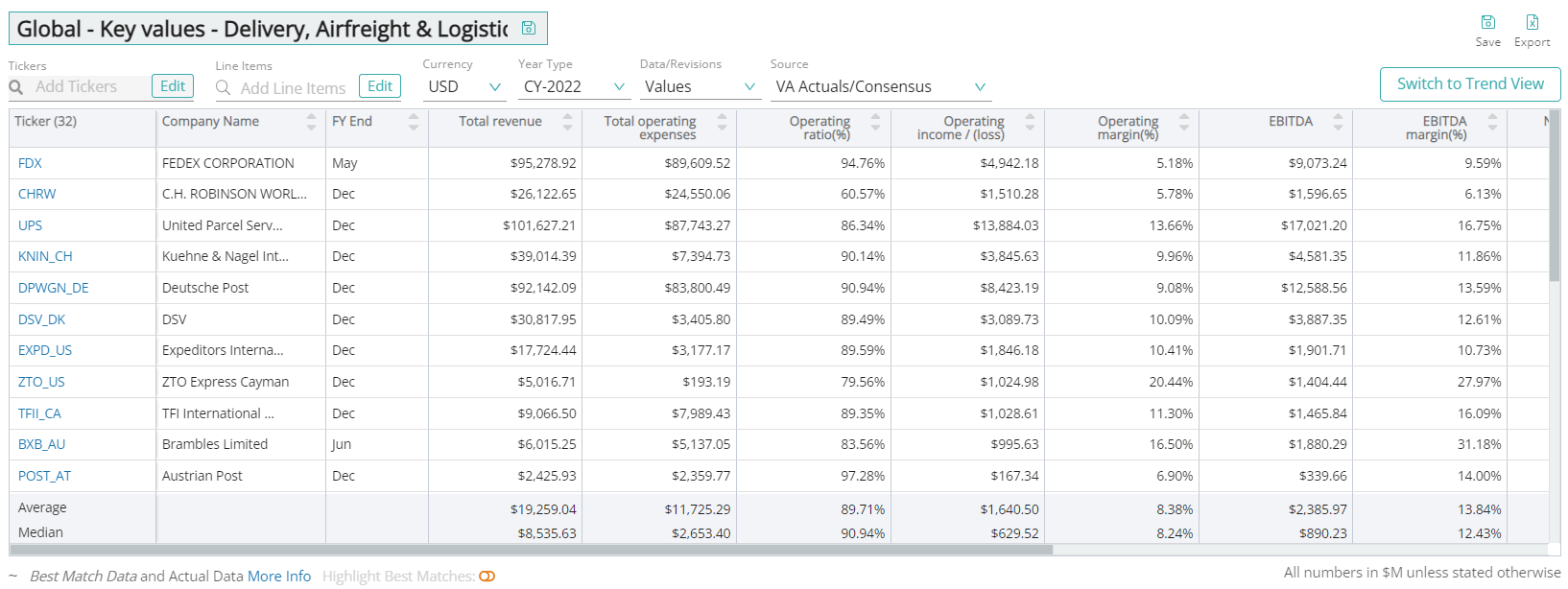

Visible Alpha offers 16 Delivery, Airfreight, and Logistics industry-related comp tables, comparing forecasts for key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for global companies, Americas, or Europe. Every pre-built, customizable comp table is based on region, sub-industry, or key operating metrics.

This guide highlights the key performance indicators for the delivery, airfreight & logistics industry and where investors should look to find an investment edge, including: