Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

This guide highlights the key performance indicators for the airport services industry and where investors should look to find an investment edge.

The airport services industry plays a crucial role in the functioning of airports around the world. These services encompass a wide range of activities and operations essential for the smooth operation of airports and the comfort and safety of passengers. From ground handling and security to retail and catering, the airport services industry is diverse and multifaceted.

Key performance indicators (KPIs) are the most important business metrics for a particular industry. When understanding market expectations for the airport services industry, whether at a company or industry level, some KPIs to consider include:

Airport service providers incur various expenses to operate and maintain airport facilities, provide essential services, ensure safety and security, and deliver a positive experience for passengers. The major expense lines for airport service providers include:

Companies in the airport services industry primarily generate revenue from two service segments:

Aeronautical revenues are a significant source of income for airport services companies. These revenues are directly related to the use of airport facilities and services by passengers, airlines, and aircraft. The four main sources of aeronautical revenue are passenger charges, landing charges, security charges, and parking charges.

Passenger charges, often referred to as airport fees or airport taxes, are fees that passengers pay for the use of airport facilities and services. These charges are levied by airports and are typically collected by airlines as part of the ticket price. They apply to passengers every time they fly in and out of an airport, as well as during any layovers or transit stops at that airport.

Apart from aeronautical revenue, airport service providers also generate income from non-aeronautical services. The four main sources of non-aeronautical revenue are real estate, retail concession, advertising, and car parking charges.

Real estate revenue for airport service providers encompasses rental income generated from leasing various spaces such as cargo buildings, hangars, office buildings, and standalone investment properties around the airport terminal. Additionally, this segment involves revenue from activities like managing properties around the terminal and operating infrastructure. Real estate income is usually recognized over the duration of the lease.

Investors assess the profitability of companies in this industry by considering various financial metrics, including:

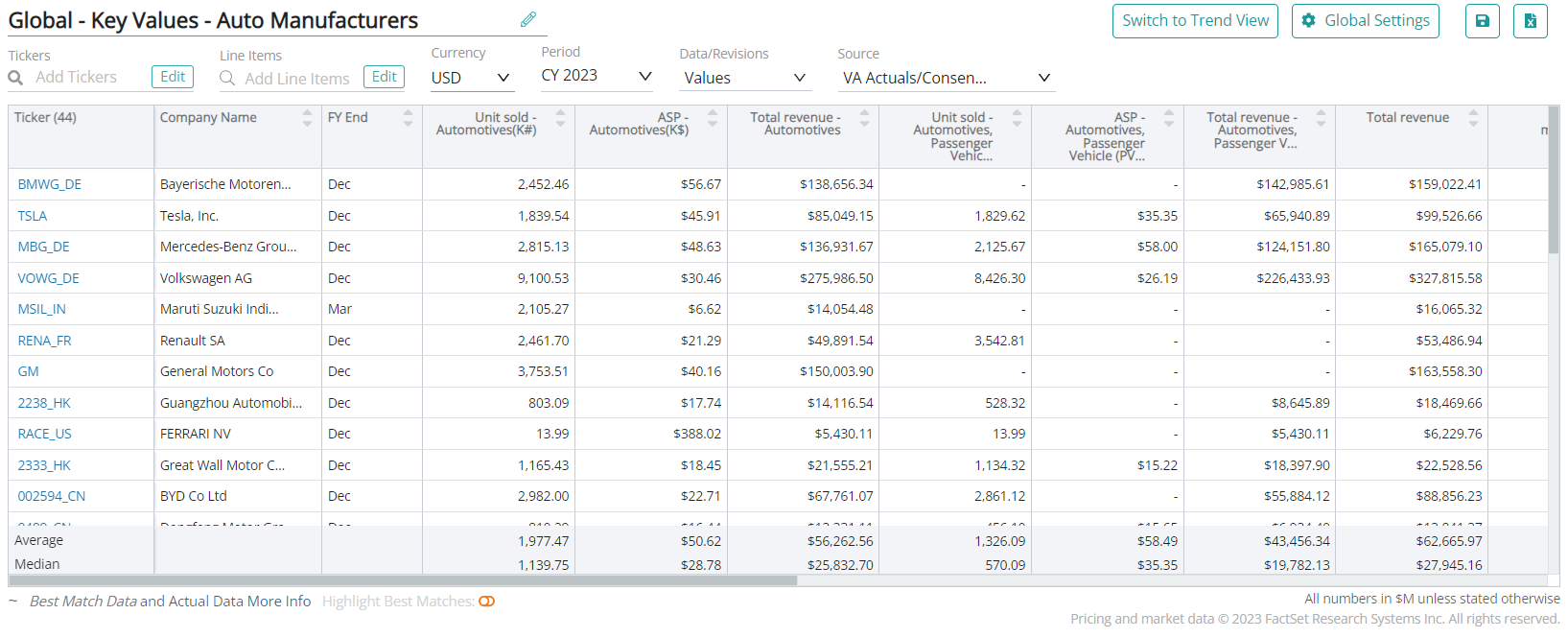

Visible Alpha offers 12 airport services-related comp tables, comparing forecasts for key financial and operating metrics, to make it easy to quickly conduct relative analysis, whether you are interested in looking at key values for global companies, Americas, or Europe. Every pre-built, customizable comp table is based on region, sub-industry, or key operating metrics.

This guide highlights the key performance indicators for the airport services industry and where investors should look to find an investment edge, including: