Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — August 22, 2025

By Dan Lowrey

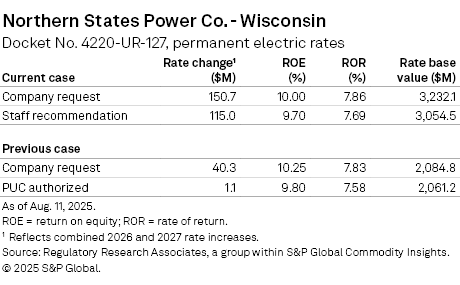

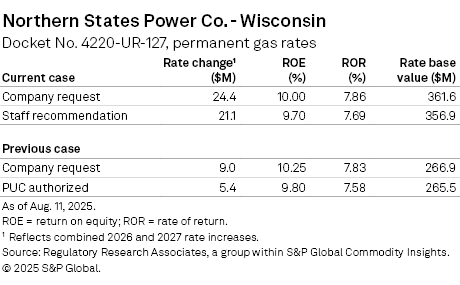

The staff of the Public Service Commission of Wisconsin recently filed testimony in Northern States Power Co. - Wisconsin's rate proceeding, supporting a $115.0 million increase in electric rates and a $21.1 million increase in gas base rates over 2026 and 2027.

➤ The PSC staff recommended a $115.0 million electric rate increase and a $21.1 million gas rate increase for Northern States Power (NSP-W) over the years 2026 and 2027, which, in aggregate, is approximately 75% of the company's original request. The recommended rate increases are based on a return on equity (ROE) of 9.70% and an overall return of 7.69%.

➤ NSP-W seeks to boost jurisdictional electric rates by $150.7 million and gas base rates by $24.4 million by 2027. The company proposes a 10.00% ROE.

➤ Wisconsin's regulatory framework is considered constructive for investors by Regulatory Research Associates, with recent legislative changes allowing expedited resolutions of rate cases. The PSC's approval of settlements has become more common since 2018. NSP-W has filed for significant rate increases to support capital investments aimed at enhancing reliability and supporting clean energy generation, including projects related to wind and solar energy.

The staff supports an increase in jurisdictional electric rates of $60.5 million in the 2026 test year and an incremental $54.4 million increase in the test year ending Dec. 31, 2027. The increases are based upon a 9.70% return on equity (53.50% of capital) and a 7.69% overall return on an electric rate base of $3.05 billion for the test year ending Dec. 31, 2027.

In addition, the staff supports an increase in jurisdictional gas rates of $16.8 million in the 2026 test year and an incremental $4.3 million in the test year ending Dec. 31, 2027. The increases are based upon a 9.70% return on equity (53.50% of capital) and a 7.69% overall return on a gas rate base of $356.9 million for the test year ending Dec. 31, 2027.

The recommended 9.70% ROE approximates national averages tracked by RRA.

The average ROE authorized for electric utilities in rate cases decided in the first half of 2025 was 9.68%, slightly below the 9.74% average observed in full year 2024. There were 23 electric ROE authorizations in the first half of 2025, versus 55 in full year 2024.

The average ROE authorized for gas utilities was 9.72% in rate cases decided in the first half of 2025, equal to the 9.72% average for full year 2024. There were 15 gas ROE authorizations in the first half of 2025, versus 44 in full year 2024.

The staff recommended adjustments for capital investments that reduced the electric revenue requirement by $15 million and the gas revenue requirement by $1 million. Among capital investments, the staff did not support spending associated with two Midcontinent ISO in Long Range Transmission Plan (LRTP) projects that are pending PSC approval — Grid Forward and Western Wisconsin Transmission Connection. It is the staff's historic practice to recommend downward revenue requirement adjustments for projects until commission approval is received. Approval of both LRTP projects is anticipated in the fourth quarter of 2025.

The staff's lower recommended ROE accounted for $7 million of the electric revenue requirement difference and $1 million of the gas revenue requirement difference. The staff's lower forecast operations and maintenance expense accounted for $6 million of the electric revenue requirement difference and $1 million of the gas revenue requirement difference.

A recommended reduction in NSP-W's nuclear decommissioning accrual further reduced the Wisconsin jurisdictional electric revenue requirement by $6.3 million.

Among operational expenses removed by staff from the revenue requirement were expenses associated with the board of directors, industry association dues, promotional advertising, institutional or goodwill advertising, economic development, employee recognition and executive coaching.

The staff supported NSP-W's initial wildfire mitigation risk review and associated capital investments but recommended excluding cost recovery for AI cameras and adjusting the revenue requirement downward due to a miscalculation in the Enhanced Powerline Safety Settings Program. The staff suggested requiring a wildfire risk management plan no later than the first quarter of each year beginning in 2026 and ending in 2028.

In terms of rate design, the staff was supportive of NSP-W's request to increase the monthly fixed charge for residential customers to $16 from $14, but backed a more gradual approach with a $1 increase in 2026 and an incremental $1 increase in 2027. The company indicated this increase is needed due to increases in the meter cost component attributable to the rollout of advanced metering infrastructure (AMI) meters and increases in the distribution cost components with continued distribution investment.

The staff said NSP-W's proposal to terminate several electric vehicle tariffs was reasonable given the lack of interest in the programs. "In reevaluating the residential programs, the company is proposing to eliminate the programs due to vendor issues and overall customer adoption," NSP-W testified. "The company's two EVSE [Electric Vehicle Supply Equipment] and data services vendors have created billing, administration and data access issues for the company and customers. The residential programs currently have 185 customers enrolled, which is just 4.5 percent of the estimated market size of 4,150 electric vehicles." The company is proposing to cancel the EVP-1 tariff in its entirety because it is no longer proposing to own public charging equipment.

In addition, the staff was generally supportive of the company's proposed residential arrears assistance program (RAAP), with the goal of reducing electric and gas arrears of customers eligible for the Wisconsin Home Energy Assistance Program (WHEAP). The proposed RAAP provides qualifying customers with a one-time credit applied to their qualified past-due balance. Qualifying customers must be enrolled in WHEAP and have a past-due balance.

|

Rate case background

On March 31, NSP-W filed a multiyear electric and gas rate increase request with the PSC, seeking to boost jurisdictional electric rates by $150.7 million and gas base rates by $24.4 million by 2027. The company indicated the higher revenues will help it upgrade and strengthen its electric and gas systems to enhance reliability and resiliency while ensuring safe operation and enabling additional clean energy generation.

In Docket 4220-UR-127 (Elec), NSP-W requested an increase in jurisdictional electric base rates of $93.4 million beginning Jan. 1, 2026, premised upon a 10.00% return on equity (53.50% of capital) and a 7.83% overall return on a rate base of $2.91 billion for a test year ending Dec. 31, 2026. The company requested an incremental $57.3 million increase in electric rates beginning Jan. 1, 2027, premised upon a 10.00% return on equity (53.50% of capital) and a 7.86% overall return on a rate base of $3.23 billion for a test year ending Dec. 31, 2027.

For gas rates, in Docket 4220-UR-127 (Gas), NSP-W is requesting an increase of $20.4 million beginning Jan. 1, 2026, premised upon a 10.00% return on equity (53.50% of capital) and a 7.83% overall return on a rate base of $340.1 million for a test year ending Dec. 31, 2026. The company requested an incremental $4.0 million increase in gas rates beginning Jan. 1, 2027, premised upon a 10.00% return on equity (53.50% of capital) and a 7.86% overall return on a rate base of $361.6 million for a test year ending Dec. 31, 2027.

The requested electric rate increases for 2026 and 2027 are driven by four key factors. First, NSP-W anticipates a significant return from a growing rate base, with capital investments of $90.1 million in 2026 and $121.8 million in 2027. Additionally, rising depreciation and tax expenses linked to these investments are projected to reach $41.8 million in 2026 and $64.3 million in 2027, alongside increasing non-Interchange Agreement operations and maintenance (O&M) expenses totaling $27.3 million in 2026 and $29.6 million in 2027, while forecast sales reductions are expected to contribute to a revenue decrease of about $20.9 million in 2026 and $17.7 million in 2027 compared to currently authorized rates.

Generation investments in 2026 and 2027 include the Wheaton Generating Station repower project, a $318.0 million project to be in service in late 2025. The Wheaton Generating Station, with a nameplate capacity of 247 MW, has operated for more than two decades beyond its original 25-year design life, was degrading in reliability and was expected to be retired in 2025. Other generation investments in the test years include several hydroelectric-related projects to maintain and improve the facilities' dams, gates and spillways.

With respect to renewables, the capital investments primarily impacting the test years are two wind repowering projects, a solar generating facility and a long-duration battery pilot project. These repowering projects replaced certain components of the existing wind farm with upgraded components such as blades, hubs and gearboxes to increase the average annual energy production from the facilities. In addition, NSP-W is building a solar generating facility and a long-duration battery pilot project at the coal-fired Sherco Generation station site in Minnesota, with in-service dates between 2024 and 2026.

For its gas business, drivers of the rate request include a higher requested return on rate base, increased book depreciation expenses and rising O&M expenses. These increases are partially mitigated by a decrease in manufactured gas plant amortization expenses and a slight expected rise in operating revenues for the respective years. NSP-W's gas business is focused on replacing gas mains, first installed in the 1950s, 60s and 70s.

Costs for wildfire mitigation and, separately, increases for the company's damage prevention program and insurance premiums are also drivers of the rate case.

Rebuttal testimony is due Aug. 28, and initial briefs are due by Sept. 26. The PSC is expected to make a decision late in the fourth quarter of 2025.

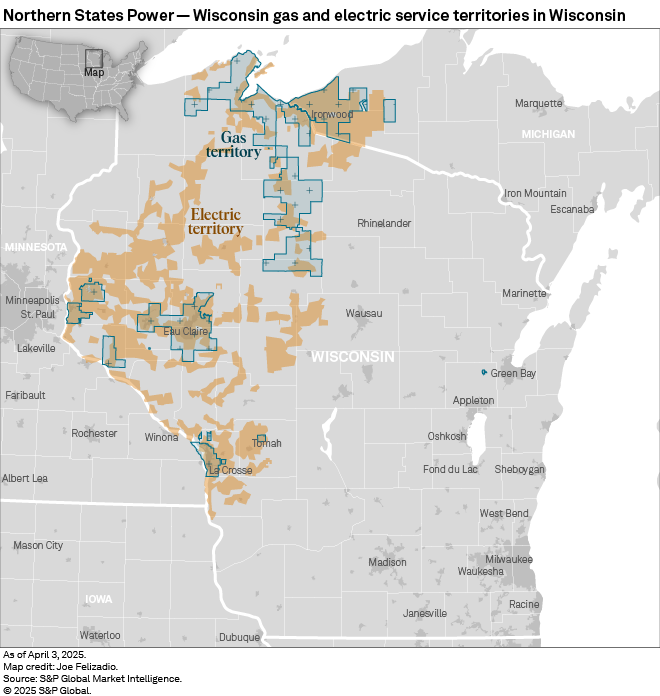

NSP-W is a subsidiary of Xcel Energy Inc. and provides the sale of electric energy to about 279,000 retail electric customers in northwestern Wisconsin and the western tip of the Upper Peninsula of Michigan, and the sale of gas to about 123,000 customers in Wisconsin and Michigan.

Wisconsin energy regulatory environment

RRA considers Wisconsin regulation to be constructive from an investor perspective. Energy utilities are regulated under a traditional framework, and the most recently authorized equity returns have been above the prevailing national averages when established. The use of forecast test periods and other constructive financial practices — reliance on comparatively equity-rich capital structures for rate-setting purposes and authorization of a cash return on 50% of construction work in progress — have provided the state's investor-owned utilities a reasonable opportunity to maintain solid credit quality metrics and to earn their authorized equity returns.

Legislation was enacted in 2018 to expedite the resolution of rate cases, authorizing the PSC to approve settlements between parties. Prior to 2018, rate cases were rarely settled. Since the enactment of the legislation, settlements in rate cases have been frequent.

The PSC also allows periodic adjustments to reflect expected changes in electric fuel costs that are outside a variance range. The commission has taken an active role in integrated resource planning; thus, before constructing a generating facility, a utility must obtain a determination of need from the PSC, which includes an estimate of the facility's costs. While certain impediments to the construction of new nuclear facilities have been removed, none of the state's electric utilities have plans to develop nuclear generation.

Recent mergers involving the state's major energy utilities have been approved without onerous conditions being imposed. In the gas industry, gas-cost recovery mechanisms are in place for local distribution companies, and gas retail choice is effectively available for large-volume customers only.

RRA accords Wisconsin energy regulation an Above Average/3 ranking, indicating it is constructive from an investor standpoint. For more information, visit the Wisconsin commission profile page.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

Content Type

Theme

Location

Products & Offerings

Segment