Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — August 22, 2025

By Seth Shafer

Paramount Skydance Corp.'s recently announced $7.7 billion, seven-year deal with TKO Group Holdings Inc. will see Paramount+ become the primary distribution platform for UFC action in the US in 2026. Purchasing via pay-per-view will no longer be available and only select coverage will be shown on the CBS broadcast network.

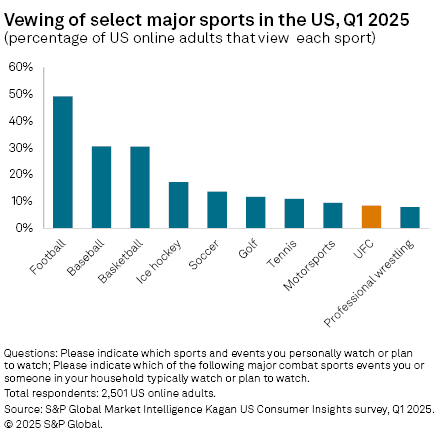

➤ Survey data from S&P Global Market Intelligence Kagan shows that while just 9% of US online adults said they typically watch UFC events, that audience is roughly on par with other popular sports such as golf, tennis, motorsports and professional wrestling.

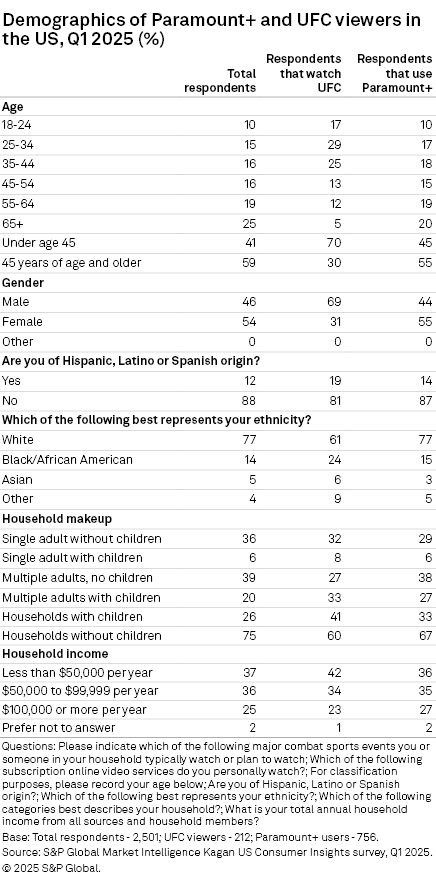

➤ UFC viewers skew much younger than overall survey respondents and are much more likely to be male. They also tend to be more ethnically diverse and more likely to live in homes with children.

➤ The demographics of Paramount+ users look very similar to overall survey respondents, suggesting that adding UFC programming could help to attract new subscribers to the service, especially among younger demographics. Among respondents who use Paramount+, 14% reported typically watching UFC events.

Kagan’s online survey of 2,501 US adults (ages 18 and older) conducted in the first quarter of 2025 reveals a tiered hierarchy of commonly watched sports that has been little changed in recent years. About half of the total survey respondents report watching football, while baseball and basketball are viewed by just under one-third. Ice hockey (17% of respondents) and soccer (14%) are next, followed by a host of other sports (including UFC) at 8% to 12%.

For additional recent US survey research, please see the following link: US Consumer Insights survey hub 2025.

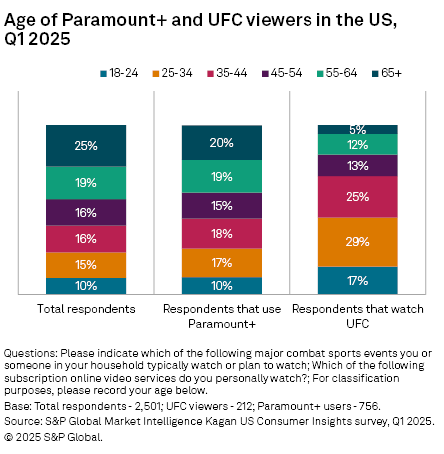

UFC viewers are among the youngest on average for major sports surveyed for, with nearly half in the 18 to 34 age bracket and 70% under the age of 45. Only 5% of UFC viewers were age 65+ compared to one-quarter of overall survey respondents. UFC viewers were also much younger than Paramount+ users, who generally looked very similar to overall survey takers as far as age distribution.

In addition to differing by age, respondents who watch UFC are much more likely to be male and come from a wider range of ethnic backgrounds when compared to both overall respondents and Paramount+ users. UFC viewers are also more likely to live in homes with children and skew slightly towards lower income homes making less than $50,000 per year.

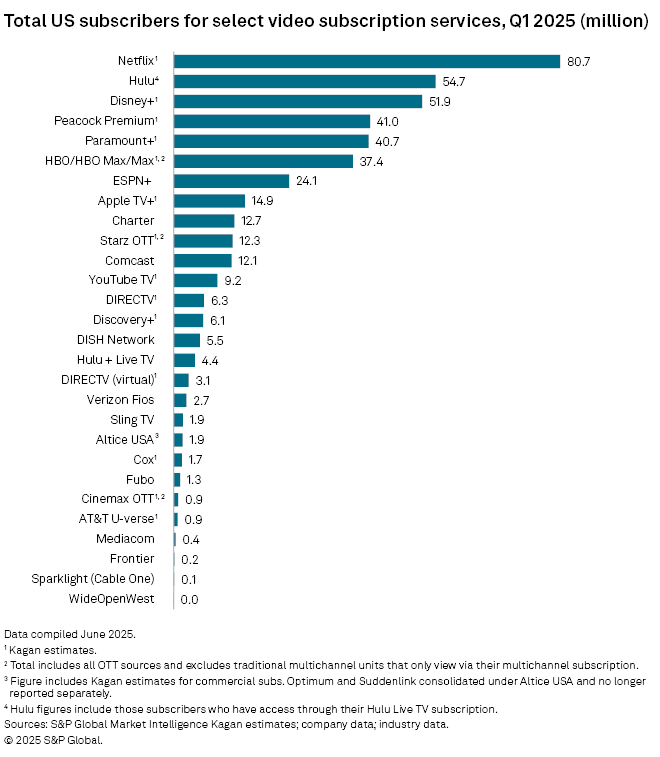

Paramount reportedly outbid the likes of Disney and Netflix to land the US rights to UFC, paying double what current rights owner Disney had paid. Survey data shows that while user bases for most major US streaming subscription video (SVOD) services were slightly more likely to watch UFC events versus total survey respondents, only ESPN+ had more than 20% of its users report that they view UFC coverage. Please note that respondents were asked separate questions regarding what sports they view and what streaming video services they use and were not directly asked if they view UFC programming on any specific service.

Kagan estimates for paid US subscribers at top SVOD operators and traditional pay TV operators as of the end of the first quarter of 2025 highlight the competitive nature of the market. Netflix still held a wide lead with just over 80 million paid subs but the next tier of services (Hulu, Disney+, HBO Max, Peacock and Paramount+) are locked in a tight race and looking to add compelling programming that can attract new subs, boost engagement and reduce churn.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Data presented in this article was collected from Kagan's US Consumer Insights survey conducted in the first quarter of 2025. The survey totaled 2,501 internet adults with a margin of error of +/-1.9 percentage points at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

Content Type

Location

Segment