Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 12, 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

In addition to the US earnings season coming into full flow, the week ahead will see some key insights into growth and inflation trends at the close of 2023 for some of the world's largest economies, providing key inputs to policy making decisions at some of the largest central banks.

High-frequency indicators of economic growth are provided in the form of updates to industrial production and retail sales for the United States and mainland China, with the former also published for the eurozone. Inflation data are meanwhile issued for the UK, Eurozone and Japan.

The data follow increased caution among investors at the start of 2024, as indicated by a renewed mood of risk aversion prevailing in the latest S&P Global Investment Manager Index (IMI). After reporting strong risk appetite late last year, the mood has soured into 2024, albeit with some mixed signals for different equity markets for the year ahead.

Investors are most positive about Japanese equities for 2024, so the upcoming release of inflation data will be important in helping justify recent multi-decade stock market highs and speculation that the Bank of Japan will be able to sustain its ultra-loose monetary policy stance, a by-product of which should be an export boost via a weaker yen.

at the other end of the scale, investors in the IMI survey are least bullish regarding mainland China equities - albeit less so than late last year. Whether this stance is justified will be tested by the release of Q4 GDP data (see box), which could add some optimism to mainland China's prospects.

the timing and extent of any Fed pivot meanwhile remains the main driver of overall market sentiment, and US data in the form of industrial production, retail sales, housing starts and consumer confidence will provide further insights into soft landing prospects. Consensus beats could cause markets to pare back expectations more in line with the three 25 basis point cuts being pencilled in for 2024 by the FOMC.

In Europe, the Bank of England's policy outlook will be guided by fresh labour market, retail sales and inflation data, with wages under particular scrutiny amid policymaker concerns over second-round inflation effects. The eurozone also releases revised inflation data for December, as well as GDP data for Germany.

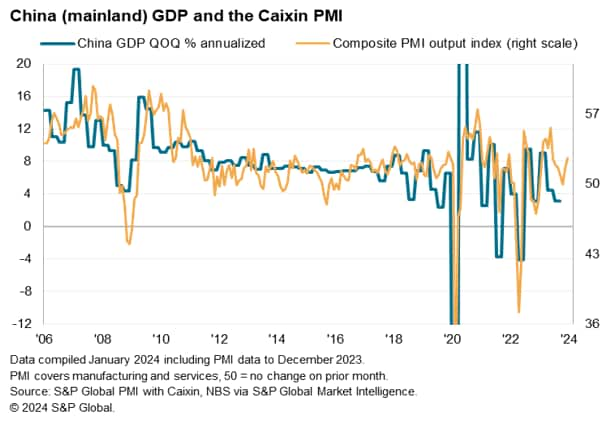

A highlight of the week will be fourth quarter GDP for mainland China. After GDP rose at a modest 3.1% quarterly annualized rate in the three months to September, one of its weakest expansions in recent history outside of the pandemic, the are broad-based hopes that growth has revived. S&P Global Market Intelligence is estimating a 7.2% annualized growth rate for the fourth quarter. The Caixin PMI, compiled by S&P Global, has also shown some improvement. The composite PMI, covering the output of both manufacturing and services, hit a ten-month low of 50.0 in October, signaling no change in output on the prior month, but has since risen to 52.6, a seven-month high. The PMI therefore adds to signs that the economy is starting to revive again, albeit from a low base.

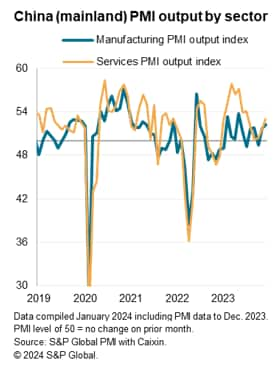

The details of the PMI also offer some encouragement. The PMI clearly tracked the rebound of post-pandemic demand for consumer-orients services such as travel, recreation and tourism, but also showed this rebound fading rapidly as 2023 progressed. More recently, the service sector has shown a welcome upswing, in part fueled by a simultaneous rise in factory output, the latter boosting demand for industrial services.

The high-frequency monthly official data will therefore be eagerly awaited for further insights into the health of China's of China's so-far unconvincing recovery.

Monday 15 Jan

United States Market Holiday

South Korea Trade (Dec)

Indonesia Trade (Dec)

India WPI (Dec)

Germany Wholesale Prices (Dec)

Germany Full Year GDP Growth (2023)

Eurozone Balance of Trade (Nov)

Eurozone Industrial Production (Nov)

Brazil Business Confidence (Jan)

Canada Manufacturing Sales (Nov)

Tuesday 16 Jan

Australia Westpac Consumer Confidence (Jan)

Japan PPI (Dec)

Germany Inflation (Dec, final)

United Kingdom Labour Market Report (Dec)

Germany ZEW Economic Sentiment Index (Jan)

Canada Inflation (Dec)

Wednesday 17 Jan

Singapore Non-oil Domestic Exports (Dec)

China (Mainland) GDP (Q4)

China (Mainland) Industrial Production (Dec)

China (Mainland) Retail Sales (Dec)

China (Mainland) Fixed Asset Investment (Dec)

China (Mainland) Unemployment Rate (Dec)

United Kingdom Inflation (Dec)

Indonesia BI Interest Rate Decision

Eurozone Inflation (Dec, final)

Brazil Retail Sales (Nov)

United States Retail Sales (Dec)

United States Industrial Production (Dec)

United States Business Inventories (Nov)

Thursday 18 Jan

Japan Machinery Orders (Nov)

Australia Employment Change (Dec)

Australia Unemployment Rate (Dec)

Eurozone Current Account (Nov)

United States Building Permits (Dec)

United States Housing Starts (Dec)

Friday 19 Jan

Japan Inflation (Dec)

Malaysia Trade (Dec)

Germany PPI (Dec)

United Kingdom Retail Sales (Dec)

Canada Retail Sales (Nov)

United States UoM Sentiment (Jan, prelim)

United States Existing Home Sales (Dec)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Americas: US retail sales, industrial production, building permits and UoM sentiment, Canada inflation

Key releases to watch in the US next week include a series of tier-2 data. Specifically, US retail sales and industrial production will be due on Wednesday for the latest update on economic activity at the end of 2023. Despite improvements observed for the US economy in December via S&P Global PMI data, growth was uneven with growth reliant on the service sector amid looser financial conditions to offset a manufacturing downturn.

Canada's inflation readings will also be due in the early half of the week with the latest December 2023 PMI prices data pointing to further easing of inflationary pressures amid a steep downturn in business activity.

EMEA: UK inflation, employment data, Germany GDP, Eurozone inflation and industrial production

The UK releases inflation, employment and retail sales data in the week to help assess recession risks and the next move from the Bank of England. According to UK PMI price data, some stickiness in inflationary pressures may be anticipated in the coming months. Employment figures will also be keenly followed with the latest KPMG/REC UK report on Jobs having suggested that recruitment activity declined at a softer pace at the end of 2023.

Germany GDP will also be out Monday for an official update on 2023 growth conditions, while eurozone inflation and industrial production figures are released through the week.

APAC: China Q4 GDP, activity data, Japan CPI

In APAC, GDP data from mainland China will be the highlight on Wednesday alongside higher-frequency official updates such as retail sales, industrial production and unemployment numbers. Recent Caixin PMI data showed that mainland China ended 2023 on a positive note as composite output growth rose to a seven-month high. This was with manufacturing output growing for a second straight month in December as new orders rose.

Separately, Japan's December inflation reading will be released on Friday. PMI prices data, with its leading-indicator properties, indicated further room for inflation to fall in the coming months, though some stickiness may be seen with the latest December data showing a slight acceleration in the rise of charges.

Global PMI ends 2023 on brighter note, but wide divergences persist - Chris Williamson

ASEAN economic outlook in 2024 - Rajiv Biswas

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location