Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 05, 2024

Some New Year cheer is provided by the PMI signaling an acceleration of growth in the vast services economy, which reported its largest rise in activity for five months in December. The improvement overshadows a downturn recorded in manufacturing to indicate that the overall pace of US economic growth likely accelerated slightly at the end of the year.

Growth nevertheless remains subdued by standards seen over the spring and summer, with many parts of the economy struggling to expand amid weak demand. Hence inflationary pressures continued to abate at the end of 2023.

However, easing financial conditions are providing a welcome support to growth, notably within financial services, which should feed through to stronger growth in the broader economy in 2024 if sustained.

The final US composite PMI Output Index, covering both manufacturing and services, came in at 50.9 in December, down slightly from the earlier flash reading of 51.0 but up on the readings of 50.7 seen in both October and November. The overall level nevertheless remains subdued by recent standards, indicating a slowdown in the pace of economic growth after GDP rose at a strong 4.9% annualized rate in the third quarter.

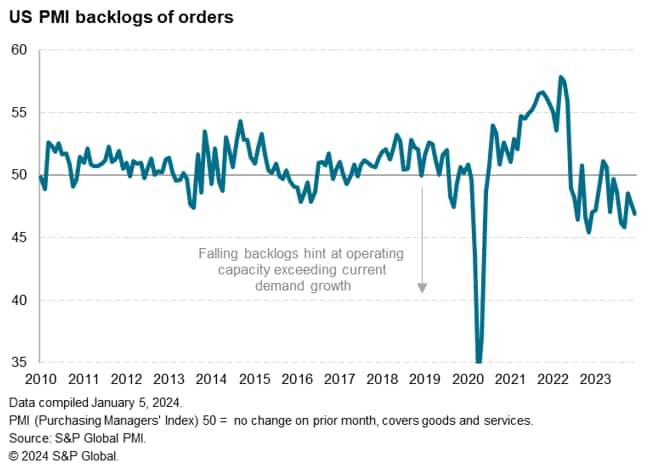

Although new order inflows rose modestly in December, firms' backlogs of work - a key indicator of workloads and future capacity requirements - remained firmly in contraction territory. The overall drop in backlogs of work in December was among the strongest recorded since survey data were first available in 2009.

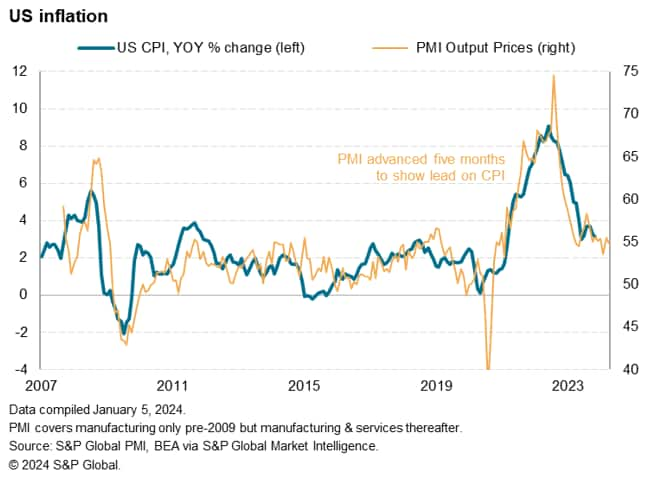

The weak demand environment signaled by the Backlogs of Work Index fed through to weaker pricing power at many companies. Average prices charged for goods and services consequently rose at a reduced rate in December. The average rise in prices over the past three months has been the lowest recorded since the first half of 2020. The PMI data are roughly consistent with CPI annual inflation running only slightly above the Fed's 2% target.

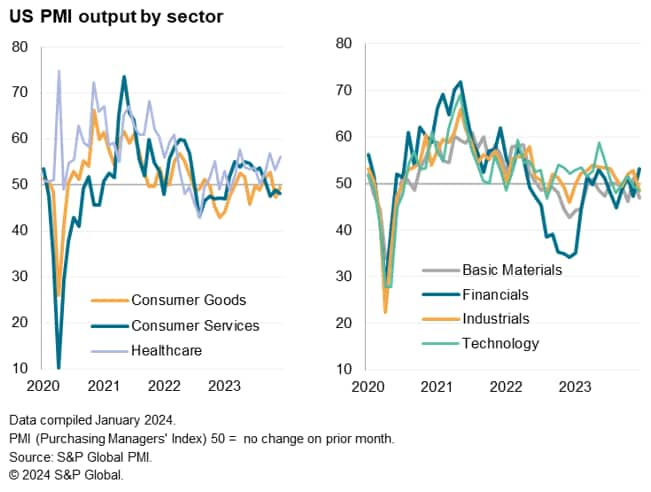

Looking into the details, the modest growth in December looks worryingly uneven. Besides healthcare, the only sector that recorded an increase in output was financial services, where growth hit a 20-month high. Worsening performances were seen in consumer services, technology - where faster rates of decline were reported - and in basic material manufacturing and industrials (the latter including business services), where renewed declines were recorded. Consumer goods production meanwhile fell for a second month running.

Total manufacturing output consequently fell for the first time in four months in December, with the struggling manufacturing sector dampening demand for business-to-business services. Consumers meanwhile remained far less inclined to spend on luxuries such as travel and recreation than earlier in the year, with firms blaming the increased cost of living and higher borrowing costs for subdued customer demand.

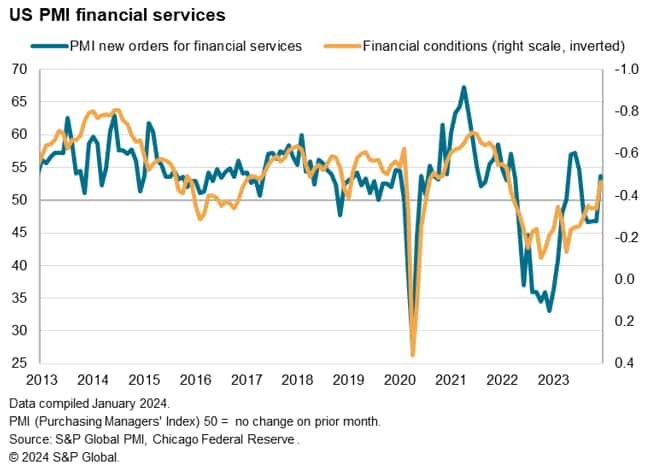

More encouragingly, some support to financial services in particular is coming from the recent loosening of financial conditions amid growing hopes of interest rate cuts in 2024. According to the Chicago Fed, US financial conditions loosened in December to their easiest since February 2022.

Despite no changes to the Fed Funds Rate in recent months, markets have increasingly priced in rate cuts in 2024, a pivot which policymakers have also begun to signal via their 'dot plot' forecasts, which now point to three 25 basis point cuts in 2024. This has boosted equity prices, reduced yields on bonds, and translated into lower borrowing costs for products such as fixed rate mortgages.

If sustained, the improving financial services trend is likely to feed through to other parts of the economy (for example, lower mortgage rates will drive home sales, boost demand for home-related products and drive more housebuilding).

However, the concern is that any reversal of this loosening of financial conditions could thwart the recent revival in financial services activity, and hence remove a key pillar of growth in the economy.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location