Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 15, 2025

By Keith Nissen

The majority of Americans are still positive about their standard of living, but rising home prices and the lack of retirement savings are increasingly putting the American dream out of reach.

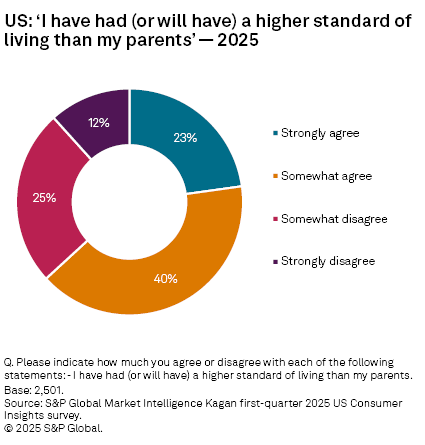

➤ Two-thirds of Americans believe they have or will have a higher standard of living than their parents.

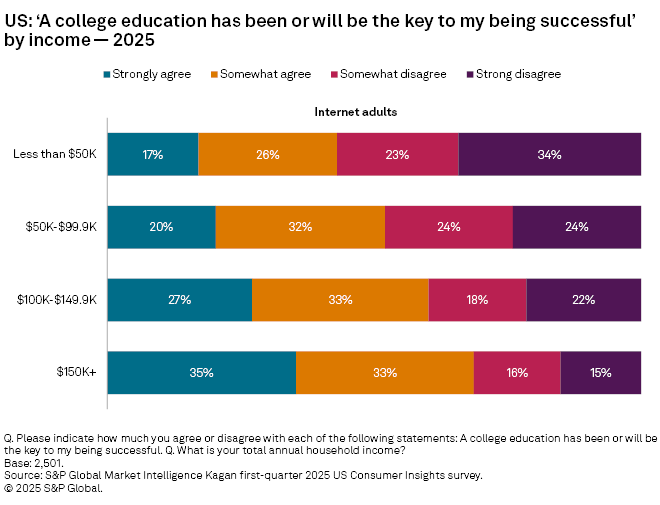

➤ Americans are split evenly as to whether a college education is the key to future success.

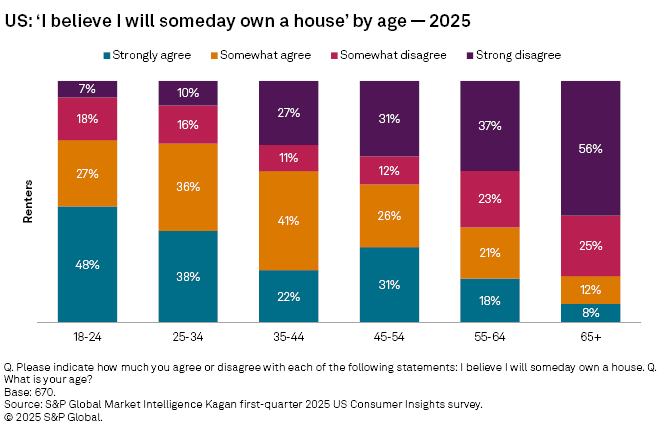

➤ Nearly half of renters in the US believe they will never own a home.

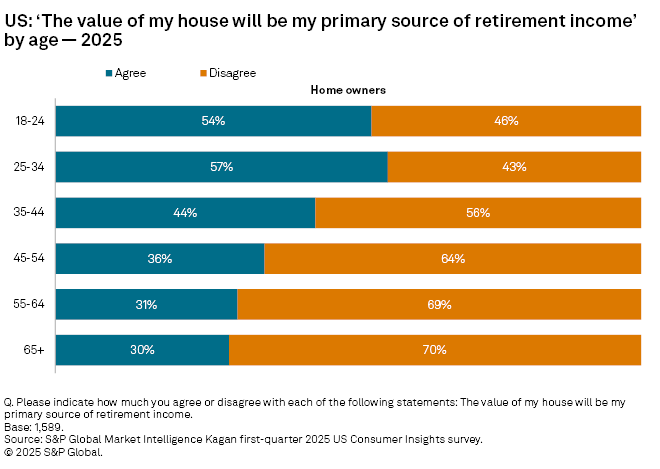

➤ Most Americans under 35 years of age believe the value of their home will be a primary source of retirement income.

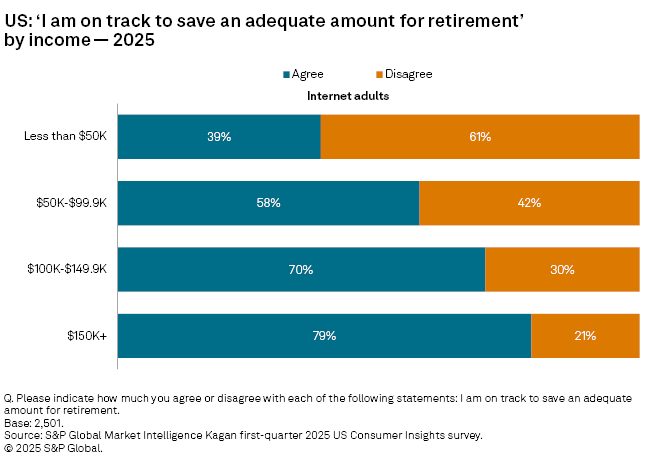

➤ Only 55% of Americans believe they are saving adequately for retirement.

The recently completed S&P Global Market Intelligence Kagan first-quarter 2025 US Consumer Insights survey asked respondents if they agreed or disagreed with a series of statements related to quality of life and one’s standard of living. For instance, the survey found that nearly two-thirds (63%) of internet adults believe they have or will have a higher standard of living than their parents. This generally positive outlook spans all age groups, as well as race/ethnicity, population center size, and education level. The main differentiator was household income, where approximately half (47%) of adults in low-income households earning less than $50,000 disagreed with the statement; double (23%) that of the highest-income households earning $150,000 or more.

Consumers were equally divided when responding to the statement “a college education has been or will be the key to my being successful.” Age was a dependent variable, with 71% of young adults ages 18–24 agreeing, while less than half (43%) of adults ages 65 and older responded in kind. It was unsurprising that two-thirds (66%) of those with a college degree agreed with the statement and 69% of those without a college degree disagreed. This sentiment was also apparent when segmenting by household income. Over one-third (35%) of adults with an annual household income of $150,000 or more strongly agreed, compared to only 17% of those with a household income of less than $50,000 annually.

Home ownership has traditionally been a major factor in defining the American standard of living. However, rising prices now place home ownership out of reach for many. The survey found that nearly half (47%) of those currently renting do not believe they will someday own a house. Eight out of 10 adults with a household income of $100,000 or more agreed that owning a home was in their future, compared to about half of renters earning less than $100,000. Yet, the dream of home ownership remains strong at about 75% among young adults under 35 years of age. The survey data shows that with age, however, the prospect of switching from renter to homeowner drops precipitously.

Among current homeowners, 63% disagreed with the statement “the value of my house will be my primary source of retirement income.” The data shows that in retirement, low-income homeowners (less than $50,000 per year) believe they will rely on home value more than those with higher incomes, but the variance is not substantial. However, the survey results highlight that the majority of younger adults (under 35 years of age) believe they will be relying on the value of their home in retirement. In comparison, approximately two-thirds of adults 45 and older said they have or will have other sources of retirement income.

Finally, only 55% of US internet adults believe they are on track to save an adequate amount for retirement. The survey found that income is much more of a factor with regard to retirement savings than age. The majority of survey respondents, regardless of age, said they are on track to save adequately for retirement. However, 61% of low-income earners reported they are not saving adequately for retirement, compared to only 21% of the highest income earners. Men (61%) were more likely to say they are saving adequately than women (49%). Six in 10 (61%) of those with a college degree agreed, while the majority (55%) of those without a college degree indicated they were not adequately saving for retirement.

The Kagan first-quarter 2025 US Consumer Insights survey was conducted in March 2025. The survey consisted of approximately 2,500 internet adults with a margin of error of +/-1.9 ppts at the 95% confidence level. Survey data should only be used to identify general market characteristics and directional trends.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Economics of Networks is a regular feature from S&P Global Market Intelligence Kagan. Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan