Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — August 14, 2025

Patricia Barreto, Ruilin Wang and Patricia Barreto

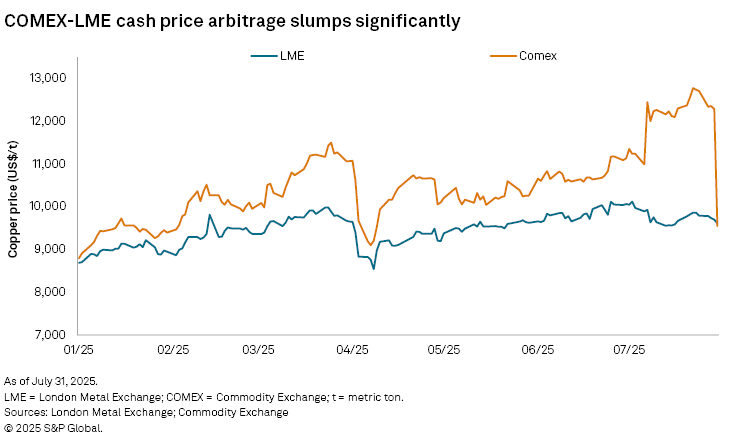

The US copper market experienced its steepest one-day price drop on record as COMEX copper futures plunged 22% following the White House announcement July 30 that refined copper would be excluded from the 50% import tariff on copper products. This surprise move sharply altered market expectations, which had anticipated broad tariffs across the copper supply chain.

➤ The 50% tariff applies to semifinished and copper-intensive products, not refined copper or scrap.

➤ Prices tumbled as market expectations were upended and stockpiled cathode may be re-exported, exerting global downward price pressure.

➤ Government mandates focus on copper mine supply, but so far omit explicit support for fabrication of semifinished products (semis).

➤ The ability of domestic semifabricators to gear up will be the key swing factor for copper flows and US market rebalancing in 2025 and beyond.

The announcement's effects rippled globally. Within a day, the premium of US copper over the London Metal Exchange (LME) benchmark collapsed from 27% to negative, while LME and Shanghai Futures Exchange (SHFE) copper prices both declined, by 1% and 0.8%, respectively. The immediate loss of a US price premium sent shockwaves through international copper flows.

On July 30, US President Donald Trump signed a proclamation, effective Aug. 1, imposing a universal 50% tariff on semifinished copper products (rods, bars, sheets, tubes, wire rod and other copper-intensive derivative components) but specifically excluding copper ores, concentrates, mattes, anodes, cathodes (refined copper) and scrap. These input materials will not face Section 232 tariffs and are carved out from new trade restrictions.

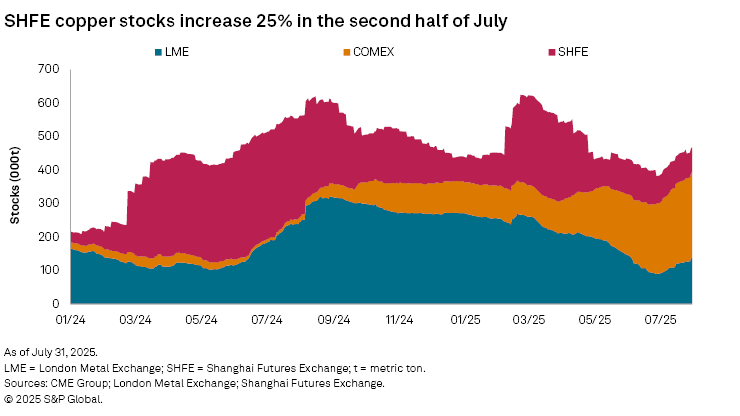

Earlier in 2025, the Section 232 investigation announcement led many in the market to expect far-reaching tariffs, including on refined copper. This fueled a surge of refined copper flows into the US — nearly 400,000 metric tons more than year-ago levels until May, representing nearly 70% of total US imports for 2025 and driving COMEX-registered stocks to a seven-year high of nearly 200,000 metric tons. With refined copper now exempt, these stocks could end up being re-exported by traders, potentially weighing on Asian and European copper prices in the months ahead.

This oversupply risk is magnified by demand-side dynamics: US buyers have been front-loading orders for all copper products, anticipating the tariff's start, which may result in a temporary lull in physical demand.

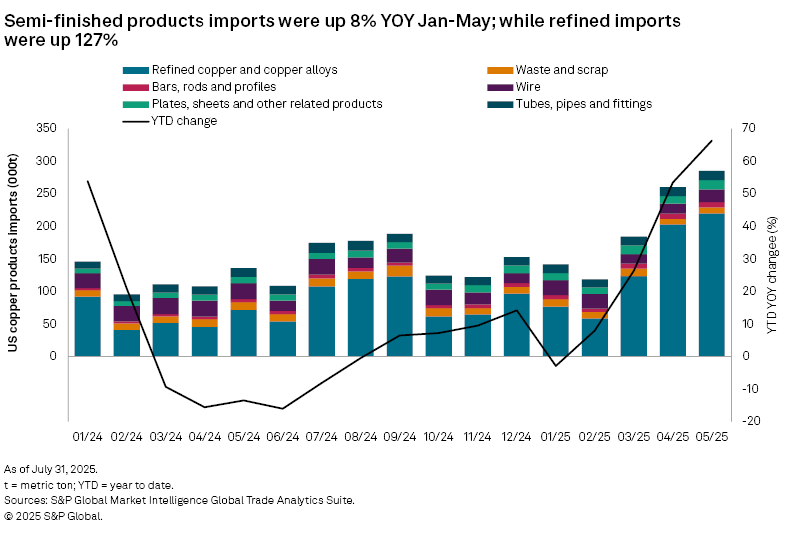

The US remains heavily dependent on imports for semifinished copper products. Overall, the US imported close to 600,000 metric tons of semis in 2024. This number is expected to remain elevated this year as domestic manufacturers ramp up but still fall short of meeting rising demand from the infrastructure, power, electric vehicle and defense sectors. From January to May, imports had increased 8% year over year. This import dependence makes domestic semifabricators' ability to increase output a decisive factor in the effectiveness of the tariff policy.

Although some surplus refined copper cathode may be exported — especially if domestic premiums collapse — the volume and direction of copper flows will ultimately hinge on the ability of US semifabricators to ramp up output. If they manage, more of the cathodes and scrap retained in the US will be channeled into producing rods, bars, tubes and wire rod for the US market, curbing the incentive to export cathodes. Conversely, if they cannot keep pace, surplus cathodes may flow out of the US, blunting the intended effects of the tariffs.

Key markets are not facing a copper shortage, with refined output expected to rise from new smelters in China, India and Indonesia. Inventories at LME warehouses have already increased by 27,725 metric tons in the second half of July, as copper initially destined for the US was redirected in anticipation of the 50% tariff on copper product imports becoming effective Aug. 1. Furthermore, tightness in copper concentrate supply will continue to support copper prices.

Recent US measures to support domestic copper supply have focused squarely on mining and refining. Under the president's new proclamation, the Defense Production Act will require that a rising share of copper input materials mined and produced in the US must be sold domestically rather than exported — 25% in 2027, up to 40% by 2029 — shoring up mine supply for US industry. However, the order does not announce subsidies, direct funding or dedicated capacity-building measures for US semifabricators. One plausible route would be for the Defense Department to use the Office of Strategic Capital (OSC) to take direct equity stakes and secure offtake agreements with copper miners. However, current OSC funding levels could be insufficient to extend these instruments to copper — so far, resources and efforts have been concentrated on rare earth elements. Without specific incentives or support programs, the challenge for the US will be whether existing and new semifabricators can absorb the additional domestically sourced metal and scale up capacity sufficiently to replace imports.

This phased approach is advantageous as it provides the US copper industry with time to increase scrap usage and potentially restart or expand smelters, while avoiding the immediate impact of a 50% tariff on manufacturing costs and inflation. Currently, about 25% of scrap is consumed domestically, a figure expected to rise with the ramp-up of Aurubis Richmond secondary smelter in Richmond, Georgia. To meet the targets set for 2028 and 2029, the industry will need to invest in additional secondary smelters, refineries and scrap-fed semifabricators. However, it is crucial to recognize that increased domestic consumption of scrap will likely lead to reduced scrap exports from the US, which is a key source for other markets.

Overall, the interplay between domestic semifabrication, mine supply mandates and copper trade flows will define the US copper market's adjustment. Much will depend on whether US semifabricators can rapidly expand capacity and investment to replace lost imports, a process that could require several years and significant capital outlays. Although it may take several months for the global market to fully redistribute copper stocks and normalize trade flows, we anticipate only a limited impact on the LME, with our annual forecast for the LME 3-month copper price in 2025 remaining steady at $9,479/t.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.