Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 18, 2025

Leonardo Silva, Patricia Barreto and Ruilin Wang

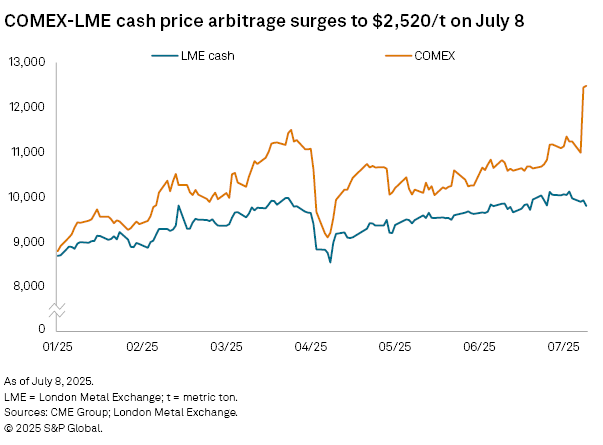

US President Donald Trump said July 8 that the administration would imminently impose a 50% tariff on copper product imports, marking a pivotal moment for the global copper market. In response, copper prices on the COMEX surged more than 13% on the same day, to exceed $12,445/t, a new record. The premium over the London Metal Exchange (LME) cash price reached a record $2,520/t; it could potentially widen to $5,000/t, or a premium of around 50%. Futures contracts had been reflecting expectations of a possible 25% tariff, but the 50% announcement took the market by surprise. This spike in COMEX copper prices underscores the scale of investor anxiety over rapid changes in trade policy and their implications for supply chains and the future market balance.

➤ Trump's tariff announcement drove COMEX-LME arbitrage above $2,500 per metric ton, a record high.

➤ COMEX-LME arbitrage could reach around $5,000/t, once US domestic stocks are depleted.

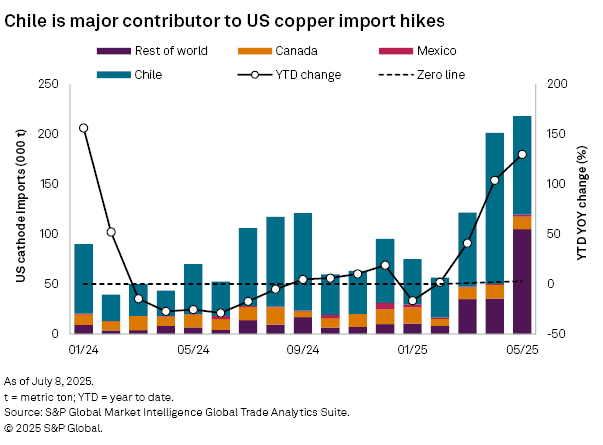

➤ Tariff expectations have led the US to stockpile in the year to date; refined copper imports are up by more than 500,000 metric tons year over year.

Following Trump's remarks, US Commerce Secretary Howard Lutnick stated that copper tariffs are expected to be implemented by late July or Aug. 1. This policy, following a lengthy Section 232 investigation, is intended to reduce US reliance on foreign copper — particularly refined copper, which is vital for national security and infrastructure. The tariffs are expected to be applied broadly, covering refined copper cathodes, wire, rods and semi-finished copper goods, mirroring earlier actions on steel and aluminum. The Department of Defense has underscored copper’s strategic importance, highlighting it as the second most utilized material in its supply chain.

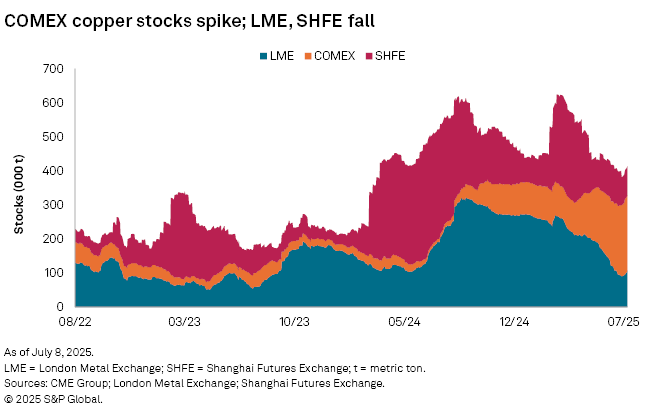

The announcement of the Section 232 investigation had already triggered dramatic shifts in global copper inventories and trade flows. In the first half of 2025, the US market responded by accelerating copper imports, leading to an increase of over 500,000 metric tons compared to the same period of 2024. This surge has pushed COMEX-registered inventories to over 200,000 metric tons, a seven-year high. Such stockpiling has resulted in a glut in the US while depleting inventories elsewhere.

Stocks at the LME have fallen sharply, down more than 60% in the year to date and standing at just above 100,000 metric tons on July 8. In China, the negative arbitrage between the Shanghai Futures Exchange (SHFE) and LME prices has discouraged imports. Chinese smelters have been exporting cathode to LME warehouses in Asia to capitalize on higher profits, rather than selling domestically.

In the first five months of 2025, copper product imports into the US increased more than 65% year over year, with refined copper accounting for nearly 70% of the volume. Refined imports grew 130% year over year in the same period and 8.3% month over month in May. Chile is by far the largest supplier of refined copper to the US, The persistently high copper imports to the US are expected to decline following the imposition of tariffs. It remains unclear whether these countries will be exempted from 50% US tariffs. If not, they are likely to redirect their copper to other major consumers such as the EU and China, aiding in replenishing LME and SHFE inventories. This redirection could pose a headwind for copper prices in these markets. As of July 9, the LME three-month and SHFE copper prices dropped 2.1% and 1.4%, respectively, compared to the previous day.

Looking ahead, the US decision to impose a 50% tariff on copper imports is causing fragmentation in the global copper market, creating sharp regional price dislocations and amplifying volatility. As the tariff regime takes hold, US copper inventories are expected to plateau and then gradually draw down as imports slow sharply and domestic supply struggles to keep pace with demand. Stocks in the rest of the world, particularly on the LME, are likely to gradually recover as trade flows adjust to the new tariff landscape. The premium of COMEX over LME is expected to persist, with the arbitrage spread potentially widening to reach 50% over the LME cash price, once the excess pre-tariff imported inventory is destocked.

A fall in US copper imports could encourage increased scrap usage and possibly restarts at US smelters, but these responses will take time and are unlikely to fully offset the loss of imports in the short term. Recent executive orders have set a clear direction to boost domestic copper supply. The administration has invoked emergency powers to streamline permitting and regulatory processes, notably expanding the FAST-41 program to accelerate federal reviews for major mining projects. This initiative now covers high-volume copper ventures such as the Resolution project in Arizona and the Pebble project in Alaska, both of which have faced years of permitting delays. By granting these projects FAST-41 status, the government aims to cut through bureaucratic hurdles and ensure timely decisions, potentially unlocking new domestic production that could eventually supply a significant share of US copper demand. It is unlikely that these operations could come online within the next four or five years, however.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.