Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 25, 2025

While markets focus on US President Donald Trump's July 8 announcement of a 50% tariff on copper imports, a noteworthy story has been unfolding for zinc, which is flashing several early warning signs of a possible short squeeze on the LME. While the situation is less acute than the copper market's dramatic squeeze in early 2024, zinc inventories are critically low, and the market structure is showing signs of tightness. Any further disruption — such as the US imposition of tariffs on zinc imports after the conclusion of the critical minerals Section 232 investigation — could push the market into a genuine short squeeze.

➤ Zinc inventories on the London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE) cover just over four days of consumption.

➤ Mild backwardation and blocked LME-SHFE arbitrage signal short-term tightness.

➤ A Section 232 investigation on critical minerals and policy risks could trigger a short squeeze.

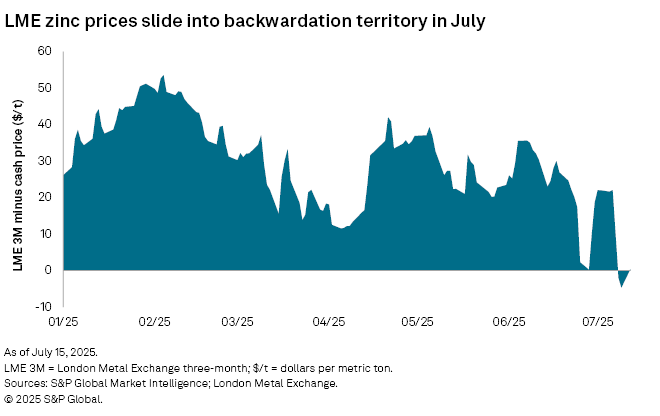

The LME zinc cash-to-three-month spread slipped into backwardation on July 9, with spot prices trading at a premium to futures. The backwardation has been mild, at a maximum of $4.70 per metric ton, and flipped back to a slight contango July 14. While this is far from the extreme and persistent backwardation that copper experienced during its squeeze, it is a sign that buyers are willing to pay up for immediate metal, possibly triggered by news about copper, and that short positions may soon find it more difficult to source zinc for delivery if the trend continues.

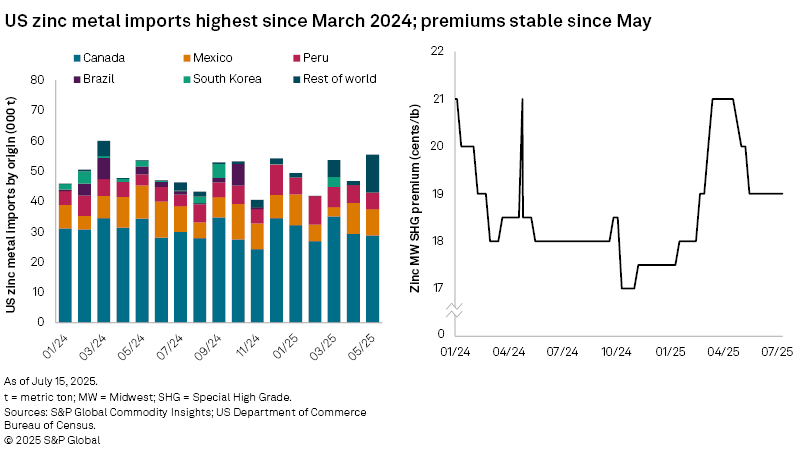

The policy backdrop only heightens the risk. The US government's Section 232 investigation into critical minerals, including zinc, was launched in April, just two months after a similar probe into copper. This has raised the specter of new trade restrictions or tariffs on zinc imports, echoing the rapid escalation in copper premiums observed in early 2025 after the Section 232 announcement. Through May, US refined zinc imports totaled nearly 250,000 metric tons, down 4.1% year over year. Canada is the leading exporter of zinc to the US, with 67.7% of 2025 US imports coming from Teck Resources Ltd.'s Trail and Glencore PLC's Valleyfield smelters, followed by Mexico, with 15.2% from Industrias Peñoles SAB de CV's Torreon smelter. The threat of new barriers has made both traders and industrial users nervous. The US Midwest SHG premium, which spiked in March on copper fears, serves as a reminder of how quickly policy can drive physical tightness and price surges.

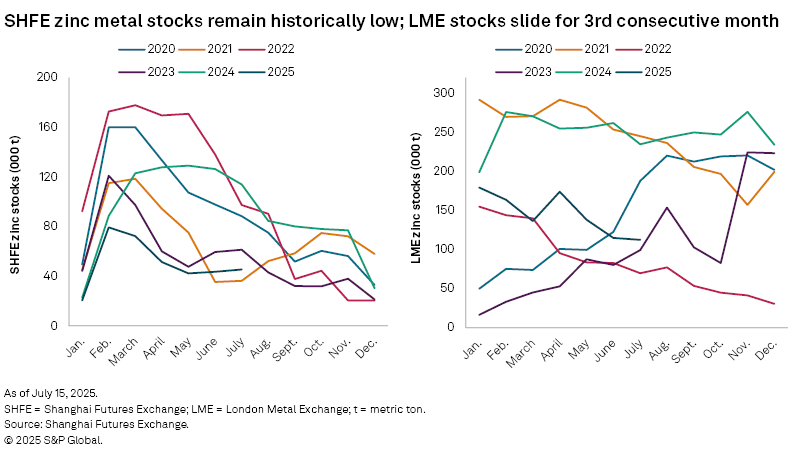

The most striking indicator is the state of visible inventories. LME zinc stocks dropped to just 113,400 metric tons on July 11, which covers only about three days of global demand. The inventories in China are also scraping multiyear lows at 49,980 metric tons, equivalent to nearly one day of global use. This reflects a combination of factors: reduced refined zinc output due to persistently low treatment charges (TCs) and the unavailability of official US warehouse stocks. In contrast to the international exchanges, US inventories have probably built up through 2025 on steady imports and softer domestic demand, and do not exhibit the same acute tightness as seen on the LME and SHFE.

Together, the LME and SHFE inventories amount to just over four days' worth of global zinc consumption — a historically thin margin that leaves the market highly exposed to any supply disruption or demand spike. This level of physical tightness is rare, and even though it is not yet at the crisis levels as those of copper in 2024 (when combined visible stocks fell below two days), it is enough to put traders and end-users on high alert.

Adding to their sense of unease is the closure of the SHFE-LME arbitrage window. With the SHFE-LME price ratio hovering around 8.1, it is unprofitable to export zinc from China to the LME, effectively blocking a major relief valve for other markets outside of China. This isolation is reminiscent of the copper squeeze, where a similar breakdown in global price relationships led to a scramble for available metal. For now, zinc has not experienced a similar frantic movement of physical stocks, but the ingredients for such a scenario are quietly accumulating.

The economics of zinc smelting are reinforcing physical supply constraints, with smelters cutting refined output, squeezed by record-low annual contract TCs. The benchmark reached $80/t in 2025, which is a 51.5% year-over-year fall, and spot rates remained historically depressed despite recent upticks. This mirrors the copper dynamic, where low TCs deepened the squeeze.

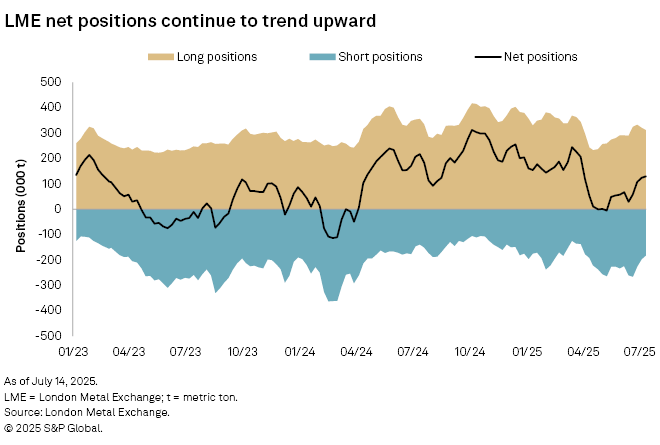

Speculative positioning rounds out the picture. Investor funds have built up significant short positions in zinc, although net positions remain long, betting on continued tightness and the potential for further price gains. However, the scale of speculative inflows remains moderate, compared to the wave of capital that flooded copper futures in 2024, when more than $25 billion poured in and forced short sellers to cover at any price. The speculative presence for zinc is strong enough to support prices, but not yet at its peak that typically precedes a violent short squeeze.

Considering all the factors — critically low inventories (LME and SHFE combined just over four days), market structure showing a mild backwardation, closed arbitrage window with China, risk of smelter output cuts, and elevated but not extreme speculative positioning — the zinc market seems to be on the edge. The warning signs point to the risk of a short squeeze, especially if the Section 232 investigation leads to new US trade measures or if inventories draw down any further. While zinc has not yet reached the tipping point that copper experienced, the combination of policy uncertainty and tight physical fundamentals indicates the situation could escalate quickly.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.