Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — August 29, 2025

By Seth Shafer and Sarah James

Nexstar Media Group Inc. aims to acquire fellow broadcaster TEGNA Inc. in a deal that will test the US Federal Communications Commission's deregulatory approach under Chairman Brendan Carr. The deal would position Nexstar to compete against larger media and technology companies.

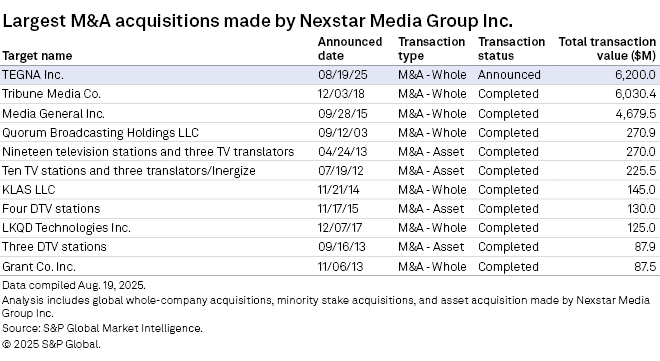

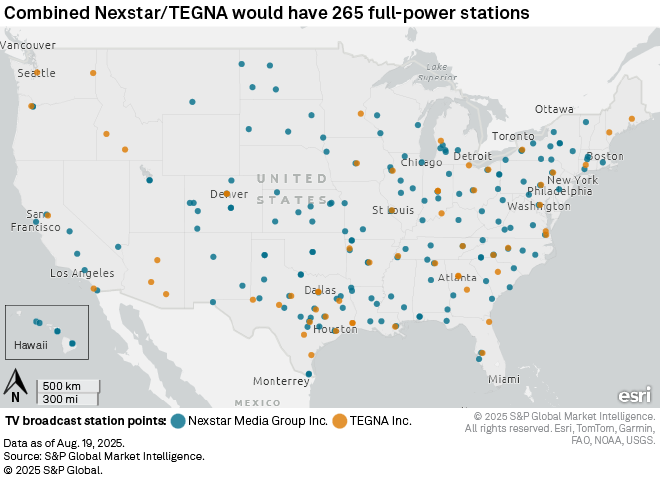

The $6.2 billion transaction would expand the company's portfolio to 265 stations, reaching 80% of US households. Including assumed debt, it would be the largest acquisition in Nexstar's history.

The combined entity would operate in 132 of the 210 markets in the US, including nine of the top 10 largest. In addition to reaching new areas, the addition of TEGNA stations would expand Nexstar's local presence in 35 market where Nexstar already has stations, setting the company up for operational efficiencies and greater leverage when negotiating retransmission consent fees from pay TV providers.

However, before Nexstar can reap any of those expected benefits, the deal must first win regulatory approval — a feat that will require the FCC to change or abandon a number of rules that have historically limited broadcast M&A. These limits include the national ownership cap, a federal law that prohibits a single broadcast station group from owning TV stations that together reach more than 39% of US TV households, and FCC rules limiting the number of stations a single entity can own within a single market.

Access the top 50 commercial TV station groups and TVHH reach data in Excel format.

Nevertheless, Nexstar Chairman and CEO Perry Sook is confident that the deal would pass regulatory muster despite the Trump administration's deregulatory efforts.

"The transaction meets the deregulatory moment where it is, and we believe the case is compelling," said Sook on a call following the announcement of the transaction. "We said before that arbitrary limitations on local broadcast ownership can no longer make sense in today's media economy."

On the national ownership cap, Sook said the FCC is refreshing the record on a proposal seeking comment on whether the cap should be retained, modified or eliminated. The reply comment period on that proceeding closes Aug. 22.

Regarding local ownership limits, Sook cited the US Court of Appeals for the Eighth Circuit's decision in July to vacate a rule that prohibited any television broadcast station owner from owning two of the top four rated stations in a given market. Notably, the court left in place a duopoly rule that prevents a single operator from owning more than two TV stations in any market.

According to Sook, without any divestitures, the TEGNA acquisition would result in some market where Nexstar would own three or four stations.

"We have yet to engage with the regulatory agencies on a formal basis to have that discussion," the CEO said. "But my gut would tell me that if there are divestitures, it will have a minimal effect on the EBITDA of the company."

Based on Sook's comments and past statements from Carr at the FCC, Nexstar will not likely have to make significant divestitures to get regulatory approval for the TEGNA deal, said S&P Global Market Intelligence Kagan analyst Justin Nielson.

"There may be some smaller to midsize markets where they may have to divest, but I mean, it's a new FCC, who knows?" Nielson said in an interview. "They seem pretty open to removing all restrictions on ownership for stations."

Carr did not immediately respond to a request for comment on the FCC's merger review process or the timeline for a vote on the deal's approval. Nexstar and TEGNA officials said in statements that they expect the deal to close in the second half of 2026.

"We look forward to reviewing the application when it is filed and assessing the public interest equities," an FCC spokesperson told S&P Global Market Intelligence.

Sook framed the transaction as a necessary countermeasure against Big Tech's growth in the digital advertising and sports media rights businesses.

"We think we are the last bastion of local journalism in our marketplaces in any meaningful way," Sook said. "We don't think anyone wants their news delivered by a chatbot, and that's where we're headed if we can't become a bigger company, a stronger company to attempt to compete with Big Tech."

Opponents of industry consolidation contend that the imposition of costly retransmission consent fees will inflict harm on consumers.

"We know exactly what will happen because of a major broadcaster consolidation — more blackouts and increased monthly bills," said America's Communications Association President and CEO Grant Spellmeyer. "The government should reject any unlawful combination that would be a raw deal for consumers."

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Segment