Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 13, 2025

By Zach Ciampa, Sheryl Kingstone, and Jordan McKee

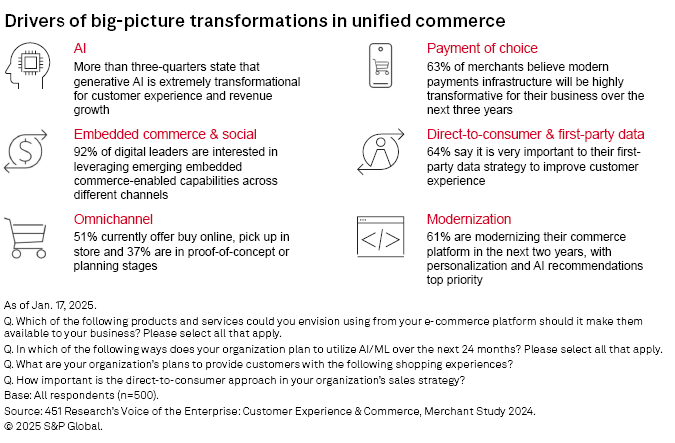

The National Retail Federation event in 2024 was all about artificial intelligence. The same can be said for NRF 2025; however, that was to be expected. Held in New York annually in January, this year's event drew a larger crowd at an estimated 41,000 attendees and at least 1,000 exhibitors to discuss the latest in retail technology innovation. The state of retail has been in transition over the past decade, with the digital in-store experience taking a back seat to digital commerce experiences. This year's report will focus again on the top 5 innovation impacts helping the industry compete in the experience economy.

Once merchants get through the tech debt holding them back to reduce customer friction points, the increasingly omnichannel retail environment offers new revenue opportunities. Although technology can smooth friction, it requires thoughtful investment by retailers. At NRF, technology vendors vied for merchants' attention to revitalize the retail renaissance through improved customer experiences. 451 Research's Customer Experience & Commerce, Merchant Study 2024 shows that the biggest spending opportunities are for commerce and the overall CX platform. Customer interactions over digital channels are now more nuanced, personalized, and interactive via mobile, social platforms and video channels along the customer journey. As relationships become less transactional between people, and more nuanced and tangled interactions between people and the systems and devices they use daily, leveraging real-time conversation to discover, engage, and transact through SMS, video and chat is becoming the norm both online and in-store.

Context

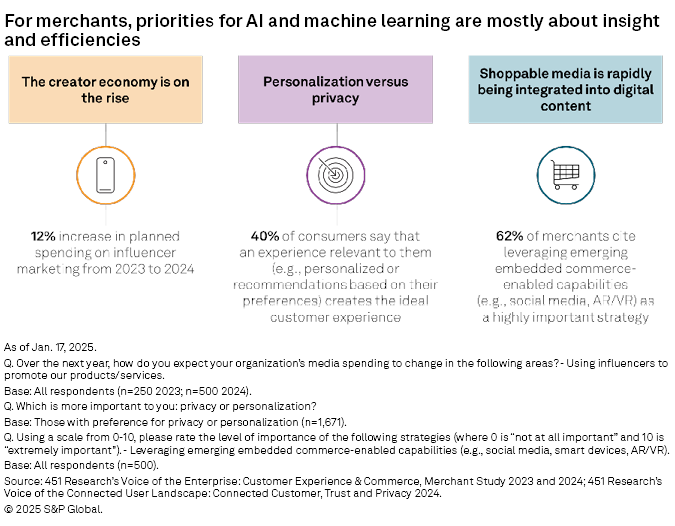

Nearly nine in 10 consumers state that having a negative experience — either online or in-store — makes them less likely to interact with the brand or retailer in the future, so the stakes are high for staying relevant in the eyes of the consumer. As retailers strive to keep up with rising customer expectations, they are looking to use AI, data and analytics to gain insights into customer behaviors and company performance.

It is also important to embrace new digital channels for customer engagement and identify moments of influence during the buying journey with embedded commerce across social media. As merchants modernize their infrastructure, they will be looking across the entire customer journey to reduce friction points and increase revenue opportunities.

At NRF, we continue to see a revitalization of the in-store experience, with a noticeable shift in connecting physical assets to digital experiences that leverage more unified commerce approaches to reduce customer friction points, and improve revenue and margin optimization.

Digitizing the store to improve path to purchase

There is still plenty of potential for RFID, 5G and Wi-Fi, computer vision, biometrics, mobile checkout, and predictive and generative AI to be combined in a variety of approaches to ensure more efficient operations and improve the CX from supply to the sales floor. We still see many of the experiences in proof of concept in specific locations, such as digital mirrors, displays and frictionless payments, but we also see deployments growing to create more immersive in-store experiences.

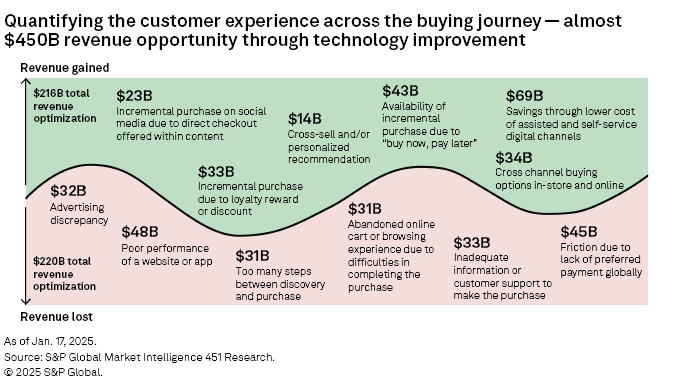

Infrastructure options for connectivity from companies like Ericsson ADR, Verizon Communications Inc. and Cisco Systems Inc. coupled with internet of things, connected products and AI enhancements to provide data for efficient operations and experiences is still just scratching the surface of its potential to help the store associate or end customer. Vendors such as Amazon Web Services Inc., NewStore Inc., Salesforce Inc., Tote.ai, Lightspeed Commerce Inc. and Manhattan Associates Inc. provide applications that can improve the path to purchase by reducing friction in discovery, fulfillment availability across channels, product recommendations, streamlining checkout and even self-service in-store. This can equate to solving for part of an almost $450 billion revenue opportunity through technology improvements.

Beyond GenAI is agentic AI

Last year was all about predictive and generative AI. This year is all about autonomous experiences to scale the personalized shopping journey. Retailers are poised to navigate a shifting landscape transformed by generative AI, unified commerce and agentic AI. As organizations look to scale personalized, real-time experiences across the customer journey, they will need to fast-track foundational improvements to take advantage of agentic AI, a framework in which AI-powered agents are deployed to analyze data, make decisions, and take action without human intervention.

These technologies promise to reshape customer engagement and operational efficiency, demanding strategic agility and robust data strategies. Organizations that effectively integrate these advances will be well positioned to deliver personalized, seamless experiences, to maintain a competitive edge in an increasingly complex digital ecosystem. AI agents will help retailers not only with retail operations, including app development and data-driven analysis, but also act as personal shopping assistants.

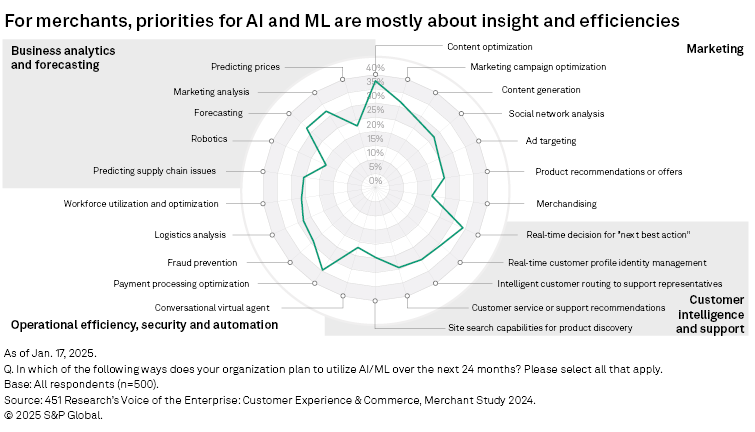

Our Merchant Study 2024 showed the variety of use cases retailers are prioritizing for predictive and generative AI, which is the foundation for achieving next-gen agentic AI capabilities. At NRF, Microsoft Corp., International Business Machines Corp., SAP SE, Salesforce, Glean, UiPath Inc., MTLAB, Coveo Solutions Inc. and Algolia demonstrated capabilities to help with search, discover and purchase, potentially across different channels.

Leveraging large language models, retrieval augmented generation interfaces with access to both structured and unstructured data, and a conversational interface, retailers can embed experiences into websites and mobile apps, going beyond the traditional chatbot that was hardcoded with less reasoning capabilities. Using AI and the new user interface can guide store associates and customers. Our Customer Experience and Commerce 2025 research indicates that service is the new marketing and that it has taken on a critical role in shaping brand perception and driving business success. Yet, at NRF, vendors showcasing customer service technology were almost nonexistent.

Talkdesk Inc. and Salesforce were the most prominent providers demonstrating autonomous customer service across the entire journey using agentic AI for a variety of use cases for specifically retail conversational commerce. InfoBip also demonstrated its conversational marketing and service engagement for improved customer engagement across a variety of different channels.

Modernizing the unified commerce experience

Keeping up with the sheer velocity of digital experiences amid growing consumer appetites is driving businesses toward a more flexible and iterative technology stack. The world is in "digital by default" mode, out to give customers dynamic yet consistent experiences across a wide array of emerging devices and channels, which is an ongoing and increasingly pressing challenge. Many retailers are still hamstrung by legacy technology that is monolithic and rigid, inhibiting agility and innovation, and resulting in IT staff struggling to keep up with line-of-business demands.

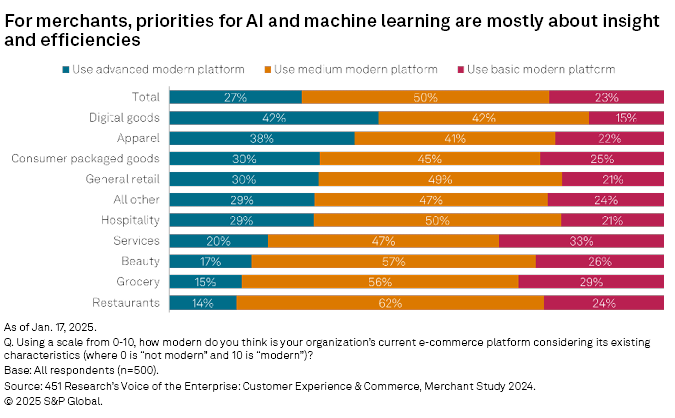

A decade ago, everyone was preaching omnichannel, but 10 years later, it is still far from reality. While our CX and merchant study stated that roughly half of merchants use a modern platform, only a little over a quarter actually do on average. Key future investment areas are API-first approaches, microservices-based architectures, and advanced data security. These critical components are not yet being implemented by many retailers, which still need to implement AI-driven personalization, omnichannel capabilities and edge computing for improved performance.

When it comes to modernizing their commerce platforms, 61% expect to do so in the next two years. Integrated payments, personalization and AI recommendations are top priorities, with the goal of easing checkout through integration via multiple gateway providers and/or offering preferred checkout options. At NRF, many of the incumbent commerce technology vendors with broad suites showed interest in injecting more composability into their offerings. These included API-first architectures from the likes of Adobe Inc., Salesforce and Shopify Inc., while specialists such as Commercetools and Elastic Path are gaining momentum in the market.

One area that is important for composability and components is the digital payment ecosystem, to provide a streamlined checkout process and payment flexibility with an embedded buy button. For example, Salesforce allows for embedded commerce experiences in partnership with Stripe Inc. Shopify has Shop Pay, which enables buyers to check out with one tap using their securely stored payment credentials. Shopify also works with Affirm Holdings Inc. to power Shop Pay Installments. A variety of other players were focused on streamlining the guest checkout flow via a one-click experience, including PayPal Fastlane and Skipify, which leverage pre-enrolled payment credentials and shipping information to reduce data entry.

Desire for more immersive content

Retailers face heavy demand for new content and must manage a surge of content types and formats across departments, ecosystem partners and customer touchpoints. The use of GenAI is also adding to the volume and velocity of content, as well as raising expectations that content will be dynamic and optimized to the contextual experience. In our 2024 study, 83% of consumer-facing businesses agreed that their organizations currently face a shortage of interesting/new content. We also found that 61% agree that their organization needs a better way to manage/scale their content across channels (e.g., website, social media, mobile).

On the surface, the issue would seem to be a lack of content to feed the demand. However, when factoring in areas such as user-generated content, which often already exist on the internet, and generative tools such as Adobe Firefly and Canva Dream Lab, which can take singular assets and turn them into thousands of variations, it then becomes a matter of simply accessing that content for deployment, rather than starting from square one. The goal should be to deliver more contextually driven consumer experiences, which means brands must be able to scale production and curation while also providing insight for content optimization.

Data-driven experience economy

At prior NRF events, there was much discussion around the use of customer data. Growth in customer data drove a demand for new ways to unify that data and activate it across different channels of engagement. Requirements for a modern 360-degree view of the customer and real-time customer profiles to improve CX across the entire journey will likely accelerate investments in customer intelligence platforms.

These platforms provide more than just a data repository for unstructured and structured data — their capabilities allow for a real-time customer profile graph that is actionable across multiple teams and stakeholders, from marketing to product development to customer service. Adobe, Salesforce, Microsoft and Twilio Inc. showcased their advances with their own approaches to a data platform. There were also vendors such as Treasure Data and Amperity offering their approaches to unifying and activating customer data.

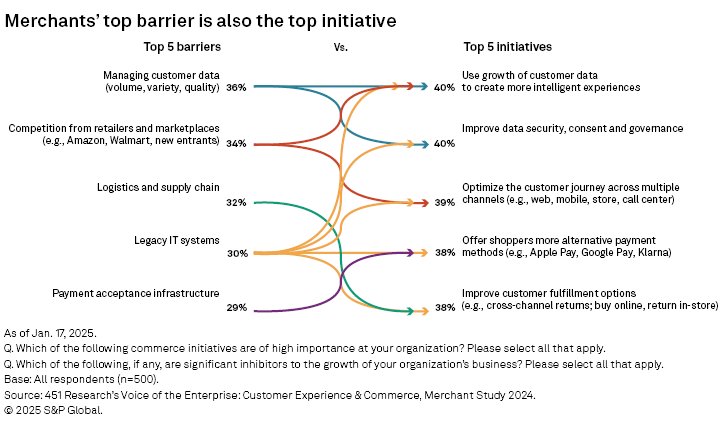

Understanding customer data is essential to improving the experience both in physical and digital stores. Our research shows that quantifying the customer experience across the buying journey to address points of friction using technology advances represents at least a $450 billion opportunity. Many of the friction points experienced can be improved with better use of data. This would include gains such as incremental revenue opportunities due to a loyalty reward or discount, personalized cross-sell opportunities, and shortening the path to purchase for a faster journey. Yet, the top barrier for merchants is managing customer data, and putting it to use to create more intelligent experiences.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment