Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 Aug, 2017 | 14:15

By Keith Nissen

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

U.S. Consumer Insights surveys, conducted over the past few years, indicate steady growth in online VOD subscriptions.

U.S. Consumer Insights surveys, conducted over the past few years, document the steady growth in online VOD subscriptions, both in terms of total market penetration and multiple subscription households.

U.S. internet households subscribing to at least one online VOD services has grown from 54% in 2014 to 65% as of first quarter 2017. The number of online VOD subscriptions per household has also continued to rise. For instance, our third quarter 2014 survey results found that 60% of surveyed internet households subscribing to an online VOD service had multiple subscriptions. As of first quarter 2017, our survey shows that 69% of online VOD subscriber households have multiple subscriptions.

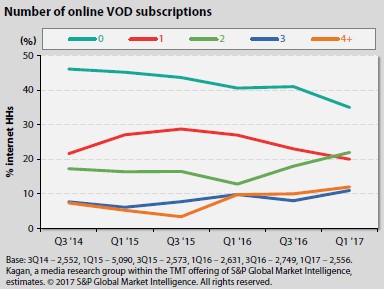

The chart below illustrates the growth in multiple subscription households since first quarter 2016. The survey results indicate that internet households with two subscriptions grew four ppts YoY to reach 22% as of first quarter 2017. Households with three or more subscriptions have also shown positive YoY growth. The survey data reveals that this YoY growth is primarily attributable to millennials (adults age 20-36).

For more information about the terms of access to the raw data underlying this survey, please contact support.MI@spglobal.com.

Data presented in this article was collected from Kagan U.S. surveys conducted from September 2014 through first quarter of 2017. The online surveys totaled 2,552 internet adults (Q3 2014), 5,090 (Q1 2015), 2,573 (Q3 2015) and 2,631 (Q1 2016), 2,749 (Q3 2016) and 2,556 (Q1 2017). All of the surveys have a margin of error of +/-1.8 ppts (or better) at the 95% confidence level. As of 2017, Millennials are adults 20-36 years of age. Gen X adults are 37-51 years old. Boomers/ senior adults are 52 years or older. For analytical purposes, Gen Z adults (18-19 years old) were aggregated into the Millennials category.

Consumer Insights is a regular feature from Kagan, a research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.