Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 30, 2025

By Seth Shafer

Netflix Inc.'s run of strong quarterly earnings continued in the second quarter of 2025 as the streaming giant reported solid growth across metrics including revenue, operating margin, net income and free cash flow.

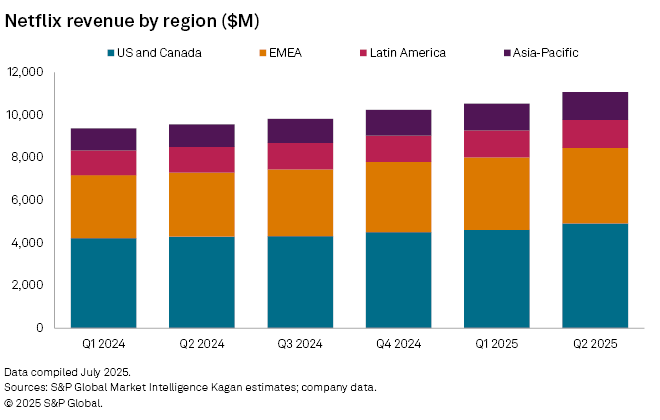

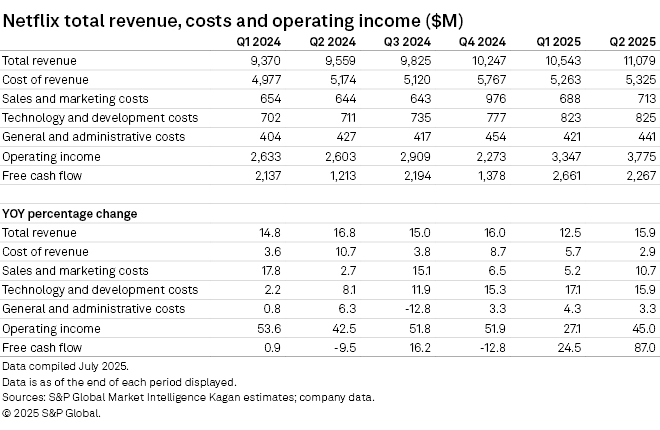

➤ Total global revenue of $11.08 billion in the second quarter rose by 15.9% on an annual basis, with increases coming across all major regions.

➤ Netflix generated $3.78 billion in operating income with an operating margin of 34.1% (up from 27.2% in the prior year quarter). Free cash flow of $2.27 billion rose by 87% compared to $1.21 billion in the second quarter of 2024.

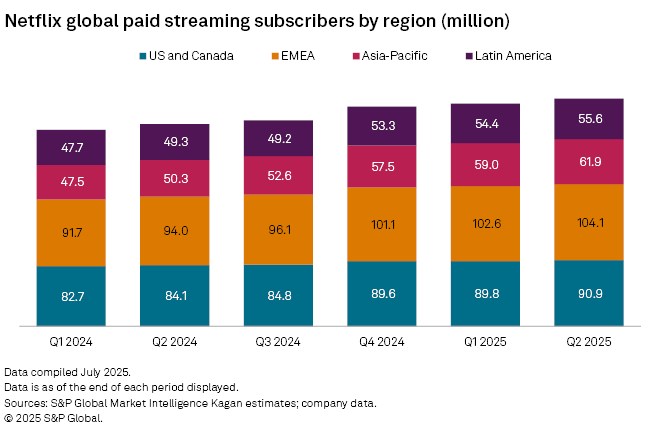

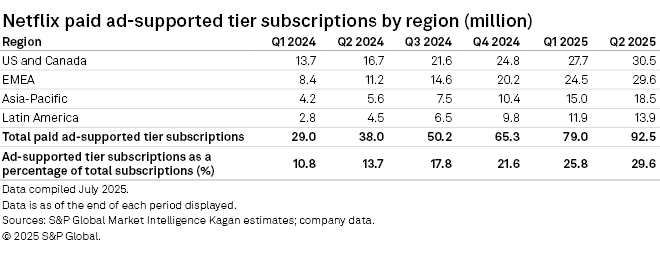

➤ S&P Global Market Intelligence Kagan estimates that Netflix’s paid global subscriber base was 312.5 million at the close of the second quarter. Approximately 92.5 million of those total paid subscriptions — roughly 30% — were from subscribers to the company’s ad-supported tier.

The US & Canada remained Netflix’s largest revenue contributor in the second quarter by region and generated $4.93 billion in revenue, up 14.7% from the prior year quarter. Revenue growth in EMEA and Asia-Pacific grew at slightly faster rates on a percentage basis at 17.6% and 24.1%, respectively, but represented sizably lower revenue bases versus the US & Canada.

Access data discussed here in Excel.

Despite ongoing expenditures for programming content, continued investments in building out its advertising technology and expanding into games, the company has successfully controlled costs in recent quarters. Cost of revenue (which includes programming expenses) has risen, but annual increases have been in single-digit percentages for the last four quarters and well below corresponding revenue growth.

Of Netflix’s reported costs, technology and development costs have grown the fastest in 2025, likely reflecting in part the company’s push to bring its ad tech platform entirely in-house, which was completed during the second quarter. Netflix initially partnered with Microsoft to power its advertising platform, but now manages all aspects of advertising itself in the 12 markets where it offers an ad-supported subscription option.

Our subscriber estimates for the first half of 2025 show Netflix tacking on 10.9 million net new paid subs since the close of 2024 to reach 312.5 million. Asia-Pacific has experienced the fastest subscriber growth on a percentage basis, but still trails EMEA and the US & Canada by a wide margin for total subscribers. We believe Netflix grew subscribers across all regions in the second quarter, although price hikes in the US rolled out in early 2025 resulted in US & Canada subscriber growth slowing sequentially and annually. Netflix stopped reporting paid subscribers in the first quarter of 2025, with subscriber totals prior to that date reported by the company.

Netflix has also declined to disclose how many of its paid subscribers are on its ad-supported tier, choosing instead to periodically reveal how many total monthly active users/viewers it believes are viewing ads on Netflix. Our estimates are for 92.5 million global paid ad tier subscriptions at the close of the second quarter, with the US & Canada and EMEA combining for nearly two-thirds of that total. Netflix offers its ad-tier plan in just 12 markets worldwide (Australia, Brazil, Canada, France, Germany, Italy, Japan, Mexico, South Korea, Spain, the UK and the US), but they include some of the world’s largest advertising markets and represent over 70% of the company’s global subscriber base.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.