Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 5 Jul, 2023

By Sarah Cottle

Today is Wednesday, July 05, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we put the spotlight on the Federal Reserve's annual bank stress test, which is designed to assess big banks' ability to keep lending during a severe recession. The stress test results this year showed smaller hypothetical losses compared with the year prior. In the aggregate, the banks' common equity Tier 1 ratio fell by a maximum of 2.3% in the simulated recession, compared with a decline of 2.7% in 2022. The aggregate loan loss rate was 6.4%, flat with 2022. This year's parameters incorporated large declines in residential and commercial real estate prices. The 23 large banks that participated in the stress test have built bigger capital cushions over existing requirements than the previous year — $231.54 billion in all, up from $220.90 billion, according to S&P Global Market Intelligence data.

Business activity across the four largest developed world economies — US, UK, Japan and eurozone — rose for a fifth month running in June, according to provisional "flash" Purchasing Managers' Index data compiled by S&P Global. However, the rate of growth slowed from May's 13-month high to register the weakest expansion of output since February. The recent growth surge seen in the spring has lost momentum, and almost petered out in the eurozone, as a deepening manufacturing downturn has been accompanied by slower growth in service sector activity. Encouragingly, inflation pressures have continued to abate, disappearing almost entirely in manufacturing and cooling in services.

Earnout payments were included in M&A deals totaling $26.86 billion globally between Jan. 1 and June 19. Private equity exits accounted for more than 22% of that total, their highest share since 2020, according to Market Intelligence data. The portion of total deal value contingent on future performance ranged from 5% to 78% among the 10 largest private equity exits to include earnouts over the last 12 months.

The Big Number

Trending

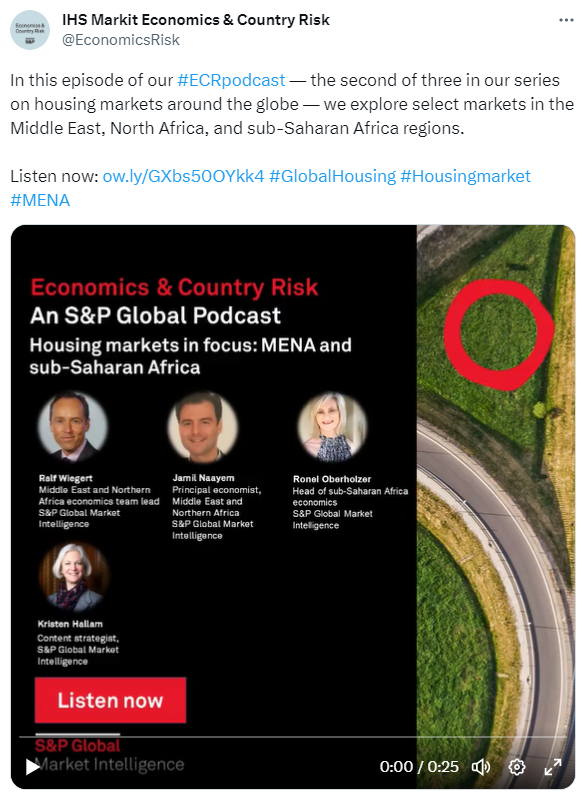

—Listen to the Podcast by S&P Global Market Intelligence and follow @EconomicsRisk on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Roma Arora

Theme