Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 7 Feb, 2023

By Sarah Cottle

Today is Tuesday, February 07, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we take a close look at M&A outlook in 2023 for multiple sectors. According to a survey by S&P Global Market Intelligence, over 40% of U.S. bankers will possibly consider an acquisition this year. Almost 11% of the participants showed their interest in a sale. Slow loan growth and increasing hiring expenses could persuade institutions to sign merger deals. 451 Research conducted a similar survey, which found that players in the tech industry will see accelerated M&A activity in 2023. 46% of respondents expect an increase, subject to favorable acquisition prices and industry growth. In the utilities sector, companies could consider minority interest buyouts, mainly due to rising interest rates, which have reduced private equity firms' interest in purchasing utility assets.

Initial public offerings and M&A deals by special purpose acquisition companies dropped in 2022, amid an uptick in interest rates and regulatory scrutiny. Only 86 companies filed for IPOs last year, compared to 610 in 2021, according to S&P Global Market Intelligence data. Blank check companies had 187 deals in 2022, down from 265 a year ago.

Total capacity retirements in the power sector increased 50.7% to 16.0 GW in 2022, from10.6 GW in 2021, according to an S&P Global Market Intelligence analysis. Coal-fired resources made up most of the capacity, totaling 12.1 GW. Natural gas-fired retirements totaled 2.5 GW, while nuclear resources represented 5.1% of retired capacity.

The Big Number

Trending

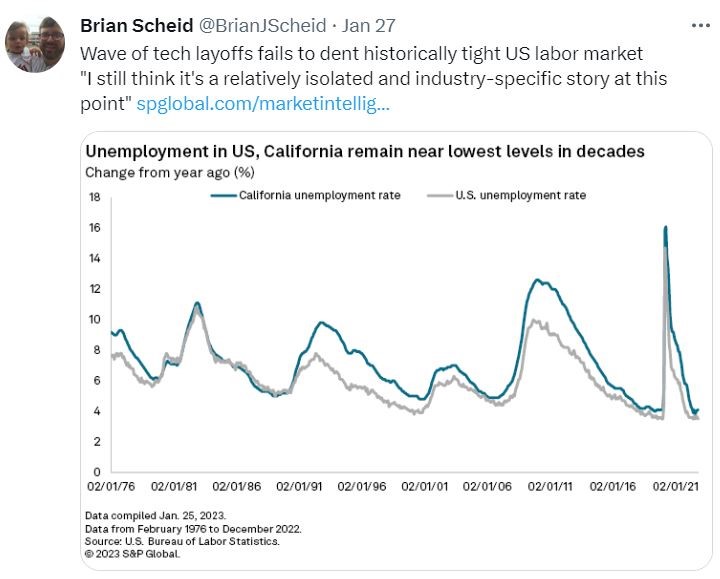

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter

Data That Delivers

When markets are unpredictable, get transparent insight with our integrated ecosystem of data, analytical solutions, and delivery channels. We help clients navigate market volatility, achieve their digital transformation goals, and automate workflows.

Explore the S&P Global Marketplace to find fundamental and alternative datasets available seamlessly via Cloud, Data Feed, API Solutions, and Capital IQ Pro, along with expert analysis you won´t find anywhere else.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Written and compiled by Waqas Azeem

Theme