Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 1 Feb, 2023

By Keith Nissen

Growth returned in 2022 to most U.K. digital entertainment market segments, including streaming video, gaming and online music, as well as cinema attendance. Video cord cutting remained minimal, good news for British multichannel TV operators.

* Survey findings show that internet adults in the U.K. spend over seven hours per day on digital entertainment.

* Overall adoption of subscription video-on-demand services reached 84% in 2022 with Netflix and Amazon Prime Video the most popular SVOD services. Nine out of 10 internet adults reported watching free online TV/video content.

* One-third (33%) of internet adults said they spend the majority of their daily TV/video viewing hours watching online video content, up from 26% in 2022.

* Forty-two percent of internet adults reported subscribing to an online music service, up significantly over 2021.

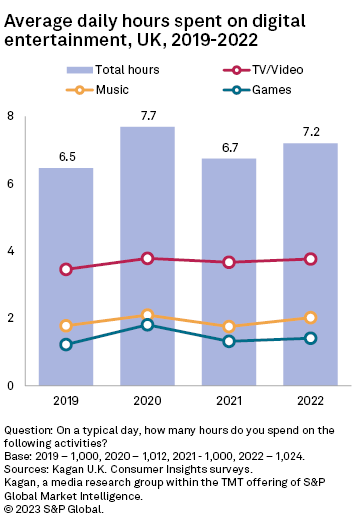

A comparison of historical data collected from Kagan U.K. Consumer Insights surveys over the past four years shows that the average number of hours spent daily on digital entertainment overall rose substantially (7.7 hours per day on average) during the pandemic year 2020 when lockdowns and work from home were commonplace. Total digital entertainment consumption fell back to near pre-pandemic levels in 2021 (6.7 hours per day on average) followed by a resurgence in 2022 to an average of 7.2 hours per day, which makes sense since similar multiyear results for TV/video viewing (average 3.8 hours/day), music (average 2 hours/day) and gaming (average 1.4 hours/day) all showed modest growth in 2022.

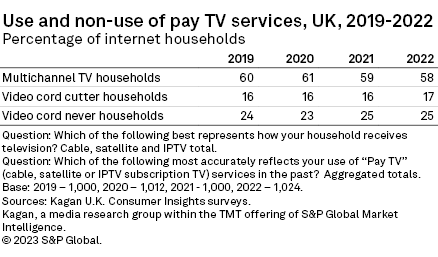

One trend that is not growing in the U.K. is video cord cutting. Historical survey data reveals that multichannel TV subscriptions have fallen only 2 percentage points over the past four years to 58% in 2022. The percentage of video cord cutters in the U.K. inched upward 1 percentage point this past year but remained within the survey margin of error. The percentage of young adults choosing to not subscribe to a multichannel TV service (aka video cord nevers) also remained flat year over year at 25%.

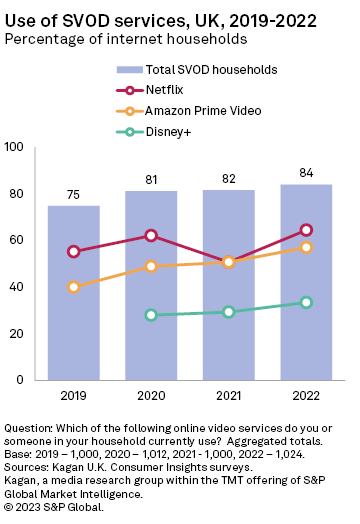

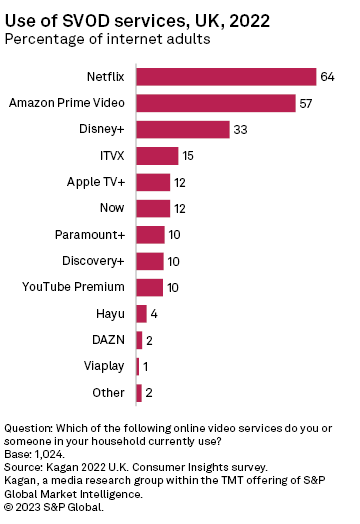

Overall adoption of online SVOD services in the U.K. rose to 84% in 2022, up 9 percentage points over the past four years. The top three SVOD services all showed an increase in users last year. Following a pandemic surge in 2020, Netflix showed a decline in users in 2021 (partly due to price increases) but rebounded strongly this past year with 64% of internet households using the service. Amazon Prime Video and Disney+ saw households using the services grow to 57% and 33%, respectively, in 2022.

Netflix and Amazon Prime Video continued to be the two dominant SVOD services in the U.K. in 2022. ITVX is a newly launched online video service that combines content from ITV Hub, Hub+ and BritBox. Sky renamed its Now TV SVOD service to simply Now. Paramount+ and Viaplay also launched in 2022 in the U.K.

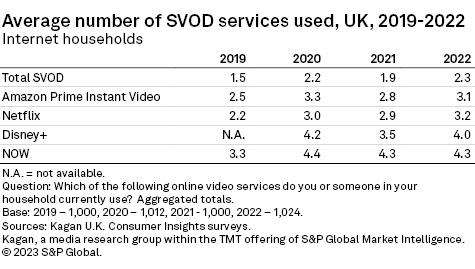

Following the same pattern as other U.K. digital entertainment trends, the average number of SVOD services subscribed to — or SVOD stacking — rose substantially during the pandemic (2.2 subscriptions on average), fell in 2021 and rebounded to 2.3 SVOD subscriptions in 2022. As of 2022, Amazon Prime Video and Netflix users subscribed to three SVOD services, on average, up from two subscriptions in 2019. Disney+ and NOW users each averaged 4 SVOD subscriptions in 2022.

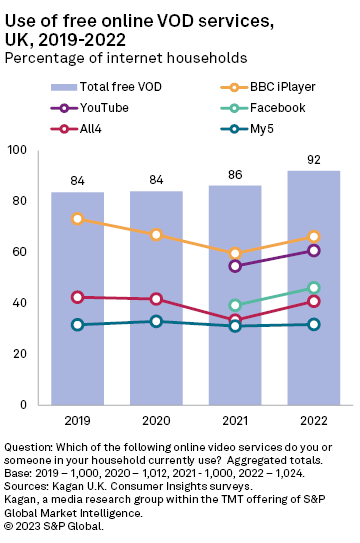

The use of free online video services also grew substantially during 2022, totaling 92% of U.K. internet households. BBC iPlayer continues to be the most popular free online video service, followed by YouTube, Facebook, All 4 and My5. With the exception of My5, all of the major free online video services showed strong year-over-year user growth in 2022. Increased viewing of SVOD and free online video content in 2022, combined with a modest increase in total TV/video viewing hours suggests a shift in TV viewing behavior away from traditional live (linear) TV.

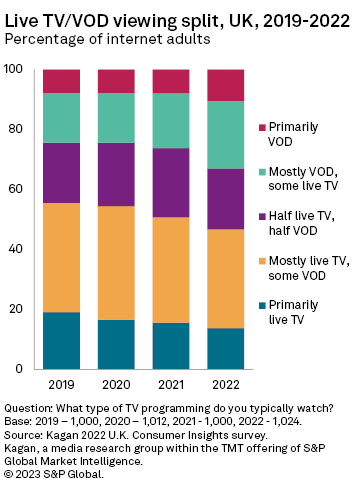

This historic shift in TV viewing behavior can be seen in the split between live TV and VOD viewing. For instance, the percentage of U.K. consumers who said they watch primarily live TV and those watching mostly live TV each shrank 2 percentage points year over year. In contrast, those who said they watch mostly VOD with some live TV increased 4 percentage points, and those watching primarily VOD content grew 3 percentage points last year. As of 2022, one-third (33%) of U.K. internet adults reported watching more on-demand video than live TV.

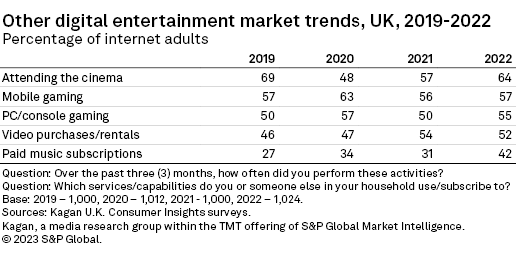

Other U.K. market segments that also rebounded during 2022 include cinema attendance, which has steadily expanded from a low of 48% during the pandemic (2020) to 64% last year. Online video rentals and purchases have climbed over the past two years to 52% in 2022, due to SVOD services integrating transactional VOD, or TVOD, titles into their video libraries.

Online subscription music services also showed strong growth in 2022, expanding 11 percentage points to 42%. However, overall use of online music (free and paid services) grew only 4 percentage points to 72% in 2022. This suggests that most of the growth in paid online music services was due to existing users converting from free to paid subscriptions. Spotify remains the most popular online music service in the U.K. with 38% of internet adults using the service, followed by Amazon Prime Music (23%) and YouTube Music (20%). The percentage of internet adults playing PC/console games rebounded in 2022 to near 2020 pandemic highs at 55%, while mobile gaming remained essentially flat year over year at 57%.

The Kagan European Consumer Insights surveys were conducted during December of each year shown with approximately 1,000 internet adults per country in the U.K., France, Germany, Italy, Sweden and Poland. Each survey has a margin of error of +/-3 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number. Survey data should only be used to identify general market characteristics and directional trends.

To submit direct feedback/suggestions on the questions presented here, please use the "feedback" button located above, directly under the title of this article. Note that while all submissions will be reviewed and every attempt will be made to provide pertinent data, Kagan is unable to guarantee inclusion of specific questions in future surveys.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.