Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 19, 2023

How fast is inflation falling, and how resilient is economic growth? Further insights into these two key issues facing policymakers and markets around the world will be provided by the upcoming PMI surveys, commencing with flash PMI data for the major developed economies on 24th July and followed by final data in early August. The surveys will provide details on industrial prices, service sector inflation, the detailed sectoral pattern of demand -notably the recent upswing in consumer services spending - as well as clues as to whether labour markets are continuing to hold up, pushing wages higher.

We look below at the top issues to monitor with the July PMI data.

Has the travel and leisure boom already peaked? Stronger global economic growth in 2023 has so far been spurred by resurgent post-pandemic spending on services such as travel and tourism. Services have consequently outpaced manufacturing in terms of output growth to a degree unprecedented in the history of the PMI surveys in all major developed and emerging markets. However, June saw some signs of this growth spurt moderating. It will be important to assess the sustainability of the upturn in July, as any marked deterioration will add to signs that consumers are buckling under the weight of higher prices and higher interest rates.

Are conditions worsening for manufacturers? Manufacturing output slipped into decline in June, as a short-term production boost from improved supply availability faded. While better supply had enabled the fulfilment of back orders in the spring, the absence of new order inflows mean factories around the world are running out of work to sustain current production volumes. Further insights in these dynamics will be eagerly awaited with the July data, helping ascertain the extent of the drag on global growth from the manufacturing sector.

An additional drag on the manufacturing sector in recent months has been the widespread incidence of inventory reduction policies globally. As our charts below indicate, this reflects a combination of a reduced need to hold safety stocks (in turn linked to improved supply availability after the pandemic) and the reduced need to hold inventory amid a weakening demand environment. We await a turnaround in this inventory correction, as this will provide renewed momentum to the manufacturing economy.

The combination of falling demand, improved supply and inventory reduction had put further downward pressure on global manufacturing prices in June. Average input costs fell for a second successive month (including in the US, see chart below, which presaged the further fall in the official PPI measure), marking a dramatic turnaround from the near-record rate of inflation seen in early 2022. Further downward pressure on material prices will be important in helping drive global inflation lower, so we will be keenly watching these input cost gauges globally in July. However, with oil prices rising again in recent session, such a further downturn cannot be guaranteed.

Labour markets are important not just in terms of their relevance to consumer spending and resultant economic growth, but also in respect to wages. So far, employment has remained resilient in 2023, continuing to expand in many as companies - especially in the service sector - seek to fill long-vacant positions. This has been aided in part by improving labour supply. However, forward looking indicators such as the PMI's backlogs of work index - an important gauge of capacity utilisation - hint at a slowdown in hiring. Any further cooling in jobs growth will likely dampen economic growth via reduced household confidence and spending.

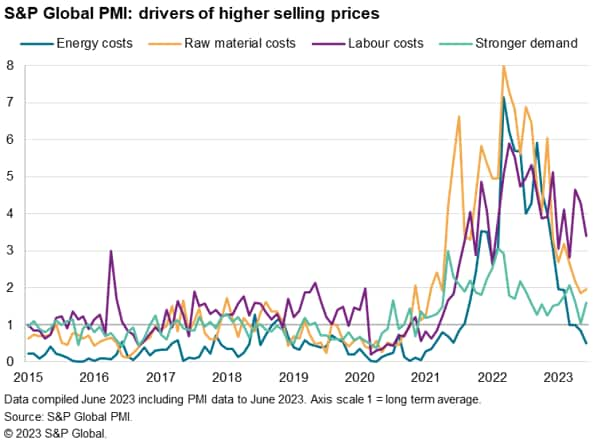

For an inflation fighting perspective, an upside to any cooling of the labour market would be a commensurate moderation of wage pressures, which - as our chart below demonstrates - have been the principal driving force of higher prices globally in recent months. However, this wage growth effect showed signs of dampening in June which, if sustained into July, will be good news for those fearing the development of wage-price spirals.

Is service sector inflation moderating? Around the world, it has been the service sector that has been the main driving force behind inflationary pressures so far in 2023, taking over from manufacturing - which had led the upturn in prices during the pandemic. Whereas the pandemic saw a surge in demand for goods accompanied by constrained production due to supply shortages, 2023 is seeing a surge in demand for services accompanied by capacity constraints and labour shortages. This generally persisted into June, albeit with services inflation showing some signs of moderating. The future path of service sector inflation will potentially represent a key determinant of central bank policy decisions.

While many of the trends we identify above are common to all major economies, there are of course national divergences worth noting and monitoring.

One of the most visible has been the relatively subdued economic recovery in mainland China after COVID-19 restrictions were suddenly relaxed at the turn of the year. Deflationary forces are meanwhile gathering. This weakness seen in the Caixin PMIs was followed by disappointing GDP data for the second quarter and recent official inflation data. Any further slippage in the PMIs for China will add to speculation that the government will seek to add more stimulus to the economy.

The US has meanwhile seen an especially resilient economic growth pattern this year, but has also seen the sharpest cooling of inflationary pressures among the major developed economies, according to both PMI and official data. The upcoming PMIs will be eyed for the lagged impact of policy hikes and assessed for the perceived need for further hikes among FOMC members.

The Eurozone has seen growth weaken more sharply than the US, and with the HCOB PMI signalling a near-stagnation in June the upcoming July flash PMI numbers will be eagerly awaited for signs of the region slipping into a downturn. Any such contraction will concern the ECB and reduce rate hike odds going forward, especially if price pressures continue to cool commensurately.

In the UK, the pace of growth has also slowed, according to the S&P Global / CIPS PMI, but price pressures have remained somewhat more elevated than in the US and Eurozone - especially in the service sector, where labour cost pressures appear more intense. Such a persistent divergence will add to further speculation that the Bank of England may need to hike rates further than the FOMC and possibly even the ECB.

Finally, in Japan, the au Jibun Bank PMI data have been prescient in signaling strong, services-led, economic growth and accompanying elevated price pressures. If persisting into July, these forces will lean on the Bank of Japan to mark a change in course on its ultra loose policy stance.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location