Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 06, 2023

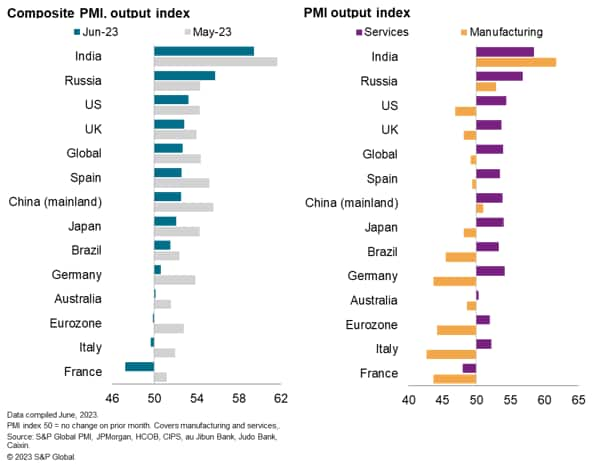

The global economy continued to expand in June, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. However, expansions slowed in almost all major economies as a broad-based weakening of service sector growth was accompanied by a renewed downturn in worldwide manufacturing output. The resulting rise in global business activity was the weakest since February.

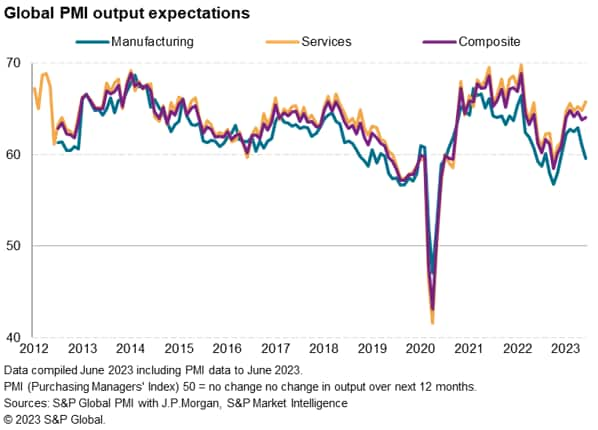

Companies expect this divergence to persist and potentially widen in the near term, with optimism sliding further below its long run average in manufacturing but rising in the service sector.

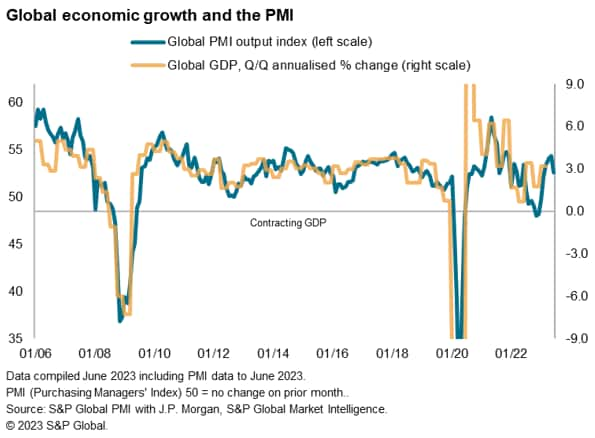

Global economic growth slowed in June to its lowest since February, according to the Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan. The headline output index fell from an 18-month high of 54.4 to 52.7. The current reading is broadly consistent with solid annualized quarterly global GDP growth of around 3%, but the rate of expansion has cooled at the end of the second quarter and there are some important sector variations.

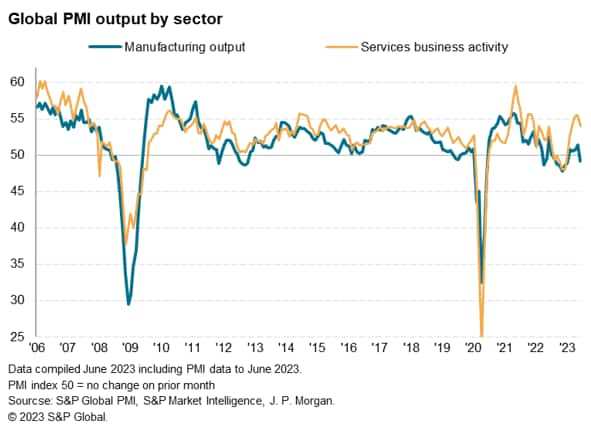

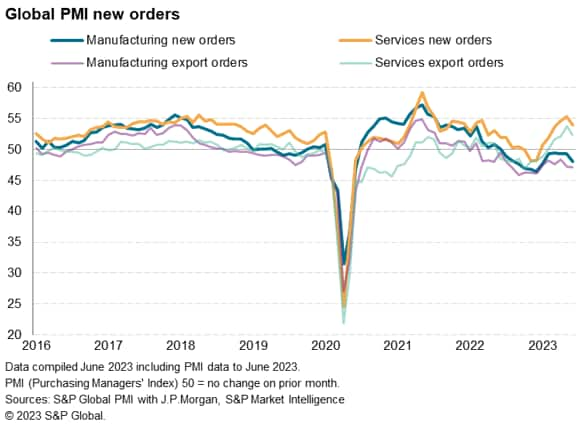

The latest PMI indicates that the global economy has grown for five successive months, with this renewed expansion having been driven primarily by a resurgence of service sector activity, in turn often linked to reviving post-pandemic demand. However, this service sector growth spurt showed signs of waning in June, as services activity growth slipped to a four-month low. New business inflows into the service sector sank to a three-month low, in part the result of slower growth in worldwide services trade.

Manufacturing meanwhile tipped back into decline after four months of tepid growth; a spell of expansion which had been fueled principally by supply chain improvements rather than rising demand. Demand for goods - as measured by new order inflows- fell for a twelfth successive month in June, declining at the sharpest rate since January. Global goods export orders fell in June at the steepest rate since last December.

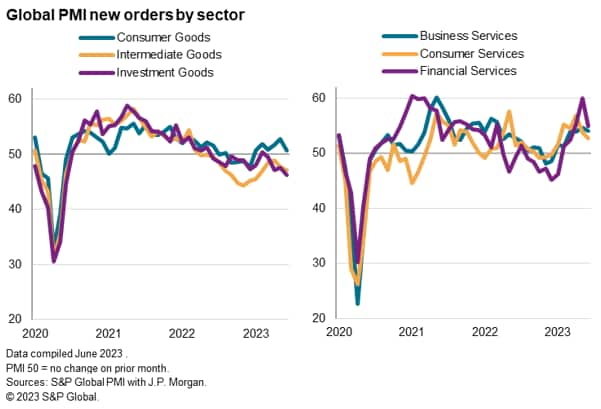

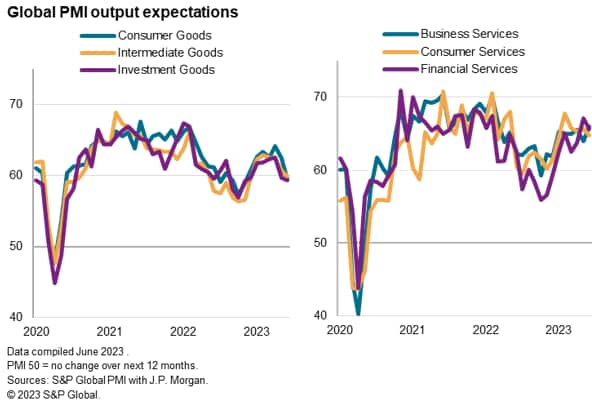

Looking further into demand growth, the strongest improvement among the broad categories of goods and services monitored by the PMI was recorded for financial services, where growth cooled from May's recent peak but remained firm by historical standards. Financial services have therefore taken over from consumer services as the main growth driver, the latter having reported the sharpest demand growth from last December through to May. Although demand for consumer services continues to grow, June's gain was the smallest since January to hint at some waning of this area of recent strength in the global economy. Steady, albeit slightly softer, growth was meanwhile recorded in demand for business services.

In the manufacturing sector, demand growth more or less stalled for consumer goods, though this nevertheless represented a stronger performance than the accelerating rates of contraction recorded for investment goods (such as plant and machinery) and intermediate goods (inputs sold to other firms).

Looking ahead, the survey data suggests that the unusual divergence between the manufacturing and service sectors looks set to persist and potentially widen.

Business expectations about output growth in the year ahead sank further in the manufacturing sector, down to a seven-month low to run well below the series' long-run average. In contrast, the service sector became more optimistic about the year ahead, with expectations rising to a 13-month high and running well above the long-run average. However, this improvement was limited to business services, with sentiment slipping for both consumer services and financial services sectors.

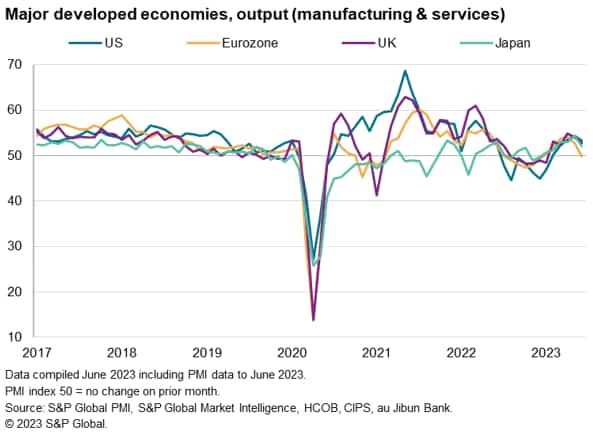

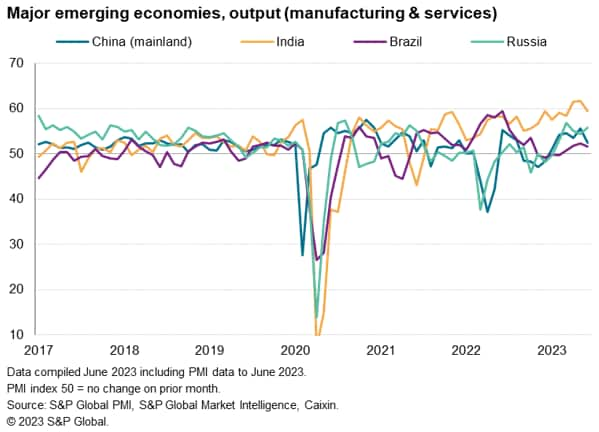

The outperformance of services relative to manufacturing was common in all 12 major developed and emerging economies covered by the PMI with the exception of India, which continued to lead the global growth rankings in June. Russia reported the second-strongest expansion, in part due to increased import substitution amid ongoing sanctions. Russia was the only economy to report faster overall business growth in June.

The eurozone was the worst performer, suffering a marginal contraction of output after five months of expansion. Growth meanwhile slowed to three-month lows in the UK and US and slipped to a four-month low in Japan.

In mainland China, this year's post-COVID-19 economic bounce lost pace, with overall business activity across manufacturing and services growing at the slowest rate since January. A cooldown in manufacturing output growth was accompanied by a marked slowing in service sector growth.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location