Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 07, 2023

By Chris Williamson and Rajiv Biswas

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Inflation data in the US takes centre stage in the coming week as investors seek guidance on the Fed's next steps after it paused its rate hikes in June. In Europe there will be new data for the hawkish-sounding Bank of England and ECB to digest via UK GDP and labour market data, as well as Eurozone industrial production and trade statistics. Key data releases will also add insights into whether Beijing will add more stimulus to help its struggling post-pandemic recovery. Central bank policy decisions are meanwhile due in Canada and South Korea, as are speeches from a series of FOMC members and RBA governor Lowe.

The markets are pricing in a return to rate hikes from the FOMC at its July meeting after it skipped a hike in May, though the upcoming inflation data will clearly add to the debate as to whether the existing tightening, which has taken the Fed funds rate to 5.00-5.25%, is taking effect. Consumer confidence and credit data will also add insights. Recent survey data showed the US economy growing increasingly dependent on the service sector to sustain growth, concentrating the stickiness of inflation in consumer- and financial -focused services.

While the scales are tipped toward Canada being the next major economy to hike rates again in the coming week, data out of mainland China will be eyed for signs of the need for further economic stimulus. China's inflation is expected to remain benign, while trade and money supply data could disappoint after June saw weak PMI survey numbers.

Further rate hikes are meanwhile pencilled in for both the Bank of England and ECB, though with the coming week only seeing official releases in the form of backward-looking UK GDP and manufacturing-heavy production and trade data in the Eurozone, there could be little to change the debate in the near-term. The exception could be UK labour market data, and in particular any signs of stubborn wage growth.

Finally, how market sentiment is bearing up will be revealed by the latest S&P Global Investment Manager Index (IMI), the June release of which showed risk appetite buoyed by reduced US debt ceiling and banking sector worries, as well as easing drags from the macro environment. The tech sector jumped up the investor rankings while real estate and consumer discretionary remained least in favour.

Some stickiness to US inflation is widely anticipated when CPI numbers for June are released on Wednesday, as signaled ahead by the S&P Global PMI data. Average prices charged for goods and services rose sharply again in June, according to the survey, the rate of increase remaining well above the average seen in the decade prior to the pandemic. Although prices charged for goods were largely unchanged, prices levied for services continued to rise at a solid pace, albeit with the rate of inflation losing some heat.

The UK is meanwhile likely to have avoided an economic downturn in the second quarter, with GDP data for May expected to have shown a modest rise according to recent PMI data. However, there are signs of the recovery losing momentum as we head into the second half of the year to suggest the revival may prove short-lived.

Monday 10 July

Japan trade balance (May)

Japan bank lending (Jun)

China mainland CPI inflation and PPI (Jun)

Netherlands industrial production (May)

Norway CPI inflation (Jun)

Sweden MPC minutes

Canada building permits (May)

US wholesale inventories (May)

US consumer credit (May)

Tuesday 11 July

Australia consumer confidence (Jul)

Netherlands CPI inflation (Jun)

Germany CPI inflation (Jun)

UK labour market report (Apr-Jun)

Mainland China new loans, money supply (Jun)

Italy industrial production (May)

Germany ZEW survey (Jul)

Brazil CPI (Jun)

S&P Global Investment Manager Index (Jul)

Wednesday 12 July

S Korea unemployment (Jun)

Japan PPI (Jun)

Japan machinery orders (Jun)

Spain CPI inflation (Jun)

India industrial production (May)

India CPI inflation (Jun)

Mexico industrial production (May)

US CPI inflation (Jun)

Canada BoC interest rate decision

Thursday 13 July

S Korea interest rate decision

Mainland China balance of trade (Jun)

UK monthly GDP inc. manufacturing, services and construction output (May)

UK trade balance (May)

UK BoE credit conditions survey (Q2)

France CPI (Jun)

Eurozone industrial production (May)

Eurozone ECB monetary policy meeting accounts

US PPI inflation (Jun)

US weekly jobless claims

US monthly budget (Jun)

Friday 14 July

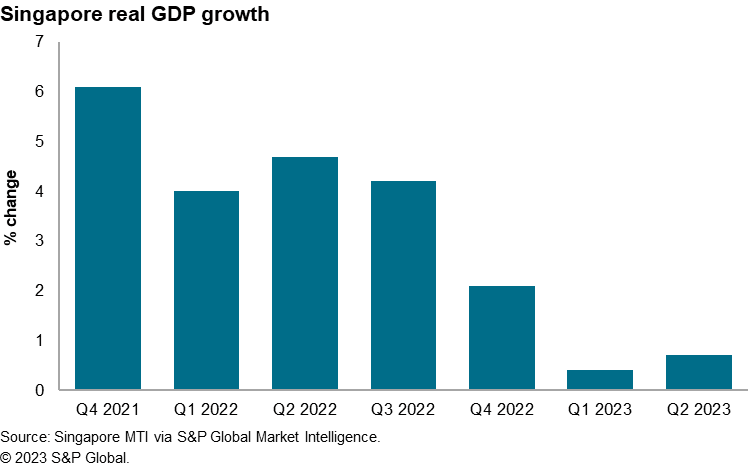

Singapore (Q2)

Japan industrial production (May)

Sweden CPI inflation (Jun)

Italy balance of trade (May)

Eurozone balance of trade (May)

Brazil retail sales (May)

India balance of trade (Jun)

US University of Michigan consumer confidence prelim (Jul)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

Americas: US inflation, consumer confidence plus FOMC speeches, Bank of Canada rates decision

Headline US inflation is expected to have risen by 0.3% in June, up from 0.1% in May. Core inflation is seen to have dipped from 0.4% but only to 0.3%. Such stickiness of the latter will worry the FOMC, though scheduled speeches from a number of Committee members will provide further insights into current thinking on the future path of policy. Weaker PPI data could well help soften inflation concerns, though it will also be important to assess the perceived health of the consumer via updated sentiment and credit data. Recent PMI data have shown lower factory prices data being offset by rising prices for services, notably in consumer markets.

The Bank of Canada is meanwhile widely expected to hike its policy rate by 25 basis points to 5.0%, though the odds of such action have fallen in recent sessions after headline inflation fell from 4.4% to 3.4% in May and recent Bank surveys showed inflation and wage expectations cooling.

Europe: UK GDP and labour market report, Eurozone industrial production and ECB policy meeting account

With the Bank of England and ECB busy making noises about how interest rates in Europe need to rise further, there will be new insights into the health of the UK and eurozone economies. In the UK, May GDP data are widely anticipated to add to signs that the economy grew marginally in the second quarter, likely reflecting a resilient service sector helping counter manufacturing weakness. However, policymakers will likely be more interested in the labour market data, and in particular wage growth, which has surprised to the upside in recent months. Consumer credit data will meanwhile provide insights into the impact of prior rate hikes. In the eurozone, we expect to see some weak data on industrial production and trade.

Asia-Pacific: Mainland China inflation, money supply and trade, Japan industrial production, PPI and trade, South Korea policy rate decision

In APAC, China's problem is growth rate than inflation. Consumer price inflation in mainland China was running at just 0.2% annually in May, with producer prices falling 4.6% on a year ago. It will therefore be the trade and money supply data that potentially hold most interest. In Japan, a two-speed economy is evident in the survey data, so buoyant service sector trends are likely to be countered by subdued industrial production and trade data.

Also watch out for a speech by RBA governor Lowe.

Global growth loses momentum as service sector slowdown accompanies factory downturn - Chris Williamson

Vietnam Economy Moderates in First Half of 2023 as Exports Slump - Rajiv Biswas

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location